ETH History Lesson: SMA Crossovers Previously Signaled Major Price Shifts

Ethereum’s price fell below the $1,810 mark recently as increasing bearish pressure emerged across the crypto market. Current technical and on-chain indicators reflect a cautious investor stance. Trading activity shows signs of declining, consistent spot outflows continue, and weak momentum metrics signal a possible continuation of the downward trend.

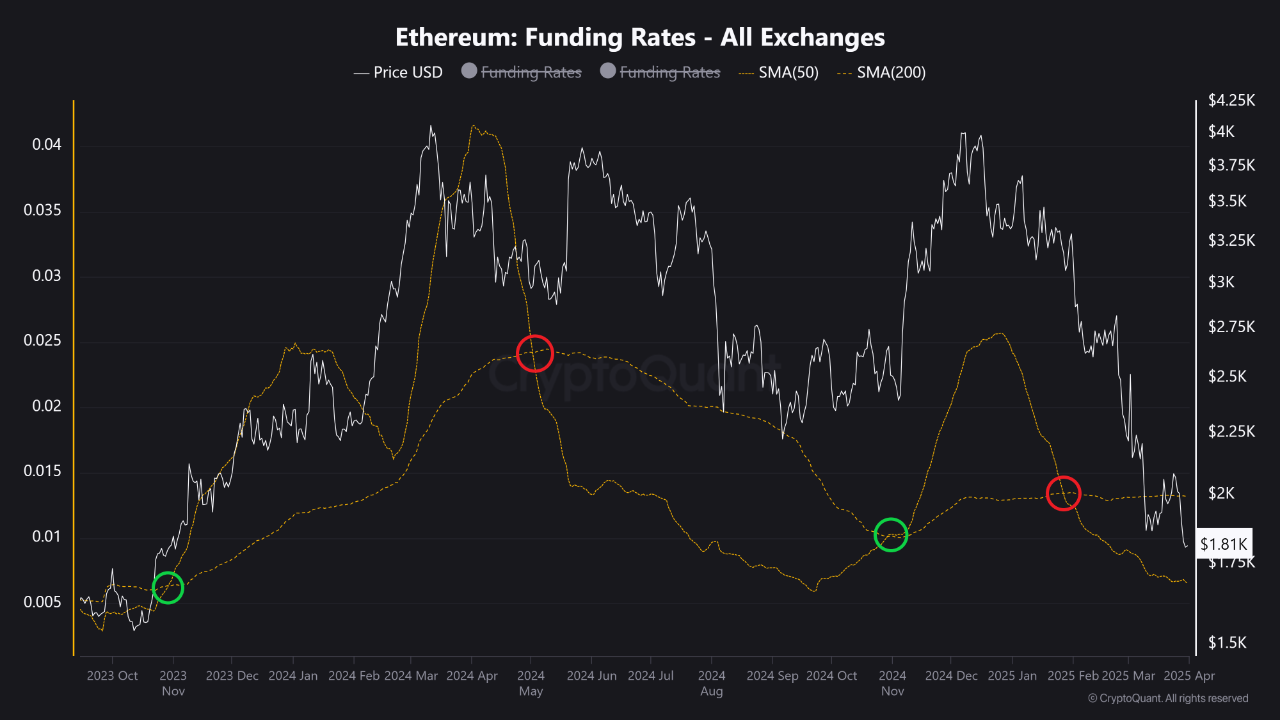

According to recent market data, Ethereum’s funding rates across major exchanges shifted into negative territory. This suggests many derivatives traders currently avoid high-risk leveraged long positions on ETH. Historical patterns observed between ETH funding rates and subsequent price action often show a strong correlation.

Source: CryptoQuant

How Have Past Indicators Predicted ETH Price Shifts?

Previous bullish and bearish crossovers of key Simple Moving Averages (SMAs), like the 50-day and 200-day, also aligned historically with major Ethereum price shifts.

A bullish SMA crossover in November 2023, for instance, preceded a significant rally that saw Ethereum rise above $4,000 by early 2024. Conversely, a bearish crossover observed in May 2024 marked the start of a sustained market downturn for ETH. Another recovery phase followed a bullish crossover in November 2024, but the most recent bearish SMA signal occurring in early 2025 coincided with the current price decline taking ETH below $2,000.

Spot Exchange Outflows Indicate Cautious Investor Behavior

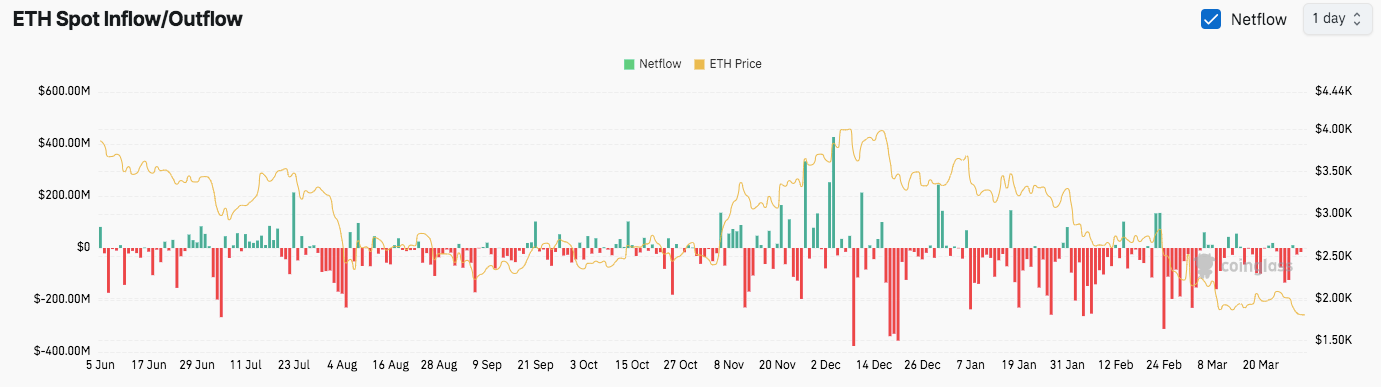

Recent CoinGlass data reveals steady Ethereum spot exchange outflows. This continues a trend observed since December 2023, with past reports noting daily net outflows regularly exceeding $200 million during certain periods.

Source: Coinglass

This sustained outflow trend, which continued through March 2025, indicates investors consistently acquire Ethereum directly from centralized exchange platforms. While some of this movement may reflect a strategic shift to long-term self-custody or staking, it also notably corresponds with a significant loss in ETH’s upward price momentum since its prior cycle peak near $4,000.

The pattern of heavy outflows combined with declining prices suggests that at least some market participants may be positioning more defensively. This could involve reducing exposure to immediate trading environments during uncertain market conditions.

Technical Indicators Show Weak Momentum Despite Oversold Signals

During the time of writing, Ethereum was trading at $1,806.31, recording a decline of 1.35% over the past day. Analysis of the 4-hour timeframe shows technical indicators like the Relative Strength Index (RSI) reading near 25.92, signaling technically oversold conditions.

Source: TradingView

Additionally, the Moving Average Convergence Divergence (MACD) also signals weakness. Although the MACD line recently moved above its signal line (often a bullish hint), both lines remain in negative territory, and the histogram shows minimal positive divergence.

Therefore, the market currently lacks strong technical confirmation of an imminent trend reversal without a more decisive bullish indicator shift or an RSI recovery back above key levels like 30 or 40.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Avalanche

Avalanche  sUSDS

sUSDS  Rain

Rain  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Pi Network

Pi Network  Uniswap

Uniswap  PAX Gold

PAX Gold  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  MemeCore

MemeCore  Mantle

Mantle  Bittensor

Bittensor  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  OKB

OKB  Sky

Sky  Aster

Aster  Aave

Aave  Global Dollar

Global Dollar  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Worldcoin

Worldcoin  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Ethena

Ethena  Quant

Quant  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Jito Staked SOL

Jito Staked SOL  Render

Render  Cosmos Hub

Cosmos Hub  NEXO

NEXO  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  USDtb

USDtb  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  Aptos

Aptos  OUSG

OUSG  Filecoin

Filecoin  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  syrupUSDT

syrupUSDT  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Stable

Stable  YLDS

YLDS  GHO

GHO  Jupiter

Jupiter  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  TrueUSD

TrueUSD  Lombard Staked BTC

Lombard Staked BTC  Virtuals Protocol

Virtuals Protocol  A7A5

A7A5  Pudgy Penguins

Pudgy Penguins  clBTC

clBTC  Stacks

Stacks  JUST

JUST  PancakeSwap

PancakeSwap  Decred

Decred  StakeWise Staked ETH

StakeWise Staked ETH  Sei

Sei  EURC

EURC  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Ether.fi

Ether.fi  Dash

Dash  WrappedM by M0

WrappedM by M0  River

River  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Siren

Siren  LayerZero

LayerZero  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Tezos

Tezos  c8ntinuum

c8ntinuum  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  Kinesis Gold

Kinesis Gold  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  Curve DAO

Curve DAO  COCA

COCA  pippin

pippin  ADI

ADI  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  PRIME

PRIME  BitTorrent

BitTorrent  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Celestia

Celestia  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Sun Token

Sun Token  SPX6900

SPX6900  Bitcoin SV

Bitcoin SV  Maple Finance

Maple Finance  Venice Token

Venice Token  Binance-Peg XRP

Binance-Peg XRP  Conflux

Conflux  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  Lighter

Lighter  DoubleZero

DoubleZero  sBTC

sBTC  JasmyCoin

JasmyCoin  Story

Story  Pyth Network

Pyth Network  Jupiter Staked SOL

Jupiter Staked SOL  IOTA

IOTA  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  BTSE Token

BTSE Token  Lombard

Lombard  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Official FO

Official FO  crvUSD

crvUSD  Optimism

Optimism  Lido DAO

Lido DAO