APAC Bitcoin Mining Goes Green Despite China Underground Activity

Bitcoin mining remains the backbone of the crypto economy. In the Asia-Pacific (APAC) region, abundant hydropower, gas reserves, and surplus electricity create opportunities and friction.

The region offers “green hash” potential yet faces high electricity costs and fragmented rules. For global investors, APAC bitcoin miners now sit at the center of debates over energy use, transparency, and capital access.

APAC Bitcoin Mining Overview

Latest Update – In July 2025, Bitdeer expanded hydropower mining capacity in Bhutan to more than 1,200MW, positioning the country as a renewable mining hub. Marathon Digital and Zero Two began operating a 200MW immersion-cooled site in Abu Dhabi, showing how advanced cooling and flare-gas integration sustain operations in extreme climates. Meanwhile, Iris Energy in Australia reported 50EH/s, signaling how APAC miners scale alongside Western peers.

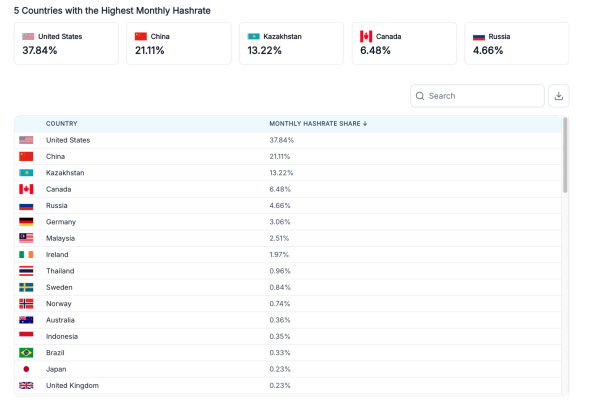

Background Context – The Cambridge Bitcoin Mining Map shows that after China’s 2021 crackdown, bitcoin mining shifted across Asia-Pacific economies while underground activity in China persists. Energy data, published by Asia-Pacific Economic Cooperation, projects rising renewable penetration, creating conditions where bitcoin mining can align with decarbonization goals if policy supports it.

Bitcoin Mining by Country 2025. Source: World Population Review

Deeper Analysis – China remains opaque. Despite the ban, seasonal hydropower in Sichuan and underground clusters persist. The Cambridge Digital Mining Industry Report 2025 warns of underreported activity in China, complicating global hash power and concentration risk assessments.

In fact, despite the 2021 ban on crypto mining, the country still accounts for more than 21% of global hashrate. This persistence is driven by underground hydropower operations in regions like Sichuan, dispersed small-scale farms that avoid detection, and local utilities quietly selling surplus electricity. While Beijing maintains a prohibition on paper, in practice, it appears to tolerate a shadow bitcoin mining industry, adding significant opacity and transparency risks to global assessments.

Japan’s high electricity prices limit domestic farms. However, firms such as SBI Crypto and GMO operate overseas, at renewable-powered sites. Domestically, SoftBank’s 300MW data center in Hokkaido illustrates how AI infrastructure overlaps with mining-scale energy loads. PTS signed agreements to supply telecom-grade hashrate over three years in Japan’s enterprise segment, indicating steady demand for stable capacity.

South Korea is exploring power-system integration. A May 2025 arXiv study suggests that monetizing surplus electricity through bitcoin mining could help KEPCO reduce debt while lowering grid losses. This model reframes mining as a grid-balancing tool rather than a burden.

Green Hash in Asia: Hydropower, Flare Gas, and Renewable Expansion

Bhutan’s hydropower expansion with Bitdeer signals how Asia can brand bitcoin mining as environmentally sustainable and attract ESG-minded capital. Abu Dhabi’s immersion-cooled site shows how flare gas and advanced infrastructure redefine efficiency in hot climates. Australia’s Iris Energy demonstrates a hybrid model by combining renewable-powered mining with AI computing, positioning itself across digital and energy markets. These cases show that Asia-Pacific bitcoin mining is growing more flexible, diversified, and sustainability-driven.

Behind the Scenes – APAC miners balance local politics and global scrutiny. Japan and Korea focus on energy integration rather than pure scale. Bhutan markets sustainability, while China’s hidden activity raises transparency concerns. The UAE and Australia leverage their energy mixes to attract institutional capital and lower marginal costs.

Broader Impact – Institutional investors demand high disclosure standards. US-listed miners win trust with SEC filings and market liquidity, while APAC firms must bridge fragmented frameworks. However, if Asian miners deliver ESG-backed transparency, capital flows could diversify more evenly between East and West.

Looking Forward – By 2026, more APAC miners could approach parity with Western peers if they combine efficiency with credible disclosure. Competitiveness will depend on rapid upgrades to next-generation ASICs, integration with renewable grids, and establishment of regional reporting standards that reduce perceived risk for global investors.

Policy Costs and Regional Risks

Data Breakdown—The CCAF 2025 report highlights hardware efficiency gains and geographic reshuffling of mining capacity. The region’s intergovernmental forum’s Energy Outlook shows how regional energy trajectories can reshape bitcoin mining’s cost base and carbon profile.

Possible Risks –

- Japan: high electricity costs cap local capacity.

- China: underground activity undermines transparency and risk assessment.

- Korea: grid integration depends on political and regulatory support.

- Bhutan and the UAE: climate variability can affect hydrology and flare-gas uptime.

- Supply chains: ASIC production remains exposed to tariffs and geopolitics.

Expert Opinion –

“The most significant risk for Asian miners remains regulatory unpredictability. Without long-term clarity, capital costs rise and global investors hesitate.”

— Cambridge Centre for Alternative Finance, Digital Mining Industry Report 2025

“Our facility in Abu Dhabi demonstrates how immersion cooling and flare gas integration can redefine mining economics in challenging climates.”

— Marathon Digital Holdings, press release

“By monetizing surplus power through mining, utilities could improve their financial health while stabilizing electricity networks.”

— ArXiv research, Bitcoin Mining and Grid Efficiency in Korea (May 2025)

The post APAC Bitcoin Mining Goes Green Despite China Underground Activity appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Zcash

Zcash  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Pepe

Pepe  Aster

Aster  Bittensor

Bittensor  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  BFUSD

BFUSD  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Gate

Gate  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  USDD

USDD  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  Usual USD

Usual USD  Stable

Stable  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  pippin

pippin  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  USDai

USDai  EURC

EURC  Stacks

Stacks  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  Dash

Dash  Virtuals Protocol

Virtuals Protocol  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Decred

Decred  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Kinesis Gold

Kinesis Gold  Story

Story  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Injective

Injective  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Lighter

Lighter  Chiliz

Chiliz  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Curve DAO

Curve DAO  COCA

COCA  LayerZero

LayerZero  Ether.fi

Ether.fi  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  AINFT

AINFT  Kaia

Kaia  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Gnosis

Gnosis  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Pyth Network

Pyth Network  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Aerodrome Finance

Aerodrome Finance  ADI

ADI  IOTA

IOTA  SPX6900

SPX6900  The Graph

The Graph  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Humanity

Humanity  Renzo Restaked ETH

Renzo Restaked ETH  FLOKI

FLOKI  JasmyCoin

JasmyCoin  sBTC

sBTC  Helium

Helium  crvUSD

crvUSD  Lido DAO

Lido DAO  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Optimism

Optimism  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Maple Finance

Maple Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Ethereum Name Service

Ethereum Name Service  Telcoin

Telcoin  DoubleZero

DoubleZero  Staked Aave

Staked Aave  ZKsync

ZKsync