ETH Rebounds as Amazon Web Services Integrates Ethereum Payments for Businesses

New York — Ethereum (ETH) is showing remarkable resilience after one of the sharpest crypto sell-offs of the year. Despite dropping to $3,510 during Friday’s “Black Monday” crash — triggered by U.S. President Donald Trump’s 100% tariff announcement on China — ETH has rebounded to around $3,817, outperforming most altcoins that lost over 70%–90% of their value.

—

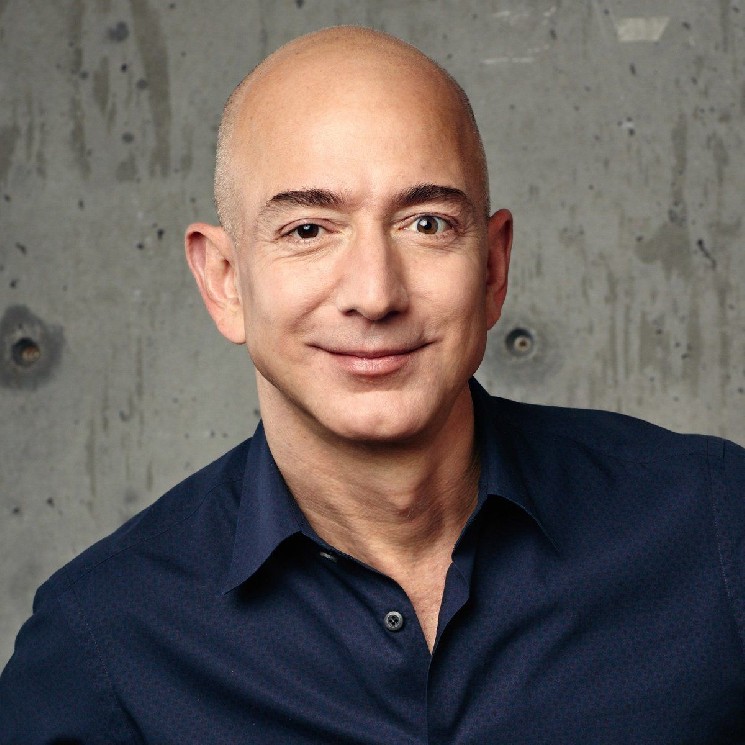

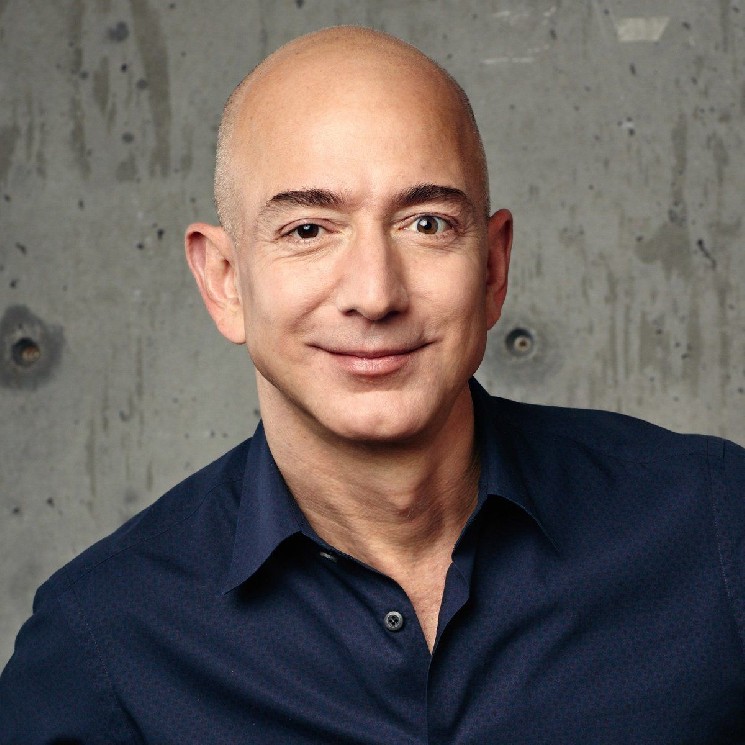

The recovery comes at a pivotal time for Ethereum’s ecosystem, as Amazon Web Services (AWS) has unveiled a new payment infrastructure supporting Ethereum and EVM-compatible networks, allowing B2B clients to accept and automate digital asset payments.

AWS Boosts Ethereum’s Institutional Relevance

AWS’s new solution lets enterprise clients integrate Ethereum and stablecoin payments directly into their cloud infrastructure — streamlining transactions between businesses using decentralized networks. While this service won’t yet impact retail payments on Amazon.com, it’s a major step toward normalizing Ethereum-based settlements across global enterprise networks.

The infrastructure enables automated B2B payment workflows, compliance management, and programmable settlement features built for large-scale financial operations. By doing so, AWS bridges the gap between traditional financial systems and blockchain-native value transfer.

This is significant, as Ethereum remains the backbone of decentralized finance (DeFi) and enterprise-grade smart contracts. Integrating ETH at the cloud-service level provides both validation of its utility and new demand pipelines that could drive long-term value appreciation.

Market Turmoil Meets Utility Momentum

Friday’s crypto crash erased nearly $20 billion in leveraged positions, with 1.6 million traders liquidated, according to CoinGlass. Bitcoin dropped from $122,000 to $102,000, while Ethereum’s decline was comparatively contained.

ETH tapped its 200-day exponential moving average (EMA) — a key technical support — before rebounding above $3,800, suggesting that long-term holders and institutional participants continue to see value at these levels.

Analysts note that while market volatility has intensified, Ethereum’s fundamental narrative remains bullish.

Why AWS’s Ethereum Move Could Support Price Recovery

The timing of AWS’s announcement couldn’t be more critical. In a week defined by liquidation and fear, Ethereum received a major validation from one of the world’s largest enterprise technology providers.

This move positions ETH as a practical settlement layer for corporate finance, supply chains, and Web3-native commerce — all sectors expected to expand dramatically through 2026.

Even amid short-term sell pressure — with record-high exchange inflows and $10B in staking withdrawals, according to CryptoQuant and Nansen — the long-term picture looks constructive.

Institutional integration from companies like Amazon strengthens the case for Ethereum’s “network value over price” thesis.

Investment research firm Fundstrat projects a potential rebound to $5,500 in the next major cycle once macro pressures subside.

The Blockster Take

Yes, the crypto markets are shaking — but Ethereum’s resilience tells the real story. AWS’s integration of Ethereum payment infrastructure signals that even amid volatility, utility and adoption continue to advance.

Short-term pain doesn’t change the long-term direction: Ethereum remains the most active platform for smart contracts, stablecoins, and decentralized applications. The more infrastructure that builds around it, the stronger its foundation becomes.

For long-term investors, this may not be the end of the storm — but it’s definitely the calm before the next surge.

Source: Intellectia AI Ainvest Cointelegraph

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Zcash

Zcash  Avalanche

Avalanche  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  Uniswap

Uniswap  PAX Gold

PAX Gold  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aave

Aave  Bittensor

Bittensor  Falcon USD

Falcon USD  Aster

Aster  Pepe

Pepe  OKB

OKB  Global Dollar

Global Dollar  Sky

Sky  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Bitget Token

Bitget Token  Ripple USD

Ripple USD  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Internet Computer

Internet Computer  BFUSD

BFUSD  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Gate

Gate  Pump.fun

Pump.fun  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Filecoin

Filecoin  USDD

USDD  Wrapped BNB

Wrapped BNB  Render

Render  Function FBTC

Function FBTC  OUSG

OUSG  pippin

pippin  Aptos

Aptos  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Stable

Stable  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Jupiter

Jupiter  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  Sei

Sei  EURC

EURC  USDai

USDai  StakeWise Staked ETH

StakeWise Staked ETH  Virtuals Protocol

Virtuals Protocol  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Dash

Dash  tBTC

tBTC  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Tezos

Tezos  JUST

JUST  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Lighter

Lighter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Story

Story  Resolv wstUSR

Resolv wstUSR  Aerodrome Finance

Aerodrome Finance  COCA

COCA  Chiliz

Chiliz  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  Kaia

Kaia  AINFT

AINFT  Bitcoin SV

Bitcoin SV  Wrapped Flare

Wrapped Flare  Injective

Injective  LayerZero

LayerZero  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Sun Token

Sun Token  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  ADI

ADI  Pyth Network

Pyth Network  Celestia

Celestia  IOTA

IOTA  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  JasmyCoin

JasmyCoin  Renzo Restaked ETH

Renzo Restaked ETH  crvUSD

crvUSD  FLOKI

FLOKI  sBTC

sBTC  Siren

Siren  Lido DAO

Lido DAO  Olympus

Olympus  Jupiter Staked SOL

Jupiter Staked SOL  Maple Finance

Maple Finance  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  DoubleZero

DoubleZero  Helium

Helium  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Optimism

Optimism  BTSE Token

BTSE Token  Telcoin

Telcoin  Ethereum Name Service

Ethereum Name Service  Staked Aave

Staked Aave  Humanity

Humanity