Bitcoin Mining’s Power Brokers: A Deep Dive Into the Top 15 Companies and Their Financial Architects

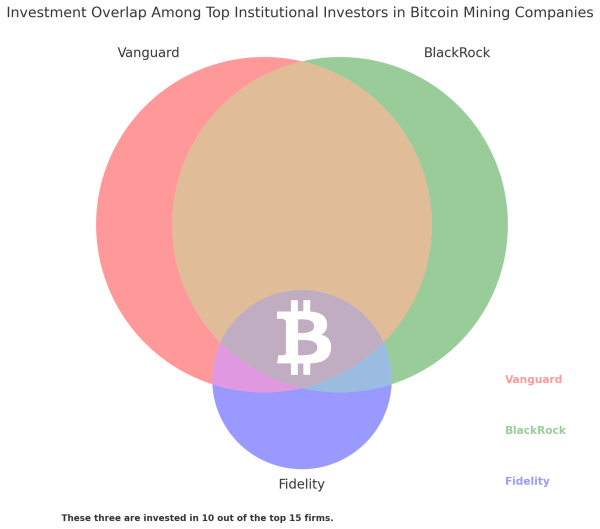

Institutional investors now hold pivotal stakes in 15 major cryptocurrency mining firms, with asset managers like Vanguard, Blackrock, and Fidelity steering ownership across an increasingly competitive sector.

Inside the Top 15 Bitcoin Mining Firms Dominated by Finance Heavyweights

Institutional investors are rewriting the rules of the cryptocurrency mining sector. Vanguard, Blackrock, and Fidelity now command towering stakes in 15 major firms, transforming a once-niche sector into a battleground for Wall Street’s billions.

From Tether’s billion-dollar dominance to retail’s fading foothold, ownership charts reveal a seismic power shift. Institutions hold up to 90% of shares in key players—staking claims on crypto’s next frontier. This analysis examines the foremost 15 publicly traded bitcoin (BTC) mining entities by market capitalization and the institutional stakeholders shaping their trajectories.

Galaxy Digital Holdings Ltd. (GLXY) is anchored by Fidelity Management & Research Co. LLC, which owns 14.88% of its shares. The firm’s institutional ownership reflects moderate influence, with retail investors retaining a notable portion of the remaining equity.

MARA Holdings, Inc. (MARA) sees Blackrock and Vanguard as its top institutional backers, holding 13% and 11% of shares, respectively. Institutional investors collectively control 44–49% of the company, while retail investors and insiders account for the majority of the remaining stake.

Riot Platforms, Inc. (RIOT) is dominated by Vanguard and Blackrock, which hold 9.8% and 7.0% of shares. Institutional ownership totals roughly 40%, with Geode Capital Management rounding out key stakeholders. Retail investors retain significant influence over the company’s strategic direction.

Core Scientific, Inc. (CORZ) stands out for its heavy institutional concentration, with 90% of shares held by firms like Vanguard (19.4 million shares) and Beryl Capital Management (18.2 million shares). This near-total institutional control underscores Wall Street’s confidence in its operational scale.

Bitdeer Technologies Group (BTDR) lists Yong Rong (HK) Asset Management as its largest institutional investor, with a $65 million stake. Trivest Advisors, SC China Holding, and Vaneck Associates follow, contributing to institutional ownership ranging between 22.25% and 40.93%.

Northern Data AG (NB2) is majority-owned by Tether Holdings Ltd., which holds a 39.29% stake valued at €1.176 billion. CEO Aroosh Thillainathan follows with 7.725%, while Vaneck Associates holds a smaller 0.98% position. Retail investors own 59.1% of the company.

Cleanspark, Inc. (CLSK) counts Vanguard (6.55%), Blackrock (6.15%), and Dimensional Fund Advisors among its top institutional holders. Institutions collectively own 43–46% of shares, leaving insiders and retail investors with the remainder.

Iris Energy Limited (IREN) features Castle Hook Partners as its largest institutional shareholder, owning 3.7% of shares. Moore Capital Management, Morgan Stanley, and Vaneck Associates also hold stakes, with institutions controlling 41–44% of the company.

Cipher Mining Inc. (CIFR) leans heavily on retail investors, who own 40% of shares. Vanguard ($29 million stake) and State Street ($27 million) lead institutional ownership, which spans 27–32%, while insiders hold another 32%.

Applied Digital Corporation (APLD) is shaped by CEO Wesley Cummins, who owns 10.39% of shares. Blackrock (6.37%) and Vanguard (5.72%) follow, contributing to institutional ownership of 65–75%—one of the sector’s highest concentrations.

Hut 8 Corp. (HUT) sees Blackrock (10%) and Vanguard (7%) as its top institutional investors. Retail investors dominate with 57% ownership, while institutions hold 31–61% depending on market conditions, reflecting fluctuating institutional interest.

Terawulf Inc. (WULF) has 62.3% institutional ownership, led by Blackrock (8.2%) and Vanguard (6.5%). Retail investors hold 37.7%, highlighting a balance between Wall Street and individual stakeholders.

Bitfufu Inc. (FUFU) remains firmly under insider control, with founders and associates owning 82.9% of shares. Institutions like Morgan Stanley hold a scant 1.37–1.49%, leaving retail investors with less than 10%.

Bitfarms Ltd. (BITF) lists Vanguard (12.5%), Blackrock (11.2%), and Fidelity (9.8%) as its largest institutional holders. Institutional ownership ranges between 25–30%, with retail investors and insiders holding the majority.

Cango Inc. (CANG) is unique for its retail-driven ownership structure, with the public controlling 51% of shares. Insiders hold 28–36%, while institutions like Morgan Stanley own just 13–14%, reflecting limited Wall Street engagement.

The rise of institutional capital in cryptocurrency mining marks a pivotal departure from its decentralized origins. As financial titans carve deeper into the sector, questions emerge about innovation’s trajectory and whether blockchain’s egalitarian ideals can coexist with Wall Street’s intentions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aave

Aave  Aster

Aster  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Internet Computer

Internet Computer  HTX DAO

HTX DAO  Pepe

Pepe  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo US Dollar Yield

Ondo US Dollar Yield  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Quant

Quant  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  Ethena

Ethena  Midnight

Midnight  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  OUSG

OUSG  USDD

USDD  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  VeChain

VeChain  Beldex

Beldex  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Stable

Stable  Jupiter

Jupiter  GHO

GHO  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  Decred

Decred  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  A7A5

A7A5  clBTC

clBTC  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  JUST

JUST  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  StakeWise Staked ETH

StakeWise Staked ETH  EURC

EURC  Ether.fi

Ether.fi  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  LayerZero

LayerZero  Sei

Sei  WrappedM by M0

WrappedM by M0  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Dash

Dash  Kinesis Gold

Kinesis Gold  Chiliz

Chiliz  Tezos

Tezos  c8ntinuum

c8ntinuum  Siren

Siren  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Curve DAO

Curve DAO  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Gnosis

Gnosis  AINFT

AINFT  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  ADI

ADI  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  USDai

USDai  PRIME

PRIME  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Celestia

Celestia  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Injective

Injective  River

River  FLOKI

FLOKI  JasmyCoin

JasmyCoin  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  IOTA

IOTA  Renzo Restaked ETH

Renzo Restaked ETH  Legacy Frax Dollar

Legacy Frax Dollar  Story

Story  sBTC

sBTC  DoubleZero

DoubleZero  Olympus

Olympus  Conflux

Conflux  Jupiter Staked SOL

Jupiter Staked SOL  Pyth Network

Pyth Network  Savings USDD

Savings USDD  crvUSD

crvUSD  Maple Finance

Maple Finance  Lighter

Lighter  Marinade Staked SOL

Marinade Staked SOL  BTSE Token

BTSE Token  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Optimism

Optimism  Lido DAO

Lido DAO  Venice Token

Venice Token  Telcoin

Telcoin