Maple Finance Ends Staking, Launches Token Buybacks in RWA-Driven Overhaul

Maple Finance is advancing a new model for decentralized credit markets through its MIP-019 proposal. The proposal replaces staking with token buybacks and governance incentives.

The move comes amid a surge in real-world asset (RWA) adoption and rising institutional interest in on-chain lending. Maple curbs token inflation and links rewards to actual financial performance, strengthening its position in the evolving RWA-driven credit ecosystem.

Maple’s MIP-019: From Staking to Sustainable On-Chain Credit

Maple Finance, a decentralized credit marketplace, has approved the MIP-019 proposal. The proposal formally ends Maple’s staking program and introduces a buyback-based mechanism for its governance token, SYRUP. The change makes Maple’s tokenomics more sustainable and aligns the protocol more closely with traditional credit markets.

Moreover, protocol revenues will repurchase SYRUP tokens from the open market under the new framework. The old model distributed inflationary staking rewards. Maple’s governance forum states this transition “limits inflation, strengthens capital efficiency, and links value directly to protocol revenue.”

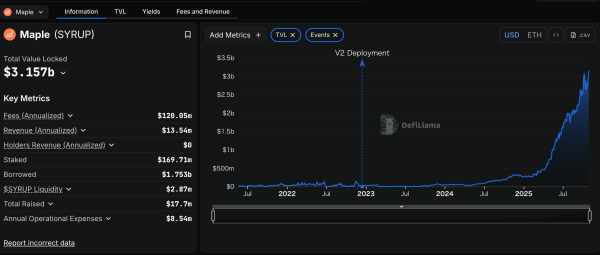

The market reacted swiftly. Maple’s total value locked (TVL) surged above $3.1 billion in late October, marking its highest level since 2022. Analysts attribute the spike to increased activity from institutional liquidity providers.

Maple’s total value locked (TVL): DefiLlama

Meanwhile, these providers are entering the RWA sector. Maple has positioned itself as a bridge between DeFi and real-world financial assets.

Market Reaction and RWA Context

The MIP-019 proposal has drawn significant attention from on-chain analysts and key opinion leaders (KOLs). For instance, RWA-focused commentator @RWA_Guru described the change as “ultra-bullish.”

“Reduces inflation, caps supply growth, and introduces stronger governance incentives.” He highlighted how Maple’s move.

MIP-019 is ultra-bullish for Maple: it extends token buybacks, gives governance power to $SYRUP, and retires outdated staking — tightening supply and boosting long-term sustainability.

Less inflation. More utility.

— RWA_Guru (@RWA_Guru) October 28, 2025

These factors are critical for sustainable DeFi credit markets.

“The token crushed a multi-month downtrend,” said @TokenTalk3x, noting the market momentum around SYRUP following the proposal’s approval.

The broader RWA sector has grown rapidly over the past year. Protocols such as Centrifuge, Ondo, and Clearpool capture institutional demand for tokenized credit instruments. Maple’s strategy reflects a growing recognition. DeFi’s future may depend on integrating with off-chain, yield-generating assets. The platform replaces staking emissions with buybacks funded by real yield.

Risks and Institutional Outlook

Analysts have welcomed MIP-019. However, they caution that Maple’s new model introduces dependencies on external credit conditions. A downturn in RWA yields could limit Maple’s buyback capacity. A contraction in institutional borrowing would have the same effect.

Nevertheless, market observers see the governance shift as part of a larger evolution. The industry is moving toward “on-chain credit infrastructure.” Many analysts believe DeFi protocols are maturing from speculative farming to genuine financial utility.

Consequently, Maple’s latest governance overhaul represents more than a tokenomics tweak. It signals DeFi’s continued convergence with traditional finance. The company anchors protocol value in real-world credit flows, positioning Maple at the center of the RWA-driven on-chain lending revolution.

The post Maple Finance Ends Staking, Launches Token Buybacks in RWA-Driven Overhaul appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Litecoin

Litecoin  Avalanche

Avalanche  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold  Bitget Token

Bitget Token  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Falcon USD

Falcon USD  PAX Gold

PAX Gold  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Pump.fun

Pump.fun  Binance-Peg WETH

Binance-Peg WETH  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aster

Aster  Ondo

Ondo  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Global Dollar

Global Dollar  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Sky

Sky  Pi Network

Pi Network  KuCoin

KuCoin  Ripple USD

Ripple USD  Binance Staked SOL

Binance Staked SOL  Ethena

Ethena  Wrapped BNB

Wrapped BNB  syrupUSDC

syrupUSDC  River

River  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  MYX Finance

MYX Finance  Gate

Gate  USDD

USDD  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Midnight

Midnight  Arbitrum

Arbitrum  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC  Render

Render  Official Trump

Official Trump  NEXO

NEXO  Filecoin

Filecoin  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  VeChain

VeChain  Mantle Staked Ether

Mantle Staked Ether  USDtb

USDtb  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Liquid Staked ETH

Liquid Staked ETH  syrupUSDT

syrupUSDT  Dash

Dash  Bonk

Bonk  Story

Story  WrappedM by M0

WrappedM by M0  Solv Protocol BTC

Solv Protocol BTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Renzo Restaked ETH

Renzo Restaked ETH  Sei

Sei  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Ondo US Dollar Yield

Ondo US Dollar Yield  StakeWise Staked ETH

StakeWise Staked ETH  clBTC

clBTC  OUSG

OUSG  Jupiter

Jupiter  COCA

COCA  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  PancakeSwap

PancakeSwap  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  Jupiter Staked SOL

Jupiter Staked SOL  Binance-Peg XRP

Binance-Peg XRP  Pudgy Penguins

Pudgy Penguins  Wrapped Flare

Wrapped Flare  Beldex

Beldex  Tezos

Tezos  Chiliz

Chiliz  Optimism

Optimism  Usual USD

Usual USD  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Stacks

Stacks  tBTC

tBTC  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  GHO

GHO  A7A5

A7A5  GTETH

GTETH  Curve DAO

Curve DAO  TrueUSD

TrueUSD  Lighter

Lighter  pippin

pippin  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Injective

Injective  Lido DAO

Lido DAO  Cap USD

Cap USD  Ether.fi

Ether.fi  Marinade Staked SOL

Marinade Staked SOL  Axie Infinity

Axie Infinity  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Kaia

Kaia  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Kinesis Silver

Kinesis Silver  Aerodrome Finance

Aerodrome Finance  Stader ETHx

Stader ETHx  DoubleZero

DoubleZero  LayerZero

LayerZero  FLOKI

FLOKI  Stable

Stable  sBTC

sBTC  BitTorrent

BitTorrent  Resolv USR

Resolv USR  Kinesis Gold

Kinesis Gold  EURC

EURC  Staked Aave

Staked Aave  Maple Finance

Maple Finance  Celestia

Celestia  Resolv wstUSR

Resolv wstUSR  The Graph

The Graph  AB

AB  Gnosis

Gnosis  IOTA

IOTA  Wrapped ApeCoin

Wrapped ApeCoin  SPX6900

SPX6900  Starknet

Starknet  Trust Wallet

Trust Wallet  Bitcoin SV

Bitcoin SV  Pyth Network

Pyth Network  JUST

JUST  Telcoin

Telcoin  Conflux

Conflux  AINFT

AINFT  crvUSD

crvUSD