Fully Diluted Valuation (FDV) in Crypto: What is It?

Fully Diluted Valuation (FDV) is a key metric in the cryptocurrency space. It estimates the total value of a crypto project if all its tokens were in circulation. By considering the maximum potential supply of tokens, FDV provides a broader view of a project’s market value.

Why FDV Matters

FDV helps investors gauge the long-term potential of a cryptocurrency. Unlike market capitalization, which only reflects the value of circulating tokens, FDV takes into account the total supply. This makes it an essential tool for evaluating the scalability and growth of a crypto project. For example, if a large portion of tokens is yet to be released, FDV can highlight potential risks or rewards tied to future supply changes.

How Does FDV Differ From Market Cap?

While market capitalization focuses on the current supply of tokens in circulation, FDV looks at the full potential supply. Here’s a simple comparison:

- Market Cap = Current Price × Circulating Supply

- FDV = Current Price × Total Supply

Market capitalization (market cap) is one of the most commonly used metrics to assess the value of a cryptocurrency. It is calculated by multiplying the current price of a token by the number of tokens currently in circulation. This gives an estimate of the project’s present value based on actively traded tokens but does not account for future token releases that could affect supply and price.

Total supply on the other hand refers to the number of tokens that exist within a cryptocurrency project. This includes tokens currently in circulation and those set aside for future distribution. However, it does not count any tokens that have been permanently removed (or burned) from supply.

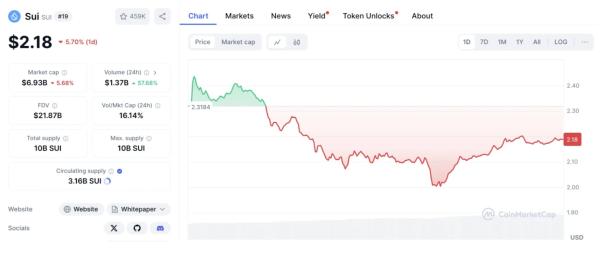

Price and market cap data for the SUI token (Coinmarketcap)

For example, in the chart above, the current price of SUI (at the time of writing) is $2.18, while the circulating and total supply is 3.16B and 10B tokens, respectively. This brings the market cap for SUI to $6.93B while the FDV would be $2.18 x 10B (i.e 21.87B).

If a large number of tokens are locked, unreleased, or reserved, the FDV might be significantly higher than the market cap. This distinction is important when assessing a project’s future value and token release schedule.

Why Some Investors Prefer FDV

FDV provides insights into the long-term prospects of a token. It allows investors to assess whether a project is overvalued or undervalued relative to its total supply. For instance, if a project has a high FDV but limited utility or adoption, it may signal overvaluation. On the other hand, a low FDV with strong fundamentals could indicate an opportunity for growth.

How Can Token Supply Affect FDV?

Changes in token supply directly impact FDV. If additional tokens are released into circulation, the FDV increases, which could dilute the value of existing tokens. Monitoring tokenomics, such as vesting schedules, staking rewards, or token burns, is crucial as they can influence both FDV and market cap.

Risks of Ignoring FDV

Overlooking FDV can lead to poor investment decisions. A project with a low market cap but a high FDV might seem undervalued at first glance. However, if a significant number of tokens are yet to be unlocked, the influx could lead to price drops. Investors should always consider FDV alongside other factors like adoption, utility, and token distribution.

Staying informed about metrics like FDV helps you make better decisions in the ever-dynamic cryptocurrency market. Whether you’re an experienced trader or a beginner, taking a closer look at FDV can provide a clearer picture of a project’s potential.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  MemeCore

MemeCore  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  OKB

OKB  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aster

Aster  Sky

Sky  Aave

Aave  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  NEAR Protocol

NEAR Protocol  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Gate

Gate  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Quant

Quant  Midnight

Midnight  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  OUSG

OUSG  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Aptos

Aptos  Filecoin

Filecoin  Render

Render  USDD

USDD  Official Trump

Official Trump  syrupUSDT

syrupUSDT  Jupiter

Jupiter  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  VeChain

VeChain  Stable

Stable  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  A7A5

A7A5  Decred

Decred  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  JUST

JUST  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  Dash

Dash  WrappedM by M0

WrappedM by M0  Tezos

Tezos  Ether.fi

Ether.fi  Kinesis Gold

Kinesis Gold  LayerZero

LayerZero  c8ntinuum

c8ntinuum  pippin

pippin  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  River

River  Resolv wstUSR

Resolv wstUSR  AINFT

AINFT  COCA

COCA  USDai

USDai  Gnosis

Gnosis  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  Kaia

Kaia  Sun Token

Sun Token  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  ADI

ADI  Siren

Siren  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  SPX6900

SPX6900  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Story

Story  Injective

Injective  Celestia

Celestia  Humanity

Humanity  Lighter

Lighter  Binance-Peg XRP

Binance-Peg XRP  Bitcoin SV

Bitcoin SV  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Legacy Frax Dollar

Legacy Frax Dollar  Venice Token

Venice Token  sBTC

sBTC  The Graph

The Graph  crvUSD

crvUSD  JasmyCoin

JasmyCoin  Jupiter Staked SOL

Jupiter Staked SOL  Pyth Network

Pyth Network  Savings USDD

Savings USDD  Olympus

Olympus  FLOKI

FLOKI  Maple Finance

Maple Finance  Marinade Staked SOL

Marinade Staked SOL  BTSE Token

BTSE Token  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Lombard

Lombard  DoubleZero

DoubleZero  Conflux

Conflux  Optimism

Optimism