Perp DEXs thrive amid liquidation chaos, fees and volume spike

DeFi protocols and perpetual DEXs survived the biggest liquidation events on October 10-11 with flying colors. This time, DeFi benefitted from fees and managed to control its liquidations.

DeFi and perp DEXs performed better following the October 10-11 market shakedown. The DeFi space, including perpetual DEXs, still saw liquidations, but showed it was much more stable compared to the 2022 crash. As Cryptopolitan reported, crypto faced $19B in liquidations, the worst event since the crash of FTX. However, this time around, DeFi showed relatively limited crisis effects.

This time around, DeFi has more reliable collaterals, including those based on tokenized T-bills and more reliable stablecoins. ETH collaterals are at much more conservative price levels, with limited liquidations. Currently, ETH has just under $1B in liquidatable values, starting at $1,548, way below market valuations.

Perp DEXs open interest attempts a recovery

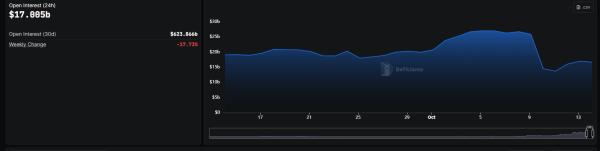

Perpetual DEXs were the most affected, losing over 50% of their open interest on liquidations. Open interest on all perp DEXs was at $25.75B before the crash, later dipping to lows of $13.71B.

Perp DEXs value locked started recovering, bouncing from lows of $13B up to $17B. Despite this, the liquidations hurt the trust in perpetual DEXs, after many traders were liquidated and lost their entire positions. | Source: DeFiLlama.

Within days, open interest recoveded to over $17B in total, where Hyperliquid still held over $8.24B in open interest, based on DeFiLlama data. Hyperliquid itself reported a delayed drop to $6.24B, down from $15B during regular trading times. Perpetual DEXs still carry over $33B in daily volumes, with record activity for the past week. Over $264B were traded during the week of October 6-12, matching the weekly record for DEXs activity.

The perp DEXs liquidations came in the middle of a highly competitive narrative, where old and new perp DEXs attracted peak activity. The crash and on-chain liquidations were especially harmful, as more retail traders attempted to hold leveraged positions, getting exposed to outsized risk.

Top perpetual DEX tokens also took a hit, with weekly losses between 16% and 45% for the leading protocols. HYPE sank to $38.71, as the sector is still attempting a recovery of value locked, open positions, and token valuations.

Lending protocols, DEXs benefit from higher fees

DEX trading saw its biggest weekly activity of over $177B in the week of 6-12 October. The outlier result followed a general trend of DEXs activity expansion.

Uniswap and PancakeSwap remained the biggest activity hubs, with no signs of distress. The recent DEXs activity also coincided with a wave of meme token trading on the Binance ecosystem.

Lending protocols had a bigger shock due to their underlying structure. Total value locked remained at over $83B, with Aave at the lead. However, total amount borrowed fell below $50B for the first time since August, as users avoided the risk of opening loans.

Briefly, the annualized yield of Lido’s stETH jumped to 7.05%, later returning to its usual range. Overall, DeFi lending decreased its outsized yields during previous market downturns, offering more conservative earnings for a lower risk of liquidations.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  Hedera

Hedera  sUSDS

sUSDS  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Toncoin

Toncoin  Tether Gold

Tether Gold  Polkadot

Polkadot  MemeCore

MemeCore  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Bittensor

Bittensor  Aave

Aave  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  OKB

OKB  Pepe

Pepe  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Sky

Sky  Bitget Token

Bitget Token  Ripple USD

Ripple USD  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  KuCoin

KuCoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  Pump.fun

Pump.fun  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Quant

Quant  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  pippin

pippin  Render

Render  USDD

USDD  OUSG

OUSG  Stable

Stable  syrupUSDT

syrupUSDT  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Beldex

Beldex  Arbitrum

Arbitrum  Decred

Decred  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Sei

Sei  EURC

EURC  Virtuals Protocol

Virtuals Protocol  USDai

USDai  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Dash

Dash  tBTC

tBTC  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Tezos

Tezos  JUST

JUST  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  Curve DAO

Curve DAO  Power Protocol

Power Protocol  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Story

Story  Resolv wstUSR

Resolv wstUSR  BitTorrent

BitTorrent  COCA

COCA  Lighter

Lighter  Chiliz

Chiliz  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  LayerZero

LayerZero  PRIME

PRIME  Aerodrome Finance

Aerodrome Finance  Kaia

Kaia  Wrapped Flare

Wrapped Flare  AINFT

AINFT  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Bitcoin SV

Bitcoin SV  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  ADI

ADI  Sun Token

Sun Token  Pyth Network

Pyth Network  IOTA

IOTA  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  crvUSD

crvUSD  sBTC

sBTC  JasmyCoin

JasmyCoin  DoubleZero

DoubleZero  Maple Finance

Maple Finance  Jupiter Staked SOL

Jupiter Staked SOL  Olympus

Olympus  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Lido DAO

Lido DAO  Siren

Siren  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Helium

Helium  Optimism

Optimism  BTSE Token

BTSE Token  Telcoin

Telcoin  Staked Aave

Staked Aave