Ethereum Price Prediction: Rising Outflows Push ETH Toward Key Breakdown Zone

Ethereum price today trades near $2,995, holding just above the critical $2,950 to $2,880 demand zone as sellers continue to pressure the structure ahead of November 19. The market remains locked inside a clear downtrend, with the descending trendline dominating price action and the EMA cluster reinforcing bearish control.

ETH Extends Breakdown As Sellers Defend The Trendline

ETH Price Action (Source: TradingView)

Ethereum has failed to break the descending trendline that has capped every rebound since early October. Each rally attempt toward $3,350 to $3,450 has been rejected at the underside of this line, confirming a steady sequence of lower highs.

Price now sits beneath all major EMAs.

- 20 EMA: $3,392

- 50 EMA: $3,703

- 100 EMA: $3,781

- 200 EMA: $3,564

The slope of these EMAs shows consistent downward pressure, while the daily candles remain trapped below the 200 day average for more than two weeks. This confirms that buyers have lost medium term control and the market is reacting more to forced flows than risk appetite.

The RSI sits near 30, showing the market is approaching oversold territory, but it has not produced any divergence strong enough to negate the broader trend.

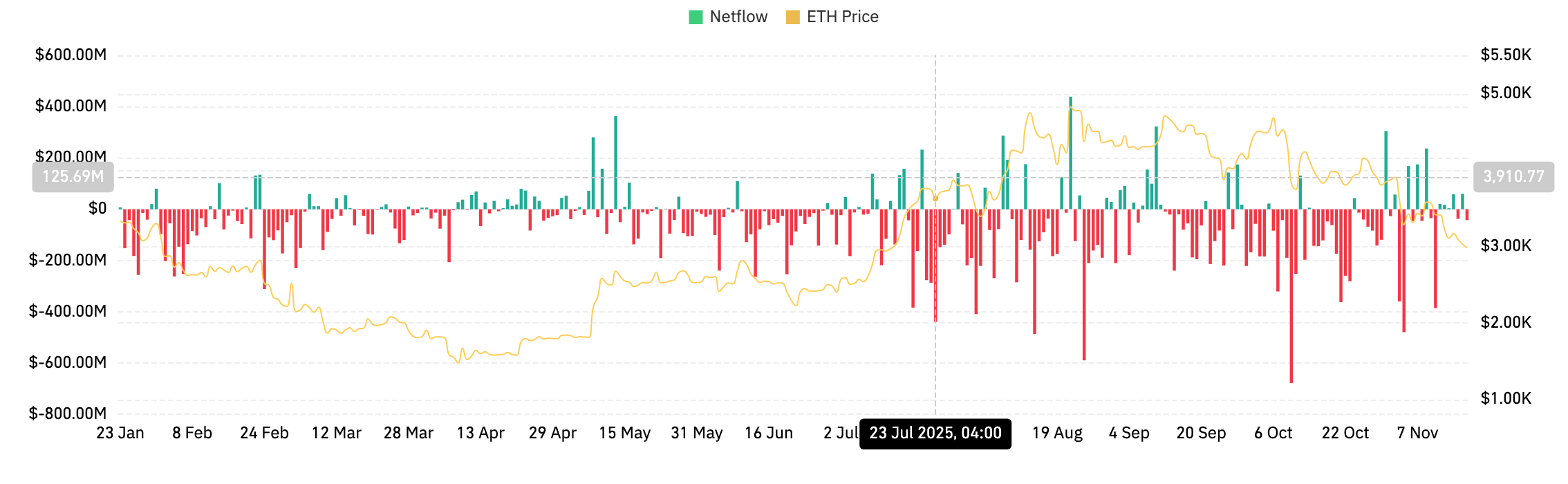

Spot Outflows Rise As Selling Pressure Continues

ETH Netflows (Source: Coinglass)

Coinglass data shows Ethereum recorded $27.56 million in net outflows on November 18, reinforcing the selling bias visible over the past week.

Most sessions in November have leaned toward outflows, suggesting that investors continue to reduce exposure rather than accumulate into weakness.

This aligns with the broader pattern of red outflow bars dating back to late October, when the break below the 200 day EMA first triggered rotation out of ETH. Rising outflows during a macro downtrend typically confirm that spot sellers are driving price, rather than derivatives liquidation alone.

Intraday Momentum Shows Weak Attempts To Stabilize

ETH Short-Term Price Dynamics (Source: TradingView)

Short-term charts reveal ETH attempting to stabilize above $2,980, but the recovery remains shallow. On the 30 minute timeframe, the Supertrend sits overhead at $3,083, forming a ceiling that has rejected every micro-bounce.

The Parabolic SAR is above price, confirming that downside momentum remains active. Each attempt to reclaim $3,050 to $3,100 has stalled immediately as sellers lean into the intraday bearish structure.

For buyers to gain footing, ETH needs a close above $3,083 to flip the Supertrend. This would signal the first sign of momentum exhaustion from sellers. Until that happens, rallies remain corrective rather than constructive.

Outlook. Will Ethereum Go Up?

Ethereum’s trend remains bearish heading into November 19, and the burden of proof shifts fully to buyers.

- Bullish case: ETH holds above $2,950, reclaims $3,083, and breaks through $3,392. That would flip short-term momentum and put the descending trendline back into play for a breakout attempt.

- Bearish case: A daily close below $2,950 exposes $2,800, followed by the deeper support zone near $2,600. Staying below the EMAs keeps the entire structure tilted downward.

If ETH reclaims $3,083 and pushes above the 20 EMA, buyers regain control. Losing $2,950 confirms continuation of the downtrend.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Zcash

Zcash  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Aave

Aave  Pepe

Pepe  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  OKB

OKB  Bitget Token

Bitget Token  Circle USYC

Circle USYC  Global Dollar

Global Dollar  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Pi Network

Pi Network  Sky

Sky  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Internet Computer

Internet Computer  BFUSD

BFUSD  Pump.fun

Pump.fun  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Gate

Gate  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Ethena

Ethena  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Algorand

Algorand  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Render

Render  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Aptos

Aptos  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  VeChain

VeChain  syrupUSDT

syrupUSDT  USDD

USDD  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  pippin

pippin  Beldex

Beldex  Bonk

Bonk  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Stable

Stable  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  Sei

Sei  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  EURC

EURC  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Tezos

Tezos  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Lighter

Lighter  Decred

Decred  Story

Story  Optimism

Optimism  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Kinesis Gold

Kinesis Gold  Mantle Staked Ether

Mantle Staked Ether  JUST

JUST  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  c8ntinuum

c8ntinuum  COCA

COCA  Humanity

Humanity  Ether.fi

Ether.fi  MYX Finance

MYX Finance  Liquid Staked ETH

Liquid Staked ETH  LayerZero

LayerZero  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Bitcoin SV

Bitcoin SV  Gnosis

Gnosis  Kaia

Kaia  BitTorrent

BitTorrent  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Pyth Network

Pyth Network  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  FLOKI

FLOKI  Celestia

Celestia  IOTA

IOTA  Binance-Peg XRP

Binance-Peg XRP  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  Aerodrome Finance

Aerodrome Finance  PRIME

PRIME  sBTC

sBTC  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  ADI

ADI  Jupiter Staked SOL

Jupiter Staked SOL  Maple Finance

Maple Finance  Savings USDD

Savings USDD  crvUSD

crvUSD  Conflux

Conflux  Legacy Frax Dollar

Legacy Frax Dollar  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Starknet

Starknet  Telcoin

Telcoin  Helium

Helium  Staked Aave

Staked Aave  Ethereum Name Service

Ethereum Name Service