DeFi, crypto lending markets have overcome 2022 chaos, Aave founder claims

Crypto lending is maturing, with stablecoin borrowing rates stabilizing around 6-8%. Aave has emerged as the clear leader after overcoming the chaos of 2022.

The Aave DAO stands on comfortable ground, and Aave protocol is a leader in DeFi lending, announced Marc Zeller, founder of the Aave Chain Initiative. The organization, which represents the interest of the Aave community, was launched in 2023, in the after math of the Terra (LUNA) and FTX crash.

Since then, Aave has evolved and rebuilt its positions. Zeller recalled that at one point, the community was convinced Aave should wind down, as DeFi is dead. However, over time, the project improved its codebase and became key in lending activity during the 2025 bull market.

Aave’s dominance is no longer threatened

According to Zeller, Aave is now well-established, based on value locked, revenue, market share, and borrowing volume. The DAO had a role in determining the conditions of lending and the available vaults, leading to success during the latest ETH bull market.

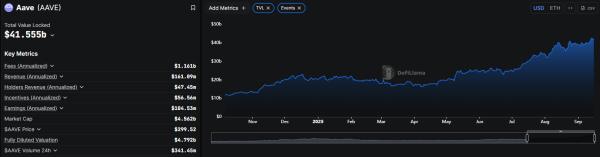

Aave carries a record $41.55B in value locked while generating $161M in annualized revenue, of which over $47M goes to holder incentives. As a result, AAVE holds around $299.48, close to its higher range. For now, AAVE has yet to revisit its records above $698, but the token has held steady and expanded during the 2024-2025 bull market.

Aave lending expanded to a new all-time peak, with native GHO tokens growing their supply to a record over 352M. | Source: DeFi Llama

Aave now dominates all DeFi verticals, including leveraged staking, borrowing stablecoins against BTC and ETH, and yield-generating collateral carry trades. Zeller is aware that Aave has taken over where other projects failed, and has attempted to secure the platform against liquidations and panic.

The native token, GHO, grew to 352M, based on the positive market performance. GHO is dynamically minted and destroyed based on the ability of Aave to support the stablecoin.

Unlike other DeFi projects, Aave limits the number of assets held as collateral. The project is also careful with costs and incentives, expanding its ability to generate predictable profits and avoid threats to liquidity.

Overall, DeFi has learned its harsh lessons from previous liquidation cascades and settled into a more mature state. Zeller noted that Aave lending settled at around 6-8% after previous rate hikes to over 16%. As of September, Aave achieved an 8.13% yield.

Aave expands to selected L2 chains

One of the major effects of Aave was to boost the economies of L2 chains. Zeller recalled the 2023-2024 bear market led to L2 fatigue, where too many chains were created. Aave launched on over 26 chains, and soon became the leading DeFi protocol.

However, Zeller estimated not all L2 versions were viable. Currently, around 86.6% of Aave revenues are made from Ethereum mainnet activity, with no need to bridge or take up additional transactions. Aave has estimated that around half of the deployments to L2 chains were not viable and has decided to limit its exposure to only key strategic networks.

The latest deployment was on Linea, following the chain’s token distribution. Aave managed to attract $2B in deposits to its Linea version, considering the chain more reliable. Recently, Linea also managed to secure record value locked, as Cryptopolitan reported.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  USDS

USDS  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Monero

Monero  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  WETH

WETH  Zcash

Zcash  USD1

USD1  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USDT0

USDT0  Dai

Dai  Shiba Inu

Shiba Inu  Hedera

Hedera  sUSDS

sUSDS  World Liberty Financial

World Liberty Financial  Ethena Staked USDe

Ethena Staked USDe  PayPal USD

PayPal USD  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Tether Gold

Tether Gold  Mantle

Mantle  MemeCore

MemeCore  Bitget Token

Bitget Token  Falcon USD

Falcon USD  PAX Gold

PAX Gold  OKB

OKB  Aave

Aave  Bittensor

Bittensor  Pepe

Pepe  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  Binance-Peg WETH

Binance-Peg WETH  Circle USYC

Circle USYC  Pump.fun

Pump.fun  HTX DAO

HTX DAO  Global Dollar

Global Dollar  Ondo

Ondo  Sky

Sky  Aster

Aster  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Ripple USD

Ripple USD  KuCoin

KuCoin  BFUSD

BFUSD  Worldcoin

Worldcoin  Wrapped BNB

Wrapped BNB  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Binance Staked SOL

Binance Staked SOL  Ethena

Ethena  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  Rocket Pool ETH

Rocket Pool ETH  USDD

USDD  Aptos

Aptos  MYX Finance

MYX Finance  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Lombard Staked BTC

Lombard Staked BTC  Function FBTC

Function FBTC  Official Trump

Official Trump  Arbitrum

Arbitrum  NEXO

NEXO  Filecoin

Filecoin  Midnight

Midnight  Render

Render  USDtb

USDtb  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  VeChain

VeChain  syrupUSDT

syrupUSDT  Mantle Staked Ether

Mantle Staked Ether  Liquid Staked ETH

Liquid Staked ETH  WrappedM by M0

WrappedM by M0  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Bonk

Bonk  River

River  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Dash

Dash  Story

Story  clBTC

clBTC  StakeWise Staked ETH

StakeWise Staked ETH  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Sei

Sei  USDai

USDai  Renzo Restaked ETH

Renzo Restaked ETH  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Beldex

Beldex  COCA

COCA  Wrapped Flare

Wrapped Flare  Jupiter Staked SOL

Jupiter Staked SOL  Usual USD

Usual USD  Binance-Peg XRP

Binance-Peg XRP  PancakeSwap

PancakeSwap  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Pudgy Penguins

Pudgy Penguins  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Tezos

Tezos  Optimism

Optimism  A7A5

A7A5  GHO

GHO  Stacks

Stacks  tBTC

tBTC  c8ntinuum

c8ntinuum  TrueUSD

TrueUSD  Chiliz

Chiliz  Virtuals Protocol

Virtuals Protocol  Curve DAO

Curve DAO  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  GTETH

GTETH  Lorenzo Wrapped Bitcoin

Lorenzo Wrapped Bitcoin  Lighter

Lighter  DoubleZero

DoubleZero  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Stable

Stable  EURC

EURC  Resolv USR

Resolv USR  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  LayerZero

LayerZero  Injective

Injective  Lido DAO

Lido DAO  Marinade Staked SOL

Marinade Staked SOL  Resolv wstUSR

Resolv wstUSR  Maple Finance

Maple Finance  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Ether.fi

Ether.fi  FLOKI

FLOKI  Aerodrome Finance

Aerodrome Finance  sBTC

sBTC  Kinesis Gold

Kinesis Gold  BitTorrent

BitTorrent  Stader ETHx

Stader ETHx  JUST

JUST  Axie Infinity

Axie Infinity  Celestia

Celestia  The Graph

The Graph  Sun Token

Sun Token  Staked Aave

Staked Aave  Gnosis

Gnosis  Pyth Network

Pyth Network  Kinesis Silver

Kinesis Silver  Kaia

Kaia  Trust Wallet

Trust Wallet  Bitcoin SV

Bitcoin SV  AINFT

AINFT  ether.fi Staked ETH

ether.fi Staked ETH  Wrapped ApeCoin

Wrapped ApeCoin  IOTA

IOTA  Conflux

Conflux  Olympus

Olympus  Starknet

Starknet  Avalanche Bridged BTC (Avalanche)

Avalanche Bridged BTC (Avalanche)  Ethereum Name Service

Ethereum Name Service