Ethereum Sees First Sustained Validator Exit Since Proof-of-Stake Shift

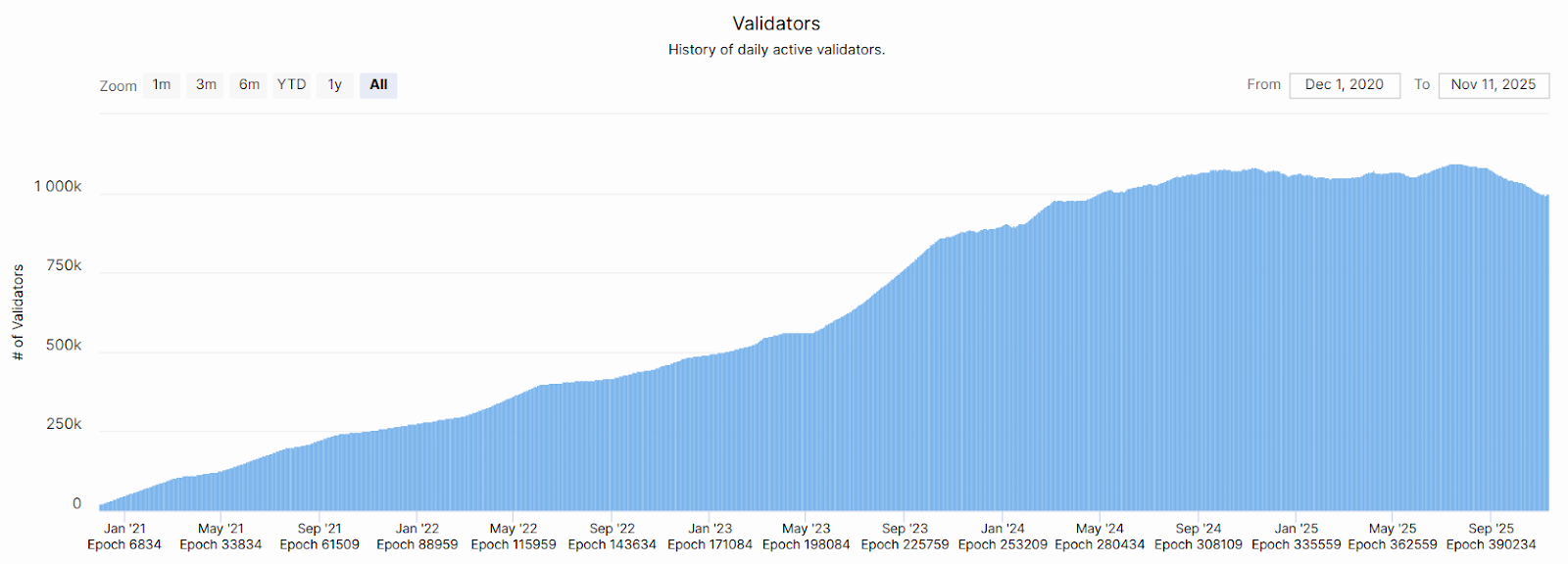

Ethereum’s daily active validator count has fallen about 10% since July to a level not seen since April 2024, according to data from Beaconchain. After a steady rise to new highs, the recent decline would be the first one of this size since the network switched from proof-of-work to proof-of-stake consensus mechanism in September 2022.

Daily active Ethereum validators. Source: Beaconchain

The number of daily active validators recently fell below the 1 million mark for the first time since April 28, 2024, and is standing at 999,203 as of today, Nov. 11.

Validators are the operators that run Ethereum’s software, staking ETH in order to process transactions and keep the network secure in exchange for rewards. In the event that they decide to stop validating the network and fully withdraw their staked ETH, they must go through an exit queue — a built-in safety feature that limits how many can withdraw at once to avoid disrupting the network. After exiting, their funds become withdrawable, and available to cash out.

Clemens Scarpatetti, CEO of CryptoCrew Validators, an Ethereum staking operator, told The Defiant in commentary that the drop in active va

lidations reflects a “mix of cyclical and structural factors.” Scarpatetti explained further:

“We’re likely seeing some profit taking as long-term stakers unwind positions after a strong Q2-Q3 ETH performance, alongside larger-scale withdrawals from liquid staking providers like Lido, whose exit queues have recently reached significant highs.”

ETH 1-year price chart. Source: CoinGecko

As of press time, ETH is trading at $3,470, down roughly 25% from late July and mid-August, when it briefly hit a new all-time high of $4,946, surpassing its November 2021 record. After a choppy year, ETH is up just 4% since January.

While the rally this summer brought relief for long-term holders, it also pushed the validator exit queue to unprecedented new highs as staking operators rushed to unstake their funds to sell at profit.

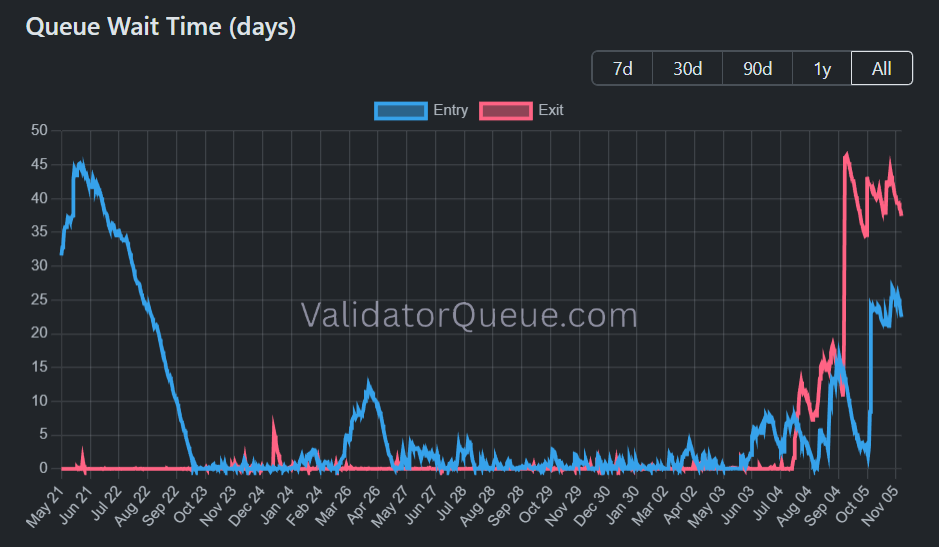

Ethereum validator entry and exit wait time. Source: ValidatorQueue

According to data from ValidatorQueue, which tracks ETH validator activity, it currently takes Ethereum validators approximately 37 days to withdraw staked ETH, up from just one day back in May.

However, the validator entry wait time has also spiked in recent months, with about 1.2 million ETH currently waiting to be staked, and a wait time of 22 days.

Validator Consolidation

Among those watching the shift is Alon Muroch, founder and CEO of SSV Labs, a crypto staking infrastructure provider. Speaking with The Defiant, Muroch said the prolonged Ethereum exit queue was “a predictable consequence of how validator exits operate at scale.”

He noted that Kiln, a large institutional staking service with over $18 billion in staked tokens across different networks, began withdrawing nearly all its validators on Ethereum in early September due to security concerns, as The Defiant previously reported. That figure represents about 4% of total staked ETH or roughly $7 billion.

According to Muroch, large institutions often manage hundreds or thousands of validators. When they exit or consolidate under Ethereum’s new MaxEB rule from the recent Pectra upgrade — which lets them combine up to 2,048 ETH into a single validator instead of running dozens of smaller ones — it can trigger a chain reaction that backs up the queue for others.

Muroch noted that as one large MaxEB validator replaces dozens of smaller ones, the current consolidation could make future mass exits more efficient.

“Real decentralization isn’t just about how many validators exist, it’s about truly independent operators,” Muroch added.

Falling Yields

Staking profitability has also been at play. Meir Rosenschein, director of product for blockchain and AI at DcentraLab, told The Defiant that another factor in the decline was staking yields dropping, and borrowing costs rising, making leveraged staking unprofitable.

As of press time, annualized staking yield for Ethereum stands at approximately 2.9% APR, down from a record 8.6% in May 2023.

“Over the next period validator participation will likely keep shifting toward larger professional operators. Pectra’s 2,048 ETH consolidation makes that easier. The exit queue probably stays slow but stable while withdrawals clear,” Rosenschein explained.

He noted that overall, the validator landscape “looks like it’s trending toward fewer bigger more optimized participants.”

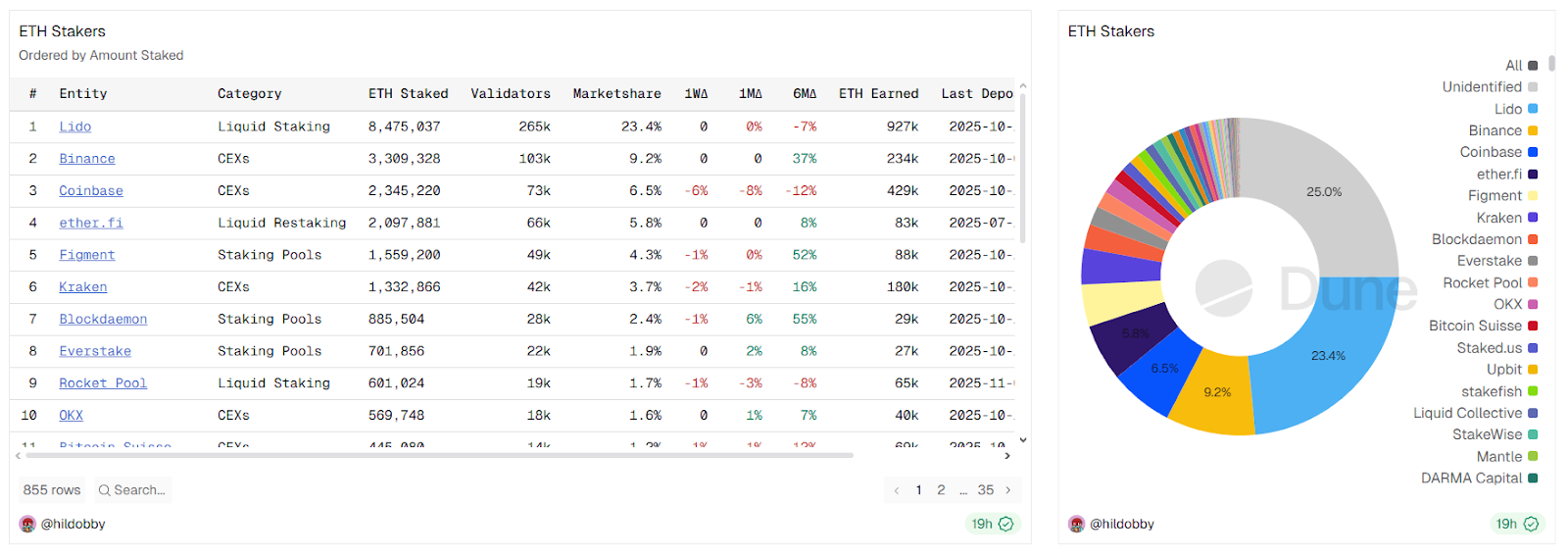

ETH validators by ETH staked. Source: Dune Analytics

Data from blockchain analytics platform Dune shows that at press time, decentralized staking protocol Lido leads the market with over 8.4 million ETH staked across 265,000 validators, holding more than a 23% share. Centralized exchanges Binance and Coinbase follow, accounting for roughly 9.2% and 6.5% of staked ETH, respectively.

Shaul Rejwan, managing partner at Masterkey VC, sees the current decline not as a structural weakness, but as a “natural rotation of capital and compute.” He added in commentary to The Defiant that the current dynamic represents “validator churn, not capitulation,” reflecting a “maturing market optimizing for efficiency.”

So for now, staking yields and participation may stay uneven while withdrawals work through the system. But over time, consolidation and new distributed validator technology could make the network leaner and more efficient, even if fewer operators remain active.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Zcash

Zcash  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Rain

Rain  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  Falcon USD

Falcon USD  Aave

Aave  Aster

Aster  Sky

Sky  OKB

OKB  Global Dollar

Global Dollar  Circle USYC

Circle USYC  Pepe

Pepe  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  MYX Finance

MYX Finance  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  NEXO

NEXO  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  Jupiter

Jupiter  clBTC

clBTC  Decred

Decred  EURC

EURC  Stacks

Stacks  Dash

Dash  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Story

Story  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  LayerZero

LayerZero  WrappedM by M0

WrappedM by M0  JUST

JUST  Pudgy Penguins

Pudgy Penguins  Optimism

Optimism  Stable

Stable  Kinesis Gold

Kinesis Gold  Lighter

Lighter  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Virtuals Protocol

Virtuals Protocol  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Curve DAO

Curve DAO  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  Resolv USR

Resolv USR  BitTorrent

BitTorrent  River

River  Liquid Staked ETH

Liquid Staked ETH  pippin

pippin  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Sun Token

Sun Token  Maple Finance

Maple Finance  Kaia

Kaia  Wrapped Flare

Wrapped Flare  AINFT

AINFT  Kinesis Silver

Kinesis Silver  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Ether.fi

Ether.fi  crvUSD

crvUSD  Lido DAO

Lido DAO  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  Celestia

Celestia  sBTC

sBTC  Bitcoin SV

Bitcoin SV  Aerodrome Finance

Aerodrome Finance  DoubleZero

DoubleZero  Jupiter Staked SOL

Jupiter Staked SOL  Savings USDD

Savings USDD  Humanity

Humanity  Legacy Frax Dollar

Legacy Frax Dollar  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Telcoin

Telcoin  SPX6900

SPX6900  ADI

ADI  PRIME

PRIME