Ethereum May Have Printed Its Bottom — Rebound Setup Points to $4,000 Target

Ethereum came dangerously close to breaching the $3,000 mark, briefly dipping to $3,053 before bouncing back. The fall rattled the market, triggering liquidations and panic selling. But after weeks of steady decline, early signs of a rebound are finally starting to appear.

Despite being down 27% in the past month and 8.4% in the last 24 hours, both technical and on-chain data now hint that Ethereum may have formed a local bottom.

Early Rebound Setup Appears on the Charts

Ethereum’s price movement over the past few weeks shows that bearish momentum is slowing.

On the 12-hour chart, Ethereum’s Relative Strength Index (RSI), which measures price momentum to indicate whether an asset is overbought or oversold, has begun forming higher lows, even as the price made lower lows between September 25 and November 4.

Ethereum Flashes Bullish Divergence: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This pattern is known as a bullish divergence, which typically signals that selling pressure is fading and a potential trend reversal or rebound may follow.

Since hitting a low of $3,053, the Ethereum price has already moved up 9%, at press time. That might mean the start of the rebound. However, it is still too early to say.

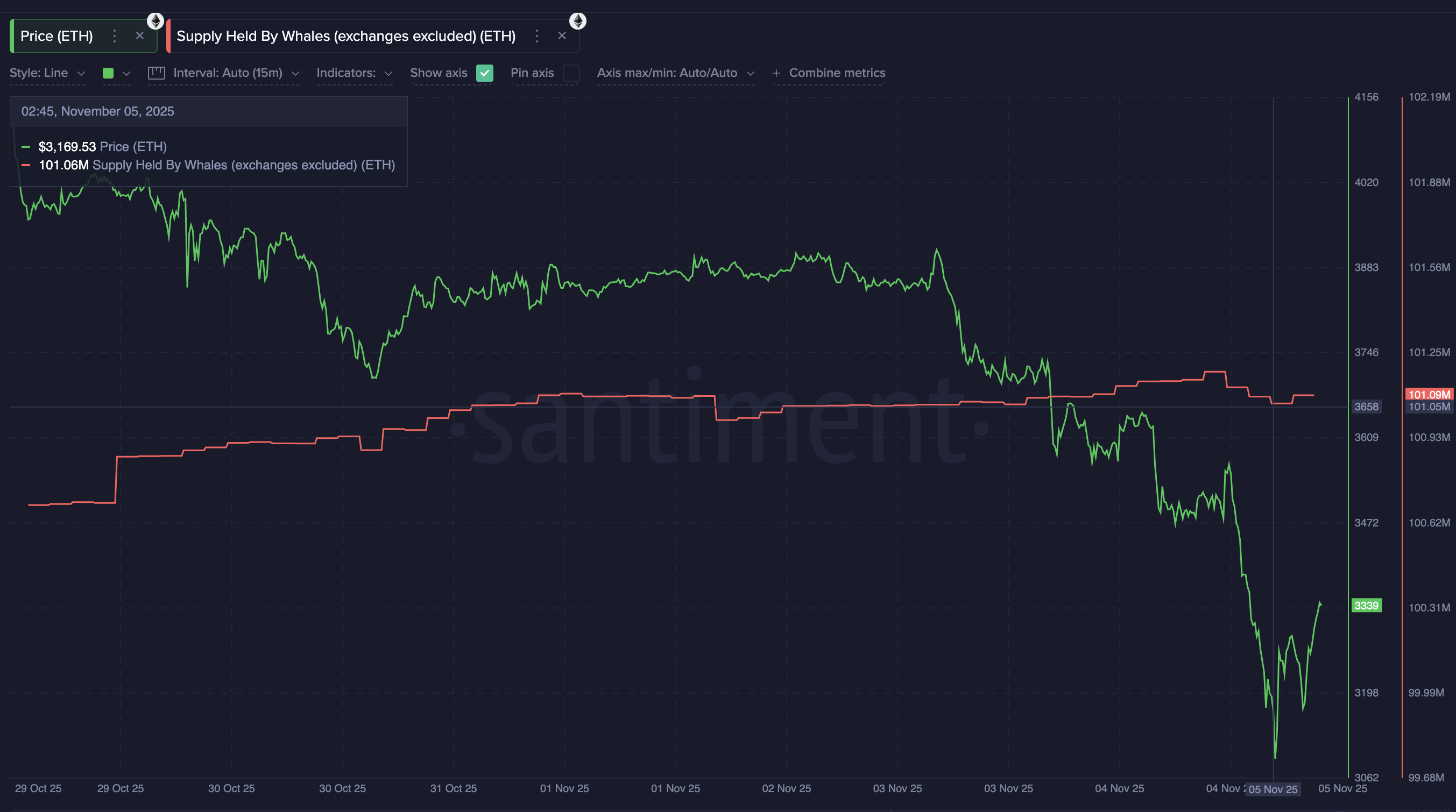

Supporting this setup, large wallet holders have begun to return quietly. Ethereum whales have increased their combined holdings from 101.05 million to 101.09 million ETH in just a few hours, adding around 0.04 million ETH, or $134 million at current prices.

It’s not an aggressive accumulation, but it’s a sign of renewed confidence after a sharp sell-off.

Ethereum Whales Are Showing Up: Santiment

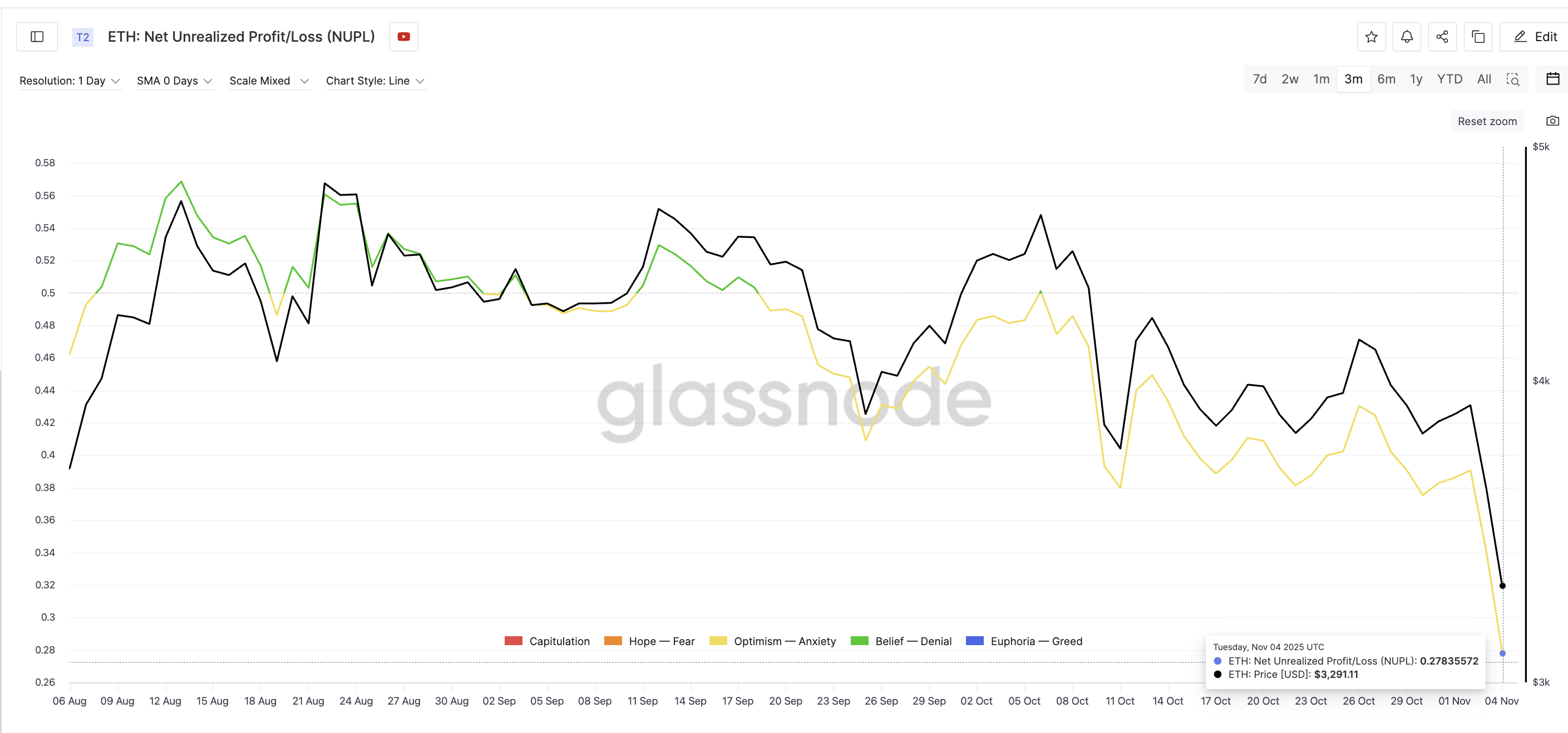

Meanwhile, the Net Unrealized Profit/Loss (NUPL) ratio, which measures how much profit or loss investors are still holding, has dropped to 0.27, its lowest level since July 7. When NUPL falls this low, it often means that most weak hands have exited at a loss, leaving behind determined holders.

Weak Hands Are Mostly Out: Glassnode

The last time this indicator dropped and formed a local bottom in mid-October, Ethereum rallied by more than 10% within two sessions, suggesting that the market may be repeating this behavior.

Derivatives Data Shows Pressure Building for a Short Ethereum Price Squeeze

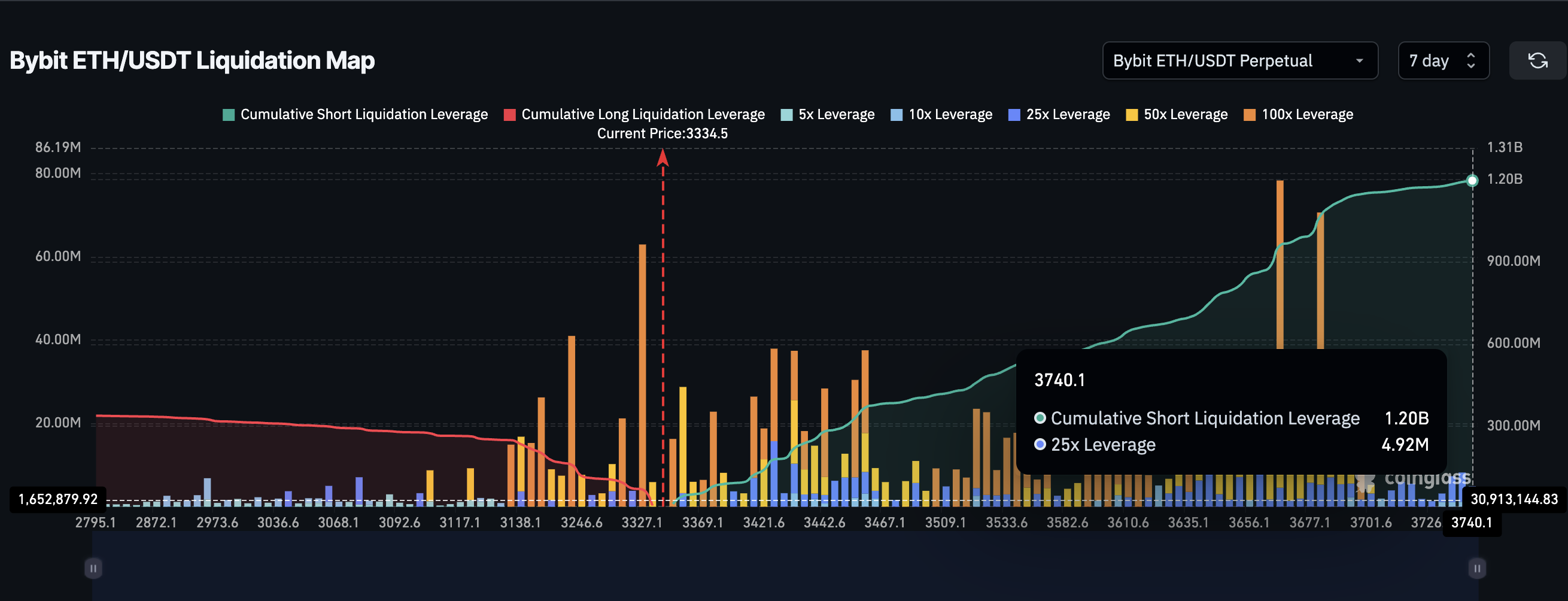

Ethereum’s derivative markets also support the rebound case. According to Bybit’s ETH/USDT liquidation map, nearly $1.2 billion in short positions are now at risk between $3,320 and $3,740.

This is massive in comparison to just $330 million in long leverage. That imbalance — almost 3.5× more shorts than longs — suggests that any upward move could trigger a short squeeze, forcing short traders to buy back and accelerate price gains.

Liquidation Map Hints At A Short Squeeze Setup: Coinglass

However, a few sizable long positions near $3,100 could still disappear if Ethereum dips again. That is one risk element traders must closely monitor.

Technically, Ethereum continues to move inside a falling channel, confirming that the broader trend is still bearish. But the critical support zone at $3,053 has held so far.

If Ethereum can close above $3,338, it would confirm a rebound setup. From there, the next major resistance is around $3,799.

Ethereum Price Analysis: TradingView

Clearing it with a 14% upmove could ignite a stronger move toward $4,000 and even $$4,260. However, if the 12-hour candle closes below $3,053, the Ethereum price would invalidate the rebound hypothesis.

The post Ethereum May Have Printed Its Bottom — Rebound Setup Points to $4,000 Target appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  USDS

USDS  Wrapped Bitcoin

Wrapped Bitcoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  Monero

Monero  Canton

Canton  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  USD1

USD1  WETH

WETH  Litecoin

Litecoin  Zcash

Zcash  USDT0

USDT0  sUSDS

sUSDS  Avalanche

Avalanche  Dai

Dai  Sui

Sui  Shiba Inu

Shiba Inu  Hedera

Hedera  Ethena Staked USDe

Ethena Staked USDe  World Liberty Financial

World Liberty Financial  PayPal USD

PayPal USD  Tether Gold

Tether Gold  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  PAX Gold

PAX Gold  Bitget Token

Bitget Token  Falcon USD

Falcon USD  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Pepe

Pepe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  HTX DAO

HTX DAO  syrupUSDC

syrupUSDC  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic  Ripple USD

Ripple USD  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Internet Computer

Internet Computer  Pump.fun

Pump.fun  Jito Staked SOL

Jito Staked SOL  Aster

Aster  Sky

Sky  Pi Network

Pi Network  Ondo

Ondo  Binance-Peg WETH

Binance-Peg WETH  BFUSD

BFUSD  Solana

Solana  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  KuCoin

KuCoin  Wrapped BNB

Wrapped BNB  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  MYX Finance

MYX Finance  Gate

Gate  Ethena

Ethena  USDD

USDD  Binance Staked SOL

Binance Staked SOL  Official Trump

Official Trump  Cosmos Hub

Cosmos Hub  Aptos

Aptos  Quant

Quant  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  USDtb

USDtb  Lombard Staked BTC

Lombard Staked BTC  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Function FBTC

Function FBTC  Midnight

Midnight  Render

Render  NEXO

NEXO  syrupUSDT

syrupUSDT  Filecoin

Filecoin  Arbitrum

Arbitrum  Kinetiq Staked HYPE

Kinetiq Staked HYPE  WrappedM by M0

WrappedM by M0  VeChain

VeChain  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Ondo US Dollar Yield

Ondo US Dollar Yield  OUSG

OUSG  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Mantle Staked Ether

Mantle Staked Ether  Jupiter

Jupiter  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Bonk

Bonk  COCA

COCA  Beldex

Beldex  Solv Protocol BTC

Solv Protocol BTC  USDai

USDai  Liquid Staked ETH

Liquid Staked ETH  clBTC

clBTC  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Usual USD

Usual USD  Sei

Sei  Wrapped Flare

Wrapped Flare  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Stacks

Stacks  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Dash

Dash  GHO

GHO  Binance-Peg XRP

Binance-Peg XRP  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  Tezos

Tezos  A7A5

A7A5  Renzo Restaked ETH

Renzo Restaked ETH  Story

Story  TrueUSD

TrueUSD  Jupiter Staked SOL

Jupiter Staked SOL  Stable

Stable  Pudgy Penguins

Pudgy Penguins  tBTC

tBTC  Chiliz

Chiliz  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  c8ntinuum

c8ntinuum  EURC

EURC  Virtuals Protocol

Virtuals Protocol  Optimism

Optimism  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  Resolv USR

Resolv USR  Resolv wstUSR

Resolv wstUSR  Lorenzo Wrapped Bitcoin

Lorenzo Wrapped Bitcoin  DoubleZero

DoubleZero  Kinesis Gold

Kinesis Gold  GTETH

GTETH  Lighter

Lighter  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  LayerZero

LayerZero  JUST

JUST  Injective

Injective  Sun Token

Sun Token  Maple Finance

Maple Finance  Ether.fi

Ether.fi  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lido DAO

Lido DAO  sBTC

sBTC  Kaia

Kaia  Aerodrome Finance

Aerodrome Finance  AINFT

AINFT  BitTorrent

BitTorrent  Decred

Decred  Savings USDD

Savings USDD  FLOKI

FLOKI  Marinade Staked SOL

Marinade Staked SOL  Celestia

Celestia  Kinesis Silver

Kinesis Silver  The Graph

The Graph  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  IOTA

IOTA  Staked Aave

Staked Aave  Wrapped STX (Velar)

Wrapped STX (Velar)  crvUSD

crvUSD  JasmyCoin

JasmyCoin  Bitcoin SV

Bitcoin SV  Stader ETHx

Stader ETHx  Starknet

Starknet  Gnosis

Gnosis  Wrapped ApeCoin

Wrapped ApeCoin  Pyth Network

Pyth Network  Cap USD

Cap USD