Bitcoin Mining Revenue in 2024: A Year of Change and Challenges

Bitcoin miners saw substantial shifts in their revenue during 2024, a pivotal year marked by the network’s fourth halving event. As bitcoin’s block reward dropped from 6.25 BTC to 3.125 BTC at block 840,000 in mid-April, the dynamics of mining profitability shifted dramatically, influencing revenue trends throughout the year.

From Peaks to Valleys: The Dramatic Revenue Shifts for Bitcoin Miners in 2024

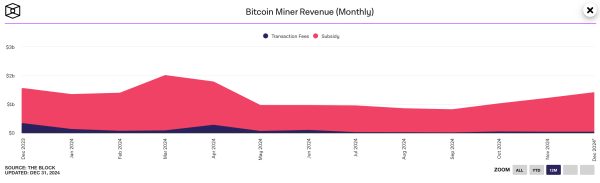

The year began on a strong note for bitcoin (BTC) miners. Metrics collected from theblock.co’s mining data shows January’s total mining revenue reached $1.35 billion, with block subsidies contributing $1.21 billion. February saw a modest rise to $1.39 billion, and March peaked pre-halving at $2.01 billion in total revenue, $1.93 billion of which came from block rewards. These strong earnings showcased the significance of block subsidies and hashprice prior to the halving event at block height 840,000.

Following April’s halving, miners experienced a sharp revenue decline. April’s total revenue was down to $1.79 billion, as subsidies fell to $1.5 billion, reflecting the reduced block reward. By May, revenue dropped below $1 billion for the first time in 2024, totaling $964.24 million, with rewards contributing $899.39 million. This downward trend continued through August, which marked the second-lowest revenue month this year at $851.36 million.

September brought further challenges, with bitcoin miners’ total revenue slipping to $815.7 million, the lowest point for block subsidies at $801.84 million. However, miners saw a gradual recovery in the fourth quarter. October’s revenue climbed to $1.02 billion, and November also surpassed the $1 billion mark at $1.21 billion, spurred by bitcoin’s price resurgence following the U.S. election.

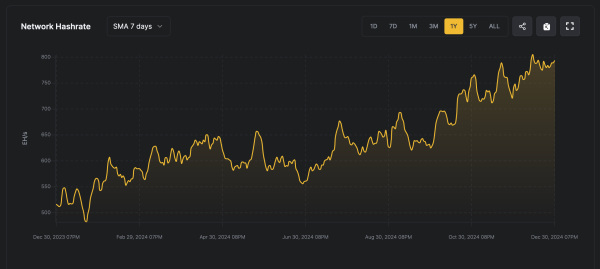

Bitcoin’s total hashrate in 2024.

December capped the year with $1.41 billion in revenue, driven by bitcoin’s price exceeding $108,000 in mid-December. December’s estimate could be a touch higher too as Dec. 31, 2024, is not quite finished. While revenues improved significantly in the final quarter, they remained below pre-halving levels. The subsidy portion of December’s revenue, $1.37 billion, highlighted the enduring importance of current block rewards despite the lower rate.

The timeline shows the halving event showcased the impact of reduced block rewards on miner earnings while highlighting the resilience of the sector. While revenue shifted immensely this year, miners still managed to break records in terms of computational power. The hashrate managed to climb over 805 exahash per second (EH/s) this month according to the seven-day simple moving average (SMA).

Moreover, Bitcoin’s network difficulty climbed sky-high this year as well rising to a massive 109.78 trillion after the difficulty change last night. As bitcoin’s price rallied late in the year, miners demonstrated adaptability in navigating new economic realities. Whether future years bring similar volatility will depend largely on market trends and technological advancements in the mining ecosystem.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Hedera

Hedera  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  Polkadot

Polkadot  MemeCore

MemeCore  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  OKB

OKB  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Aster

Aster  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Worldcoin

Worldcoin  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  Quant

Quant  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Midnight

Midnight  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Render

Render  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Filecoin

Filecoin  Official Trump

Official Trump  syrupUSDT

syrupUSDT  Jupiter

Jupiter  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Stable

Stable  YLDS

YLDS  Arbitrum

Arbitrum  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  Decred

Decred  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  EURC

EURC  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Ether.fi

Ether.fi  Kinetiq Staked HYPE

Kinetiq Staked HYPE  JUST

JUST  tBTC

tBTC  Sei

Sei  WrappedM by M0

WrappedM by M0  LayerZero

LayerZero  Chiliz

Chiliz  Dash

Dash  Kinesis Gold

Kinesis Gold  Tezos

Tezos  c8ntinuum

c8ntinuum  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  Siren

Siren  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  pippin

pippin  Resolv wstUSR

Resolv wstUSR  Gnosis

Gnosis  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  AINFT

AINFT  BitTorrent

BitTorrent  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  USDai

USDai  ADI

ADI  Sun Token

Sun Token  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Injective

Injective  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Celestia

Celestia  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  SPX6900

SPX6900  JasmyCoin

JasmyCoin  FLOKI

FLOKI  Story

Story  IOTA

IOTA  Binance-Peg XRP

Binance-Peg XRP  Legacy Frax Dollar

Legacy Frax Dollar  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Pyth Network

Pyth Network  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  Bitcoin SV

Bitcoin SV  sBTC

sBTC  Olympus

Olympus  Lighter

Lighter  crvUSD

crvUSD  Jupiter Staked SOL

Jupiter Staked SOL  DoubleZero

DoubleZero  Savings USDD

Savings USDD  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Conflux

Conflux  Marinade Staked SOL

Marinade Staked SOL  Lombard

Lombard  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Optimism

Optimism  Telcoin

Telcoin  Venice Token

Venice Token  Lido DAO

Lido DAO