Bitcoin Enters Death Cross—And Ethereum Isn’t Far Behind: Analysis

Crypto traders and investors who bought near highs in recent months are getting absolutely rekt right now, as hype fades and the market bleeds.

Bitcoin is down to around $88,000, falling more than 20% over the last 30 days. The crypto market as a whole today fell to $3.04 trillion—down 4.82% in 24 hours—with 95% of all coins bleeding red. The Fear and Greed Index just hit 16, the lowest reading since April, firmly in extreme fear territory. To put this in perspective: Zcash is the only coin in the top 50 by market cap managing to stay green today, squeezing out a 4% gain.

And the macro picture? It’s not helping.

Expectations for a December Federal Reserve rate cut are decreasing, Bitcoin ETFs just posted their fifth consecutive day of outflows (a record $523 million from BlackRock alone just yesterday), and traders seem to be looking for a hedge as the possibility of a crypto winter in 2026 gets more serious.

Meanwhile, on Myriad—the prediction market built by Decrypt’s parent company Dastan—traders are positioning for more carnage. A whopping 73.3% of the money on Myriad is betting Bitcoin dumps to $85K, as opposed to pumping to $115K. As for Ethereum, Myriad users place the odds at 62% that ETH, currently trading for around $2,800, slides to $2.5K over a rally to $4K.

Are they right? Here’s what the charts say.

Bitcoin (BTC) price: Death cross confirmed

Bitcoin opened today at $92,911 and promptly fell off a cliff, sliding more than 4% to its current price of $88,605. That’s a $4K slip in a single day that once again pushed BTC below the psychologically critical $90K level and marked a fresh seven-month low.

The technical setup is starting to look ugly.

Bitcoin (BTC) price data. Image: Tradingview

Exponential Moving Averages, or EMAs, help traders identify trend direction by tracking the average price of an asset over the short, medium, and long term. When the short-term 50-day EMA falls below the long-term 200-day EMA, it typically means sellers are dominating the market structure.

For Bitcoin, the 50-day EMA just crossed below the 200-day EMA, forming the dreaded “death cross” pattern that signals longer-term bearish momentum. Bitcoin is now trading well below both moving averages, which creates nasty overhead resistance that bulls need to reclaim before any meaningful recovery can begin.

Here’s where it gets worse: The Average Directional Index—which measures trend strength regardless of direction—is sitting at a robust 38.25. ADX readings above 25 indicate a strong trend is in place, and above 35 signals a very strong trend. This tells us the current downtrend isn’t some weak, directionless chop; there’s real momentum behind this selloff, as reflected in the “extreme fear” reading on the Crypto Fear and Green Index.

Bitcoin’s Relative Strength Index, or RSI, has cratered to 27.12, firmly in oversold territory below 30. RSI measures whether an asset is overbought or oversold based on recent price movements, and at 27, Bitcoin is stretched like a rubber band. This doesn’t mean the selling stops immediately, but it does suggest we’re approaching exhaustion levels where a violent bounce becomes more likely. That may mean prices soon testing the support (now resistance) level that has been in place since June, visible in the chart above in the dotted white line.

The Squeeze Momentum Indicator, which shows the market phase of prices and helps identify when trends are about to shift, is flashing bearish impulse signals, confirming the compression is releasing downward.

So are Myriad predictors right in setting that $85K target?

The wisdom of the crowd might be onto something. The chart shows a Fibonacci support around $84,451, with stronger support near $71,486. If Bitcoin loses the $88K-$89K zone it’s currently testing, there’s not much stopping a move toward $85K and below.

However, that oversold RSI suggests any drop to $85K would likely be a quick wick rather than a sustained breakdown. Capitulation moves tend to reverse violently once they flush out the last of the leveraged long positions—those futures contracts betting on the price of Bitcoin to go up using borrowed capital.

The upside case to $115K would require Bitcoin to reclaim the death cross and break above the descending trendline around $100,492—a tall order that explains why only 26.7% of traders are betting on it.

Key levels:

Resistance:

- $92,000 (immediate),

- $100,492 (descending trendline)

Support:

- $84,451 (strong),

- $71,486 (major)

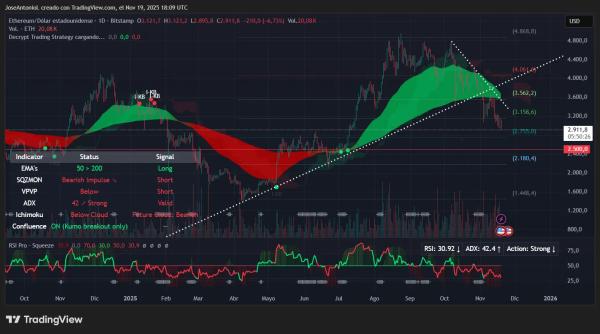

Ethereum (ETH) price: When good indicators turn bad

And if Bitcoin is in bad shape, then Ethereum has it even worse. ETH today dumped 6.73% from an opening price of $3,121.7 to close at $2,911.8, with an intraday low of $2,895.8.

Ethereum (ETH) price data. Image: Tradingview

Unlike Bitcoin, Ethereum’s 50-day EMA is still trading above its 200-day EMA—a “golden cross” that’s supposed to be bullish. So why is ETH getting destroyed?

The golden cross tells you the longer-term trend structure is intact, but it doesn’t protect you from brutal corrections within that trend. Ethereum is trading below both moving averages despite the golden cross, which means the bullish structure is being tested hard.

Also, the setup is very likely to turn bearish soon: The two EMAs are just about to cross, so if ETH dips for a few days, you’ll have another death cross here too.

And get this: Ethereum’s ADX is even more extreme than Bitcoin’s at 42.4. Traders would view this as a very strong trend, and right now that trend is firmly bearish. The Squeeze Momentum Indicator for ETH is likewise showing bearish impulse signals

What might make this particularly painful for ETH holders is that Ethereum has stronger downward momentum (higher ADX) but is also barely above oversold territory with an RSI of 30.92—just kissing the 30 threshold. This creates a knife-edge situation where the strong downtrend could push RSI deeper into oversold before reversing.

The ETH chart shows support around $2,796 and stronger support near $2,300. Myriad users are again strongly favoring the downside at the moment, with nearly 67% odds that Ethereum falls to $2.5K or below, which aligns with the technical analysis.

Ethereum needs to hold the $2,700-$2,800 zone (shown in the Fibonacci levels) to keep the 200-day EMA intact. If that breaks, the next meaningful support is indeed around $2,300-$2,500—exactly where most Myriad users are looking.

For the 33% betting on $4K? That would require ETH to reclaim the $3,100-$3,200 zone, hold it as support, and grind through multiple resistance levels. It’s possible if macro conditions improve, but the technicals right now don’t support it.

Keep praying, bulls. This is crypto after all. Crazier things have happened.

Key Levels:

Resistance:

- $3,100 (50-day EMA)

- $3,562 (prior resistance)

Support:

- $2,700-$2,800 (200-day EMA critical)

- $2,300 (strong)

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Cronos

Cronos  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pepe

Pepe  Aster

Aster  Aave

Aave  Falcon USD

Falcon USD  Bittensor

Bittensor  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Circle USYC

Circle USYC  syrupUSDC

syrupUSDC  Pi Network

Pi Network  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  Cosmos Hub

Cosmos Hub  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Quant

Quant  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  Filecoin

Filecoin  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Bonk

Bonk  Stable

Stable  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  pippin

pippin  USDai

USDai  clBTC

clBTC  Sei

Sei  EURC

EURC  Stacks

Stacks  Dash

Dash  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Decred

Decred  Kinesis Gold

Kinesis Gold  Story

Story  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  JUST

JUST  Lighter

Lighter  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Injective

Injective  COCA

COCA  Ether.fi

Ether.fi  LayerZero

LayerZero  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  AINFT

AINFT  Kaia

Kaia  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Gnosis

Gnosis  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  The Graph

The Graph  ADI

ADI  SPX6900

SPX6900  IOTA

IOTA  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Aerodrome Finance

Aerodrome Finance  Renzo Restaked ETH

Renzo Restaked ETH  Humanity

Humanity  crvUSD

crvUSD  sBTC

sBTC  JasmyCoin

JasmyCoin  Optimism

Optimism  Lido DAO

Lido DAO  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  Conflux

Conflux  Olympus

Olympus  Helium

Helium  Marinade Staked SOL

Marinade Staked SOL  Maple Finance

Maple Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  BTSE Token

BTSE Token  Telcoin

Telcoin  Ethereum Name Service

Ethereum Name Service  Staked Aave

Staked Aave