Ethereum short positions reach record high despite bullish sentiments

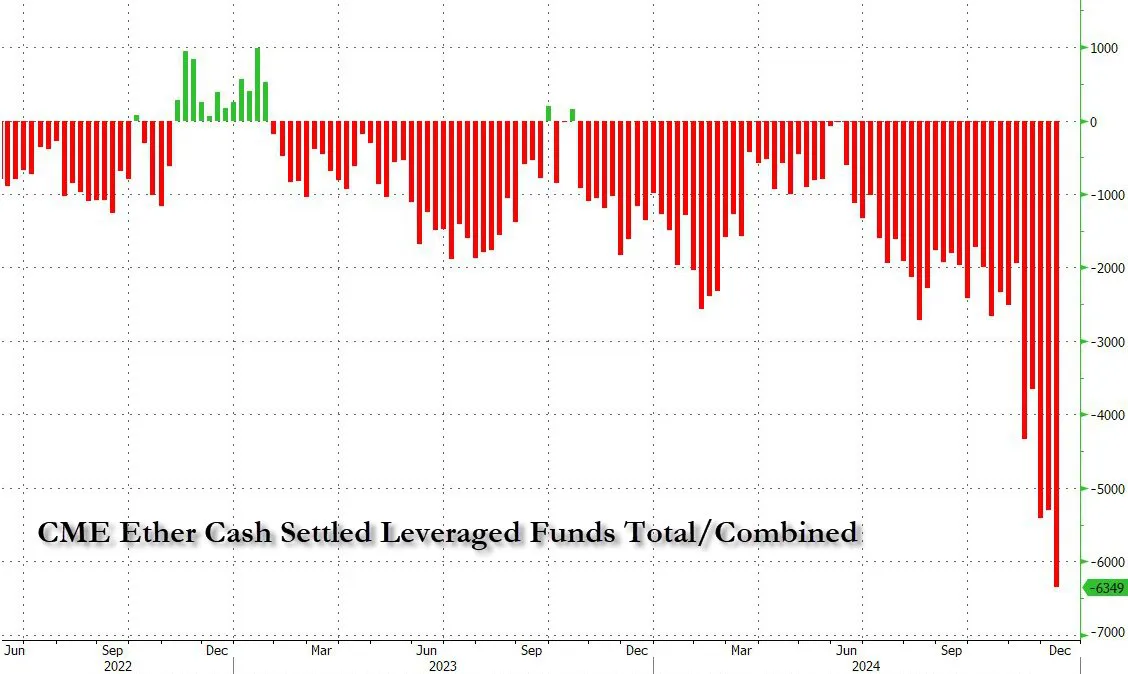

Ethereum’s leveraged short position on the Chicago Mercantile Exchange (CME) has reached an all-time high, indicating a strong bearish sentiment in the market. The record leveraged shorts happened as open interest in Ethereum futures on the CME reached a record high of over one million ETH.

Overall, open interest in Ethereum has increased over the past few weeks, setting a new record high of 6.91 million ETH ($27 billion) across all exchanges. While the heightened open interest indicates more speculative activity, the short positions raise concerns about the ETH price.

ETH shorts reach new highs on the CME. Source: Zerohedge

Meanwhile, record shorts on CME suggest that institutional investors (hedge funds) are shorting ETH. This has led to speculation about whether this is a basis trade, i.e., investors hedging their bets on spot ETH by shorting its futures to take advantage of the price gaps.

Nevertheless, the leveraged short positions pose a risk of massive liquidation if the price of ETH should rise unexpectedly. This could also mean extra sell pressure for the asset, as the short squeeze could force more people to become cautious and reduce their exposure.

Onchain analysts bullish on ETH due to increased demand

Despite the record short positions, many analysts believe that ETH will rise in value soon and point to on-chain signals to prove their point. According to data from CryptoQuant, Ethereum will likely surpass $5,000, as its realized price upper band is at $5,200. The blockchain analytics platform notes that demand and supply are gaining the strength to play out this scenario.

It said:

“The realized price upper band, currently at $5.2k, matches the level seen during the 2021 bull run peak, signaling strong potential for further growth.”

Most of that growing demand comes from Ethereum exchange-traded funds (ETFs), which have seen more investor interest recently. The net inflow into ETFs now stands at $2.268 billion despite Grayscale ETHE seeing over $3.5 billion in outflows. BlackRock ETHA also has over $3 billion inflow after ten consecutive days of inflows. These continuous accumulations have driven the upward movement of ETH price.

With the accumulation increasing, many believe ETH will see massive gains in 2025. VanEck, in its predictions for next year, projected that ETH would reach $6,000, while BitWise was even more bullish, with a $7,000 prediction.

$3,700 to $3,810 is a key support level for ETH price. Source: Ali Martinez

However, whether ETH will even finish 2024 above $4,000 still depends on its ability to maintain its price above $3,700. Technical analyst Ali Martinez has noted that $3,700 to $3,810 is one of ETH’s most important support levels, as three million wallets bought 4.6 million ETH at that level.

Ethereum is seeing a surge in scarcity

Meanwhile, ETH supply, which is currently around 120 million, has also witnessed a turnaround in the burn rate. The network was at the center of a debate about L2s earlier in the year due to the high emissions of ETH on the L1 network and low transaction volume, which has caused the burn rate also to fall.

However, the average daily burn rate has increased to 2,700 ETH, compared to 80 ETH in August. This means that ETH supply has once again become deflationary due to heightened network activity, and many believe this will cause the ETH price to increase further.

Most of the network activities seem to be trending up for Ethereum. The network has seen an 8-month high in new wallets, with an average of over 130,000 new addresses created daily throughout December, a 2.63% increase this week. The last time it saw this much activity was in April.

Additionally, active addresses on Ethereum also increased by 4.24% this week, while addresses with zero balance fell by 4.06%.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Litecoin

Litecoin  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Zcash

Zcash  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  PAX Gold

PAX Gold  MemeCore

MemeCore  Pi Network

Pi Network  Polkadot

Polkadot  Ethena Staked USDe

Ethena Staked USDe  Uniswap

Uniswap  Mantle

Mantle  Circle USYC

Circle USYC  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Sky

Sky  Falcon USD

Falcon USD  Global Dollar

Global Dollar  Aster

Aster  NEAR Protocol

NEAR Protocol  Aave

Aave  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Pepe

Pepe  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  KuCoin

KuCoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Render

Render  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Midnight

Midnight  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  OUSG

OUSG  Aptos

Aptos  Filecoin

Filecoin  Official Trump

Official Trump  syrupUSDT

syrupUSDT  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Arbitrum

Arbitrum  Stable

Stable  GHO

GHO  Jupiter

Jupiter  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Bonk

Bonk  Solv Protocol BTC

Solv Protocol BTC  TrueUSD

TrueUSD  Lombard Staked BTC

Lombard Staked BTC  A7A5

A7A5  Decred

Decred  clBTC

clBTC  JUST

JUST  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  PancakeSwap

PancakeSwap  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Sei

Sei  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Ether.fi

Ether.fi  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  WrappedM by M0

WrappedM by M0  Dash

Dash  Siren

Siren  LayerZero

LayerZero  Kinesis Gold

Kinesis Gold  Tezos

Tezos  Chiliz

Chiliz  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  River

River  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Curve DAO

Curve DAO  Gnosis

Gnosis  ADI

ADI  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  USDai

USDai  BitTorrent

BitTorrent  PRIME

PRIME  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Bitcoin SV

Bitcoin SV  Celestia

Celestia  The Graph

The Graph  JasmyCoin

JasmyCoin  FLOKI

FLOKI  Binance-Peg XRP

Binance-Peg XRP  SPX6900

SPX6900  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Maple Finance

Maple Finance  Renzo Restaked ETH

Renzo Restaked ETH  Story

Story  Lighter

Lighter  sBTC

sBTC  Legacy Frax Dollar

Legacy Frax Dollar  IOTA

IOTA  BTSE Token

BTSE Token  Jupiter Staked SOL

Jupiter Staked SOL  Conflux

Conflux  Savings USDD

Savings USDD  Olympus

Olympus  Pyth Network

Pyth Network  Official FO

Official FO  Marinade Staked SOL

Marinade Staked SOL  DoubleZero

DoubleZero  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  crvUSD

crvUSD  Lombard

Lombard  Lido DAO

Lido DAO  Venice Token

Venice Token  Staked Aave

Staked Aave