Trend Research’s Ethereum Exit Results in Nearly $750 Million Losses, but Did It Sell at the Bottom?

Trend Research, an investment firm led by Jack Yi, founder of Liquid Capital, has sold its entire Ethereum ($ETH) position, reportedly locking in losses of nearly $750 million.

The large-scale sell-off comes as Ethereum continues its broader downturn, with the altcoin down more than 30% in the past month. The price performance has reignited debate over whether $ETH is approaching a market bottom.

Trend Research Sells Ethereum Amid Market Volatility

BeInCrypto recently reported that Trend Research began transferring Ethereum to Binance at the beginning of the month. On-chain analytics platform Lookonchain confirmed that the firm completed the sell-off yesterday.

In total, Trend Research moved 651,757 $ETH, worth approximately $1.34 billion, to Binance at an average price of $2,055. The transactions reduced the firm’s $ETH holdings to just 0.0344 $ETH, valued at around $72.

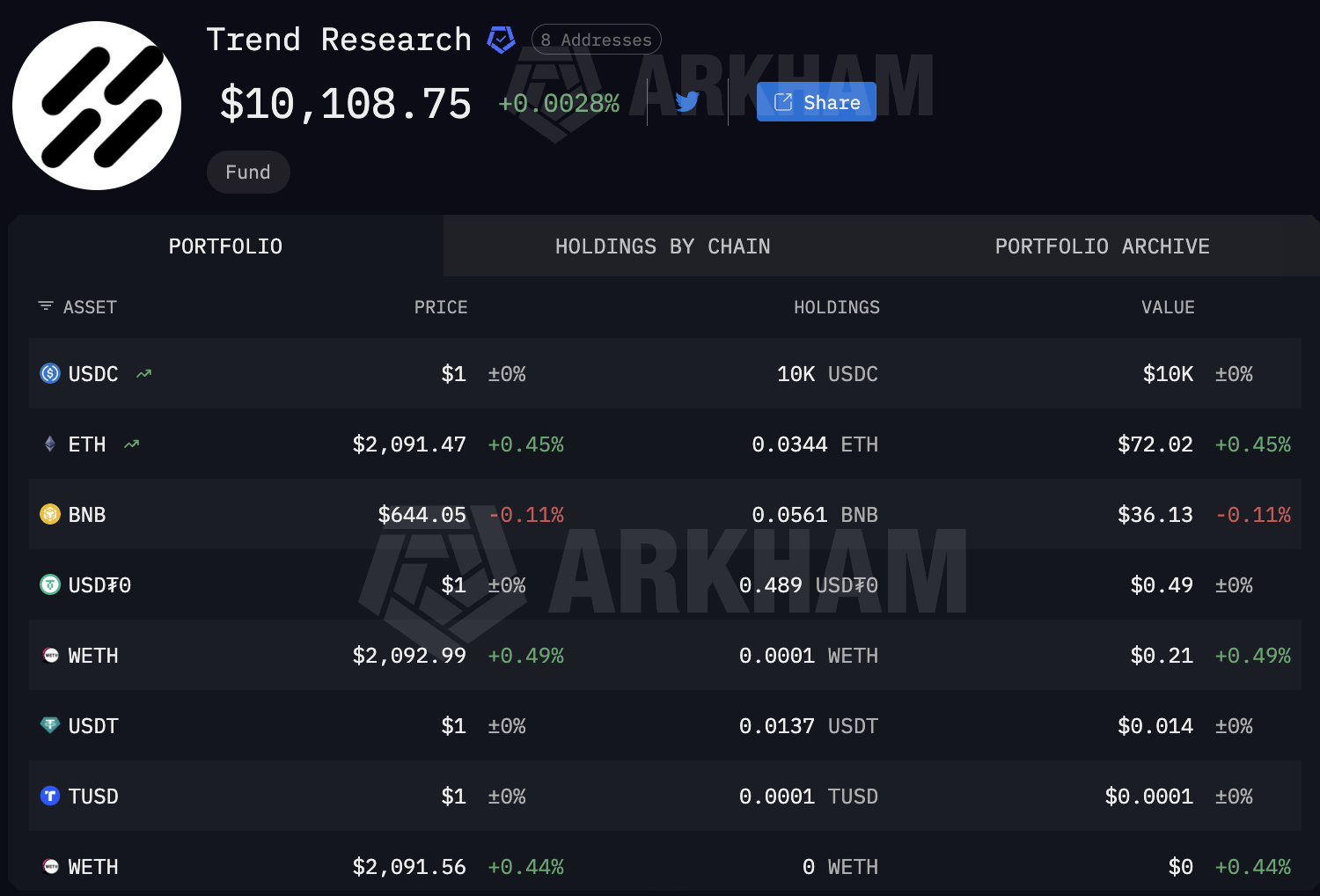

Data from Arkham Intelligence corroborates the near-complete exit, showing residual balances of roughly $10,000 in USDC and minor amounts of other tokens.

“The total loss is ~$747 million,” Lookonchain wrote.

$ETH Sell-Off.”> Trend Research’s Portfolio After $ETH Sell-Off. Source: Arkham

The exit followed a leveraged strategy built on the decentralized finance (DeFi) lending protocol Aave. An analyst explained that Trend Research initially purchased $ETH on centralized exchanges and deposited it as collateral on Aave.

The firm then borrowed stablecoins against the collateral and repeatedly reinvested the borrowed funds into additional $ETH purchases, creating a recursive leveraged position that significantly increased both exposure and liquidation risk.

As $ETH’s price continued to decline, the position moved closer to the liquidation threshold. Rather than risk forced liquidation, Trend Research chose to unwind the entire position voluntarily.

🚨Jack Yi’s Trend Research built a $2.6 BILLION $ETH leveraged long position via Aave.

This month, they sold their entire holdings for $1.74 billion to repay their loans.

They lost $750 MILLION on this trade. pic.twitter.com/00B8OYLiGC

— Ash Crypto (@AshCrypto) February 8, 2026

While Trend Research pivoted to selling, BitMine has taken the opposite approach. Despite mounting unrealized losses, the firm has continued to increase its exposure, recently purchasing $42 million worth of Ethereum.

What an Ethereum Market Bottom Could Mean for Bitmine and Trend Research

The opposing strategies come amid a period of heightened market volatility for Ethereum. BeInCrypto Markets data shows that the second-largest cryptocurrency has declined 32.4% over the past month.

On February 5, $ETH also slipped below $2,000 before recovering. At press time, Ethereum was trading at $ 2,094.16, up around 0.98% over the past 24 hours.

$ETH) Price Performance”> Ethereum ($ETH) Price Performance. Source: BeInCrypto Markets

Amid the downturn, some analysts have suggested that Ethereum may be approaching a market bottom. One analyst described Trend Research’s exit as the “largest capitulation signal.”

“Such forced exits often happen near major lows,” Axel stated.

Joao Wedson, founder of Alphactal, also noted that Ethereum’s price bottom is likely to occur months before Bitcoin’s, citing the faster liquidity cycle typically observed in altcoins.

According to Wedson, some chart indicators suggest that Q2 2026 could mark a potential price bottom for $ETH.

“Some charts already indicate that Q2 2026 could mark a potential price bottom for $ETH. Capitulation has arrived, and realized losses are set to increase sharply,” Wedson added.

$ETH is incredibly oversold.

We have had 6 red months in a row, with the 1M RSI now tagging bear market bottom levels.

Statistically, the R/R for $ETH is very high here.

Added $SOL, already hodl nice bags of $ETH.

It’s looking positive for these big guns now.

I truly believe… pic.twitter.com/mku1VbCOP4

— Sykodelic 🔪 (@Sykodelic_) February 6, 2026

While no bottom has been confirmed yet, the possibility could carry broader implications for institutional sentiment, particularly as some firms choose to de-risk while others continue to accumulate amid ongoing market weakness.

If Ethereum is indeed approaching a market bottom, BitMine’s continued accumulation could prove well-timed, positioning the firm to benefit from a future recovery.

However, if downside pressure persists, Trend Research’s decision to fully unwind its position may ultimately be viewed as a prudent move to limit the risks associated with leveraged strategies.

The post Trend Research’s Ethereum Exit Results in Nearly $750 Million Losses, but Did It Sell at the Bottom? appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Chainlink

Chainlink  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  Rain

Rain  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  Circle USYC

Circle USYC  OKB

OKB  Pepe

Pepe  Bittensor

Bittensor  Sky

Sky  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Aster

Aster  Ripple USD

Ripple USD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Pi Network

Pi Network  Pump.fun

Pump.fun  MYX Finance

MYX Finance  Ondo

Ondo  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Quant

Quant  Jito Staked SOL

Jito Staked SOL  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  NEXO

NEXO  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Render

Render  Filecoin

Filecoin  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  Sei

Sei  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Story

Story  Dash

Dash  PancakeSwap

PancakeSwap  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Decred

Decred  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Pudgy Penguins

Pudgy Penguins  WrappedM by M0

WrappedM by M0  Optimism

Optimism  Lighter

Lighter  Kinesis Gold

Kinesis Gold  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv USR

Resolv USR  Resolv wstUSR

Resolv wstUSR  LayerZero

LayerZero  COCA

COCA  Stable

Stable  AINFT

AINFT  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sun Token

Sun Token  Maple Finance

Maple Finance  BitTorrent

BitTorrent  Injective

Injective  Wrapped Flare

Wrapped Flare  Ether.fi

Ether.fi  DoubleZero

DoubleZero  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Kinesis Silver

Kinesis Silver  Lido DAO

Lido DAO  IOTA

IOTA  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  crvUSD

crvUSD  Renzo Restaked ETH

Renzo Restaked ETH  Celestia

Celestia  Aerodrome Finance

Aerodrome Finance  sBTC

sBTC  pippin

pippin  Telcoin

Telcoin  Bitcoin SV

Bitcoin SV  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  SPX6900

SPX6900  JasmyCoin

JasmyCoin  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Axie Infinity

Axie Infinity  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  River

River  PRIME

PRIME  Humanity

Humanity