Ethereum price finally topped $3K, but data suggests a reversal is nowhere in sight

There is an old saying in traditional markets which is actually more like a trading rule. It goes, “when the trend is negative, one can only be neutral or short,” meaning bet on the price decrease. The problem is that a relief bounce tricks traders into believing that the negative prevailing sentiment has shifted into a buyers’ market.

For example, after analyzing Ether’s (ETH) price chart, one might conclude that after a 41% crash, a bull run should be ignited sooner rather than later. Unfortunately, this is a bit of a fallacy because markets can exist in periods of non-definition (trendwise).

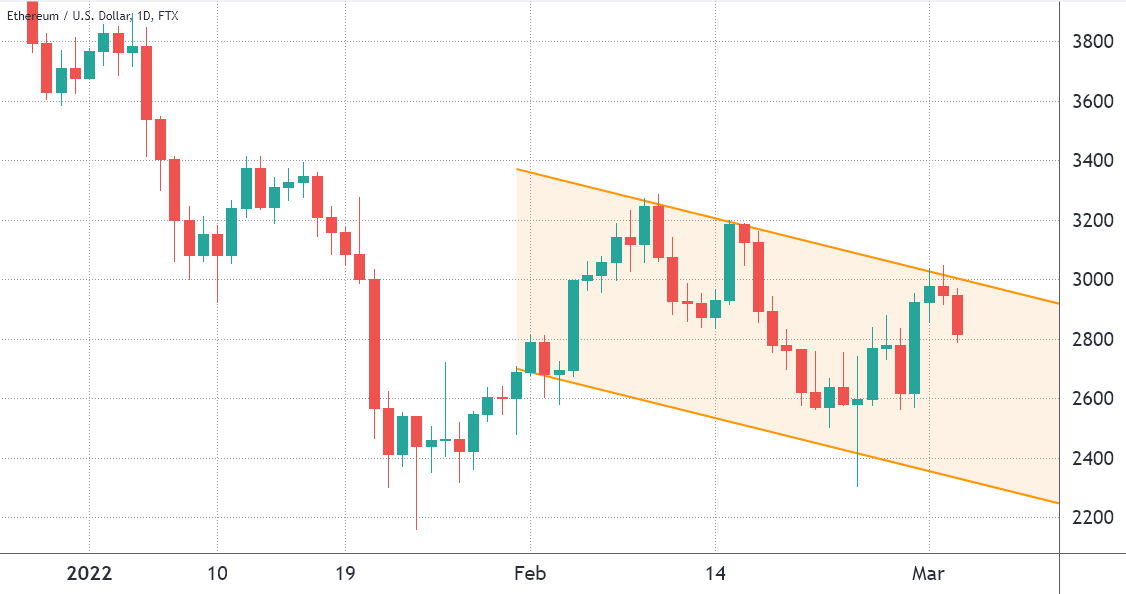

Ether price at FTX, in USD. Source: TradingView

Thus, you could say that the above chart presents a long period of range trading near $2,800, for example. Considering Ether’s 88% annualized volatility, moves between $2,400 and $3,200 should be regarded as normal.

Using technical analysis, a trader might point to lower highs forming the above downtrend channel, but should Ether bears celebrate and call for $2,500 and lower? That largely depends on how retail traders are positioned, along with the Ethereum network’s on-chain metrics.

A few things to consider are whether the 63% drop in network transaction fees to the current $17 reflects a decrease in the use of decentralized applications (DApps), or are users benefiting from engaging with other layer-2 scaling solutions?

Ether’s futures premium is absent

To understand how confident traders are about Ether’s price recovery, one should analyze the perpetual contracts futures data. This is the retail traders’ preferred derivative because exchanges offer up to 50x leverage, and its price tends to track the regular spot markets perfectly.

In any futures contract trade, longs (buyers) and shorts (sellers) are matched at all times, but their leverage use can vary. Consequently, exchanges will charge a funding rate to whichever side deposited less margin, and this fee is paid to the opposing side.

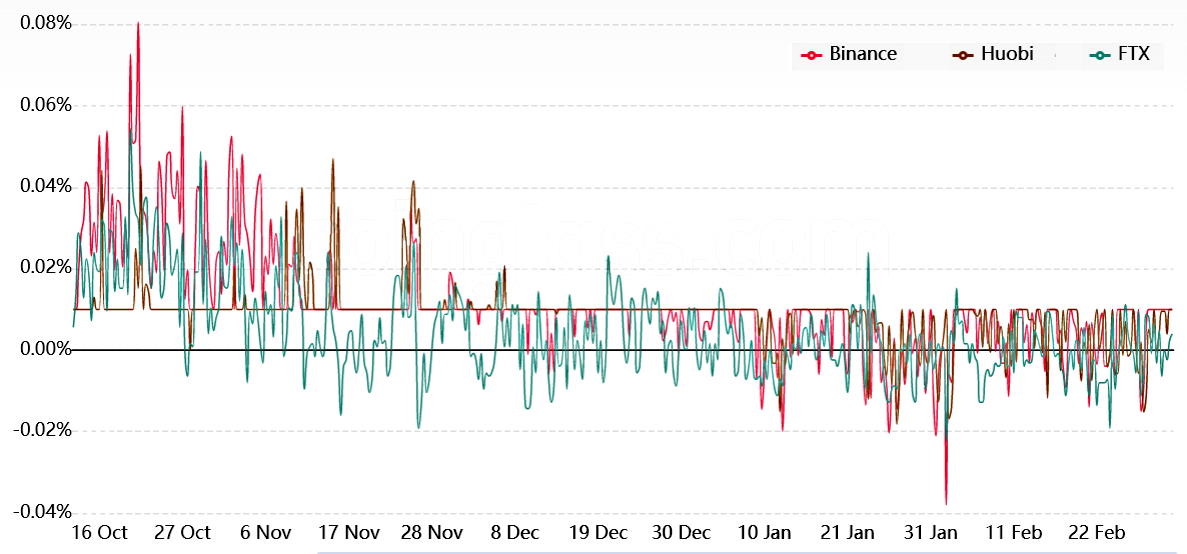

Ether perpetual futures 8-hour funding rate. Source: Coinglass

This data tells us whether retail traders are getting excited, causing the funding rate to move above 0.05%, equivalent to 1% per week. Notice how the past couple of months showed a slightly negative funding rate, reflecting a neutral-to-bearish sentiment. Currently, there is no sign that retail traders are confident enough to buy Ether using leverage.

To exclude externalities that might have influenced derivatives data, one should analyze the Ethereum network’s on-chain data. For example, monitoring the network use tells us whether actual use cases support the demand for Ether tokens.

On-chain metrics raise concern

Measuring the monetary value of the Ether transacted on the network provides a quick and reliable indicator of effective use. Of course, this metric could be masqueraded by increasing adoption in layer-2 solutions, but it works as a starting point.

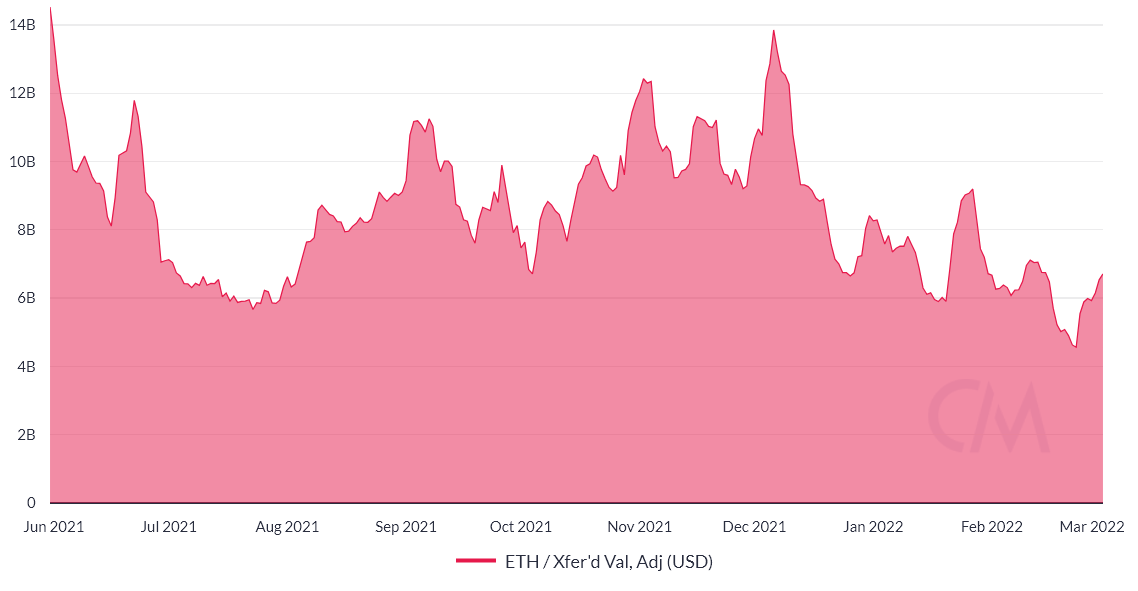

7-day average of native ETH token transfers per day, USD. Source: CoinMetrics

The current $6.7 billion daily transaction average is a 6% increase from 30 days before, but it’s nowhere near the $9 billion seen late-2021. Data shows that Ether token transactions are not showing signs of growth, at least on the primary layer.

One should proceed to decentralized applications usage metrics, but avoid exclusive focus on the Total Value Locked (TVL) because that metric is heavily concentrated on lending platforms and decentralized exchanges (DEX), so gauging the number of active addresses provides a broader view.

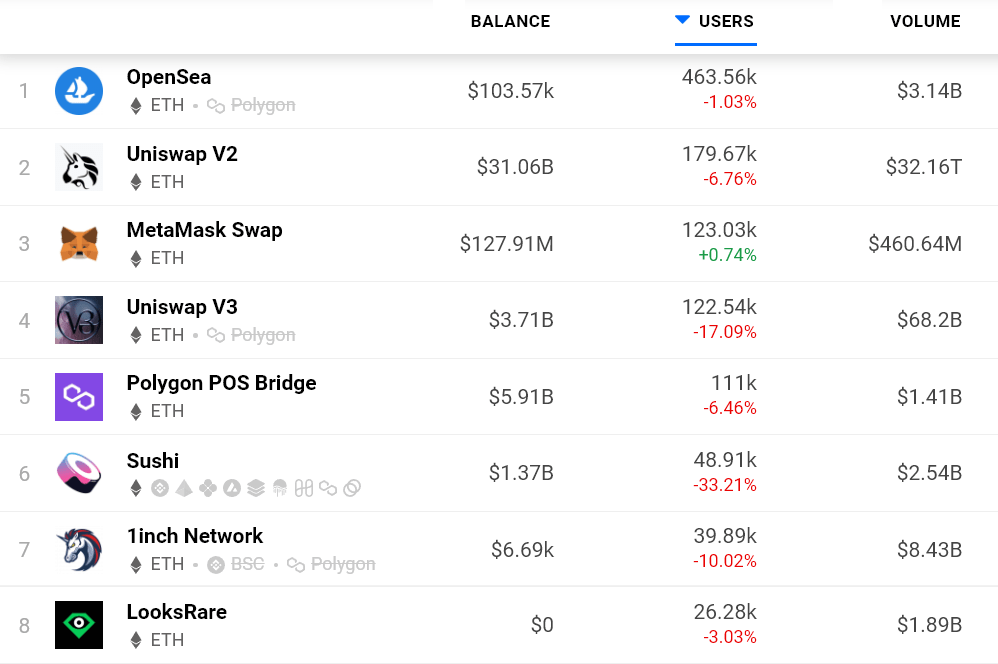

Ethereum network 30-day DApps activity. Source: DappRadar

On average, Ethereum DApps saw a monthly 10% decrease on active addresses. In a nutshell, the data is disappointing because the smart contract network was specifically designed to host decentralized applications such as non-fungible token (NFT) marketplaces and decentralized finance, DeFi.

Unless there is a decent growth in Ether transactions and DApps usage, bears are likely to have the upper hand. As for retail traders’ neutral funding rate, it should not be considered a bearish sign as those investors typically enter long leveraged positions after a strong price rally.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Hedera

Hedera  sUSDS

sUSDS  Rain

Rain  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Polkadot

Polkadot  Tether Gold

Tether Gold  MemeCore

MemeCore  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Circle USYC

Circle USYC  Bittensor

Bittensor  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  OKB

OKB  Pepe

Pepe  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Sky

Sky  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  BFUSD

BFUSD  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  KuCoin

KuCoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Render

Render  USDD

USDD  Stable

Stable  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  pippin

pippin  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Arbitrum

Arbitrum  Beldex

Beldex  Decred

Decred  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  Stacks

Stacks  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Virtuals Protocol

Virtuals Protocol  Sei

Sei  EURC

EURC  USDai

USDai  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Tezos

Tezos  JUST

JUST  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Story

Story  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  LayerZero

LayerZero  Resolv wstUSR

Resolv wstUSR  BitTorrent

BitTorrent  COCA

COCA  Chiliz

Chiliz  Lighter

Lighter  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  Aerodrome Finance

Aerodrome Finance  AINFT

AINFT  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Injective

Injective  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Sun Token

Sun Token  Pyth Network

Pyth Network  IOTA

IOTA  Celestia

Celestia  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  Power Protocol

Power Protocol  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  JasmyCoin

JasmyCoin  crvUSD

crvUSD  sBTC

sBTC  FLOKI

FLOKI  DoubleZero

DoubleZero  Olympus

Olympus  Jupiter Staked SOL

Jupiter Staked SOL  Maple Finance

Maple Finance  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Lido DAO

Lido DAO  Optimism

Optimism  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Helium

Helium  BTSE Token

BTSE Token  Siren

Siren  Telcoin

Telcoin  Staked Aave

Staked Aave  Ethereum Name Service

Ethereum Name Service