Cap Labs attracts capital with EigenLayer-backed credit model

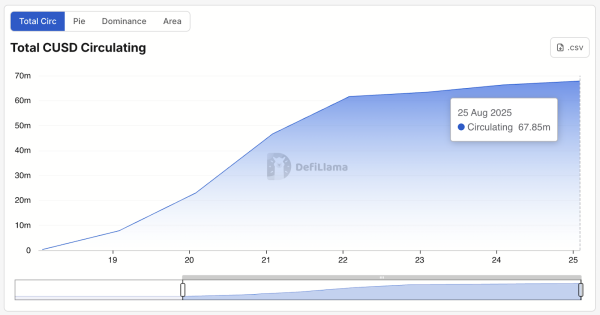

Cap Labs’ new stablecoin cUSD has seen rapid adoption since launch, climbing to $67.85 million in circulation over the past week, according to DefiLlama.

Etherscan shows 2,735 holders of the token to date. The jump signals strong demand for Cap’s yield-layered digital dollar model, which combines regulated reserve assets with EigenLayer-powered credit underwriting.

Built atop the newly launched Cap Stablecoin Network (CSN), cUSD is designed as a 1:1 redeemable stablecoin backed by assets like PayPal’s PYUSD, BlackRock-managed BUIDL, and Franklin Templeton’s BENJI. The yield-bearing version stcUSD — minted by staking cUSD — is enabled by a three-party system of lenders, operators, and restakers.

Cap’s core innovation lies in its structure: operators borrow stablecoins to deploy yield strategies, restakers underwrite the operator’s credit risk, and lenders (stcUSD holders) earn a floating yield, currently around 12%, depending on market demand and operator performance. While restaker collateral provides protection against operator default, stcUSD holders are still exposed to fluctuating yield dynamics.

cUSD’s impressive growth; Source: DefiLlama

Unlike many past stablecoin launches, Cap’s model is carefully tuned to comply with the GENIUS Act, the sweeping US stablecoin legislation that prohibits interest-bearing payment tokens. Speaking at the Stablecoin Summit in Cannes in June, Cap Labs founder Benjamin Lens was blunt:

“They said no yield, and it’s pretty clear — there’s no way around it. They do not want stablecoins giving yield to retail investors,” Lens said.

Thus, stcUSD is a separate ERC-4626 vault token, which users can mint by staking cUSD. The yield is generated through a marketplace of borrowing and restaking, not directly from Cap Labs.

“Genius Act covers companies that are generating yield on behalf of users and giving them to the users,” Lens said in Cannes, whereas Cap is “an immutable open protocol like Ethereum, like Bitcoin.”

Combined with the fact that the percentage of any one stablecoin backing cUSD is limited to 40%, Lens thinks they have a compliant mechanism. “This is the standard that we’ve agreed to with Templeton and BlackRock for our integration with them,” Lens told Blockworks, noting it’s the same arrangement that UStB (from Ethena) made in partnership with BlackRock.

Restaking evolution

Cap’s design aligns with a trend emerging on EigenLayer: the financialization of Actively Validated Services (AVSs). Traditionally, AVSs on EigenLayer offered infrastructure services — like oracles or bridges — with risk limited to uptime or correctness. But a new wave of AVSs is using EigenLayer to underwrite financial guarantees.

Cap is one example highlighted by EigenLayer founder Sreeram Kannan. “A staker can stake and promise that an operator [like Susquehanna] is going to make a 10% APR,” Kannan told Blockworks. “You can underwrite financial risk using EigenLayer, which is a very new kind of risk, which requires much, much more active curation and monitoring,” he said.

What makes this possible is EigenLayer’s recent rollout of a new feature, complementary to slashing, which went live in April.

While slashing enables restakers to be penalized for backing underperforming operators, redistribution, launched in late July, allows slashed funds to be redirected back to the impacted AVS — such as Cap’s lending vault — rather than burned.

That change turns EigenLayer into a programmable risk distribution layer, capable of enforcing structured finance contracts entirely onchain.

“With financial AVSs, slashing is the core logic,” Kannan said. “A liquidation is an example — if the hurdle rate is not met — slash and move the money out.” That’s easier than slashing some infrastructure AVSs like a ZK or TEE coprocessor, where it’s harder to adequately express the slashing logic onchain, he added.

According to a research note from Serenity Research and Catalysis published Sunday, Cap’s model resembles a CDS-like structure: Restakers sign off-chain legal agreements to cover operator defaults, post collateral onchain, and are liquidated if their guarantee fails. Cap currently lists market makers like Fasanara, GSR, and Amber as operators, with Gauntlet and Symbiotic restakers providing credit protection.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Rain

Rain  USD1

USD1  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Avalanche

Avalanche  PayPal USD

PayPal USD  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  Uniswap

Uniswap  PAX Gold

PAX Gold  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Pepe

Pepe  Bittensor

Bittensor  Aster

Aster  Falcon USD

Falcon USD  OKB

OKB  Sky

Sky  Global Dollar

Global Dollar  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Bitget Token

Bitget Token  Ripple USD

Ripple USD  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Internet Computer

Internet Computer  BFUSD

BFUSD  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  KuCoin

KuCoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  Pump.fun

Pump.fun  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Cosmos Hub

Cosmos Hub  Midnight

Midnight  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Official Trump

Official Trump  Binance-Peg WETH

Binance-Peg WETH  USDtb

USDtb  Rocket Pool ETH

Rocket Pool ETH  Filecoin

Filecoin  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Render

Render  Wrapped BNB

Wrapped BNB  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Function FBTC

Function FBTC  USDD

USDD  OUSG

OUSG  pippin

pippin  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Arbitrum

Arbitrum  Bonk

Bonk  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Stable

Stable  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  Stacks

Stacks  Decred

Decred  clBTC

clBTC  TrueUSD

TrueUSD  Sei

Sei  Pudgy Penguins

Pudgy Penguins  Virtuals Protocol

Virtuals Protocol  StakeWise Staked ETH

StakeWise Staked ETH  EURC

EURC  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Dash

Dash  tBTC

tBTC  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  JUST

JUST  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  Story

Story  Lighter

Lighter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Chiliz

Chiliz  COCA

COCA  Gnosis

Gnosis  Aerodrome Finance

Aerodrome Finance  Liquid Staked ETH

Liquid Staked ETH  PRIME

PRIME  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Injective

Injective  Bitcoin SV

Bitcoin SV  BitTorrent

BitTorrent  AINFT

AINFT  Wrapped Flare

Wrapped Flare  Kaia

Kaia  Celestia

Celestia  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  LayerZero

LayerZero  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Pyth Network

Pyth Network  Sun Token

Sun Token  ADI

ADI  IOTA

IOTA  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  FLOKI

FLOKI  Renzo Restaked ETH

Renzo Restaked ETH  JasmyCoin

JasmyCoin  crvUSD

crvUSD  sBTC

sBTC  Lido DAO

Lido DAO  Olympus

Olympus  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Savings USDD

Savings USDD  Optimism

Optimism  DoubleZero

DoubleZero  Helium

Helium  Marinade Staked SOL

Marinade Staked SOL  Telcoin

Telcoin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Ethereum Name Service

Ethereum Name Service  Starknet

Starknet  Staked Aave

Staked Aave  AB

AB