Ethereum Price Faces Crucial Test As Price Dips Below Holder Cost Basis

Ethereum price faces risks amid the recent price drops affecting the markets. As the larger market experienced a downturn, ETH price saw extreme lows much like the rest of the cryptos. Most cryptocurrencies have followed BTC price making lower yearly lows.

The price of Ethereum stands at $1,542.74, representing a major decrease under the $2,200 average purchase price of Ethereum holders.

Many Ethereum investors face net losses because their assets have fallen beneath the buying prices, demonstrating substantial capital loss throughout the Ethereum network.

Large-scale Ethereum holders with more than 100,000 tokens present an average cost basis of $1,290.

This specific price number stands strong because it defines a significant support boundary. This is where Ethereum may reach in case its price slides.

The market demonstrated signs of recovery in the Luna crisis of June 18, 2022, and other previous market downturns when Ethereum prices dropped to $870.

Previous market recoveries offer hope for stabilization and recovery when Ethereum prices reach these historical levels.

According to CoinMarketCap, the value of Ethereum decreased by 10.84% within one day to settle at $1,542.74.

The trading volume reached 552.31% higher while the market cap stood at $186.13 Billion due to substantial selling pressure.

The market value looks highly unstable which suggests short-term price declines could occur.

Technical Analysis of Ethereum Price Charts

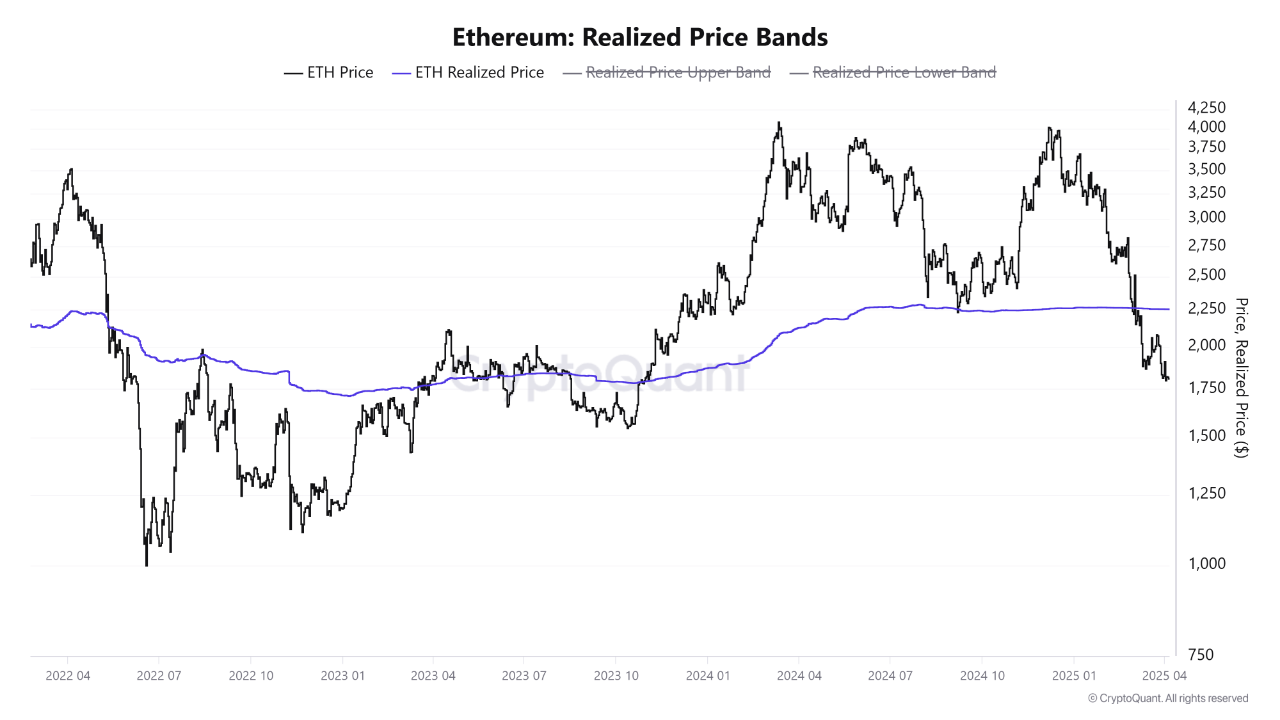

According to the provided graphical data, the Ethereum markets displayed substantial price instability during the observed period.

Ethereum Data Chart | Source: CryptoQuant

According to the chart, the average price at which all Ethereum tokens are traded during market transactions is the essential indicator known as the realized price.

The black line depicts Ethereum market prices from current exchanges while they remain under the realized price value.

The realized price line is the main criterion for numerous holders to determine their maximum loss level.

Trade activity below the realized price indicates a current market situation of negative dynamics. This leads to losses for most Ethereum holders.

Ethereum’s current value position at its lowest end suggests additional downward price movement unless it initiates a price change.

The present price movements in this analysis reflect Ethereum’s current market stabilization.

However, they also hint at a forthcoming substantial shift based on market-wide trends.

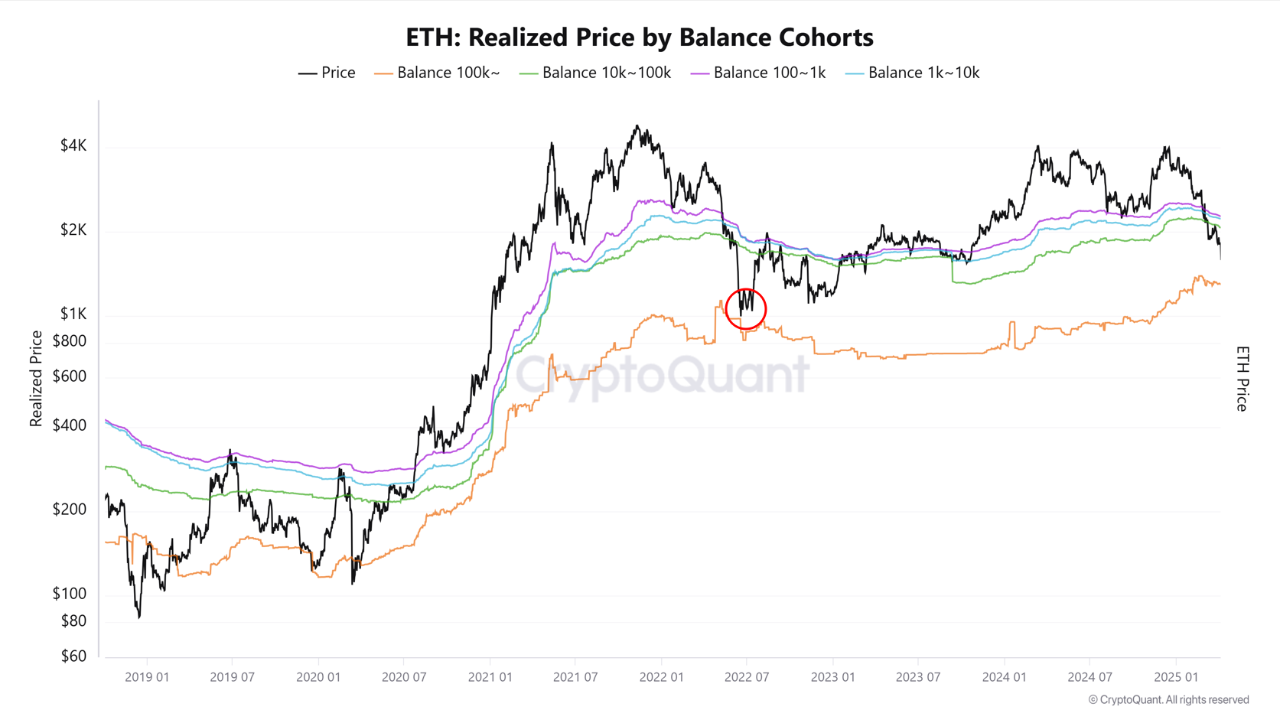

ETH: Realized Price by Balance Cohorts Analysis

Other charts show Ethereum holders into distinct groups based on their balance size. This is the price realized by balance cohorts.

Realized prices reached higher levels among the holders, as shown by the green and purple lines, compared to the others.

Ethereum Data Chart | Source: CryptoQuant

The groups with Ethereum holdings between 1,000 and 100,000 have probably paid elevated asset prices based on their possession quantities.

Since Ethereum’s market value has dropped under the defined range, the holders of these levels now face losses in their asset positions.

Small Ethereum holders show evidence of holding assets at more expensive prices.

This indicates they might become more inclined to sell in response to additional market decreases.

This could thus push the market toward further decline.

However, not everyone is fearful of the dip. The sudden Hyperliquid 50X Whale appearance might mean some investors, if not all, are targeting a bounce.

As such, a whale has an open long on the whale’s $47 Million with significant leverage, which means that it is inevitable that ETH will either recover or stay at the price levels it currently trades.

The entry of a major market player tends to precede major price movements, and such large trades often precede large price reversals.

If the whale increases the price of Ethereum, this will change the sentiment in the broader market and cause other investors to follow the whale’s action.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Cronos

Cronos  Tether Gold

Tether Gold  Polkadot

Polkadot  MemeCore

MemeCore  PAX Gold

PAX Gold  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Aave

Aave  Falcon USD

Falcon USD  Bittensor

Bittensor  Global Dollar

Global Dollar  Aster

Aster  OKB

OKB  Pi Network

Pi Network  Ripple USD

Ripple USD  syrupUSDC

syrupUSDC  Pepe

Pepe  Sky

Sky  Bitget Token

Bitget Token  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo

Ondo  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  KuCoin

KuCoin  Pump.fun

Pump.fun  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Official Trump

Official Trump  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  USDD

USDD  Wrapped BNB

Wrapped BNB  OUSG

OUSG  Function FBTC

Function FBTC  Filecoin

Filecoin  Aptos

Aptos  Render

Render  Stable

Stable  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  pippin

pippin  Beldex

Beldex  Arbitrum

Arbitrum  Decred

Decred  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Sei

Sei  EURC

EURC  USDai

USDai  StakeWise Staked ETH

StakeWise Staked ETH  Virtuals Protocol

Virtuals Protocol  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Dash

Dash  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Tezos

Tezos  JUST

JUST  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  Curve DAO

Curve DAO  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Story

Story  Resolv wstUSR

Resolv wstUSR  Lighter

Lighter  COCA

COCA  BitTorrent

BitTorrent  Chiliz

Chiliz  PRIME

PRIME  Liquid Staked ETH

Liquid Staked ETH  LayerZero

LayerZero  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  AINFT

AINFT  Gnosis

Gnosis  ADI

ADI  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Power Protocol

Power Protocol  Sun Token

Sun Token  Pyth Network

Pyth Network  IOTA

IOTA  Celestia

Celestia  Binance-Peg XRP

Binance-Peg XRP  crvUSD

crvUSD  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  SPX6900

SPX6900  Renzo Restaked ETH

Renzo Restaked ETH  The Graph

The Graph  JasmyCoin

JasmyCoin  sBTC

sBTC  FLOKI

FLOKI  Maple Finance

Maple Finance  Legacy Frax Dollar

Legacy Frax Dollar  Jupiter Staked SOL

Jupiter Staked SOL  DoubleZero

DoubleZero  Savings USDD

Savings USDD  Olympus

Olympus  Lido DAO

Lido DAO  Optimism

Optimism  Marinade Staked SOL

Marinade Staked SOL  Siren

Siren  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Conflux

Conflux  Helium

Helium  BTSE Token

BTSE Token  Telcoin

Telcoin  Staked Aave

Staked Aave  AB

AB