How Long Until XRP Gets Its Own Strategy? Expert Reacts as Solana Receives $500M Investment

The XRP community is pondering the arrival of a strategy that invests in XRP, similar to what is available with other prominent crypto assets like Bitcoin and Solana.

Dom Kwok, Co-founder of EasyA Labs, expressed this perspective in a tweet. Specifically, he asked how long it will take until the crypto community sees an XRP strategy that commits to investing in the asset.

Kwok’s tweet came in response to an announcement by SOL Strategies, a Canadian investment company, about securing a $500 million convertible note facility to fund the purchase and staking of SOL tokens. The move marks the largest staking-yield-tied financing deal in the Solana ecosystem.

As part of the deal, SOL Strategies will initially draw $20 million by May 1, 2025. It has the option to access up to $480 million more over time. Interest on the notes will be paid in SOL, tied directly to staking returns, up to 85% of the generated yield.

Beyond SOL Strategies, DeFi Dev Corp (Janover) recently announced the acquisition of 88,164 SOL tokens worth $11.5 million for its crypto treasury strategy. This development came a few weeks after the firm made an earlier $4.6 million Solana investment.

1/ The $SOL stackin’ must carry on! 🚀

DeFi Dev Corp has purchased another 65,305 $SOL worth ~$9.9M as part of our crypto-forward treasury strategy.

This brings our total holdings to 317,273 $SOL, valued at approximately $48.2M (including staking rewards). pic.twitter.com/WC9Oqv3WwM

— DeFi Dev Corp (@defidevcorp) April 23, 2025

Given this massive investment entering the Solana ecosystem, XRP community members wonder when a similar initiative might emerge for XRP.

Already, many companies have adopted a Bitcoin strategy, following in the footsteps of Bitcoin firm Strategy (formerly MicroStrategy). These firms add BTC tokens as part of their financial investments through continuous acquisitions.

A specific example includes Metaplanet Inc., which just bought over $13 million worth of Bitcoin today, bringing its holdings to 5,000 BTC. Other Bitcoin-buying firms include GameStop and Rumble.

But Wen an XRP Strategy?

XRP enthusiasts eagerly look forward to a similar large-scale initiative, and one of their biggest hopes includes exchange-traded funds (ETFs). Several firms have already sought the SEC’s permission to list ETFs that would directly invest in XRP.

Recent reports suggest that such funds could take until the end of this year to go live, as the applications remain under review.

Notably, an XRP ETF recently launched in the U.S., but this fund, which is a leveraged product, does not directly invest in XRP. Instead, it capitalizes on XRP’s daily performance.

Meanwhile, outside of the U.S. market, funds investing in XRP exist, and these funds are attracting investments weekly. However, these investments are not as robust as what the U.S. market would witness.

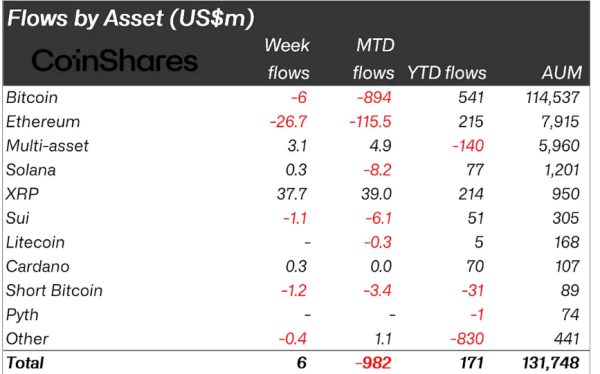

Notably, the most recent investment report by CoinShares shows that XRP investments attracted $37.7 million last week. Interestingly, during the same period, Bitcoin investments reported a drain of $6 million. Ethereum investments posted more significant outflows of $26 million.

CoinShares chart showing XRP investment inflow

Proposal for XRP Strategy in Japan

Beyond ETFs, other significant financial institutions are receiving requests to adopt MicroStrategy’s Bitcoin investment style.

Recently, shareholder GAM Investments urged Japanese financial giant SBI Holdings to adopt an ambitious XRP-focused strategy. GAM proposed that SBI implement an XRP buyback program, similar to MicroStrategy’s Bitcoin accumulation approach.

GAM pointed out SBI’s market undervaluation, highlighting the hidden value of its crypto assets, particularly its substantial stake in Ripple and XRP holdings.

They also suggested that SBI’s underperformance is partly due to the lack of a clear strategy regarding its investments in Ripple and XRP. To address this, GAM recommended increased transparency, including daily valuations of its XRP holdings and regular updates on its net asset value (NAV).

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Bittensor

Bittensor  Aave

Aave  Sky

Sky  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  NEAR Protocol

NEAR Protocol  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Gate

Gate  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  OUSG

OUSG  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Filecoin

Filecoin  Official Trump

Official Trump  USDD

USDD  Render

Render  syrupUSDT

syrupUSDT  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  YLDS

YLDS  Stable

Stable  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  JUST

JUST  Pudgy Penguins

Pudgy Penguins  WrappedM by M0

WrappedM by M0  Kinesis Gold

Kinesis Gold  Dash

Dash  Tezos

Tezos  Ether.fi

Ether.fi  LayerZero

LayerZero  c8ntinuum

c8ntinuum  pippin

pippin  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Curve DAO

Curve DAO  Resolv wstUSR

Resolv wstUSR  AINFT

AINFT  COCA

COCA  Gnosis

Gnosis  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Siren

Siren  Kaia

Kaia  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  ADI

ADI  Humanity

Humanity  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  SPX6900

SPX6900  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  Story

Story  Injective

Injective  River

River  Bitcoin SV

Bitcoin SV  Binance-Peg XRP

Binance-Peg XRP  Lighter

Lighter  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  JasmyCoin

JasmyCoin  sBTC

sBTC  Legacy Frax Dollar

Legacy Frax Dollar  Maple Finance

Maple Finance  Venice Token

Venice Token  Jupiter Staked SOL

Jupiter Staked SOL  Pyth Network

Pyth Network  Savings USDD

Savings USDD  FLOKI

FLOKI  Olympus

Olympus  crvUSD

crvUSD  Marinade Staked SOL

Marinade Staked SOL  Lombard

Lombard  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  BTSE Token

BTSE Token  Optimism

Optimism  Conflux

Conflux  Staked Aave

Staked Aave