Bitcoin’s Struggle as a Safe-Haven: Can It Outperform Gold During Geopolitical Crises?

Bitcoin experienced volatility on Friday following the airstrike by Israel on Iran. The intensification of conflicts shook the world markets, resulting in substantial corrections for the cryptocurrencies. Bitcoin, which was above $107,000 since June 9, briefly fell under $103,000. At the time of press, BTC is at $104,815, showing a 2.23% decrease over the last 24 hours.

The market’s performance amid geopolitical tensions has raised doubts about Bitcoin as a safe-haven asset. Gold supporter Peter Schiff was swift to highlight the difference between Bitcoin and conventional assets in a crisis. Amidst a 5% rise in oil prices and a 1.5% fall in S&P futures, Bitcoin fell by 2%.

Israel attacks Iran. Oil prices jump 5% while S&P futures fall 1.5%. In response, investors seeking a safe haven buy gold, sending its price up 0.85%. Meanwhile, investors dump Bitcoin, pushing its price down 2%. How can anyone consider Bitcoin to be a digital version of gold?

— Peter Schiff (@PeterSchiff) June 13, 2025

The remarks of Schiff challenged Bitcoin as digital gold. He pointed out that investors rushed towards the gold, causing its price to increase by 0.85%. Conversely, Bitcoin lacked resilience, which brought into question its suitability as a store of value during turbulent periods.

Bitcoin Outperformed Gold and Stocks in Crisis

The Bitcoin enthusiasts, however, were quick to disagree with this narrative. Blockstream CEO Adam Back pointed to past performance to reveal that Bitcoin has beaten traditional assets following past geopolitical crises. He pointed out that even though Bitcoin is prone to short-term decline, it tends to rebound, and usually with greater strength than gold and equities.

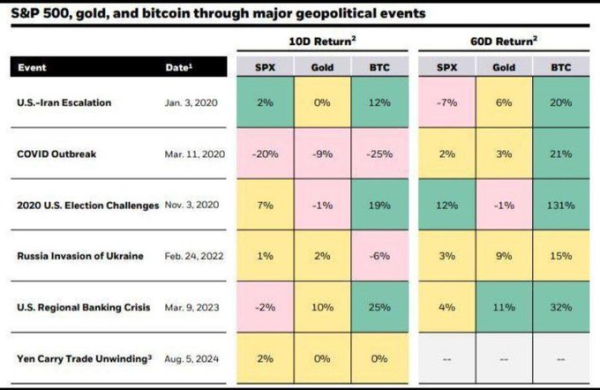

This argument can be substantiated through a historical analysis of how Bitcoin performed during times of crisis. As an illustration, when US-Iran tensions escalated in January 2020, Bitcoin increased by 20% over the following two months. This beat gold, which rose 6%, as well as the S&P 500, which fell 7%.

Likewise, following the onset of the Russia-Ukraine war in 2022, Bitcoin returned 15 %over 60 days, compared with gold, which returned 9%. Amid the banking crisis in the US in March 2023, Bitcoin rose by 32% over the next two months. Gold increased by 11% and equities only by 4%.

Source: X

Bitcoin’s Resilience and Path to Traditional Finance

The performance of Bitcoin through such events demonstrates that it can rebound and surpass the conventional markets. As seen in the case of the COVID-19 outbreak, Bitcoin declined by 25% but then increased by 21% over the next two months. The most notable was in the 2020 US election, where Bitcoin surged 131% in 60 days.

Some industry participants, such as Andrei Grachev, acknowledge that cryptocurrency would benefit from being more integrated with traditional finance. Grachev proposed a Nasdaq listing as a way of gaining the interest of conventional investors. The step may give the crypto market greater stability and longer-term institutional backing.

Although the recent fall of Bitcoin following geopolitical tensions raised concerns. The asset’s track record during previous crises suggests that it could still rally and surpass conventional assets.

Related: Crypto Crash Caused by Israel-Iran Conflict: Prices of Bitcoin, Ethereum, and XRP Drop Sharply

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Canton

Canton  Zcash

Zcash  Sui

Sui  Litecoin

Litecoin  Avalanche

Avalanche  USD1

USD1  Shiba Inu

Shiba Inu  Hedera

Hedera  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Tether Gold

Tether Gold  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave  Bittensor

Bittensor  PAX Gold

PAX Gold  OKB

OKB  Falcon USD

Falcon USD  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Pump.fun

Pump.fun  Binance-Peg WETH

Binance-Peg WETH  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Aster

Aster  HTX DAO

HTX DAO  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Wrapped SOL

Wrapped SOL  Sky

Sky  Worldcoin

Worldcoin  KuCoin

KuCoin  Pi Network

Pi Network  Ripple USD

Ripple USD  Wrapped BNB

Wrapped BNB  Binance Staked SOL

Binance Staked SOL  Ethena

Ethena  syrupUSDC

syrupUSDC  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Rocket Pool ETH

Rocket Pool ETH  POL (ex-MATIC)

POL (ex-MATIC)  Aptos

Aptos  Gate

Gate  Quant

Quant  MYX Finance

MYX Finance  USDD

USDD  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Lombard Staked BTC

Lombard Staked BTC  Render

Render  Arbitrum

Arbitrum  Function FBTC

Function FBTC  River

River  Midnight

Midnight  Official Trump

Official Trump  NEXO

NEXO  Filecoin

Filecoin  VeChain

VeChain  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Mantle Staked Ether

Mantle Staked Ether  USDtb

USDtb  Liquid Staked ETH

Liquid Staked ETH  syrupUSDT

syrupUSDT  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Bonk

Bonk  WrappedM by M0

WrappedM by M0  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Dash

Dash  Story

Story  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Solv Protocol BTC

Solv Protocol BTC  Renzo Restaked ETH

Renzo Restaked ETH  Sei

Sei  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  StakeWise Staked ETH

StakeWise Staked ETH  clBTC

clBTC  OUSG

OUSG  Jupiter

Jupiter  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  COCA

COCA  Binance-Peg XRP

Binance-Peg XRP  Jupiter Staked SOL

Jupiter Staked SOL  Wrapped Flare

Wrapped Flare  Beldex

Beldex  Chiliz

Chiliz  Optimism

Optimism  Usual USD

Usual USD  Tezos

Tezos  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Stacks

Stacks  tBTC

tBTC  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  A7A5

A7A5  GHO

GHO  GTETH

GTETH  TrueUSD

TrueUSD  Lighter

Lighter  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Injective

Injective  Lido DAO

Lido DAO  DoubleZero

DoubleZero  Stable

Stable  Ether.fi

Ether.fi  Kinesis Silver

Kinesis Silver  Cap USD

Cap USD  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Marinade Staked SOL

Marinade Staked SOL  Aerodrome Finance

Aerodrome Finance  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Stader ETHx

Stader ETHx  Kinesis Gold

Kinesis Gold  LayerZero

LayerZero  Maple Finance

Maple Finance  EURC

EURC  Axie Infinity

Axie Infinity  FLOKI

FLOKI  sBTC

sBTC  Staked Aave

Staked Aave  pippin

pippin  Resolv USR

Resolv USR  Celestia

Celestia  BitTorrent

BitTorrent  JUST

JUST  Kaia

Kaia  Resolv wstUSR

Resolv wstUSR  The Graph

The Graph  Gnosis

Gnosis  Pyth Network

Pyth Network  Trust Wallet

Trust Wallet  IOTA

IOTA  Wrapped ApeCoin

Wrapped ApeCoin  Starknet

Starknet  Bitcoin SV

Bitcoin SV  crvUSD

crvUSD  SPX6900

SPX6900  Conflux

Conflux  Sun Token

Sun Token  Telcoin

Telcoin