XRP Market Update: A Symphony of Bearish Signals Amplifies Downward Trajectory

On Feb. 2, 2025, XRP oscillated at $2.57 to $2.61 over the last hour, its market valuation eclipsing $150 billion alongside a $12.19 billion daily turnover. Intraday fluctuations spanned $2.52 to $2.95 per XRP, mirroring intense volatility as supply overwhelmed demand.

XRP

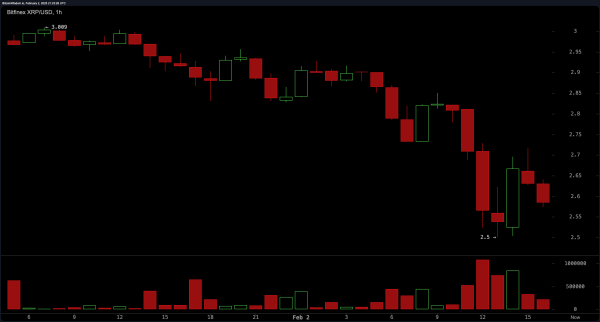

XRP’s hourly chart reveals a dominant bearish trajectory, with prices faltering in attempts to maintain upward progress. Supply-side forces have dictated movement, illustrated by sequential declines in peaks and troughs. Resistance solidifies at $2.75, while $2.50 anchors tentative support. A failure to breach resistance may catalyze a descent toward the Fibonacci extension at $2.40. The relative strength index (RSI) lingers near equilibrium, hinting at possible deterioration if sell-offs persist. Meanwhile, the moving average convergence divergence (MACD) remains entrenched in negative alignment, amplifying XRP’s pessimistic forecasts.

XRP/USD 1H chart via Bitfinex on Feb. 2, 2025.

Expanding to the four-hour timeframe, XRP has persistently underperformed critical exponential moving averages (EMA) and simple moving averages (SMA), validating sustained downward momentum. A forceful rejection at $2.75 underscores buyers’ lack of conviction, with prices gravitating toward deeper corrections. The $2.50 support zone now acts as a linchpin; a violation of this threshold could hasten a retreat to $2.40. Resistance crystallizes at the 38.2% Fibonacci retracement ($3.05), necessitating a decisive close above this barrier to suggest recovery. Until then, bearish strategies hold appeal, with traders monitoring resistance zones for tactical entries.

XRP/USD 4H chart via Bitfinex on Feb. 2, 2025.

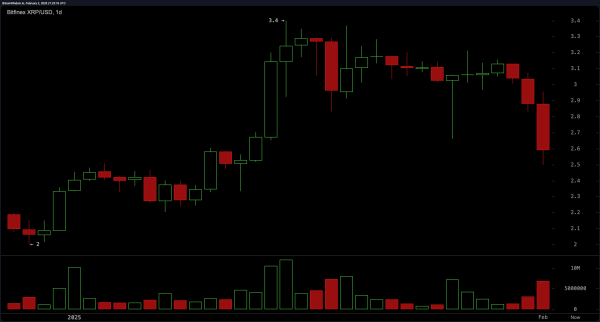

Zooming out, the daily chart paints an extended bearish framework. XRP struggles to recapture prior peaks it once saw, stymied by the 50-day EMA and SMA, which now function as ceilings. These barriers bolster expectations of further depreciation, while the 100-day and 200-day averages offer distant cushions at $2.14 and $1.59, respectively. A breach beneath $2.50 might initiate a descent toward these levels. Conversely, a daily settlement above $2.75 could foreshadow a reversal, though confirmation demands consistent demand and an advance beyond the 50% Fibonacci marker at $2.91.

XRP/USD 1D chart via Bitfinex on Feb. 2, 2025.

Oscillators emit ambiguous signals: the RSI (38.83) hovers in neutral territory, approaching oversold thresholds, while the Stochastic (31.52) and commodity channel index (-215.76) reflect indecision. The average directional index (18.91) implies tepid trend potency. Though the awesome oscillator (0.208) hints at marginal upward impetus, the MACD (0.081) reinforces the dominant bearish inclination.

Moving averages (MAs) uniformly advocate for bearish positions, with the 10-, 20-, 30-, and 50-day EMAs and SMAs aligned downward. Only the 100- and 200-day averages flash buy signals, suggesting longer-term foundations retain stability. A sustained drop below $2.50 per XRP may test these deeper supports, while a clearance of critical resistance at $2.75 and $2.91 is essential for bullish momentum. Presently, the scales tip decisively toward caution, with downward risks eclipsing fragile optimism.

Bull Verdict:

While prevailing sentiment skews bearish, latent optimism flickers in XRP’s technical tapestry. A decisive close above $2.75—and subsequently the 50% Fibonacci level at $2.91—could ignite a reversal, buoyed by the Awesome Oscillator’s faint bullish whisper and the 100-/200-day moving averages’ steadfast support. Traders eyeing contrarian plays may find strategic entries if demand resurges to overpower supply.

Bear Verdict:

The symphony of technical evidence resounds with caution. Persistent failures to breach resistance, coupled with moving averages’ downward chorus and the MACD’s bearish refrain, tilt risk-reward decisively south. A breakdown below $2.50 risks unraveling toward $2.14 or lower, with oscillators’ neutral ambivalence offering little defense. Until buyers orchestrate a structural shift, prudence favors bearish alignment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Dai

Dai  sUSDS

sUSDS  Rain

Rain  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Stable

Stable  Jupiter

Jupiter  Arbitrum

Arbitrum  GHO

GHO  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  JUST

JUST  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Sei

Sei  Ether.fi

Ether.fi  WrappedM by M0

WrappedM by M0  LayerZero

LayerZero  Dash

Dash  Chiliz

Chiliz  Kinesis Gold

Kinesis Gold  Tezos

Tezos  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  pippin

pippin  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Siren

Siren  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  Gnosis

Gnosis  AINFT

AINFT  ADI

ADI  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  PRIME

PRIME  USDai

USDai  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  SPX6900

SPX6900  JasmyCoin

JasmyCoin  FLOKI

FLOKI  River

River  Binance-Peg XRP

Binance-Peg XRP  Story

Story  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Legacy Frax Dollar

Legacy Frax Dollar  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  Lombard

Lombard  Olympus

Olympus  Pyth Network

Pyth Network  Jupiter Staked SOL

Jupiter Staked SOL  crvUSD

crvUSD  Savings USDD

Savings USDD  DoubleZero

DoubleZero  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Lighter

Lighter  Optimism

Optimism  Telcoin

Telcoin  Lido DAO

Lido DAO  Staked Aave

Staked Aave