Bitcoin Price Watch: Struggles at $84K—Will Bulls Take Control?

Bitcoin traded at $84,222 on March 15, 2025, with a market capitalization of $1.67 trillion, a 24-hour global trade volume of $25.99 billion, and an intraday price range between $82,705 and $85,139, showing signs of potential consolidation amid mixed technical indicators.

Bitcoin

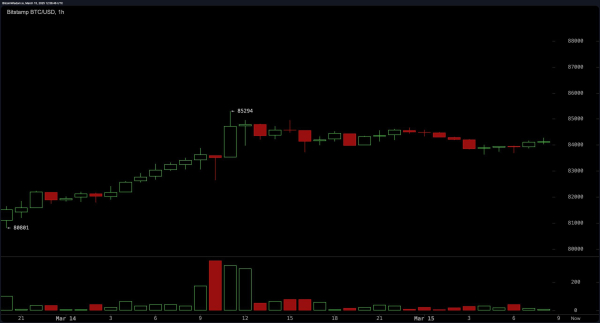

On the 1-hour chart, bitcoin‘s recent momentum stalled after reaching $85,294, suggesting a short-term pullback. Immediate support lies near $83,500, with resistance forming at $85,000. A series of small red candlesticks indicate profit-taking, while the drop in buying volume implies market participants are waiting for more favorable entry points. If bitcoin breaks below $82,500, further downside toward $80,000 may occur, while a successful defense of $83,500 could trigger another upward test of resistance levels.

BTC/USD 1H chart on March 15, 2025.

The 4-hour chart presents a slightly more optimistic outlook, as bitcoin has rebounded from a local bottom of $76,600 and briefly peaked at $85,294. The support level at $80,000 remains crucial for maintaining bullish momentum, while resistance near $85,000 must be surpassed for continued upside. However, declining volume following the bounce suggests waning bullish conviction. If bitcoin retraces to the $82,000–$83,000 range and shows renewed buying strength, it could provide a viable long entry opportunity, while another rejection at $85,000 could lead to a larger corrective move.

BTC/USD 4H chart on March 15, 2025.

On the daily chart, bitcoin is consolidating after a significant drop from its recent high of $100,185 to a low of $76,600. Key resistance sits near $90,000, with major support established at $76,600. Candlestick patterns suggest a stabilization phase, but buying pressure needs to increase to sustain a recovery. The market has seen a mix of bullish and bearish activity, with the potential for another leg down if bitcoin fails to hold the $80,000 level.

BTC/USD 1D chart on March 15, 2025.

Oscillators remain neutral overall, with the relative strength index (RSI) at 44, Stochastic at 35, and the commodity channel index (CCI) at -36, indicating a lack of strong directional momentum. However, momentum (10) sits at -6,483, signaling a bearish bias, while the moving average convergence divergence (MACD) level (12,26) at -3,104 presents a buy signal. Moving averages (MAs) show mixed signals, with short-term exponential moving averages (EMA) and simple moving averages (SMA) favoring buying, while longer-term indicators, such as the 50-day, 100-day, and 200-day EMAs and SMAs, remain bearish.

Fibonacci retracement levels indicate that $85,609 (38.2% level) is acting as immediate resistance, while $82,166 (23.6% level) serves as minor support. A break above $85,609 could lead to a move toward $88,392 (50% level), with $91,176 (61.8% level) representing a stronger resistance point. Conversely, if bitcoin drops below $82,000, a retest of $76,600 is likely. The overall market outlook suggests a need for bitcoin to hold above $80,000 to maintain its bullish structure, while traders should watch for breakouts above $85,609 to confirm a potential trend reversal.

Bull Verdict:

Bitcoin’s ability to maintain support above $82,000–$83,000, coupled with bullish signals from the MACD and short-term moving averages, suggests a potential rebound. If bitcoin successfully breaks through the $85,609 resistance level, it could trigger a rally toward $88,392 and beyond. A close above $90,000 would confirm renewed bullish momentum, making higher price targets, including $95,138, achievable in the coming days.

Bear Verdict:

With declining volume, bearish momentum readings, and longer-term moving averages signaling a downtrend, bitcoin remains vulnerable to a deeper correction. A failure to hold above $82,000 could accelerate losses, with a drop below $80,000 opening the door for a retest of the $76,600 support zone. If selling pressure intensifies, further downside toward lower Fibonacci levels and psychological barriers could materialize.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Avalanche

Avalanche  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  OKB

OKB  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  KuCoin

KuCoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  Midnight

Midnight  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  OUSG

OUSG  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Aptos

Aptos  USDD

USDD  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Stable

Stable  Jupiter

Jupiter  Arbitrum

Arbitrum  GHO

GHO  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  EURC

EURC  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  JUST

JUST  Ether.fi

Ether.fi  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  Sei

Sei  WrappedM by M0

WrappedM by M0  LayerZero

LayerZero  Dash

Dash  Kinesis Gold

Kinesis Gold  Chiliz

Chiliz  Tezos

Tezos  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  pippin

pippin  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Siren

Siren  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  AINFT

AINFT  Gnosis

Gnosis  ADI

ADI  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  PRIME

PRIME  USDai

USDai  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  SPX6900

SPX6900  JasmyCoin

JasmyCoin  FLOKI

FLOKI  Story

Story  Binance-Peg XRP

Binance-Peg XRP  Legacy Frax Dollar

Legacy Frax Dollar  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  River

River  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  Olympus

Olympus  Pyth Network

Pyth Network  crvUSD

crvUSD  Jupiter Staked SOL

Jupiter Staked SOL  DoubleZero

DoubleZero  Savings USDD

Savings USDD  Lombard

Lombard  Lighter

Lighter  Maple Finance

Maple Finance  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  BTSE Token

BTSE Token  Optimism

Optimism  Telcoin

Telcoin  Lido DAO

Lido DAO  Staked Aave

Staked Aave