Ethereum Whales Control 43% Of Supply – What This Means For Retail Traders

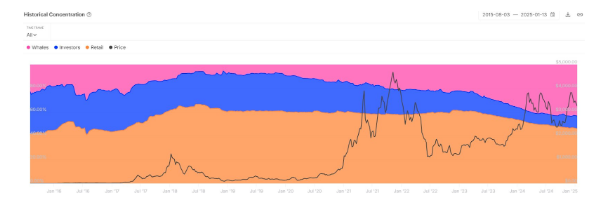

Large holders of Ethereum, also called Ethereum whales, have been on an accumulation trend for a while now, with on-chain data revealing a fascinating increase in their collective holdings. Particularly, data from blockchain analytics firm IntoTheBlock shows that Ethereum whales now hold about 43% of the total circulating supply of ETH.

The imbalance in ETH holdings raises important questions about its implications for Ethereum’s price and market dynamics moving forward.

Whale Accumulation Surges By Over 90% Since Early 2023

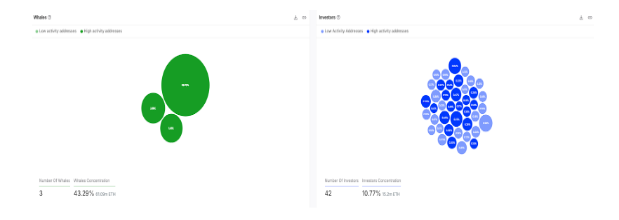

According to IntoTheBlock, the total concentration of ETH in whale addresses is currently at 61.09 ETH, which represents about 43% of the total supply. This marks a significant shift from early 2023, when whales held just 22% of Ethereum’s circulating supply. IntoTheBlock classifies whale addresses as those holding more than 1% of the total circulating supply of ETH.

The nearly twofold increase in Ethereum whale holdings within just a year is a noteworthy development. Naturally, such a concentration of a large supply of cryptocurrency into a few wallets would spell doom for the asset, as it would mean a few players would be able to manipulate price dynamics as they wish. However, Ethereum’s case deviates from this narrative due to the unique nature of its ecosystem and recent structural shifts within the network since 2022.

The sharp rise in whale concentration can be attributed to two major factors: the Ethereum merge and the growing appeal of ETH staking to earn rewards. The Ethereum merge, which took place in 2022, transitioned the blockchain from a proof-of-work (PoW) system to a proof-of-stake (PoS) mechanism.

As such, in-depth data from IntoTheBlock, which shows the 61.09 million ETH concentrated in only three whale addresses, makes much sense.

What this means is that these ETH are mostly those locked in the proof-of-stake staking algorithm used by block validators on the Ethereum network. By locking up their Ethereum, ETH miners and large holders have not only reduced the circulating supply but also contribute to price appreciation by reducing the amount of Ethereum available for trading.

Ethereum Holder Dynamics – Investors And Retailers

The increase in ETH among whale addresses has meant less ETH is available for investors and retail owners. IntoTheBlock classifies investors as addresses holding between 0.1% and 1% of the total circulating supply, while retail are those with less than 0.1% of the total circulating supply.

At the time of writing, there are 42 investor addresses and they collectively own 15.2 million ETH, which translates to 10.77% of the total circulating supply. Keeping in mind that the three whale addresses do not do much with price dynamics, investor addresses holding significant but more liquid portions of ETH have a greater capacity to affect market movements. Any substantial selloff from these investor addresses could trigger a sharp decline in Ethereum’s price.

On the other hand, retailers, which constitute over 99% of ETH addresses, are left with 46% of the total circulating supply. At the time of writing, Ethereum is trading at $3,225 and is down by 2% in the past 24 hours.

Featured image from Pexels, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Bittensor

Bittensor  Sky

Sky  Global Dollar

Global Dollar  Aster

Aster  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  Aave

Aave  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Pepe

Pepe  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ethena

Ethena  USDtb

USDtb  Render

Render  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  OUSG

OUSG  Aptos

Aptos  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Stable

Stable  YLDS

YLDS  Arbitrum

Arbitrum  GHO

GHO  Jupiter

Jupiter  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Decred

Decred  JUST

JUST  clBTC

clBTC  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Ether.fi

Ether.fi  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  WrappedM by M0

WrappedM by M0  Siren

Siren  LayerZero

LayerZero  Dash

Dash  Kinesis Gold

Kinesis Gold  Tezos

Tezos  Chiliz

Chiliz  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  pippin

pippin  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  River

River  COCA

COCA  Curve DAO

Curve DAO  ADI

ADI  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  BitTorrent

BitTorrent  Kaia

Kaia  PRIME

PRIME  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  Bitcoin SV

Bitcoin SV  SPX6900

SPX6900  JasmyCoin

JasmyCoin  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Story

Story  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Maple Finance

Maple Finance  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  Legacy Frax Dollar

Legacy Frax Dollar  sBTC

sBTC  IOTA

IOTA  Lighter

Lighter  DoubleZero

DoubleZero  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Savings USDD

Savings USDD  Olympus

Olympus  Pyth Network

Pyth Network  Official FO

Official FO  Marinade Staked SOL

Marinade Staked SOL  crvUSD

crvUSD  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Lombard

Lombard  Venice Token

Venice Token  Optimism

Optimism  Staked Aave

Staked Aave