Whales Are Going All-In on Ethereum — But Record Leverage Puts Their Longs at Risk

After the FED announced interest rate cuts, major whale wallets began pouring capital into long positions on Ethereum (ETH). These moves signal strong confidence in ETH’s upside. They also increase overall risk.

Several factors suggest that their long positions may face liquidation soon without effective risk management.

How Confident Are Whales in Their Ethereum Long Positions?

Whale behavior offers a clear view of current sentiment.

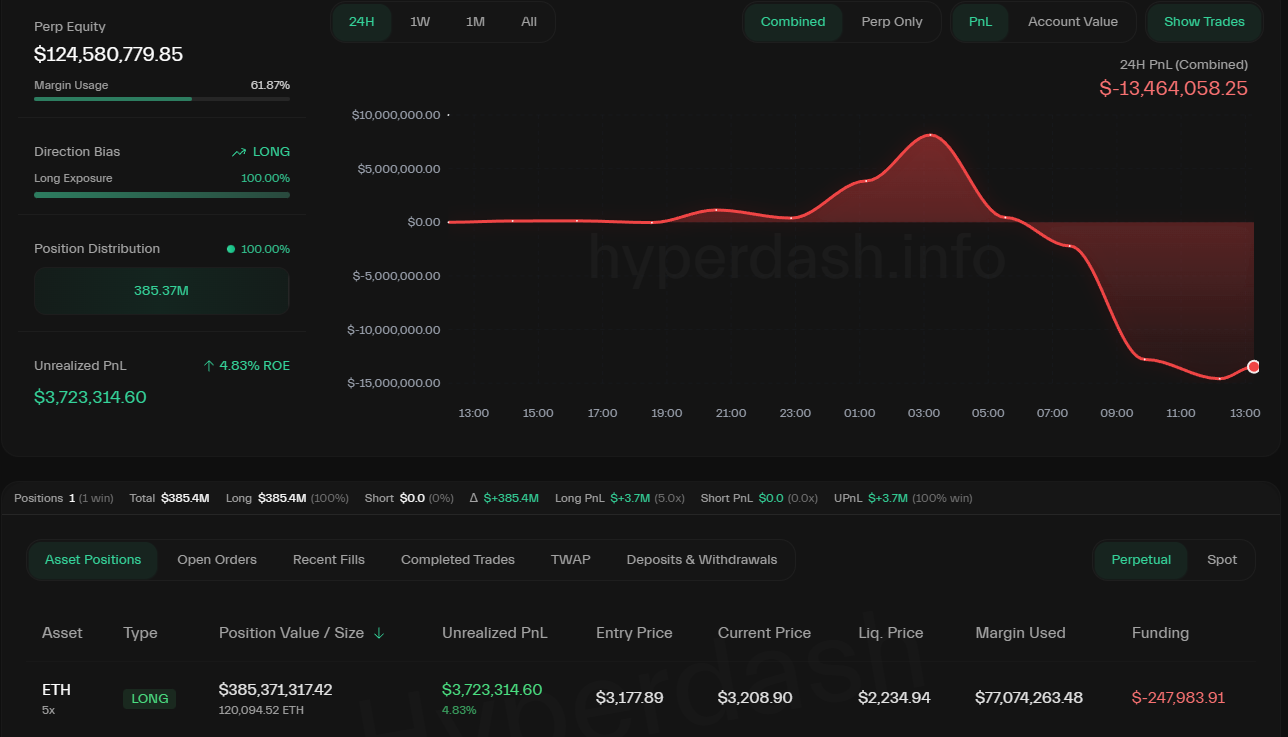

On-chain tracking account Lookonchain reported that a well-known whale, considered a Bitcoin OG, recently expanded a long position on Hyperliquid to 120,094 ETH. The liquidation price sits at only $2,234.

This position is currently showing a 24-hour PnL loss of more than $13.5 million.

A Whale’s Long ETH Position on Hyperliquid. Source: HyperDash

Similarly, another well-known trader, Machi Big Brother, is maintaining a long position worth 6,000 ETH with a liquidation price of $3,152.

Additionally, on-chain data platform Arkham reported that the Chinese whale trader who called the 10/10 market crash is now holding a $300 million ETH long position on Hyperliquid.

Whale activity in ETH long positions reflects their expectation of a near-term price increase. However, behind this optimism lies a significant risk stemming from Ethereum’s leverage levels.

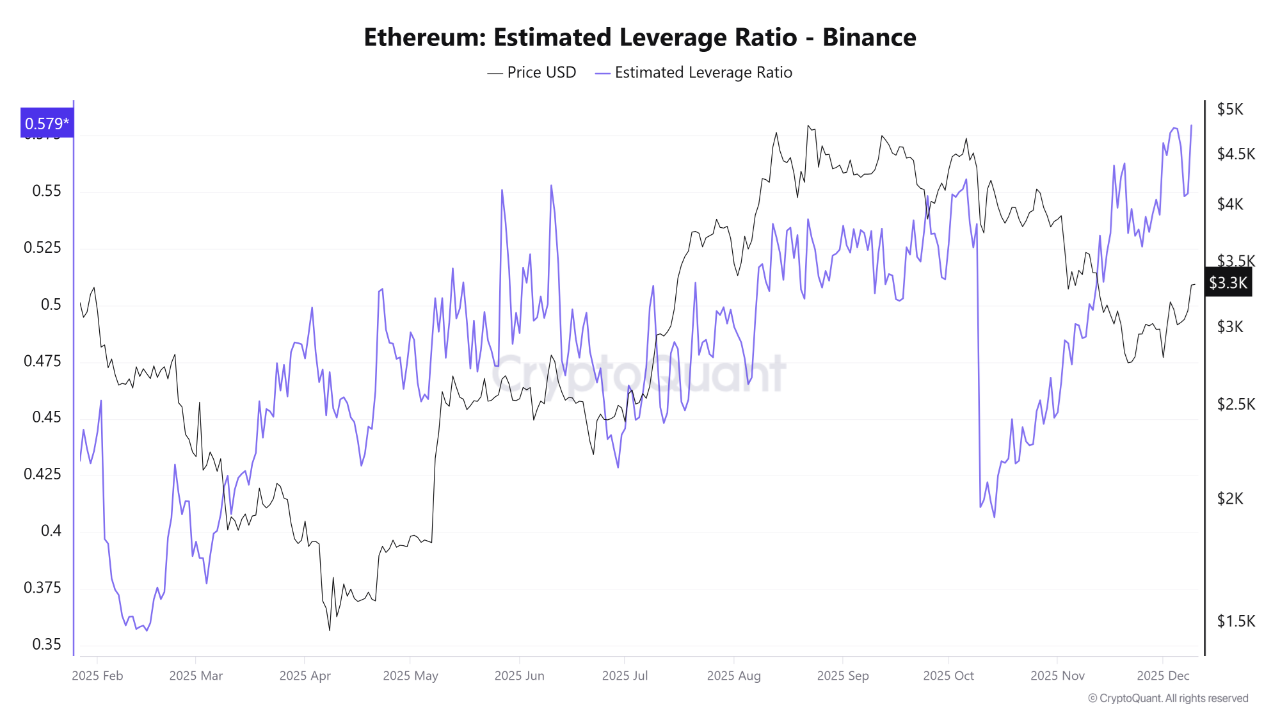

ETH Leverage Is Reaching Dangerous Highs

CryptoQuant data shows that ETH’s estimated leverage ratio on Binance has reached 0.579 — the highest in history. This level indicates extremely aggressive leverage usage. Even a small price swing could trigger a domino effect.

Ethereum Estimated Leverage Ratio – Binance. Source: CryptoQuant.

“Such a high leverage ratio means that the volume of open contracts financed by leverage is rising faster than the volume of actual assets on the platform. When this occurs, the market becomes more vulnerable to sudden price movements, as traders are more susceptible to liquidation—whether in an upward or downward trend,” analyst Arab Chain said.

Historical data indicate that similar peaks typically coincide with periods of intense price pressure and often signal local market tops.

Spot Market Weakness Adds More Risk

The spot market is also showing clear signs of weakening. Crypto market watcher Wu Blockchain reported that spot trading volume on major exchanges dropped 28% in November 2025 compared to October.

November Exchange Data Report: Spot trading volume of major exchanges in November 2025 fell 28% compared with October. The top three exchanges by change rate were Bitfinex +17%, Coinbase -8%, and KuCoin -17%. The bottom three were Bitget -62%, Gate -44%, and MEXC -34%.… pic.twitter.com/oXgFKyrv6b

— Wu Blockchain (@WuBlockchain) December 10, 2025

Another report from BeInCrypto highlighted that stablecoin inflows into exchanges have declined by 50%, falling from $158 billion in August to $ 78 billion as of today.

Combined, low spot buying power, high leverage, and shrinking stablecoin reserves reduce ETH’s ability to recover. These conditions could put whale long positions at significant risk of liquidation.

The post Whales Are Going All-In on Ethereum — But Record Leverage Puts Their Longs at Risk appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Bittensor

Bittensor  Sky

Sky  Global Dollar

Global Dollar  Aster

Aster  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  Aave

Aave  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Pepe

Pepe  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ethena

Ethena  USDtb

USDtb  Render

Render  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  OUSG

OUSG  Aptos

Aptos  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Stable

Stable  YLDS

YLDS  Arbitrum

Arbitrum  GHO

GHO  Jupiter

Jupiter  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Decred

Decred  JUST

JUST  clBTC

clBTC  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Ether.fi

Ether.fi  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  WrappedM by M0

WrappedM by M0  Siren

Siren  LayerZero

LayerZero  Dash

Dash  Kinesis Gold

Kinesis Gold  Tezos

Tezos  Chiliz

Chiliz  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  pippin

pippin  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  River

River  COCA

COCA  Curve DAO

Curve DAO  ADI

ADI  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  BitTorrent

BitTorrent  Kaia

Kaia  PRIME

PRIME  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  Bitcoin SV

Bitcoin SV  SPX6900

SPX6900  JasmyCoin

JasmyCoin  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  Story

Story  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Maple Finance

Maple Finance  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  Legacy Frax Dollar

Legacy Frax Dollar  sBTC

sBTC  IOTA

IOTA  Lighter

Lighter  DoubleZero

DoubleZero  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Savings USDD

Savings USDD  Olympus

Olympus  Pyth Network

Pyth Network  Official FO

Official FO  Marinade Staked SOL

Marinade Staked SOL  crvUSD

crvUSD  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Lombard

Lombard  Venice Token

Venice Token  Optimism

Optimism  Staked Aave

Staked Aave