The 65-Month Clock Is Ticking: Why Bitcoin May Drop 20% While Silver Shines

As risk assets enter a sensitive phase, many analysts are closely monitoring the 65 Month Liquidity Cycle. This model is believed to have accurately forecasted market peaks and troughs for over two decades.

Are we approaching a new tightening phase where Bitcoin faces 20% downward pressure, while Silver emerges as an alternative haven?

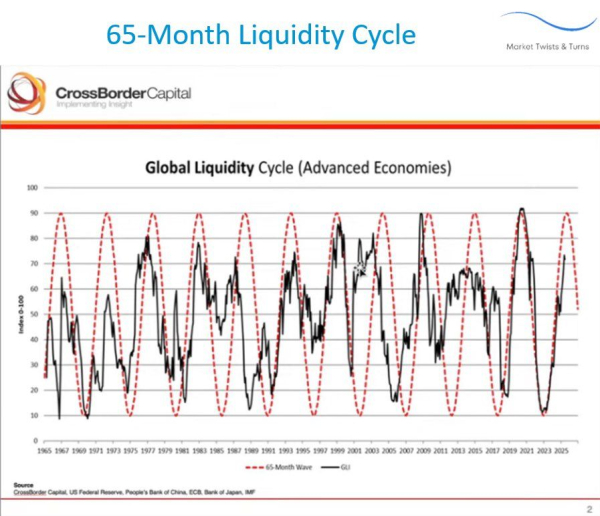

65 Month Liquidity Cycle: Global Liquidity Map Enters Final Stage

In the latest chart from CrossBorder Capital, the black line represents the Global Liquidity Index (GLI). It is currently rising sharply, approaching the red peak area. Its movement resembles the late phases of the 2016-2021 cycle. This strongly suggests we are entering the vibrant late upswing phase of the liquidity cycle. During this period, asset valuations are soaring well beyond their intrinsic worth.

65 Month Liquidity Cycle. Source: X

This is an average 5.5-year cycle, first identified through Fourier analysis in 1999. Each cycle follows a familiar pattern: capital is injected strongly in the early phase, peaks when monetary policy is extremely loose, and then reverses as credit and liquidity tighten.

Based on the slopes of previous cycles, the next liquidity peak is expected to appear in Q1 or Q2 2026, roughly between March and June, just a few months away. This suggests we are nearing an “overheat” phase, when capital flow slows and adjustment risks rise.

If this assumption holds, risk assets—from tech stocks to crypto—will soon enter a “re-pricing” period. This is when smart money begins to reduce exposure to highly leveraged positions, potentially leading to a 15-20% correction in Bitcoin before the new cycle bottom forms.

Although the chart and overall analysis are compelling, as one analyst on X points out, the cycle timing on the chart is often off by several years. This means we cannot know for certain whether the market has peaked, will accelerate, remain flat, or do nothing.

“I like the chart and the overall analysis, but the timing of the cycle is on average off by years in this chart. So, you don’t know whether it has peaked, whether it will accelerate, or do nothing, based on the chart. It is a coinflip,” the analyst noted.

Bitcoin Drops, Silver Rises: Safe Money Rotation Signals

An interesting trend in 2025 is the divergence between Bitcoin (BTC) and Silver. According to charts from 2021 to 2025, Bitcoin has fallen roughly 15-20%, from $109,000 to $82,000. At the same time, Silver rose 13%, from $29 to $33. This reflects a clear shift in capital flows. As global liquidity tightens, investors gradually exit high-risk assets, such as cryptocurrencies, and rotate toward “collateral-backed” assets, including precious metals.

Bitcoin vs Silver divergence. Source: X

This divergence suggests that Bitcoin serves as a risk-on indicator, benefiting directly from liquidity expansion. At the same time, Silver exhibits dual characteristics of a commodity and a safe-haven asset, making it more attractive when inflation remains high but economic growth slows.

Based on stagflation signals and historical trends of the liquidity cycle, many experts predict Silver may outperform Bitcoin during January-April 2026. However, year-end 2025 rallies in both assets suggest that this shift will not occur abruptly but will be moderated by market sentiment and macro events.

“As we move into January-April 2026, we may see this trend accelerate. Bitcoin may only recover moderately, while Silver rises sharply, deepening the rotation toward tangible collateral assets,” the analyst noted.

2026: A Pivot Year for the Cycle – Bitcoin Rebounds or Silver Continues to Lead?

Although a 20% drop in Bitcoin sounds bearish, it does not necessarily mark the end of the bullish cycle. In most late liquidity cycle phases, the market typically experiences a sharp correction before entering the final upswing, known as the “liquidity echo rally.” If this scenario repeats, Bitcoin may undergo a technical dip before rebounding strongly in the second half of 2026.

Meanwhile, Silver, benefiting from industrial demand and hedging flows, may sustain short-term gains. However, when global liquidity expands again in 2027, speculative capital may shift away from precious metals toward cryptocurrencies and equities in search of higher returns.

In summary, the 65 Month Liquidity Cycle is entering a critical phase. Bitcoin is likely to experience a temporary correction, while Silver continues to play the market’s “steady hand.” For long-term investors, this may not be a signal to exit, but rather an opportunity to reposition portfolios ahead of the next liquidity wave in 2026-2027.

The post The 65-Month Clock Is Ticking: Why Bitcoin May Drop 20% While Silver Shines appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Zcash

Zcash  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Rain

Rain  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  Falcon USD

Falcon USD  Aave

Aave  OKB

OKB  Pepe

Pepe  Sky

Sky  Circle USYC

Circle USYC  Global Dollar

Global Dollar  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Bittensor

Bittensor  Ripple USD

Ripple USD  Aster

Aster  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  MYX Finance

MYX Finance  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Quant

Quant  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  Algorand

Algorand  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  NEXO

NEXO  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  OUSG

OUSG  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  Sei

Sei  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Dash

Dash  Decred

Decred  EURC

EURC  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Story

Story  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Pudgy Penguins

Pudgy Penguins  WrappedM by M0

WrappedM by M0  Optimism

Optimism  Kinesis Gold

Kinesis Gold  Lighter

Lighter  c8ntinuum

c8ntinuum  Virtuals Protocol

Virtuals Protocol  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  LayerZero

LayerZero  Resolv wstUSR

Resolv wstUSR  Resolv USR

Resolv USR  COCA

COCA  Gnosis

Gnosis  Stable

Stable  Maple Finance

Maple Finance  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sun Token

Sun Token  Kaia

Kaia  AINFT

AINFT  Wrapped Flare

Wrapped Flare  Injective

Injective  Ether.fi

Ether.fi  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Lido DAO

Lido DAO  FLOKI

FLOKI  IOTA

IOTA  The Graph

The Graph  Binance-Peg XRP

Binance-Peg XRP  crvUSD

crvUSD  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Aerodrome Finance

Aerodrome Finance  Renzo Restaked ETH

Renzo Restaked ETH  Celestia

Celestia  DoubleZero

DoubleZero  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Telcoin

Telcoin  SPX6900

SPX6900  Jupiter Staked SOL

Jupiter Staked SOL  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Olympus

Olympus  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Humanity

Humanity  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  pippin

pippin  PRIME

PRIME  Pyth Network

Pyth Network  ADI

ADI