Crypto degens are taking wagers on global conflict via Polymarket

As global tensions escalate following the Israel-Iran conflict and traditional investors seek safety in safe haven assets like gold, crypto punters are seeking action on the crypto-based betting platforms, Polymarket.

The crypto betting platform rose to prominence for predicting President Donald Trump’s 2024 election victory before other traditional news outlets and polls. It has also become the leading venue for punters making bets on the escalating crisis between Israel and Iran, becoming something of a high-stakes casino for the geopolitical drama in the Middle East.

Crypto punters wager on the Israel-Iran conflict and outcomes

As geopolitical tensions rise, Polymarket has become an unlikely casino, where crypto degens are taking wagers on global conflict. Its top active markets are centered on the escalating Israel-Iran conflict.

Polymarket predicted an 88% chance of Israel striking Iran in June, a 71% chance of the strike hitting Iranian nuclear facilities, and an astonishing 99% chance of the strike happening by Friday, the 13th.

Following the accurate prediction of the strike, punters took to Polymarket to place more wagers. This resulted in the top prediction markets being dominated by the wagers placed on the conflict.

The market went as high as a 99% chance that Iran would strike Israel in June, pulling in over $1 million in volume. Iran struck Israel in a military attack later on the same day, June 13.

Source: Polymarket

It also estimates a 42% chance of the U.S. taking military action against Iran before July. That market has now pulled in over $1.7 million in volume.

Source: Polymarket

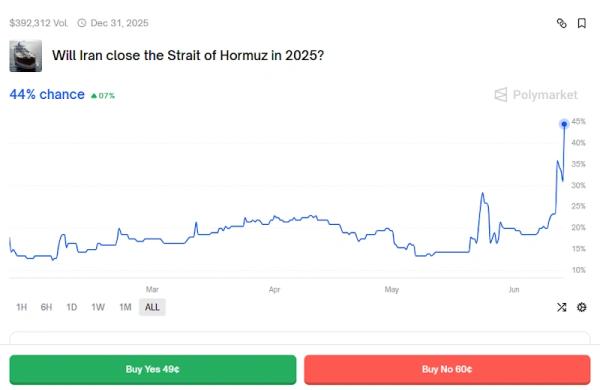

Another market that has sprung up with the Middle East conflict is the spike in the price of Brent crude. It currently predicts a 44% chance that Iran will close the Strait of Hormuz, which could further lead to global oil prices skyrocketing.

Source: Polymarket

Another market that could soon gain momentum is the prediction about whether Iran will confirm the possession of a nuclear weapon by 2025. This follows Israel’s claims that its preemptive strikes were on Iran’s nuclear facilities. This market has gained over $154,000 in volume.

Source: Polymarket

These markets operate in a regulatory grey area. After being fined $1.4 million by the U.S. Commodity Futures Trading Commission (CFTC) in 2022, Polymarket banned U.S. users from its platform.

Placing wagers on real-time geopolitical crises raises ethical concerns. Critics argue that it could be seen as trivializing suffering and incentivizing misinformation. Also, there are concerns of market manipulation, with the CFTC saying prediction markets are vulnerable to manipulation.

Israel-Iran conflict shakes global financial markets

On Friday, 13, 2025, Israel declared a special emergency following preemptive strikes on Iran, which are reported to have hit Iranian nuclear facilities and killed top Iranian generals. This event sent ripples through the global financial market.

With fears of broader conflicts arising, assets such as gold are seeing inflows. An ounce of gold has gained 1.2% to $3,444.70. Bitcoin dropped sharply, falling below $103,000 as investors fled risk assets; however, it quickly gained $105,700, a little bit off its intraday high.

Brent crude surged about 14% intraday, settling at about $75.54/barrel, driven by fears of disruption around the Strait of Hormuz, which is responsible for about a fifth of global consumption flows and bordered by Iran, which also happens to be one of the world’s largest exporters of oil.

Global stocks were hit; the S&P 500 and Nasdaq Composite fell about 0.4%, with the Dow industrials losing about 600 points.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Tether Gold

Tether Gold  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave  PAX Gold

PAX Gold  Bittensor

Bittensor  OKB

OKB  Falcon USD

Falcon USD  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Binance-Peg WETH

Binance-Peg WETH  Pump.fun

Pump.fun  Ethereum Classic

Ethereum Classic  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Worldcoin

Worldcoin  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  HTX DAO

HTX DAO  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Sky

Sky  Solana

Solana  Pi Network

Pi Network  KuCoin

KuCoin  Ripple USD

Ripple USD  Ethena

Ethena  Wrapped BNB

Wrapped BNB  Binance Staked SOL

Binance Staked SOL  syrupUSDC

syrupUSDC  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Rocket Pool ETH

Rocket Pool ETH  POL (ex-MATIC)

POL (ex-MATIC)  Aptos

Aptos  Gate

Gate  MYX Finance

MYX Finance  USDD

USDD  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Render

Render  Arbitrum

Arbitrum  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Midnight

Midnight  River

River  Official Trump

Official Trump  NEXO

NEXO  Filecoin

Filecoin  VeChain

VeChain  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Mantle Staked Ether

Mantle Staked Ether  USDtb

USDtb  Liquid Staked ETH

Liquid Staked ETH  syrupUSDT

syrupUSDT  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Bonk

Bonk  WrappedM by M0

WrappedM by M0  Story

Story  Dash

Dash  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Solv Protocol BTC

Solv Protocol BTC  Sei

Sei  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Jupiter

Jupiter  Ondo US Dollar Yield

Ondo US Dollar Yield  StakeWise Staked ETH

StakeWise Staked ETH  clBTC

clBTC  OUSG

OUSG  Renzo Restaked ETH

Renzo Restaked ETH  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  COCA

COCA  Jupiter Staked SOL

Jupiter Staked SOL  Binance-Peg XRP

Binance-Peg XRP  Wrapped Flare

Wrapped Flare  Beldex

Beldex  Optimism

Optimism  Usual USD

Usual USD  Chiliz

Chiliz  Tezos

Tezos  Virtuals Protocol

Virtuals Protocol  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Stacks

Stacks  tBTC

tBTC  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Curve DAO

Curve DAO  A7A5

A7A5  GHO

GHO  GTETH

GTETH  Lighter

Lighter  TrueUSD

TrueUSD  Stable

Stable  Injective

Injective  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  Kinesis Silver

Kinesis Silver  Ether.fi

Ether.fi  DoubleZero

DoubleZero  Cap USD

Cap USD  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Marinade Staked SOL

Marinade Staked SOL  Aerodrome Finance

Aerodrome Finance  Kinesis Gold

Kinesis Gold  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  pippin

pippin  Stader ETHx

Stader ETHx  Maple Finance

Maple Finance  EURC

EURC  sBTC

sBTC  Celestia

Celestia  LayerZero

LayerZero  FLOKI

FLOKI  Staked Aave

Staked Aave  BitTorrent

BitTorrent  Resolv USR

Resolv USR  JUST

JUST  The Graph

The Graph  Resolv wstUSR

Resolv wstUSR  Kaia

Kaia  Axie Infinity

Axie Infinity  Gnosis

Gnosis  Pyth Network

Pyth Network  Trust Wallet

Trust Wallet  Wrapped ApeCoin

Wrapped ApeCoin  IOTA

IOTA  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  crvUSD

crvUSD  SPX6900

SPX6900  Conflux

Conflux  Ethereum Name Service

Ethereum Name Service  Telcoin

Telcoin