Ethereum News: Will ETF Outflows Push ETH Price Below $4,000?

Ethereum price has slipped under the $4,200 support zone, triggering a sharp correction that has rattled the broader altcoin market. With ETF flows weakening, macro uncertainty growing, and technical breakdowns appearing on the daily chart, investors are asking the same question: is ETH price headed for a deeper correction or just a temporary shakeout?

Ethereum News: Why Ethereum Price Fell Below $4,200?

The latest dip was triggered when Ethereum lost its $4,200 support, a level that had previously served as a strong defensive line. This breakdown coincided with cascading liquidations worth over $1.7 billion across altcoins, of which $212.9 million came from ETH alone. That kind of forced selling accelerates momentum to the downside and often overshoots fundamental value.

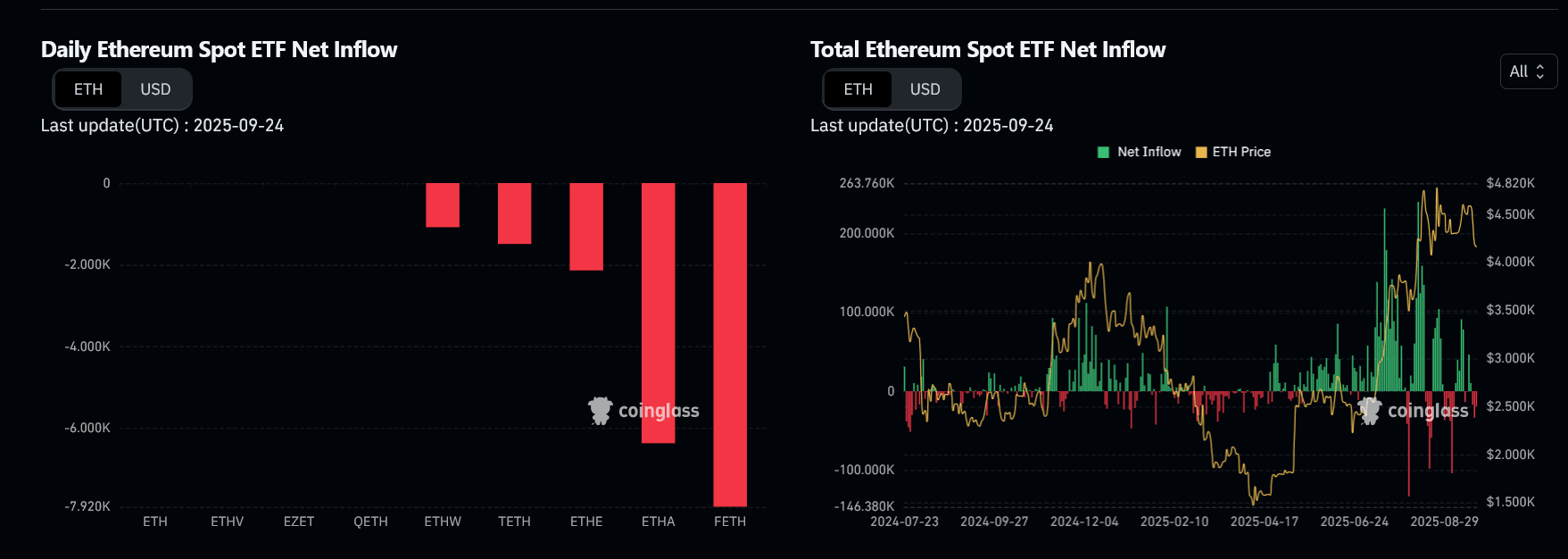

Image Source: coinglass ETH ETF Overview

The Ethereum ETF data tells the real story here. September has seen just $110 million in net ETH ETF inflows, a massive drop compared to August’s $3.8 billion. Worse, the most recent data shows consistent outflows across multiple Ethereum ETF products, with FETH and ETHA showing the heaviest redemptions. This is a clear sign that institutional appetite is cooling, which removes a key driver of the summer rally.

On the cumulative ETF net inflow chart, the momentum shift is obvious. After peaking in mid-2025 with large spikes in green bars, inflows have flattened and slipped negative. That weakens the narrative of ETFs being a sustained bull driver.

Ethereum News: Fed Rate Cuts Lose Their Punch

While the Fed did cut rates by 25 basis points in September, Chair Jerome Powell’s statement that he is “in no hurry” to cut further undermined market confidence. The lack of dovish follow-through has meant crypto traders are no longer betting on rapid liquidity injections. This neutral to slightly hawkish stance reduces the appeal of speculative risk assets like ETH, especially after such a big rally.

Ethereum Price Prediction: Breakdown Signals Risk Ahead

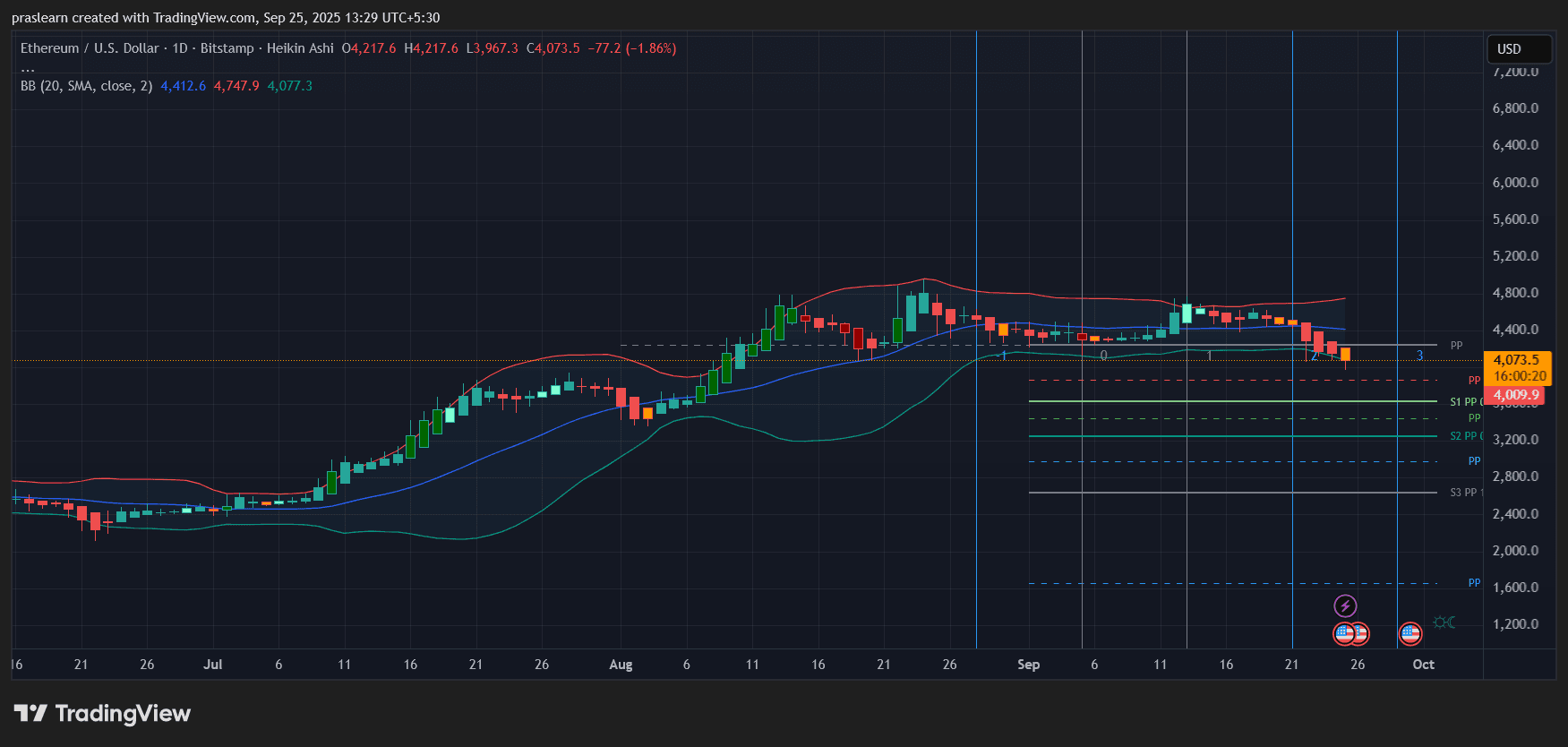

ETH/USD Daily Chart- TradingView

On the TradingView daily chart, ETH price is trading near $4,073, with price slipping below the mid-line of the Bollinger Bands and heading toward the lower band support near $4,000. The Heikin Ashi candles have turned red for several consecutive sessions, showing clear selling momentum.

Key support levels now lie at:

- $4,000 psychological barrier

- $3,750 pivot support

- $3,200 (S2 pivot) as the deeper downside target

On the upside, resistance is at $4,400 and $4,750, both of which must be reclaimed quickly to reset bullish momentum.

The pivot chart shows Ethereum price breaking under its central pivot, suggesting sellers are in control for now. If price closes decisively below $4,000, the next leg could easily test $3,750 or even $3,200.

Short-Term Ethereum Price Prediction: Can ETH Price Hold $4,000?

The combination of ETF outflows, failed macro catalyst, and technical breakdown makes $4,000 the key battleground. A bounce from here would need renewed ETF inflows or strong spot buying to reverse sentiment. Without that, ETH could consolidate between $3,750–$4,200 for weeks, frustrating bulls who expected a breakout toward $5,000.

If ETF flows remain negative, $ETH risks slipping toward $3,200 in Q4. On the other hand, if U.S. macro data softens and Powell signals more cuts, ETF inflows could revive, giving ETH the push back above $4,500.

Ethereum’s correction is not just a chart-driven event; it’s being reinforced by weakening ETF flows and a less supportive Fed. Traders should watch $4,000 closely. A failure to hold it could open the door to a much deeper correction, while a quick reclaim of $4,400 would restore confidence. For now, caution is warranted, and downside protection looks wise until flows turn positive again.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Chainlink

Chainlink  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Litecoin

Litecoin  sUSDS

sUSDS  Dai

Dai  Zcash

Zcash  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Sui

Sui  PayPal USD

PayPal USD  WETH

WETH  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  Rain

Rain  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  Pepe

Pepe  Circle USYC

Circle USYC  OKB

OKB  Bittensor

Bittensor  Global Dollar

Global Dollar  Sky

Sky  syrupUSDC

syrupUSDC  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Aster

Aster  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  MYX Finance

MYX Finance  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  Ethena

Ethena  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  USDD

USDD  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  USDtb

USDtb  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  NEXO

NEXO  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Render

Render  OUSG

OUSG  VeChain

VeChain  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum

Arbitrum  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  Sei

Sei  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  PancakeSwap

PancakeSwap  Story

Story  Dash

Dash  Tezos

Tezos  StakeWise Staked ETH

StakeWise Staked ETH  EURC

EURC  Chiliz

Chiliz  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Decred

Decred  Lighter

Lighter  WrappedM by M0

WrappedM by M0  Pudgy Penguins

Pudgy Penguins  Optimism

Optimism  Virtuals Protocol

Virtuals Protocol  JUST

JUST  Kinesis Gold

Kinesis Gold  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv USR

Resolv USR  Resolv wstUSR

Resolv wstUSR  LayerZero

LayerZero  COCA

COCA  AINFT

AINFT  Sun Token

Sun Token  Ether.fi

Ether.fi  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Maple Finance

Maple Finance  BitTorrent

BitTorrent  Injective

Injective  Gnosis

Gnosis  Wrapped Flare

Wrapped Flare  Stable

Stable  DoubleZero

DoubleZero  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  FLOKI

FLOKI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Lido DAO

Lido DAO  IOTA

IOTA  Aerodrome Finance

Aerodrome Finance  The Graph

The Graph  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  crvUSD

crvUSD  Renzo Restaked ETH

Renzo Restaked ETH  SPX6900

SPX6900  sBTC

sBTC  Kinesis Silver

Kinesis Silver  Bitcoin SV

Bitcoin SV  Telcoin

Telcoin  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  JasmyCoin

JasmyCoin  Pyth Network

Pyth Network  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Starknet

Starknet  PRIME

PRIME  River

River  AB

AB  Staked Aave

Staked Aave