Ethereum’s Leverage Reset Clears The Path For A Healthy Rebound – Analyst

Ethereum is attempting to push back above the $2,000 level as the broader crypto market navigates persistent uncertainty and ongoing selling pressure. Recent price action reflects a fragile recovery effort rather than a confirmed trend reversal, with volatility remaining elevated and traders cautious after months of corrective momentum. The $2,000 threshold has become a key psychological and technical battleground, shaping short-term sentiment as investors evaluate liquidity conditions, macro signals, and derivatives positioning.

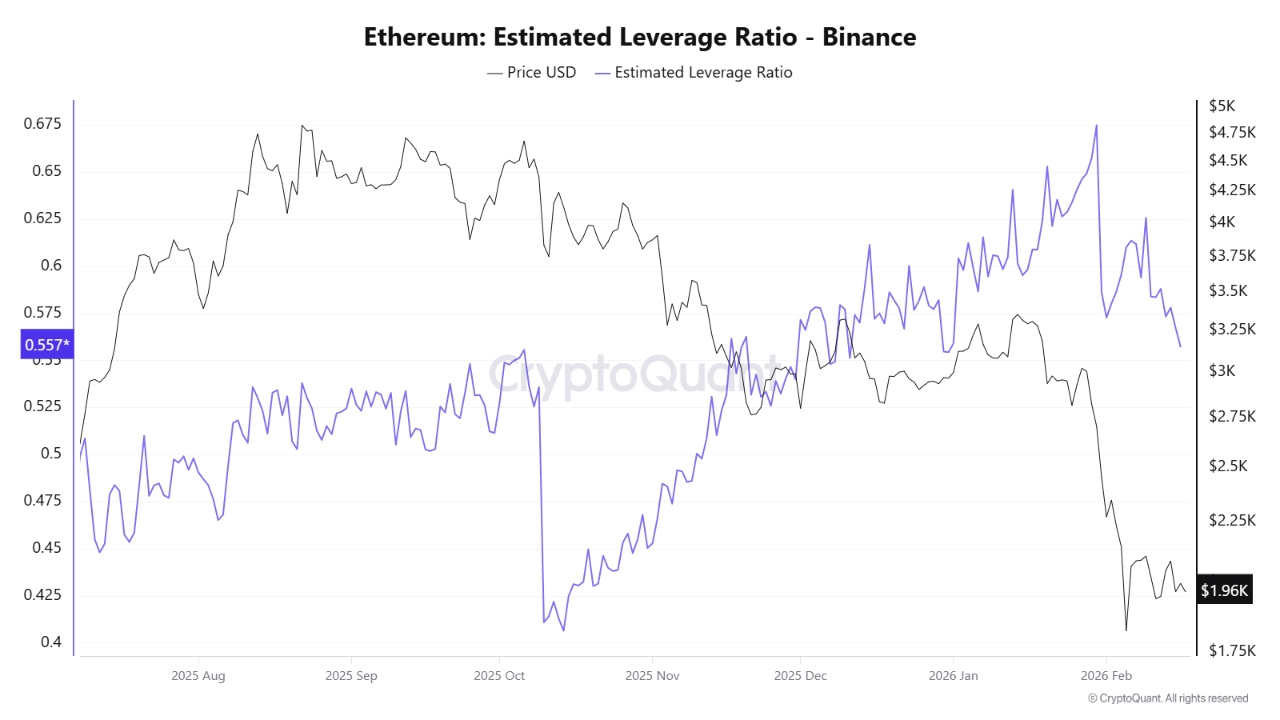

A recent CryptoQuant analysis offers additional insight into evolving market dynamics, particularly within Ethereum’s derivatives landscape. Data tracking the Estimated Leverage Ratio on Binance shows a clear shift in trader behavior. The indicator recently dropped to around 0.557, marking its lowest reading since last December. This decline follows a period of heightened leverage, when the ratio peaked near 0.675, reflecting a more aggressive risk environment earlier in the cycle.

The reduction in leverage suggests traders are scaling back risk exposure, closing highly leveraged positions, or moving toward more conservative strategies. Such transitions often occur during consolidation phases, when markets attempt to stabilize after volatility spikes.

Declining Leverage Points To Potential Market Stabilization

The analyst further notes that the recent decline in Ethereum’s estimated leverage ratio reflects a broader reduction in speculative risk across the derivatives market. Lower leverage typically indicates that traders are trimming highly leveraged positions or closing them altogether, shifting toward more conservative exposure. Historically, such deleveraging phases have often preceded the formation of new price bases, as market participants prioritize capital preservation over short-term speculative gains.

The drop from roughly 0.675 to around 0.557 is therefore not simply a minor technical fluctuation. Instead, it signals a meaningful shift in market sentiment. Periods characterized by elevated leverage tend to amplify volatility and increase the probability of abrupt liquidations. Conversely, declining leverage generally corresponds with calmer market conditions, where price movements are less driven by forced liquidations and more by underlying demand dynamics.

From a medium-term perspective, this transition may be constructive. Reduced leverage can create a healthier foundation for price discovery, particularly if accompanied by strengthening spot demand. In this context, the combination of lower leverage readings and relatively stable price action suggests the market could be undergoing a consolidation or repositioning phase. Such environments often precede more decisive directional moves once liquidity and sentiment conditions align.

Ethereum Price Remains Under Pressure Below Key Averages

Ethereum continues to trade near the $2,000 level after a sharp corrective move that followed its late-2025 highs. The chart shows a clear bearish structure, with price consistently printing lower highs since the October peak while failing to sustain recoveries above key moving averages. Recent attempts to stabilize have produced only shallow rebounds, indicating persistent selling pressure and cautious market positioning.

Notably, ETH remains below its short-, medium-, and long-term moving averages, which are all trending downward. This alignment typically reflects sustained bearish momentum and suggests that rallies may continue to face resistance unless the price can reclaim these levels decisively. The 200-day moving average, currently well above spot price, stands out as a major structural resistance zone.

Volume data also provides context. The most recent sell-off was accompanied by a noticeable spike in trading activity, often associated with liquidation events or accelerated distribution. Since then, volume has moderated, consistent with a consolidation phase rather than an immediate reversal.

From a technical perspective, the $1,900–$2,000 range now acts as a short-term stabilization zone. However, failure to hold this area could expose lower support levels, while a sustained break above nearby resistance would be needed to signal improving momentum.

Featured image from ChatGPT, chart from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Hedera

Hedera  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Bittensor

Bittensor  Pepe

Pepe  Falcon USD

Falcon USD  Aster

Aster  Pi Network

Pi Network  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Sky

Sky  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  Pump.fun

Pump.fun  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  Quant

Quant  Midnight

Midnight  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  OUSG

OUSG  Filecoin

Filecoin  Ondo US Dollar Yield

Ondo US Dollar Yield  USDD

USDD  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  GHO

GHO  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  A7A5

A7A5  Solv Protocol BTC

Solv Protocol BTC  Stable

Stable  Lombard Staked BTC

Lombard Staked BTC  Jupiter

Jupiter  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  pippin

pippin  EURC

EURC  Dash

Dash  Stacks

Stacks  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  WrappedM by M0

WrappedM by M0  Chiliz

Chiliz  Decred

Decred  Story

Story  Kinesis Gold

Kinesis Gold  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Lighter

Lighter  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Ether.fi

Ether.fi  COCA

COCA  AINFT

AINFT  Injective

Injective  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sun Token

Sun Token  Kaia

Kaia  Bitcoin SV

Bitcoin SV  Optimism

Optimism  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  SPX6900

SPX6900  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Gnosis

Gnosis  LayerZero

LayerZero  ADI

ADI  Humanity

Humanity  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Helium

Helium  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  The Graph

The Graph  sBTC

sBTC  Celestia

Celestia  JasmyCoin

JasmyCoin  Aerodrome Finance

Aerodrome Finance  Jupiter Staked SOL

Jupiter Staked SOL  Lido DAO

Lido DAO  Savings USDD

Savings USDD  Olympus

Olympus  Legacy Frax Dollar

Legacy Frax Dollar  Maple Finance

Maple Finance  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Telcoin

Telcoin  DoubleZero

DoubleZero  Ethereum Name Service

Ethereum Name Service  Starknet

Starknet  Staked Aave

Staked Aave