Bitcoin’s New Investors Hold the Line as Bulls Eye Return to $122,000

Leading cryptocurrency Bitcoin has witnessed heightened volatility this week, marked by sharp price swings and fresh record highs. Just yesterday, the coin surged to a new all-time high of $123,731 before retreating. Now trading at $119,937, the asset has pulled back by roughly 4% from its peak.

However, despite these fluctuations, on-chain data has revealed a holding pattern among Bitcoin’s short-term holders (STHs). This could help drive another upward push for the coin in the short term.

Short-Term Holders Could Be Fuel for Bitcoin’s Next Rally

BTC STHs (investors who have held their coins for 155 days or less) have reduced their selloffs and gradually fallen into an accumulation pattern even as the market’s volatility climbs.

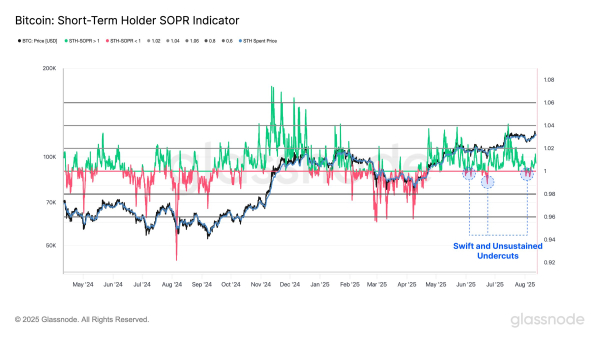

This is reflected by the coin’s STH Spent Output Profit Ratio (STH-SOPR) metric, which briefly dipped below the neutral line but has rebounded, per Glassnode.

Bitcoin STH-SOPR. Source: Glassnode

The STH-SOPR metric measures whether coins moved by STHs are being sold at a profit or a loss. When it stays above the neutral one level, STHs sell at a profit, signaling strong market sentiment. On the other hand, when it drops below one, these investors are distributing their coins at a loss.

The movement of BTC’s STH-SOPR above the neutral line is noteworthy because STHs are among the most influential participants in BTC’s price movements. With their cost bases often close to the current market price, STHs are usually the first to react to swings. They worsen selloffs during downturns or improve rallies when they hold or accumulate.

Therefore, their decision to revert to a holding pattern, despite sharp price fluctuations, reflects a degree of conviction that can help stabilize the market.

Bitcoin’s Aggressive Buyers Absorb Sell Pressure

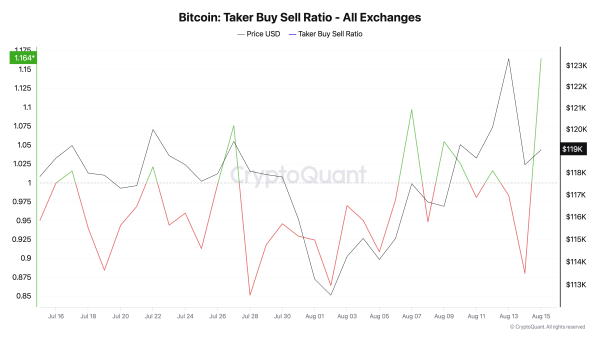

Bitcoin’s taker-buy/sell ratio has climbed to a monthly high of 1.16, confirming the bullish tilt in sentiment among derivatives traders.

Bitcoin Taker Buy Sell Ratio. Source: CryptoQuant

The ratio measures the balance between market buy orders and sell orders on futures and perpetual contracts. A value above one means that more trades are executed at the ask price (market buys) than at the bid price (market sells), signaling stronger buyer aggression.

BTC’s current taker-buy/sell ratio means buyers in its derivatives market are actively absorbing sell-side liquidity. This shows growing demand and highlights strengthening conviction, which could drive a rebound.

$122,000 Breakout or Drop to $115,000?

If these trends persist, the king coin BTC could be back on track to retest the $122,000 level in the near term. A breach of the resistance at $122,190 could trigger a rebound toward its all-time high of $123,731.

BTC Price Analysis. Source: TradingView

However, if volatility strengthens and bullish conviction weakens, sell-side pressure could increase, causing a price drop to $115,892.

The post Bitcoin’s New Investors Hold the Line as Bulls Eye Return to $122,000 appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Cardano

Cardano  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Monero

Monero  Chainlink

Chainlink  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  PayPal USD

PayPal USD  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Zcash

Zcash  Avalanche

Avalanche  Shiba Inu

Shiba Inu  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Rain

Rain  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Falcon USD

Falcon USD  Bitget Token

Bitget Token  Aave

Aave  Circle USYC

Circle USYC  Global Dollar

Global Dollar  OKB

OKB  HTX DAO

HTX DAO  Pepe

Pepe  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Sky

Sky  Bittensor

Bittensor  BFUSD

BFUSD  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  Worldcoin

Worldcoin  KuCoin

KuCoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  POL (ex-MATIC)

POL (ex-MATIC)  Cosmos Hub

Cosmos Hub  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  Midnight

Midnight  USDtb

USDtb  Algorand

Algorand  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  NEXO

NEXO  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Aptos

Aptos  VeChain

VeChain  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Render

Render  Arbitrum

Arbitrum  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  MYX Finance

MYX Finance  USDai

USDai  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Sei

Sei  clBTC

clBTC  pippin

pippin  Stacks

Stacks  EURC

EURC  Jupiter

Jupiter  PancakeSwap

PancakeSwap  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Stable

Stable  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  LayerZero

LayerZero  WrappedM by M0

WrappedM by M0  River

River  Pudgy Penguins

Pudgy Penguins  Kinesis Gold

Kinesis Gold  Story

Story  Decred

Decred  Optimism

Optimism  Mantle Staked Ether

Mantle Staked Ether  Virtuals Protocol

Virtuals Protocol  Lighter

Lighter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Resolv wstUSR

Resolv wstUSR  JUST

JUST  COCA

COCA  c8ntinuum

c8ntinuum  Curve DAO

Curve DAO  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  Sun Token

Sun Token  Gnosis

Gnosis  AINFT

AINFT  Wrapped Flare

Wrapped Flare  Ether.fi

Ether.fi  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Maple Finance

Maple Finance  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Humanity

Humanity  PRIME

PRIME  crvUSD

crvUSD  ADI

ADI  Binance-Peg XRP

Binance-Peg XRP  JasmyCoin

JasmyCoin  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Bitcoin SV

Bitcoin SV  Renzo Restaked ETH

Renzo Restaked ETH  Kinesis Silver

Kinesis Silver  FLOKI

FLOKI  sBTC

sBTC  IOTA

IOTA  The Graph

The Graph  Lido DAO

Lido DAO  Jupiter Staked SOL

Jupiter Staked SOL  Celestia

Celestia  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Olympus

Olympus  DoubleZero

DoubleZero  Marinade Staked SOL

Marinade Staked SOL  Aerodrome Finance

Aerodrome Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Pyth Network

Pyth Network  SPX6900

SPX6900  Telcoin

Telcoin  ZKsync

ZKsync  Staked Aave

Staked Aave  Resolv USR

Resolv USR