Over 1 Million ETH Withdrawn from Exchanges — Ethereum to $3,000 Next?

Ethereum recovered over 50% in May. On-chain data is offering new insights into the changing sentiment of Ethereum investors following the Pectra upgrade. As a result, many analysts are now expecting higher price levels.

This on-chain data includes ETH withdrawals from exchanges, exchange reserves, and ETH whale accumulation. Over the past month, all these metrics have hit impressive milestones.

Over 1 Million ETH Withdrawn from Exchanges in the Past Month

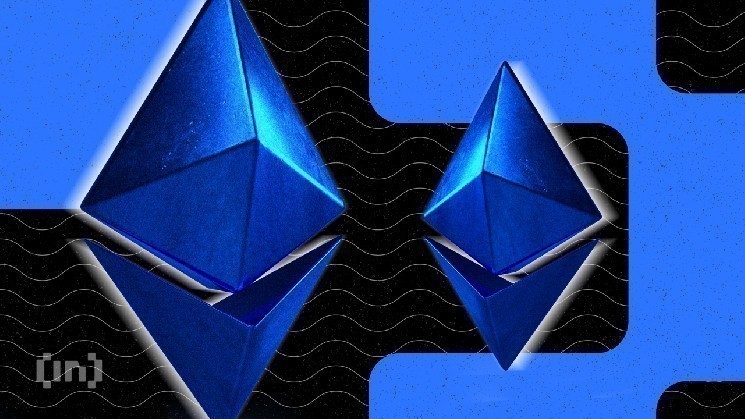

According to Cryptorank, the amount of ETH available on centralized exchanges has dropped from over 18 million to nearly 17 million within one month.

Ethereum Supply on Exchange. Source: Cryptorank

“Over the past month, more than 1 million ETH have been withdrawn from centralized exchanges, which accounts for approximately 5.5% of the total ETH held on these platforms. This trend suggests that users are increasingly choosing to accumulate Ethereum rather than trade it. The recent Pectra upgrade, which went live on May 7, may further support this behavior and, in turn, add upward pressure to Ethereum’s price,” Cryptorank said.

CryptoQuant data shows that over 300,000 ETH were withdrawn from Binance alone in the past month. Since the beginning of the year, more than 800,000 ETH have been withdrawn from the platform.

This withdrawal activity occurred not just when ETH prices dropped sharply below $1,400 in early April, but also accelerated during ETH’s rebound above $2,400 in May.

Furthermore, the chart from CryptoRank illustrates that ETH prices surged while exchange reserves fell, reinforcing the correlation between supply and price.

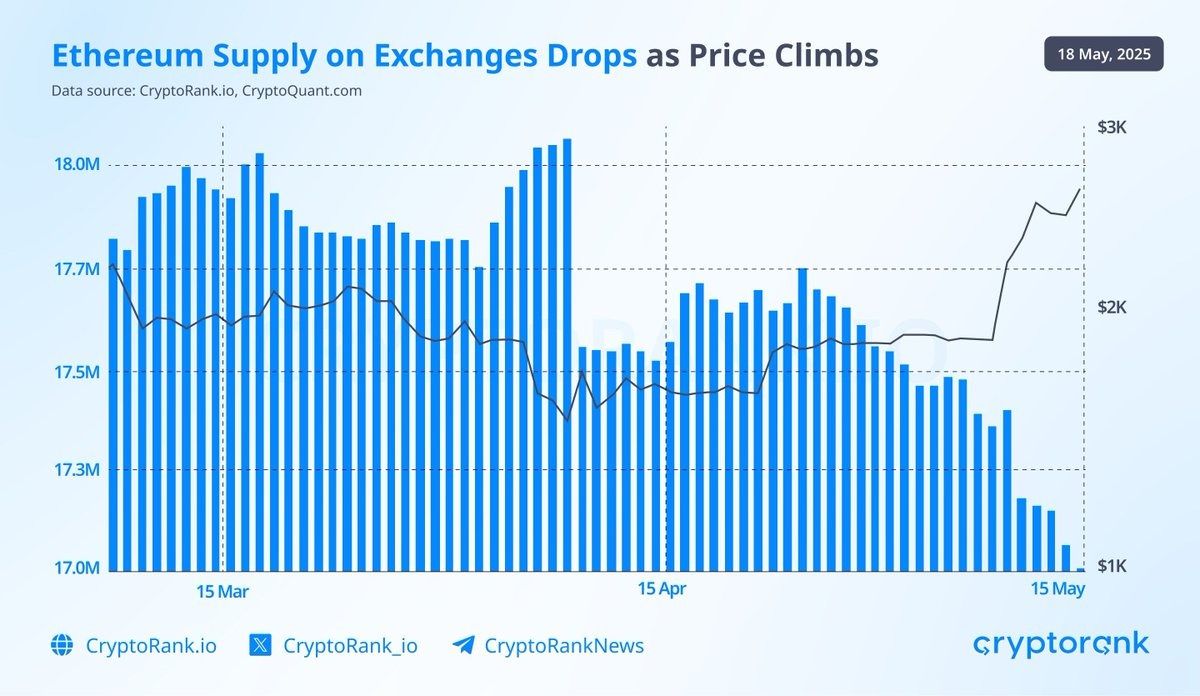

In addition, large accumulation addresses recorded their highest inflow in history. Specifically, CryptoQuant reported that on May 12, whale wallets accumulated over 325,000 ETH — the highest single-day amount ever recorded.

Ethereum Inflow Into Accumulation Address. Source: CryptoQuant

When whales accumulate, they often withdraw ETH from exchanges to store in cold wallets. This reduces the circulating supply and creates upward pressure on the price.

Meanwhile, based on a rare bullish technical pattern that emerged in May, analyst TedPillows predicted ETH could soon return to $3,000, a key psychological level.

Ethereum Price’s Golden Cross. Source: TedPillows

“ETH Golden Cross confirmed. $3,000 Ethereum is coming next,” Ted predicted.

Arthur Hayes Predicts Ethereum Will Outperform Solana

Despite these positive on-chain indicators, ETH’s price is still far from its peak. It would need to rise another 70% to surpass its 2024 high, and it would need to more than double to reach a new all-time high.

Bitcoin analyst PlanB recently labeled Ethereum as “centralized” and “pre-mined,” while Zach Rynes argued that ETH lacks a coherent economic narrative.

However, in a May 18 interview, Arthur Hayes offered a different perspective. He admitted that while ETH is often disliked, it remains the most secure blockchain with the highest Total Value Locked (TVL). He believes ETH could soon outperform Solana.

“I think Ethereum has a better performance outlook mostly because it’s very hated. Everyone thinks Ethereum does nothing, that they haven’t done anything correctly. But it still has the most TVL, the most developers, and is still the most secure proof-of-stake blockchain. Yeah, the price hasn’t done that well from 2020 to now. Solana obviously did very well, going from $7 to $172. But if I’m going to deploy a fresh unit of fiat capital into the system, I think Ethereum could outperform Solana in this next 18–24 month bull run,” Hayes explained.

Moreover, many industry experts go even further. They predict that ETH could eventually outperform Bitcoin, especially as Ethereum is increasingly central in real-world assets (RWA) and the broader DeFi ecosystem.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Chainlink

Chainlink  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Pepe

Pepe  Aster

Aster  Falcon USD

Falcon USD  Bittensor

Bittensor  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Sky

Sky  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Cosmos Hub

Cosmos Hub  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Midnight

Midnight  Quant

Quant  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  GHO

GHO  Stable

Stable  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  A7A5

A7A5  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  USDai

USDai  TrueUSD

TrueUSD  pippin

pippin  clBTC

clBTC  Sei

Sei  EURC

EURC  Stacks

Stacks  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  Virtuals Protocol

Virtuals Protocol  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  PancakeSwap

PancakeSwap  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Decred

Decred  Chiliz

Chiliz  Story

Story  Kinesis Gold

Kinesis Gold  JUST

JUST  Lighter

Lighter  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Curve DAO

Curve DAO  Resolv wstUSR

Resolv wstUSR  Ether.fi

Ether.fi  COCA

COCA  AINFT

AINFT  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Sun Token

Sun Token  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  Bitcoin SV

Bitcoin SV  Injective

Injective  Humanity

Humanity  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Gnosis

Gnosis  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  LayerZero

LayerZero  ADI

ADI  SPX6900

SPX6900  Aerodrome Finance

Aerodrome Finance  IOTA

IOTA  Binance-Peg XRP

Binance-Peg XRP  Optimism

Optimism  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  The Graph

The Graph  sBTC

sBTC  Celestia

Celestia  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  Jupiter Staked SOL

Jupiter Staked SOL  Olympus

Olympus  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Maple Finance

Maple Finance  Conflux

Conflux  Marinade Staked SOL

Marinade Staked SOL  Helium

Helium  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Telcoin

Telcoin  BTSE Token

BTSE Token  AB

AB  ZKsync

ZKsync  Staked Aave

Staked Aave