Uniswap Volume Crashes Canada’s GDP—Analyst Eyes $15 UNI Rise

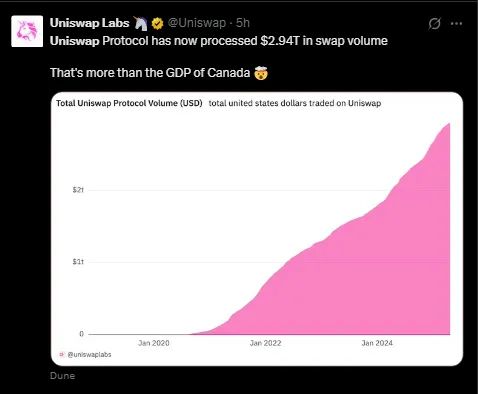

On April 23, 2025, Uniswap Labs announced that the Uniswap protocol had processed $2.94 trillion in swap volume since its 2018 launch, surpassing Canada’s 2023 GDP of $2.142 trillion.

This figure, representing the total value of token swaps across thousands of assets pairs, marks a historic moment for decentralized finance (DeFi).

Source: X

Canada’s GDP reflects a robust G7 economy, yet Uniswap’s decentralized platform has outstripped it, highlighting the transformative potential of blockchain-based trading.

Uniswap’s Rise Since 2018

Founded by Hayden Adams in November 2018, Uniswap pioneered the automated market maker (AMM) model, enabling users to swap ERC-20 tokens directly from their wallets.

Unlike centralized exchanges, Uniswap operates without intermediaries, relying on smart contracts for liquidity and pricing.

This innovation drove its growth, with the DeFi boom from summer 2020 to late 2022 pushing swap volume past $1 trillion.

By April 2025, continued user adoption and trading activity tripled that figure to $2.94 trillion, per Uniswap Labs. The protocol’s ability to handle such volumes demonstrates its scalability.

UNI’s Price Analysis

Uniswap’s native token, UNI, is riding this wave. As of this writing, UNI traded at $6.03, a 7% increase in 24 hours, according to CoinMarketCap.

Crypto analyst CW, posting on X, predicts UNI could hit $15, a 150% gain, citing a breakout from a descending wedge pattern above $5.255.

UNI/USDT Price Analysis| Source: CW X

This technical setup, where price escapes converging downtrend lines, often signals bullish reversals. UNI’s 50-day simple moving average (SMA) of $6.59, supports a positive medium-term trend.

The descending wedge breakout is a key driver of CW’s optimism. Formed by down sloping trendlines, this pattern indicates weakening selling pressure and buyer resurgence.

UNI’s move above $5.255 confirms the breakout, positioning it for potential gains. The broader crypto market bolsters this outlook.

Despite Ethereum’s decline from $4,000 to below $1,700, DeFi tokens like UNI are benefiting from renewed investor interest.

Why does this Matter?

Uniswap’s $2.94 trillion milestone is more than a number—it’s a challenge to centralized finance. Operating without offices or CEOs, Uniswap offers transparency, 24/7 access, and unlimited liquidity, contrasting with traditional systems’ gatekeepers.

This resonates with users seeking financial control, as evidenced by Uniswap’s user base growth since 2018. The milestone counters skeptics who dismiss crypto as speculative, showing DeFi’s ability to scale and process trillions trustlessly.

Uniswap’s success aligns with growing institutional interest in crypto. Bitcoin ETFs, holding $36 billion in net inflows since launch, per SoSoValue, reflect TradFi’s embrace of digital assets.

Uniswap’s model could attract similar capital, especially as DeFi platforms innovate. However, risks remain. The crypto market’s volatility—exemplified by Ethereum’s 60% drop—poses challenges.

Uniswap Founder Issues Warning on Ethereum’s Focus on L1

Recently, Uniswap founder Hayden Adams issued a stark warning: Ethereum, the backbone of 60% of DeFi’s activity, risks ceding its lead to Solana if it doesn’t prioritize layer 2 (L2) scaling.

Adams’ post on X ignited fierce debate among developers and investors, spotlighting a high-stakes race between Ethereum’s layered approach and Solana’s streamlined layer 1 (L1). Is Ethereum’s DeFi dominance slipping? Let’s break it down.

According to Adams, Ethereum’s community should stay committed to its L2 scaling roadmap, a strategy in place since 2020. ““Ethereum has been working towards an L2-centric/horizontal scaling roadmap for 5+ years,” he wrote.

“You want to throw this away at the final stretch because of what reason?” He warned that without focus, Ethereum could lose its grip on DeFi, where it hosts $48 billion in TVL.

Adams contrasted Ethereum’s path with Solana’s. He praised Solana’s team and vision, noting its L1 optimizations—faster transactions and lower fees—make it a strong DeFi contender.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  OKB

OKB  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo US Dollar Yield

Ondo US Dollar Yield  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Quant

Quant  Midnight

Midnight  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  OUSG

OUSG  Wrapped BNB

Wrapped BNB  Algorand

Algorand  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Render

Render  Filecoin

Filecoin  Official Trump

Official Trump  syrupUSDT

syrupUSDT  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Arbitrum

Arbitrum  Stable

Stable  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Jupiter

Jupiter  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  EURC

EURC  PancakeSwap

PancakeSwap  JUST

JUST  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  LayerZero

LayerZero  WrappedM by M0

WrappedM by M0  Ether.fi

Ether.fi  Dash

Dash  Chiliz

Chiliz  Kinesis Gold

Kinesis Gold  Tezos

Tezos  c8ntinuum

c8ntinuum  pippin

pippin  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Siren

Siren  Resolv wstUSR

Resolv wstUSR  Gnosis

Gnosis  COCA

COCA  AINFT

AINFT  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  Sun Token

Sun Token  ADI

ADI  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  JasmyCoin

JasmyCoin  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  SPX6900

SPX6900  Story

Story  FLOKI

FLOKI  IOTA

IOTA  Binance-Peg XRP

Binance-Peg XRP  Legacy Frax Dollar

Legacy Frax Dollar  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  Pyth Network

Pyth Network  Olympus

Olympus  sBTC

sBTC  crvUSD

crvUSD  DoubleZero

DoubleZero  Bitcoin SV

Bitcoin SV  Jupiter Staked SOL

Jupiter Staked SOL  Lighter

Lighter  Savings USDD

Savings USDD  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Conflux

Conflux  Marinade Staked SOL

Marinade Staked SOL  Optimism

Optimism  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Lombard

Lombard  Telcoin

Telcoin  Lido DAO

Lido DAO  River

River