Public Mining Companies Raise Billions in Debt to Fund AI Pivot

Major public mining companies are aggressively raising billions of dollars through convertible bonds, the largest capital push since 2021.

This could mark a turning point toward AI expansion, but also carries the risk of equity dilution and mounting debt pressure if profits fail to accelerate.

A New Wave of Large-Scale Debt Issuance

The year 2025 marks a clear shift in how Bitcoin miners raise capital. Bitfarms recently announced a $500 million offering of convertible senior notes due 2031. TeraWulf proposed a $3.2 billion senior secured note issuance to expand its data center operations.

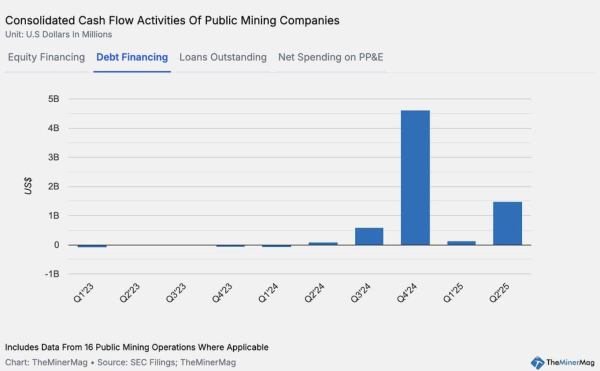

According to TheMinerMag, the total value of convertible and debt note issuances from 15 public mining companies reached a record $4.6 billion in Q4 2024. That figure fell below $200 million in early 2025 before surging again to $1.5 billion in Q2.

Consolidated cash flow activities of public mining companies. Source: TheMinerMag

This capital strategy mirrors what MicroStrategy has done successfully in recent years. However, today’s debt model fundamentally differs from the 2021 cycle in the mining industry. Back then, ASIC mining rigs were often used as collateral for loans.

Public mining companies increasingly turn to convertible notes as a more flexible approach to financing. This strategy shifts financial risk from equipment repossession to potential equity dilution.

While this gives companies more breathing room to operate and expand, it also demands stronger performance and revenue growth to avoid weakening shareholder value.

Opportunities and Risks

If miners pivot toward new business models, such as building HPC/AI infrastructure, offering cloud computing services, or leasing hash power, these capital inflows could become a powerful growth lever.

Diversifying into data services promises longer-term stability than pure Bitcoin mining.

For instance, Bitfarms has secured a $300 million loan from Macquarie to fund HPC infrastructure at its Panther Creek project. Should AI/HPC revenues prove sustainable, this financing model could be far more resilient than the ASIC-lien structure used in 2021.

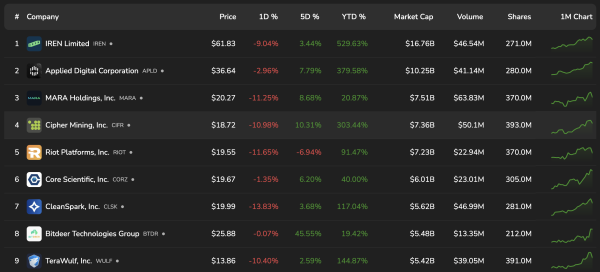

The market has seen a positive reaction from mining stocks when companies announce debt issuances, with stock prices rallying as the expansion and growth narrative is emphasized. However, there are risks if expectations are not met.

Shares of mining companies. Source: bitcoinminingstock

Suppose the sector fails to generate additional income to offset financing and expansion costs. In that case, equity investors will bear the brunt through heavy dilution — instead of equipment repossession as in previous cycles.

This comes when Bitcoin’s mining difficulty has reached an all-time high, cutting into miners’ margins, while mining performance across major companies has been trending downward in recent months.

In short, the mining industry is once again testing the limits of financial engineering — balancing between innovation and risk — as it seeks to transform from energy-intensive mining to>Public Mining Companies Raise Billions in Debt to Fund AI Pivot appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Canton

Canton  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  PayPal USD

PayPal USD  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Cronos

Cronos  USDT0

USDT0  Toncoin

Toncoin  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  Polkadot

Polkadot  MemeCore

MemeCore  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aave

Aave  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  Falcon USD

Falcon USD  Bittensor

Bittensor  Aster

Aster  Pi Network

Pi Network  Sky

Sky  OKB

OKB  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Ethena

Ethena  Ondo US Dollar Yield

Ondo US Dollar Yield  Quant

Quant  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Official Trump

Official Trump  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Algorand

Algorand  Function FBTC

Function FBTC  OUSG

OUSG  Filecoin

Filecoin  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Render

Render  syrupUSDT

syrupUSDT  Stable

Stable  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Jupiter

Jupiter  Beldex

Beldex  Arbitrum

Arbitrum  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  pippin

pippin  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  Virtuals Protocol

Virtuals Protocol  A7A5

A7A5  Stacks

Stacks  EURC

EURC  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  USDai

USDai  PancakeSwap

PancakeSwap  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  Dash

Dash  WrappedM by M0

WrappedM by M0  JUST

JUST  Kinesis Gold

Kinesis Gold  Tezos

Tezos  Power Protocol

Power Protocol  LayerZero

LayerZero  Ether.fi

Ether.fi  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  COCA

COCA  Gnosis

Gnosis  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  AINFT

AINFT  Lighter

Lighter  Kaia

Kaia  Wrapped Flare

Wrapped Flare  ADI

ADI  Aerodrome Finance

Aerodrome Finance  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Sun Token

Sun Token  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  Bitcoin SV

Bitcoin SV  Story

Story  Venice Token

Venice Token  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  crvUSD

crvUSD  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Siren

Siren  Renzo Restaked ETH

Renzo Restaked ETH  Celestia

Celestia  IOTA

IOTA  sBTC

sBTC  River

River  JasmyCoin

JasmyCoin  The Graph

The Graph  Jupiter Staked SOL

Jupiter Staked SOL  Pyth Network

Pyth Network  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Maple Finance

Maple Finance  Olympus

Olympus  Marinade Staked SOL

Marinade Staked SOL  FLOKI

FLOKI  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Optimism

Optimism  Lido DAO

Lido DAO  BTSE Token

BTSE Token  DoubleZero

DoubleZero  Staked Aave

Staked Aave