Ethereum price prediction: top reasons why ETH may surge in 2025

Ethereum price has risen for three consecutive weeks, helped by the ongoing recovery of cryptocurrencies. ETH, the second-biggest cryptocurrency, rose to $3,670 on Tuesday, as technicals and fundamentals pointed to more gains in the current quarter. So, how high can ETH get this year?

Polymarket users are bullish on Ethereum price

There are rising odds that the ETH price will continue doing well this year. A Polymarket poll with over $2 million shows that the odds of ETH reaching $4,500 on March 31 are at 55%. If that happens, it means that the ETH price will rise by over 23% from the current level.

Another Polymarket poll shows that the odds of the coin soaring to an all-time high by June have risen to 56%. The odds that the ETH price will get to $5,000 this year have risen to 65%.

Therefore, traders are optimistic that the coin will do well in the long term. This is notable since Polymarket has proven to be a highly accurate prediction market such as its prediction about the US presidential election when it predicted that Trump would win.

ETH price technicals point to a rebound

Meanwhile, Ethereum price has strong technicals, pointing to more gains in the long term. The weekly chart shows that the ETH has formed a symmetrical triangle chart pattern. The upper side of this triangle connects the highest swings since November 2021.

This triangle has more room to form, meaning another drop to the lower side cannot be ruled out. Besides, the coin has formed a triple-top chart pattern at $4,085. A triple-top is a popular bearish reversal pattern.

I just cannot get over how good this $ETH weekly chart looks. Time to remind everyone what a real ETH rally looks like. I’m ready.

The Ethereum price has remained above the 50-week and 100-week Exponential Moving Averages (EMA), which is a positive sign. It has moved slightly below the 23.6% Fibonacci Retracement level and formed a cup and handle pattern.

Therefore, ETH price will likely continue rising in the next few months. For this to happen, the coin will need to jump and cross the upper side of the triple-top pattern at $4,085. If this happens, the next level to watch will be the all-time high of $4,883. It will then surge to the key psychological point at $5,000 if it flips the ATH.

ETH price daily chart

Key catalysts for Ethereum

The price of ETH has numerous catalysts that could increase it in the longer term. First, the first quarter is usually the best-performing one. It rose by 59% in Q1 ’24 and 52% in Q1 ’23. The average gains in Q1 are 83%, and the coin has only fallen two first quarters since 2017.

Second, spot Ethereum ETFs are doing well and seeing strong inflows, a sign of robust demand. All ETH ETFs have accumulated over $2.7 billion in inflows, bringing the combined assets to $13.47 billion. More inflows will continue in the next few months as demand rises.

Further, data shows that the volume of ETH in exchanges has remained under pressure. While the amount has risen in the past few days, it remains much lower than it was a few years ago. Falling volume is a sign that investors are holding the coin for longer.

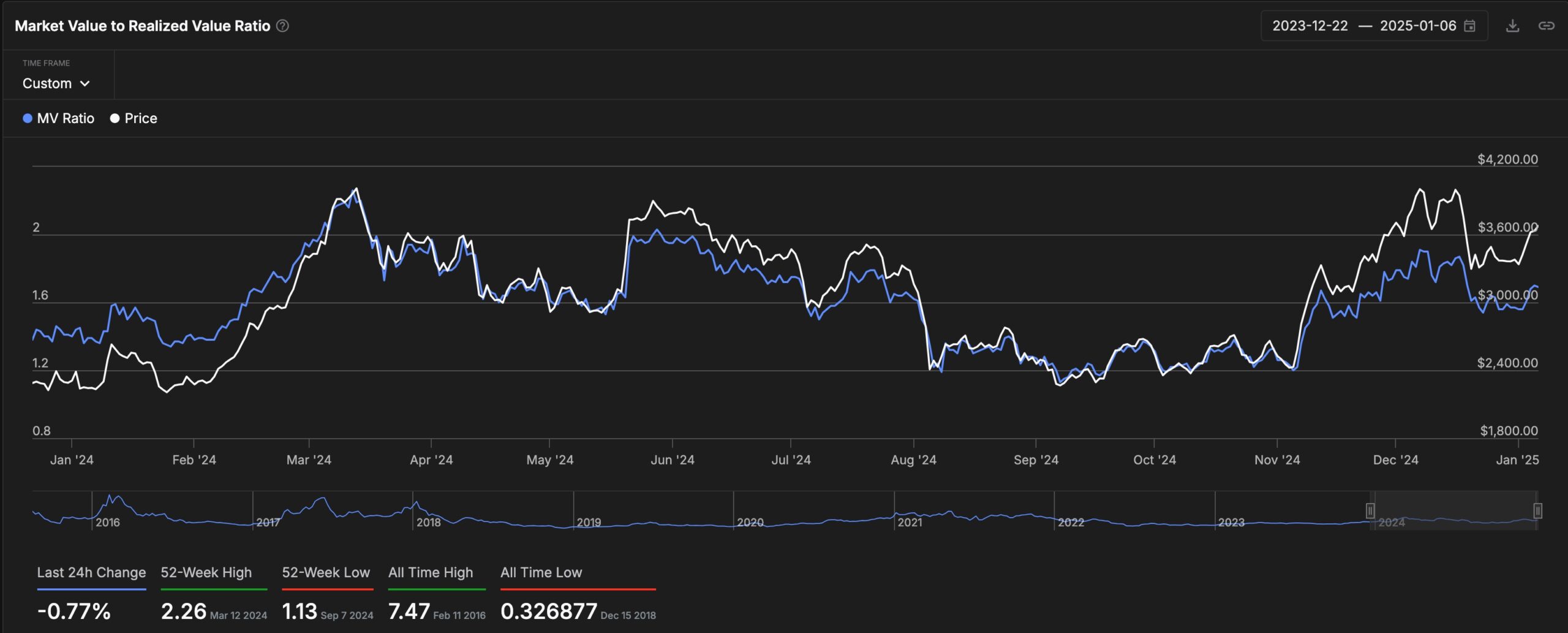

Ethereum is also fairly cheap when you use the MVRV-Z score indicator. The market value to relative value z-score is an indicator that compares the MV and RV, and then standardizes it. A crypto is said to be cheap when the MVRV indicator is below 3.8. Ethereum’s figure is at 1.6, meaning that the coin has more upside to go.

Therefore, Ethereum has a combination of strong technicals and fundamentals that will likely push it higher for longer.

The post Ethereum price prediction: top reasons why ETH may surge in 2025 appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Dai

Dai  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Pi Network

Pi Network  Aave

Aave  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ondo US Dollar Yield

Ondo US Dollar Yield  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Aptos

Aptos  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  OUSG

OUSG  Official Trump

Official Trump  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Render

Render  USDD

USDD  syrupUSDT

syrupUSDT  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  Beldex

Beldex  YLDS

YLDS  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Stable

Stable  Solv Protocol BTC

Solv Protocol BTC  GHO

GHO  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  Decred

Decred  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  Sei

Sei  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  USDai

USDai  tBTC

tBTC  Dash

Dash  WrappedM by M0

WrappedM by M0  JUST

JUST  Tezos

Tezos  Ether.fi

Ether.fi  River

River  Kinesis Gold

Kinesis Gold  LayerZero

LayerZero  c8ntinuum

c8ntinuum  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Gnosis

Gnosis  Siren

Siren  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Liquid Staked ETH

Liquid Staked ETH  AINFT

AINFT  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  Lombard

Lombard  SPX6900

SPX6900  PRIME

PRIME  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kaia

Kaia  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  ADI

ADI  Story

Story  Humanity

Humanity  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  Injective

Injective  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lighter

Lighter  Renzo Restaked ETH

Renzo Restaked ETH  Bitcoin SV

Bitcoin SV  IOTA

IOTA  sBTC

sBTC  Pyth Network

Pyth Network  Maple Finance

Maple Finance  The Graph

The Graph  Jupiter Staked SOL

Jupiter Staked SOL  JasmyCoin

JasmyCoin  Savings USDD

Savings USDD  FLOKI

FLOKI  Legacy Frax Dollar

Legacy Frax Dollar  Venice Token

Venice Token  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  Optimism

Optimism  crvUSD

crvUSD  Lido DAO

Lido DAO  Staked Aave

Staked Aave  Plasma

Plasma