Crypto Market Wipes Out September Gains as Bitcoin Barely Hangs On: Analysis

Brace yourselves, the Red September curse is upon us.

The crypto market has officially entered negative territory for September, despite Bitcoin holding on to a slight gain, after a brutal week that erased $162 billion from crypto valuations. The wipeout canceled out the gains generated from the bullish two-week start to the month, back when Bitcoin briefly notched its second-best September performance in 13 years.

Crypto market cap data. Image: Tradingview

The seasonal curse, though, doesn’t seem to be affecting traditional markets, despite September also being historically the worst month of the year for Wall Street. The S&P 500 gained 0.64% over the past 24 hours while gold retreated 1.2% from recent highs near $2,670 per ounce showing investors still want risk instead of hedge.

That risk appetite, however, does not appear to currently extend to crypto—outside of a few, recent overperformers, such as the still only-a-week-old Aster.

The crypto market’s longstanding correlation with broader risk assets is today offering little relief, with Bitcoin unable to hold the line at the crucial $111,000 support mark and Ethereum breaking below $4,000, triggering cascading liquidations across digital assets.

The crypto market as a whole has dropped 4.7% so far today, falling to $3.73 trillion and extending a seven-day decline that has revived talk of September’s notorious weakness for digital assets.

Bitcoin’s remaining 1% gain for the month, trading now at just above $109,000, represents the sole barrier preventing the entire crypto market from posting even bigger monthly losses—a precarious position given the asset’s 67% market dominance means minor selling pressure could flip the narrative completely red.

Bitcoin price data. Image: Tradingview

Red September: The fundamentals behind the curse

September has historically delivered negative returns for crypto markets in eight of the past 11 years, a phenomenon traders attribute to institutional portfolio rebalancing after summer holidays and fiscal year-end adjustments.

This year’s pattern seems to be following the script: Despite early buyings pushing the total market cap above $4 trillion with trading volumes surging 27% in the opening days of September, profit-taking mid-month could end up pushing performance to a monthly net loss.

The mechanics of the current selloff reveal how leverage amplified the damage. When Ethereum dropped 9% below the psychologically important $4,000 level—its first breach since August—it triggered $500 million in long liquidations on that asset alone. The contagion spread immediately to smaller tokens more prone to volatility.

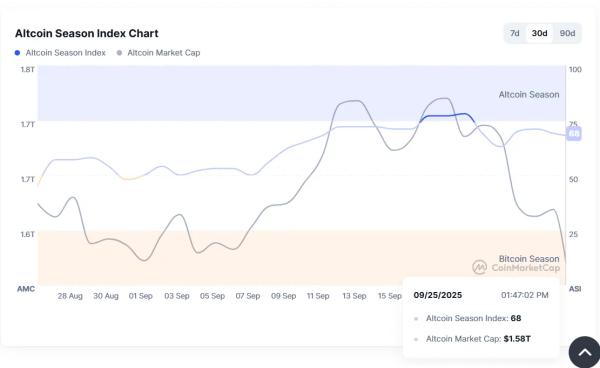

The Altcoin Season Index, which measures capital rotation between Bitcoin and alternative cryptocurrencies, fell sharply over the week from 77 to 69 points as investors retreated to the perceived safety of the largest cryptocurrency, Bitcoin. In other words, traders are getting rid of their tokens, some of them rotating into Bitcoin, as the nervousness intensifies.

Alctoin Season Index. Image: Coinmarketcap

For what it’s worth, the way the Alcoin Season Index is structured, it does not matter whether traders are swapping altcoins for Bitcoin or exiting the market completely: Bitcoin dominance increases in either scenario.

What’s more, regulatory headwinds are compounding the observable technical weakness in the charts. The Senate’s October 1 crypto tax hearing and SEC/CFTC joint roundtable on September 29 create event risk that could catalyze selling if outcomes disappoint. Historical data shows crypto markets typically decline 3-5% in the 48 hours preceding major regulatory announcements as traders reduce exposure.

Can Bitcoin save crypto from Red September?

At the moment, the charts say Bitcoin is holding the life saver, but it’s losing its strength.

Users on Myriad, a prediction market operated by Decrypt’s parent company Dastan, believe there’s a nearly 60% chance today will be another red day for BTC, meaning the price of Bitcoin will close the day lower than when it started.

On the plus side, Myriad prediction market users place the odds at 68% that Bitcoin manages to stay above $105K throughout the September. But, for context, those odds have dropped rapidly in just the last few hours, falling from 84% early this morning.

Looking ahead to “Uptober”—with October being historically the best month for crypto markets—Myriad users currently favor the price of Bitcoin reaching $120K, but only by a slight margin over the $110K to $11K range. So, perhaps a green month ahead—just not that green.

Do the charts agree with predictors?

Bitcoin’s technical structure suggests the largest cryptocurrency by market cap may struggle to prevent the broader market from slipping into September losses, despite currently trading above $109,000 and within an ascending trend that has been in place since March.

Bitcoin price data. Image: Tradingview

While Bitcoin maintains a golden cross formation—where the 50-day moving average sits above the 200-day line, typically a bullish configuration—momentum indicators tell a different story. The Squeeze Momentum indicator has flipped to a bearish impulse, marking a shift in short-term direction that often precedes deeper corrections.

The Average Directional Index, or ADX, reads just 17, well below the 25 threshold that signals a strong trend in either direction. This weak trend strength means Bitcoin lacks the momentum to push decisively higher or lower, leaving it vulnerable to external shocks.

The Relative Strength Index—basically a thermometer of how hyped an asset is—sits at 42, having declined from overbought conditions above 70 just weeks ago. This rapid deterioration in momentum while price remains elevated often marks distribution phases where larger holders sell into residual buying interest.

Bitcoin’s ascending channel, while appearing bullish at first glance, actually constrains upside potential. The coin has been bouncing at a very solid support line, showing that bulls refuse to die when prices dip too much. However, the top doesn’t match the bottom, and prices are showing a “lower highs, higher lows,” pattern that usually ends in compression before an explosive movement in the near future.

Bitcoin’s inability to reclaim $115,000 after three attempts this month has created a descending triangle on shorter timeframes, a pattern that resolves lower 67% of the time, according to technical analysis textbooks. The measured move target from this formation points to $108,000, which would represent a 5% decline sufficient to push the entire crypto market into negative territory for September.

The good news for bulls? September will be over in five more days. The bad news? Uptober is no guarantee either.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Chainlink

Chainlink  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Litecoin

Litecoin  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  Rain

Rain  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  Circle USYC

Circle USYC  Bittensor

Bittensor  OKB

OKB  Pepe

Pepe  Aster

Aster  Sky

Sky  syrupUSDC

syrupUSDC  Global Dollar

Global Dollar  HTX DAO

HTX DAO  Ripple USD

Ripple USD  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Pi Network

Pi Network  Pump.fun

Pump.fun  Ondo

Ondo  MYX Finance

MYX Finance  KuCoin

KuCoin  Gate

Gate  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  USDtb

USDtb  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  NEXO

NEXO  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Render

Render  Filecoin

Filecoin  OUSG

OUSG  VeChain

VeChain  syrupUSDT

syrupUSDT  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Arbitrum

Arbitrum  Ondo US Dollar Yield

Ondo US Dollar Yield  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  Sei

Sei  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  Story

Story  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Decred

Decred  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Pudgy Penguins

Pudgy Penguins  Lighter

Lighter  Optimism

Optimism  c8ntinuum

c8ntinuum  Virtuals Protocol

Virtuals Protocol  JUST

JUST  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kinesis Gold

Kinesis Gold  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  LayerZero

LayerZero  Resolv wstUSR

Resolv wstUSR  Resolv USR

Resolv USR  COCA

COCA  AINFT

AINFT  Stable

Stable  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  Sun Token

Sun Token  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Maple Finance

Maple Finance  Kaia

Kaia  Ether.fi

Ether.fi  BitTorrent

BitTorrent  Wrapped Flare

Wrapped Flare  Injective

Injective  DoubleZero

DoubleZero  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  FLOKI

FLOKI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Lido DAO

Lido DAO  IOTA

IOTA  The Graph

The Graph  Binance-Peg XRP

Binance-Peg XRP  Aerodrome Finance

Aerodrome Finance  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Celestia

Celestia  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  Kinesis Silver

Kinesis Silver  sBTC

sBTC  Telcoin

Telcoin  Bitcoin SV

Bitcoin SV  SPX6900

SPX6900  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  JasmyCoin

JasmyCoin  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Starknet

Starknet  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Pyth Network

Pyth Network  PRIME

PRIME  Humanity

Humanity  AB

AB  Staked Aave

Staked Aave