Analysis: DATs Keep Buying Bitcoin, Outperforming ETFs Is the Hard Part

“Just buy an ETF.” That blunt advice from Strive Asset Management CEO Matt Cole during a panel at Hong Kong’s Bitcoin Asia in August summed up the growing frustration with Digital Asset Treasuries (DAT), the corporate vehicles that promise to outperform bitcoin BTC$112,720.84 through clever financing and balance-sheet engineering but, so far, struggle to make good on that pledge.

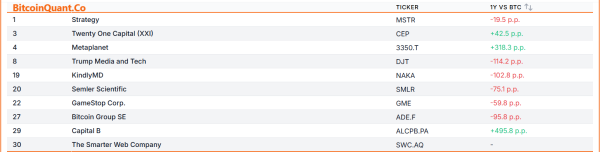

(BitcoinQuant.co)

Bitcoin itself is up about 23% this year. Yet, most Digital Asset Treasuries, including MicroStrategy, Semler Scientific, GameStop, and Trump Media, have badly trailed both BTC and the ETFs tracking it. Only a few outliers, like Twenty One Capital and Japan’s Metaplanet, which has been prone to volatility, have managed to beat the benchmark.

That gap exposes the core weakness of the DAT trade. These companies were built to outperform BTC through leverage, financing, or operational alpha, but most are lagging the simplest possible exposure.

The pitch of levered beta with balance-sheet discipline only works when equity premiums, convertibles, and debt markets stay friendly. Think about how toxic Strategy’s $8 billion in debt would look if there were a rate hike. With an average coupon of just 0.42% and maturities stretching over four years, those bonds look manageable today, but that comfort vanishes in a higher-rate world.

Even though the headlines come through daily about crypto entrepreneurs taking over a shell company and pumping its balance sheet full of BTC, the warnings are growing louder and louder.

Galaxy Digital has warned that the entire structure depends on a persistent premium to net asset value, a reflexive setup reminiscent of the 1920s investment-trust boom. NYDIG has been just as critical, arguing that the industry’s favored “mNAV” metric masks liabilities and inflates per-share exposure by assuming debt conversions that never happen.

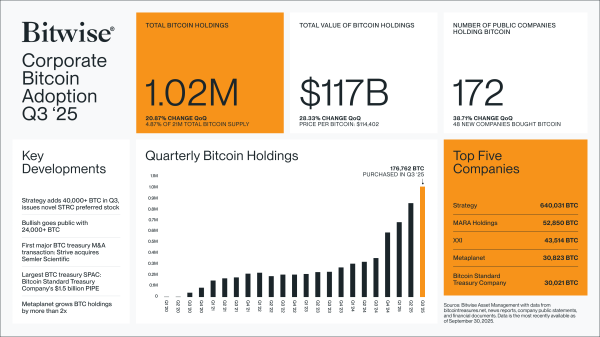

None of this means corporate bitcoin adoption is a mirage; it’s growing faster than ever. There are almost 40% more public companies holding bitcoin today than there were three months ago, according to data compiled by Bitwise.

(Bitwise)

Some of these companies are real firms that have BTC on the balance sheet because of the nature of their industry, like Coinbase, Bullish (Bullish is the parent company of CoinDesk), or BTC miners like MARA. Others have it as a hedge against fiat instability.

But, so many companies on Bitwise’s list are BTC DATs, and it’s important to differentiate these from other DATs that list proof-of-stake altcoins like ETH or Solana. This is a different offering.

By staking native assets and operating validators, these DATs earn yield not from leverage but from network activity itself. For instance, owning an ETH or TRX DAT would get exposure to Ethereum or Tron – the networks that the stablecoin revolution live on. In theory, this exposure turns treasuries into miniature ecosystems, compounding value as the network scales.

Tron’s listco, SRM, now Tron Inc after a rocky start, is showing how this is done. Nearly half of USDT activity lives on Tron, so if investors want a ‘Visa moment’ for USDT – especially in the most exciting markets for stablecoins like Latin America – Tron Inc is a DAT that fits this bill.

Still, that kind of on-chain exposure remains the exception, not the rule. Most DATs haven’t figured out how to translate balance-sheet size into operational yield or network participation. They were supposed to be smarter than ETFs, capital-efficient, yield-bearing, and tied to the real economic flow of blockchains, but many remain little more than leveraged proxies for bitcoin beta.

Until more treasury firms can prove they can compound capital faster than a passive ETF, the simplest takeaway from the Hong Kong stage might remain the best one: just buy the ETF.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Chainlink

Chainlink  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  PayPal USD

PayPal USD  Dai

Dai  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Global Dollar

Global Dollar  Falcon USD

Falcon USD  Aster

Aster  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Pi Network

Pi Network  Sky

Sky  syrupUSDC

syrupUSDC  Bitget Token

Bitget Token  Ripple USD

Ripple USD  Pepe

Pepe  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Pump.fun

Pump.fun  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  USDtb

USDtb  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Ethena

Ethena  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  OUSG

OUSG  USDD

USDD  Wrapped BNB

Wrapped BNB  Algorand

Algorand  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  Filecoin

Filecoin  Aptos

Aptos  Render

Render  syrupUSDT

syrupUSDT  Stable

Stable  pippin

pippin  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  VeChain

VeChain  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Arbitrum

Arbitrum  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Decred

Decred  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  TrueUSD

TrueUSD  Bonk

Bonk  clBTC

clBTC  USDai

USDai  EURC

EURC  Stacks

Stacks  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Kinesis Gold

Kinesis Gold  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Pudgy Penguins

Pudgy Penguins  Dash

Dash  Tezos

Tezos  Power Protocol

Power Protocol  Ether.fi

Ether.fi  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  PRIME

PRIME  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  AINFT

AINFT  COCA

COCA  BitTorrent

BitTorrent  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Chiliz

Chiliz  Liquid Staked ETH

Liquid Staked ETH  Lighter

Lighter  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Gnosis

Gnosis  Kaia

Kaia  ADI

ADI  Story

Story  Wrapped Flare

Wrapped Flare  LayerZero

LayerZero  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Sun Token

Sun Token  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Aerodrome Finance

Aerodrome Finance  Injective

Injective  crvUSD

crvUSD  IOTA

IOTA  Legacy Frax Dollar

Legacy Frax Dollar  Binance-Peg XRP

Binance-Peg XRP  Olympus

Olympus  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Celestia

Celestia  Renzo Restaked ETH

Renzo Restaked ETH  Pyth Network

Pyth Network  The Graph

The Graph  sBTC

sBTC  JasmyCoin

JasmyCoin  FLOKI

FLOKI  SPX6900

SPX6900  Jupiter Staked SOL

Jupiter Staked SOL  BTSE Token

BTSE Token  Savings USDD

Savings USDD  DoubleZero

DoubleZero  Maple Finance

Maple Finance  River

River  Marinade Staked SOL

Marinade Staked SOL  Lido DAO

Lido DAO  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  AB

AB  Helium

Helium  Telcoin

Telcoin  Conflux

Conflux  Staked Aave

Staked Aave  Optimism

Optimism