BTC hits 4-week low as profit-taking, weak demand weigh

Bitcoin slipped to its lowest level in four weeks late Thursday, with Glassnode analysts citing profit-taking by long-term holders and fading institutional demand as reasons behind the king crypto’s devastating trading week.

The largest coin by market cap dropped under $109,000 just over a week after the US Federal Open Market Committee (FOMC) cut its benchmark interest rate. The week-long fall took Bitcoin to prices below $109,000, levels not seen since September 4, according to data from TradingView. On Coinbase, Bitcoin traded at $108,700 in late Thursday.

Although the asset has not yet revisited the $107,500 low recorded on September 1, Glassnode predicts its cooling phase is in the beginning.

Long-term holders turn to profit-taking

According to the crypto market analytics firm, long-term bitcoin holders have realized around 3.4 million BTC in profits. At the same time, short-term investors are struggling to keep Bitcoin upwards of a critical cost basis near $110,000, and a sustained break below this threshold could accelerate losses.

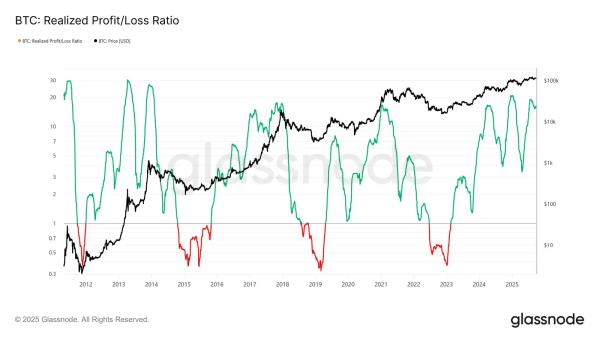

BTC Realized profit to loss ratio: Source: Glassnode.

Glassnode noted that long-term holder distribution surged around the FOMC decision, with 122,000 BTC being sold monthly. Exchange-traded funds (ETFs) net inflows collapsed from 2,600 BTC per day to almost zero on a seven-day average basis.

The analysts said the combination of rising sell pressure and fading institutional demand created a vulnerable backdrop for bitcoin.

Glassnode researchers compared current conditions to the steady advance seen in 2015–2017, though they did not include a final surge phase that characterized that period. If $124,000 proves to be the global top, this cycle has so far lasted 1,030 days. That figure closely matches the roughly 1,060-day lengths of the previous two market cycles.

Stop-loss selling could take Bitcoin further into the red-zone

Bitcoin sentiment all round the market seems mostly “gloomy,” as more analysis points to further downside risks. Markus Thielen, head of research at 10x Research, said the coin’s rebound from early September lows “quickly lost momentum.”

At the time of this publication, BTC prices are hovering near those levels again, and according to Thielen, another spree of stop-loss selling is coming.

According to Glassnode’s data, the cumulative value of capital absorbed into bitcoin, known as “Realized Cap,” has risen in three distinct waves since November 2022 and now stands at $1.06 trillion.

Bitcoin Realized Cap chart. Source: Glassnode.

Realized cap growth in previous cycles was recorded as $4.2 billion between 2011–2015, $85 billion between 2015–2018, and $383 billion between 2018–2022. The current cycle has seen $678 billion in net inflows, nearly 1.8 times the prior cycle.

Unlike earlier phases, where single prolonged waves dominated, this cycle has produced three separate multi-month surges. Each has coincided with heavy profit-taking, with more than 90% of moved coins sold at a profit.

Per Glassnode’s insight, there is a pattern of cyclical peaks seen in a market stepping back from its third such extreme, which is raising the likelihood of a prolonged cooling phase.

Volatile trading week sends US Dollar upwards

Bitcoin’s woes began on Monday when prices dropped from $115,500 to $112,000. Although the market recovered some ground mid-week, another selloff on Thursday drove BTC down to $108,600 on Bitstamp.

As expected, gold advocate and long-time bitcoin skeptic Peter Schiff jabbed the crypto community, saying the drop was the “start of a bear market.”

Bitcoin is not living up to its hype. Priced in gold, Bitcoin is now 20% below its record high set in August. In other words, Bitcoin is in a bear market. Since Bitcoin is promoted as being digital gold, being down 20% in gold is more significant than being down 10% in dollars.

— Peter Schiff (@PeterSchiff) September 23, 2025

Spot gold slipped 0.2% to $3,741.21 per ounce by early Friday in Asia, even as the metal remained up 1.6% for the week. US gold futures for December delivery were steady at $3,771.30. The dollar index hovered near a three-week high, making gold and other dollar-priced assets more expensive for foreign investors.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Dai

Dai  sUSDS

sUSDS  Litecoin

Litecoin  Hedera

Hedera  Zcash

Zcash  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Rain

Rain  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bitget Token

Bitget Token  Falcon USD

Falcon USD  Aave

Aave  OKB

OKB  Pepe

Pepe  Circle USYC

Circle USYC  Sky

Sky  Global Dollar

Global Dollar  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Bittensor

Bittensor  Ripple USD

Ripple USD  Aster

Aster  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  NEAR Protocol

NEAR Protocol  Pi Network

Pi Network  Ondo

Ondo  Pump.fun

Pump.fun  MYX Finance

MYX Finance  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  USDD

USDD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Quant

Quant  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  Algorand

Algorand  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  NEXO

NEXO  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  Render

Render  syrupUSDT

syrupUSDT  Filecoin

Filecoin  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  USDai

USDai  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  Sei

Sei  TrueUSD

TrueUSD  clBTC

clBTC  Decred

Decred  Stacks

Stacks  Dash

Dash  EURC

EURC  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Tezos

Tezos  Story

Story  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  Pudgy Penguins

Pudgy Penguins  WrappedM by M0

WrappedM by M0  Optimism

Optimism  Kinesis Gold

Kinesis Gold  Lighter

Lighter  c8ntinuum

c8ntinuum  Virtuals Protocol

Virtuals Protocol  JUST

JUST  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv USR

Resolv USR  Resolv wstUSR

Resolv wstUSR  LayerZero

LayerZero  COCA

COCA  Gnosis

Gnosis  BitTorrent

BitTorrent  Maple Finance

Maple Finance  Liquid Staked ETH

Liquid Staked ETH  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Sun Token

Sun Token  Stable

Stable  Kaia

Kaia  AINFT

AINFT  Wrapped Flare

Wrapped Flare  Injective

Injective  Ether.fi

Ether.fi  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  IOTA

IOTA  FLOKI

FLOKI  Lido DAO

Lido DAO  crvUSD

crvUSD  Binance-Peg XRP

Binance-Peg XRP  DoubleZero

DoubleZero  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  Aerodrome Finance

Aerodrome Finance  Celestia

Celestia  sBTC

sBTC  Bitcoin SV

Bitcoin SV  SPX6900

SPX6900  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  Telcoin

Telcoin  Savings USDD

Savings USDD  Humanity

Humanity  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  pippin

pippin  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  JasmyCoin

JasmyCoin  PRIME

PRIME  Pyth Network

Pyth Network  ADI

ADI