Ethereum recoils as ETF outflows, CEX balances rise, staking yield falls

Ethereum remained on edge during the weekend as its exchange-traded funds experienced large outflows, exchange balances rose, and staking yield fell.

Ethereum (ETH) was trading at $3,268, down from last month’s high of $4,104. This price action mirrors that of Bitcoin (BTC), which has retreated from an all-time high of $108,000 to below $95,000.

Ether has pulled back as data shows that demand for its ETFs on Wall Street has fallen in the past few days. According to SoSoValue, all Ethereum funds lost $68 million in assets on Friday after losing $159.3 million on Thursday. They lost $86 million in assets on Wednesday.

These funds now have over $11.61 billion in assets, representing 2.96% of Ethereum’s market cap. In contrast, Bitcoin ETFs have $107 billion in assets, or 5.2% of its market cap.

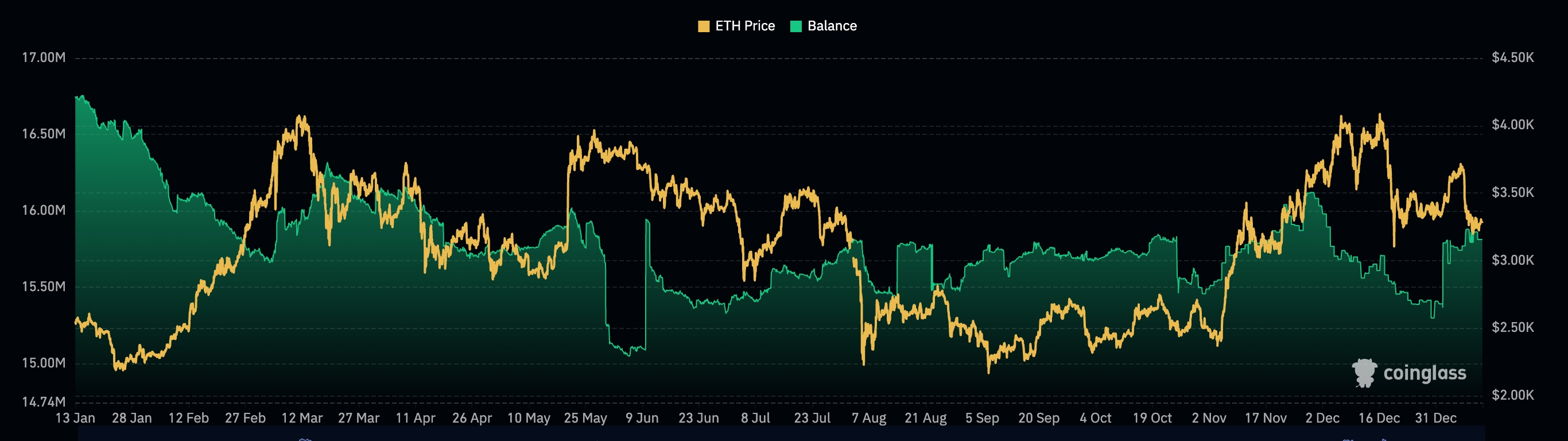

Meanwhile, according to CoinGlass, Ethereum balances on centralized exchanges have risen this year. There are now 15.8 million ETH coins on exchanges, up from 15.30 million on Dec. 30.

Higher exchange balances is a sign that investors are moving their tokens from their wallets to CEX platforms. Transferring cryptocurrencies to exchanges is usually the first step for selling them.

Ethereum balances on CEX exchanges | Source: CoinGlass

More data shows that Ethereum’s futures open interest has dropped from its December high of $31.1 billion, a sign of falling demand. In the last five days, its daily open interest has remained at $28.4 billion, down from the December high of $31.1 billion.

You might also like: Donald Trump: First Sitting U.S. President to HODL meme coins

On the positive side, Ethereum and other cryptocurrencies often rebound when the open interest falls. For example, ETH price started its recent rally in November when the interest dropped to $14 billion.

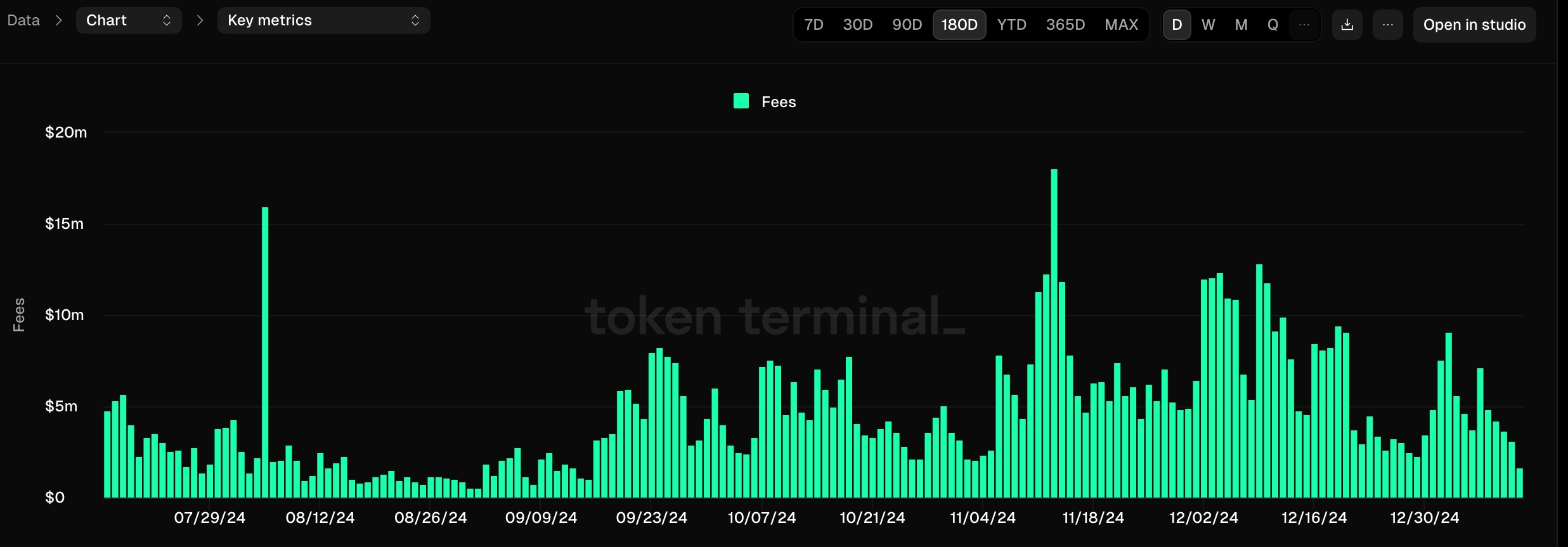

Meanwhile, Ethereum stakers are generating a smaller yield. According to StakingRewards, ETH has a staking reward rate of 3.10%, much lower than Solana’s (SOL) 7% and Tron’s (TRX) 4.52%. Ethereum’s staking rewards often drops when more tokens are delegated to staking pools and when fees fall. As shown below, Ethereum’s fees have been on a downward trajectory in the last few weeks.

Ethereum fees | Source: TokenTerminal

Ethereum price chart analysis

ETH price chart | Source: crypto.news

The daily chart shows that the ETH price peaked at $4,104 in December, forming a double-top pattern with a neckline at $3,520.

It has dropped below the 50-day moving average at $3,415, and found substantial support at the 100-day moving average. Ethereum also found support at the ascending trendline that connects the lowest levels since Nov. 15.

There are signs that the coin has formed a head-and-shoulders pattern, a popular bearish sign. Therefore, a drop below the 100-day moving average and the ascending trendline will point to a bearish breakdown, potentially to $2,820, the highest level since August last year.

Read more: Bitcoin price at risk as bearish divergence forms, hash rate falls

Source

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Dai

Dai  sUSDS

sUSDS  Rain

Rain  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo US Dollar Yield

Ondo US Dollar Yield  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Midnight

Midnight  Quant

Quant  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Aptos

Aptos  Wrapped BNB

Wrapped BNB  OUSG

OUSG  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Stable

Stable  YLDS

YLDS  Jupiter

Jupiter  Arbitrum

Arbitrum  GHO

GHO  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  JUST

JUST  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Sei

Sei  Ether.fi

Ether.fi  WrappedM by M0

WrappedM by M0  LayerZero

LayerZero  Dash

Dash  Chiliz

Chiliz  Kinesis Gold

Kinesis Gold  Tezos

Tezos  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Siren

Siren  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Gnosis

Gnosis  AINFT

AINFT  ADI

ADI  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  PRIME

PRIME  USDai

USDai  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  JasmyCoin

JasmyCoin  SPX6900

SPX6900  FLOKI

FLOKI  Story

Story  Binance-Peg XRP

Binance-Peg XRP  River

River  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Legacy Frax Dollar

Legacy Frax Dollar  The Graph

The Graph  sBTC

sBTC  Olympus

Olympus  Pyth Network

Pyth Network  Lombard

Lombard  Jupiter Staked SOL

Jupiter Staked SOL  crvUSD

crvUSD  Savings USDD

Savings USDD  DoubleZero

DoubleZero  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Marinade Staked SOL

Marinade Staked SOL  Lighter

Lighter  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Conflux

Conflux  Optimism

Optimism  Telcoin

Telcoin  Lido DAO

Lido DAO