Is this the end of Bitcoin’s bull run — or just a healthy correction?

Bitcoin reached a new all-time high of $109,114 on January 20. However, instead of fueling hopes of further gains, it has faced persistent sell pressure, dropping about 20% from the peak as of this writing. Recent weeks have seen weak demand, fading accumulation, and rising fear among short-term investors.

At Outset PR, we observe that such corrections are not uncommon in Bitcoin’s historical cycles, often driven by shifts in liquidity, derivatives market positioning, and investor sentiment. Below, I’ll look into the ongoing Bitcoin liquidity trends, derivatives market activity, and holder cohorts’ behavior to see whether the original cryptocurrency has already peaked for this cycle or is going through a temporary correction.

Table of Contents

- From distribution to potential accumulation

- Contracting liquidity limits Bitcoin’s upside

- UTXO age data reveals strong holder conviction

- ETF flows and market impact

- Closing thoughts

From distribution to potential accumulation

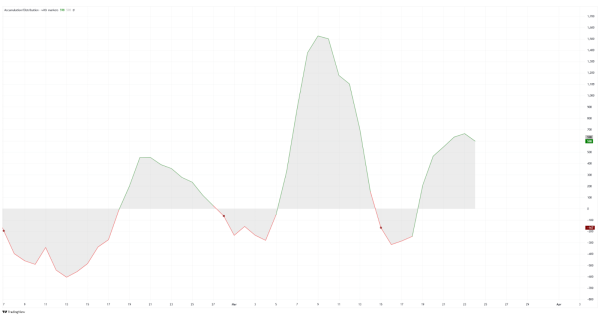

Bitcoin’s market cycles are driven by phases of accumulation and distribution. While a clear distribution phase emerged in late February 2025, recent movements in the Accumulation/Distribution (A/D) Indicator reveal a strong cycle of accumulation followed by intense selling pressure over the past few weeks.

After hitting its lowest point in mid-March, the indicator is now rebounding, suggesting that accumulation is resuming. Historically, such rebounds in the A/D Indicator have often preceded periods of price stabilization or recovery. However, whether this marks the beginning of a sustained accumulation phase or just a temporary bounce remains to be seen.

Bitcoin Accumulation/Distribution Indicator | Source: TradingView

Further confirming this trend, spot trading volumes on centralized exchanges dropped by 19.9%, and derivatives trading volumes declined by 20.9%, according to the February 2025 CoinDesk Data’s Exchange Review. Additionally, open interest on derivatives exchanges fell by 29.8%, the lowest since November 2024.

The situation worsened after the Bybit hack, which resulted in a $1.4 billion loss, amplifying sell pressure and discouraging accumulation as liquidity concerns and market uncertainty intensified.

Contracting liquidity limits Bitcoin’s upside

Persistent liquidity contraction — typical of market behavior during corrections — is one of the major causes of Bitcoin’s difficulty in reaching new highs. According to Glassnode data, net capital inflows into Bitcoin have stalled, with the Realized Cap growing at just +0.67% per month. This means the market lacks the necessary influx of fresh capital, hindering price increases.

Additionally, Hot Supply — a key indicator of active trading liquidity — has declined from 5.9% to 2.8%, a drop of more than 50%. Exchange inflows have also fallen by 54%, further reinforcing that trading activity is slowing and demand-side pressure is weakening

On the derivatives side, open interest in Bitcoin futures has fallen from $57 billion at ATH to $37 billion (-35%), showing reduced speculative interest and hedging activity.

Glassnode data also shows that the 30-day rolling sum of short-term holder losses has reached $7 billion, marking the largest sustained loss-taking event of the cycle, yet remaining less severe than the May 2021 crash and the 2022 bear market.

UTXO age data reveals strong holder conviction

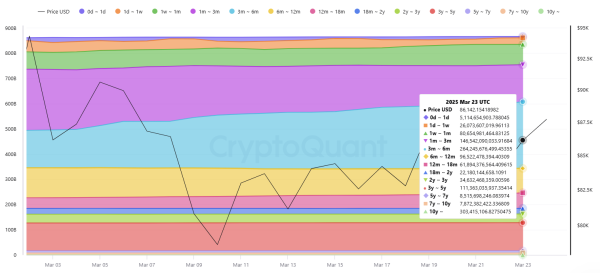

CryptoQuant’s Realized Cap – UTXO Age Bands, which tracks the USD value of coins by age since last moved, shows that a significant share of Bitcoin’s realized cap is held by long-term investors.

Bitcoin Realized Cap – UTXO Age Bands | Source: CryptoQuant

A breakdown of the realized cap across age cohorts as of March 23, 2025, shows the following:

- 0–1 day: $5.1 billion

- 1 day–1 week: $26.1 billion

- 1 week–1 month: $80.7 billion

- 1–3 months: $146.5 billion

- 3–6 months: $264.2 billion

- 6–12 months: $96.5 billion

- 12–18 months: $61.9 billion

- 18 months–2 years: $22.2 billion

- 2–3 years: $34.6 billion

- 3–5 years: $111.4 billion

- 5–7 years: $8.5 billion

- 7–10 years: $7.9 billion

- Over 10 years: $303.4 billion

We can see that UTXOs in the under one-week range total $31.2 billion, accounting for just 2.7% of the total realized cap. This indicates that while short-term trading exists, it is not the primary force driving the market. The low proportion of newly moved coins suggests that most recent buyers are still holding their positions, and many participants are not capitulating.

In contrast, the 3–6 month cohort now holds the largest share of Bitcoin’s realized cap at $264.2 billion. This cohort has remained largely unmoved through recent price swings, further reinforcing long-term conviction in the market.

Notably, Bitcoin, which has been held for over 10 years, represents $303.4 billion, the single largest realized value across all age bands.

Taken together, the current UTXO age distribution supports a bullish accumulation narrative, where long-term holders remain confident, speculative flipping is subdued, and overall supply continues to tighten—conditions that have historically laid the groundwork for strong price recoveries.

ETF flows and market impact

The latest ETF data from March 5-21, 2025, highlights mixed signals, with some ETFs experiencing strong inflows while others continue to face significant outflows, suggesting that while Bitcoin’s price action remains under pressure, long-term institutional interest is supporting market sentiment.

- IBIT (BlackRock’s Bitcoin ETF) recorded a total inflow of 39,774 BTC.

- FBTC (Fidelity’s Bitcoin ETF) saw an inflow of 11,392 BTC.

- ARKB (Ark Invest’s Bitcoin ETF) attracted 2,021 BTC, while BTCO (Invesco’s Bitcoin ETF) recorded 2,678 BTC in net inflows.

- GBTC (Grayscale’s Bitcoin Trust) continued to face outflows, losing 22,526 BTC.

- Bitcoin ETFs collectively added 36,138 BTC over this period, indicating that institutional demand remains in place.

Closing thoughts

Bitcoin is navigating a complex post-ATH environment, where a mix of short-term headwinds and long-term strength is clearly seen. Liquidity contraction is seen in both spot and derivatives markets as capital inflows slow and speculative activity declines. However, accumulation is rebounding, UTXO age data shows strong long-term holder conviction and low short-term selling, and institutional flows — despite volatility — continue to favor Bitcoin, with net inflows across several major ETFs. While price pressure persists, these underlying dynamics suggest the current phase may represent a healthy consolidation rather than the end of the current bull cycle.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  Rain

Rain  USD1

USD1  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  PayPal USD

PayPal USD  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Toncoin

Toncoin  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Polkadot

Polkadot  Uniswap

Uniswap  PAX Gold

PAX Gold  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Bittensor

Bittensor  Aster

Aster  Aave

Aave  Pi Network

Pi Network  Sky

Sky  Falcon USD

Falcon USD  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  OKB

OKB  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Pepe

Pepe  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  BFUSD

BFUSD  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Ondo US Dollar Yield

Ondo US Dollar Yield  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Official Trump

Official Trump  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  Filecoin

Filecoin  OUSG

OUSG  Render

Render  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  syrupUSDT

syrupUSDT  USDD

USDD  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Beldex

Beldex  Stable

Stable  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  clBTC

clBTC  TrueUSD

TrueUSD  A7A5

A7A5  Sei

Sei  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  EURC

EURC  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Dash

Dash  tBTC

tBTC  Tezos

Tezos  WrappedM by M0

WrappedM by M0  JUST

JUST  Ether.fi

Ether.fi  LayerZero

LayerZero  Kinesis Gold

Kinesis Gold  Curve DAO

Curve DAO  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Gnosis

Gnosis  Resolv wstUSR

Resolv wstUSR  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Aerodrome Finance

Aerodrome Finance  SPX6900

SPX6900  Liquid Staked ETH

Liquid Staked ETH  River

River  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  AINFT

AINFT  Lighter

Lighter  PRIME

PRIME  Wrapped Flare

Wrapped Flare  pippin

pippin  Kaia

Kaia  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Story

Story  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  IOTA

IOTA  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  ADI

ADI  Renzo Restaked ETH

Renzo Restaked ETH  Pyth Network

Pyth Network  JasmyCoin

JasmyCoin  sBTC

sBTC  FLOKI

FLOKI  The Graph

The Graph  Maple Finance

Maple Finance  Jupiter Staked SOL

Jupiter Staked SOL  Siren

Siren  Savings USDD

Savings USDD  Lido DAO

Lido DAO  Optimism

Optimism  Venice Token

Venice Token  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Legacy Frax Dollar

Legacy Frax Dollar  crvUSD

crvUSD  Conflux

Conflux  Telcoin

Telcoin  Staked Aave

Staked Aave  Plasma

Plasma  DoubleZero

DoubleZero