Fluid DEX Faces Backlash Over Rebalancing Risks Amid ETH Volatility

In the decentralized finance (DeFi) world, Fluid DEX — an emerging decentralized exchange — has drawn major attention. Liquidity providers (LPs) in its USDC-ETH pool have reported losses of up to $19 million caused by the platform’s rebalancing mechanism.

This incident has sparked debate across the DeFi community and raised serious questions about transparency and accountability in protecting users.

Ethereum Volatility Triggers Losses for Fluid DEX

Fluid DEX launched in October 2024, when ETH traded around $4,400. The platform promised to generate liquidity of up to $39 for every $1 total value locked (TVL), attracting many LPs to provide liquidity to pools like USDC-ETH.

However, since early 2025, ETH’s price dropped below $1,400 at one point and now hovers around $2,550. This sharp decline caused severe impermanent losses. According to Fluid’s report, the pool’s automated rebalancing mechanism — designed to optimize profits — became the primary source of these losses.

“While the pool performs exceptionally well when prices stay within range (accruing strong fees for LPs), high volatility triggers rebalancing. This happens gradually through trades routed via the pool — from ~$3,800 to ~$1,560, and now ~$2,340. The rebalancing mechanism incurs realized losses for LPs that outweighed fee income,” Samyak Jain, co-founder of Fluid, said.

Rebalancing mechanisms in AMMs like Fluid automatically adjust the pool’s asset ratio to maintain a balanced value based on mathematical formulas. This approach ensures stable liquidity and optimizes trading fee income, especially in high-volume pools.

However, the risks are significant, particularly in volatile pools like USDC-ETH. When asset prices fluctuate heavily, they trigger impermanent loss. This means LPs may suffer losses compared to simply holding the assets outside the pool.

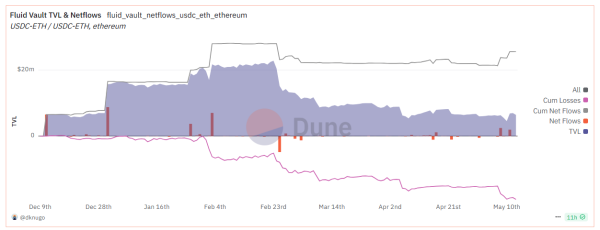

Data from Dune Analytics shows a sharp drop in Fluid Vault’s TVL. As of mid-May 2025, cumulative losses for LPs reached $19 million.

Fluid Vault TVL & Netflows. Source: Dune

Tensions escalated when DeFi news provider DefiMoon publicly criticized Fluid and paid Key Opinion Leaders (KOLs) for failing to warn users about the rebalancing risks.

DefiMoon claimed that Fluid heavily promoted the pool, promising high yields and even suggesting it could surpass Uniswap, one of the top DEXs. However, they said the platform barely mentioned the rebalancing risks, leaving many inexperienced LPs with heavy losses.

“None of them ever mentioned rebalancing as a potential issue and I’m pretty sure neither of them put a single dollar of capital into this pool!” DefiMoon stated.

Still, Samyak Jain defended the platform. He emphasized that Fluid’s stablecoin pools are still performing well and continue to generate strong returns for LPs. He also denied the $19 million figure, claiming the ETH-USDC pool only suffered “partial loss” due to general market volatility, not due to any flaw in Fluid itself.

Fluid proposed a compensation plan to support affected LPs. It offered 500,000 FLUID tokens, worth $2.6 million, with a one-year vesting schedule.

The Fluid DEX case serves as a warning to the DeFi community. Understanding risks is crucial before providing liquidity to any pool.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Rain

Rain  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  Aave

Aave  Bitget Token

Bitget Token  Circle USYC

Circle USYC  OKB

OKB  Global Dollar

Global Dollar  HTX DAO

HTX DAO  Pepe

Pepe  syrupUSDC

syrupUSDC  Sky

Sky  Ripple USD

Ripple USD  Bittensor

Bittensor  BFUSD

BFUSD  Pi Network

Pi Network  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Cosmos Hub

Cosmos Hub  Ethena

Ethena  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  USDD

USDD  Render

Render  VeChain

VeChain  syrupUSDT

syrupUSDT  Filecoin

Filecoin  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  MYX Finance

MYX Finance  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  pippin

pippin  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  Sei

Sei  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Jupiter

Jupiter  EURC

EURC  Dash

Dash  Decred

Decred  StakeWise Staked ETH

StakeWise Staked ETH  Stable

Stable  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Pudgy Penguins

Pudgy Penguins  Story

Story  Optimism

Optimism  River

River  LayerZero

LayerZero  Mantle Staked Ether

Mantle Staked Ether  Kinesis Gold

Kinesis Gold  Lighter

Lighter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Virtuals Protocol

Virtuals Protocol  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  Humanity

Humanity  JUST

JUST  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  c8ntinuum

c8ntinuum  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Bitcoin SV

Bitcoin SV  BitTorrent

BitTorrent  Kaia

Kaia  Gnosis

Gnosis  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  AINFT

AINFT  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Ether.fi

Ether.fi  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Maple Finance

Maple Finance  Injective

Injective  ADI

ADI  PRIME

PRIME  Binance-Peg XRP

Binance-Peg XRP  Kinesis Silver

Kinesis Silver  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  crvUSD

crvUSD  Renzo Restaked ETH

Renzo Restaked ETH  JasmyCoin

JasmyCoin  FLOKI

FLOKI  sBTC

sBTC  Lido DAO

Lido DAO  The Graph

The Graph  IOTA

IOTA  Jupiter Staked SOL

Jupiter Staked SOL  Celestia

Celestia  Savings USDD

Savings USDD  Conflux

Conflux  DoubleZero

DoubleZero  Legacy Frax Dollar

Legacy Frax Dollar  Marinade Staked SOL

Marinade Staked SOL  Pyth Network

Pyth Network  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Aerodrome Finance

Aerodrome Finance  Olympus

Olympus  SPX6900

SPX6900  Telcoin

Telcoin  Staked Aave

Staked Aave  Starknet

Starknet