Ethereum Whales Grab 22% More as Upgrade Nears, ETH Price Breakout Coming?

Key Insights:

- Long-term ETH price holders increased wallets by 22%, lowering cost basis despite unrealized losses.

- Ethereum nears breakout zone with RSI neutral, volume rising, and Bollinger Bands tightening.

- Options volume surges 75% as traders position long ahead of Pectra upgrade and market movement.

A clear shift in Ethereum (ETH) on-chain behavior has emerged over the past two months. Data from CryptoQuant showed that long-term ETH holders—defined by addresses that steadily receive ETH without major selling—boosted their holdings from 15.53 million ETH on March 10 to 19.03 million ETH by May 3.

This marks a 22.54% increase in holdings during a period of price weakness. This activity came as Ethereum dropped below the average entry price of many of these wallets.

Source: X

As of March 10, ETH was trading at $1,866.70, as the realized price of acquiring wallets was around what was about $2,026. Rather, these wallets simply continued to accumulate, bringing down their average cost basis to $1,980 as of May 3 instead of decreasing exposure.

ETH Accumulation Holds Strong Despite Losses

The price of Ethereum has been under pressure since it peaked at $4,107 in December 2024. Since then, ETH has trended downward month after month with the correction that followed. However, the rise of holdings from long-term addresses signals that they are not acting based on short-term price action.

These coins are used in these wallets, and they are kept by them for more than 155 days. They have consistently behaved: added more ETH, and they have not sold.

“Behavior reflects structural conviction & clear expectations of short-term appreciation,” said @oro_crypto, referencing the data tracked in CryptoQuant’s accumulation metrics.

ETH Price Levels Tighten, Traders Watch for Price Breakout

Ethereum is now trading in a narrow zone between $1,783 and $1,831. The Bollinger Bands are tightening, and the price is hovering just below a resistance level at $1,941. The 20-day moving average, sitting at $1,739, continues to provide support.

Source: TradingView

Market momentum remained neutral. The RSI was at 54.63, just under its trend line of 55.50 at press time. These numbers showed that ETH was neither overbought nor oversold. At the same time, volume has grown since mid-April, meaning that larger moves are on the way as attention increases.

Derivatives Market Suggests Bullish Expectations

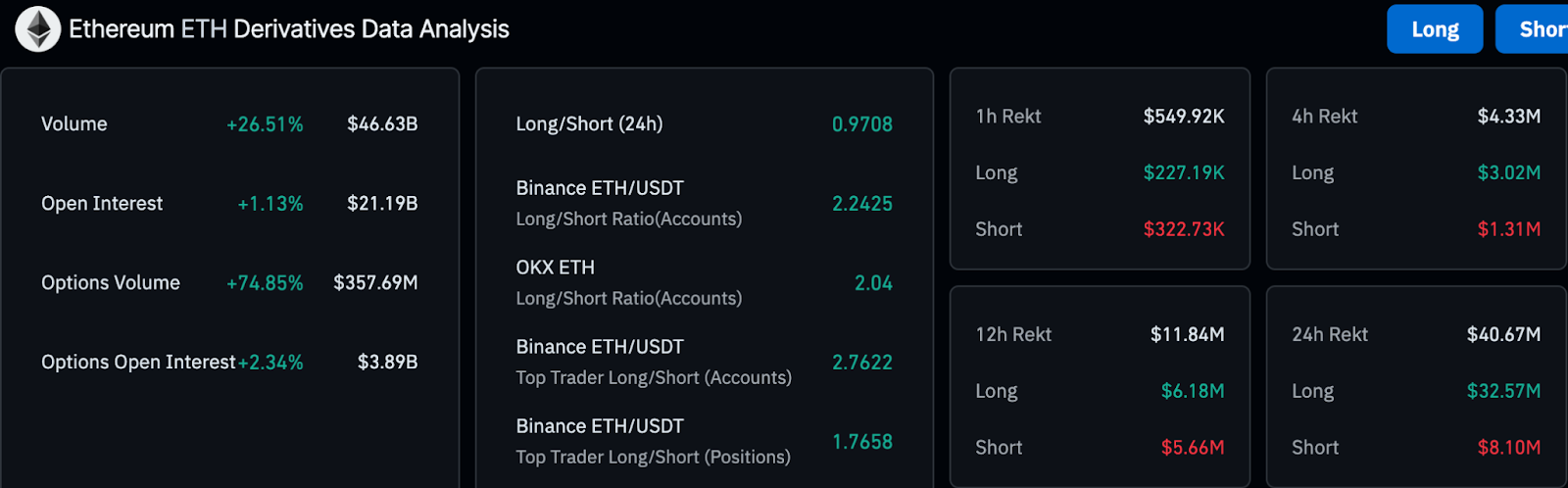

Derivatives activity around Ethereum has picked up. Total trading volume rose 26.51% to $46.3 billion, while open interest saw a smaller rise of 1.13%, now at $21.9 billion. In the options market, volume jumped nearly 75% to $357.69 million, showing that traders are preparing for price volatility.

Shorts were outnumbered by long positions on major exchanges. When writing, the long-to-short ratio on Binance was 2.24, and on OKX, it was 2.04.

Additionally, the ratio was higher among Binance’s top trader accounts at 2.76. This implied that most traders were still betting on what could happen, that of a rise as opposed to a decline.

Source: Coinglass

Liquidations over the last 24 hours amounted to $40.67 million, with $8.10 million off that as a short position. Though long liquidations were higher in general, losing short liquidations in multiple time frames suggested upward pressure.

Chart watchers have noticed a tightening pattern in price action. According to analyst called Thecryptomist, Ethereum was forming an ascending triangle, and price movement inside a smaller wedge could soon trigger a breakout.

“$1950 remains programmed next,” Thecryptomist noted, identifying it as a key level to watch.

Ethereum Upgrade Draws Market Attention to ETH Price

The Ethereum network is set for an upgrade on May 7 called Pectra. There is one notable change, and it is that the validator staking limit is going to be raised from 32 ETH to 2,048 ETH. In addition, it will increase the number of data blobs per block, which may improve throughput and efficiency.

There is building investor attention ahead of the upgrade. “Buying $ETH now is like buying BTC at $4,000,” said analyst @TedPillows, who pointed to Ethereum’s growing use in real-world asset tokenization and its rising institutional interest.

Consequently, the increase in long-term accumulation, derivatives activity, and upcoming protocol changes all suggest that Ethereum is approaching a crucial period.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Bittensor

Bittensor  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  Falcon USD

Falcon USD  Aster

Aster  Aave

Aave  Sky

Sky  Pi Network

Pi Network  OKB

OKB  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Ondo US Dollar Yield

Ondo US Dollar Yield  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Algorand

Algorand  Function FBTC

Function FBTC  Filecoin

Filecoin  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Render

Render  syrupUSDT

syrupUSDT  Jupiter

Jupiter  Stable

Stable  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Beldex

Beldex  Arbitrum

Arbitrum  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  EURC

EURC  USDai

USDai  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Dash

Dash  JUST

JUST  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  Curve DAO

Curve DAO  LayerZero

LayerZero  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  River

River  COCA

COCA  Gnosis

Gnosis  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  AINFT

AINFT  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  pippin

pippin  Aerodrome Finance

Aerodrome Finance  Lighter

Lighter  Wrapped Flare

Wrapped Flare  Kaia

Kaia  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  SPX6900

SPX6900  Sun Token

Sun Token  Injective

Injective  Siren

Siren  Bitcoin SV

Bitcoin SV  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Story

Story  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  IOTA

IOTA  sBTC

sBTC  Pyth Network

Pyth Network  The Graph

The Graph  Venice Token

Venice Token  Jupiter Staked SOL

Jupiter Staked SOL  JasmyCoin

JasmyCoin  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  FLOKI

FLOKI  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Optimism

Optimism  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Maple Finance

Maple Finance  Lido DAO

Lido DAO  BTSE Token

BTSE Token  Plasma

Plasma  Staked Aave

Staked Aave  Conflux

Conflux  DoubleZero

DoubleZero