Is The Solana Bottom In? Experts Answer

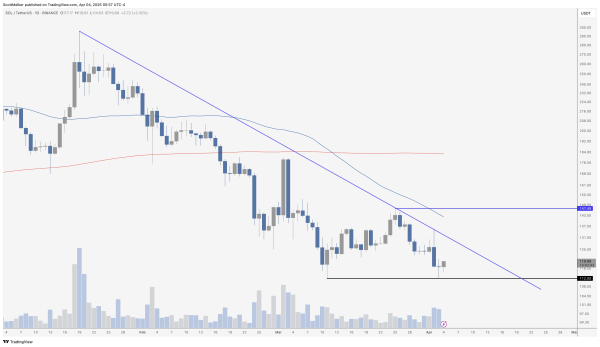

In a new technical analysis shared via X, crypto analyst Scott Melker aka The Wolf Of All Streets (@scottmelker) highlighted a critical support-resistance setup for Solana (SOL), emphasizing what he views as a textbook bounce off of a key technical level. “Picture perfect bounce off of $112 support. Double bottom would confirm with a break above $147, the swing high between the two bottoms. Don’t let anyone call it a double bottom until that happens. Regardless, nice bounce off of support with defined resistance to watch,” Melker stated.

The analyst’s chart shows SOL rebounding from near $112, reinforcing that zone as significant short-term support. For a bullish double-bottom pattern to validate, Melker points to a breakout above the downtrend line (currently around $130). If SOL breaks this resistance, $147 will be the critical level that would need to be breached. Until then, he advises caution about prematurely labeling the formation as a confirmed double bottom.

Solana Bottom In?

Notably, these remarks come on the heels of unlocks. According to a post by on-chain intelligence firm Arkham on Thursday, “$200M OF SOL UNLOCKING TOMORROW. Tomorrow (4th April) marks the largest single-day unlock of staked SOL until 2028. These 4 accounts staked a total of $37.7M of SOL in April 2021, and are up 5.5x at current prices.” The scale of these unlocks has generated considerable discussion on social media.

Another trader, NooNe0x, took a more optimistic stance, remarking, “SOL unlocks. Looking at the bright side, today’s unlock was the last large block. Today alone is as much as 40% of everything that is still left. It is 78% done, May, June and <December> only large-ish blocks left. Ripping the bandaid off.” In other words, with the bulk of significant unlocks possibly behind it, the supply overhang from locked tokens might be dissipating.

Historically, major token unlock events—whether for Solana or other projects—have often been anticipated well in advance by traders and investors. Markets “price in” that large holders sell their old tokens, sometimes driving prices lower ahead of the actual unlock. Once the unlock date arrives, if the anticipated sell-off does not materialize as severely as feared (or if much of the unlocked stake remains off the market), prices have tended to stabilize and often recover in the days or weeks that follow.

This pattern emerges because many holders, especially larger or early investors, may opt to restake or hold onto their tokens if they maintain a strong fundamental outlook. Meanwhile, short-term traders who had been betting on unlock-related volatility might close positions once the event passes. This “buy the rumor, sell the news” (or vice versa) dynamic can lead to price whipsaws around unlock periods, but no single outcome is guaranteed; much depends on how much actual selling pressure surfaces and broader market sentiment at the time.

Meanwhile, Awawat, a trader and angel investor at APG Capital, cautioned that Solana could be in a precarious position despite holding above $100. “SOL absolutely shrekt – broke 170 range low, bounced at 120 a few times – now holding above 100 but the ice is thin – last big unlock tomorrow – will bid sub-100 if given but this looks rough given the state of the trenches,” he wrote.

At press time, SOL traded at $115.

Featured image from Shutterstock, chart from TradingView.com

Source

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Avalanche

Avalanche  sUSDS

sUSDS  Rain

Rain  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Zcash

Zcash  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  Pi Network

Pi Network  MemeCore

MemeCore  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Polkadot

Polkadot  Mantle

Mantle  Circle USYC

Circle USYC  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Sky

Sky  Aster

Aster  Aave

Aave  Global Dollar

Global Dollar  Falcon USD

Falcon USD  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Worldcoin

Worldcoin  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Official Trump

Official Trump  Ethena

Ethena  Render

Render  Jito Staked SOL

Jito Staked SOL  Quant

Quant  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Cosmos Hub

Cosmos Hub  NEXO

NEXO  Binance-Peg WETH

Binance-Peg WETH  Midnight

Midnight  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  USDtb

USDtb  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  Aptos

Aptos  OUSG

OUSG  Filecoin

Filecoin  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  syrupUSDT

syrupUSDT  VeChain

VeChain  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Stable

Stable  YLDS

YLDS  Jupiter

Jupiter  GHO

GHO  Bonk

Bonk  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Virtuals Protocol

Virtuals Protocol  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  Pudgy Penguins

Pudgy Penguins  A7A5

A7A5  clBTC

clBTC  Stacks

Stacks  PancakeSwap

PancakeSwap  JUST

JUST  Decred

Decred  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  EURC

EURC  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Siren

Siren  Ether.fi

Ether.fi  WrappedM by M0

WrappedM by M0  Dash

Dash  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  River

River  LayerZero

LayerZero  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Tezos

Tezos  c8ntinuum

c8ntinuum  Kinesis Gold

Kinesis Gold  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  Curve DAO

Curve DAO  COCA

COCA  pippin

pippin  Gnosis

Gnosis  ADI

ADI  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  BitTorrent

BitTorrent  PRIME

PRIME  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  SPX6900

SPX6900  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  Sun Token

Sun Token  FLOKI

FLOKI  Bitcoin SV

Bitcoin SV  Maple Finance

Maple Finance  Binance-Peg XRP

Binance-Peg XRP  Venice Token

Venice Token  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Conflux

Conflux  Renzo Restaked ETH

Renzo Restaked ETH  JasmyCoin

JasmyCoin  Lighter

Lighter  sBTC

sBTC  Pyth Network

Pyth Network  Story

Story  DoubleZero

DoubleZero  Jupiter Staked SOL

Jupiter Staked SOL  IOTA

IOTA  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  BTSE Token

BTSE Token  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  Optimism

Optimism  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Official FO

Official FO  crvUSD

crvUSD  Lido DAO

Lido DAO  Lombard

Lombard