Ethereum Faces Historic Short Interest: Rally Could Trigger Massive Liquidations

Ethereum is under pressure as volatility spikes, with the price recently slipping below the $4,300 mark. After weeks of strong momentum and multi-year highs, bulls are now struggling to defend support zones. The loss of this level raises concerns about a potential deeper correction, though fundamentals remain firmly bullish.

Institutional adoption continues to provide strong tailwinds, with major firms increasing exposure to Ethereum through ETFs, treasury strategies, and on-chain accumulation. This steady demand reflects growing confidence in ETH’s long-term role within the digital asset ecosystem. At the same time, Open Interest has been rising sharply, highlighting a surge in speculation and leveraged positioning across derivatives markets. While this can amplify moves in both directions, it underscores the intense battle between bulls and bears at current levels.

Market participants now see the coming days as critical for Ethereum’s short-term trajectory. Holding above nearby support could pave the way for a rebound and renewed attempts to challenge the $4,500–$4,800 resistance zone.

Ethereum Faces Record Short Position Pressure

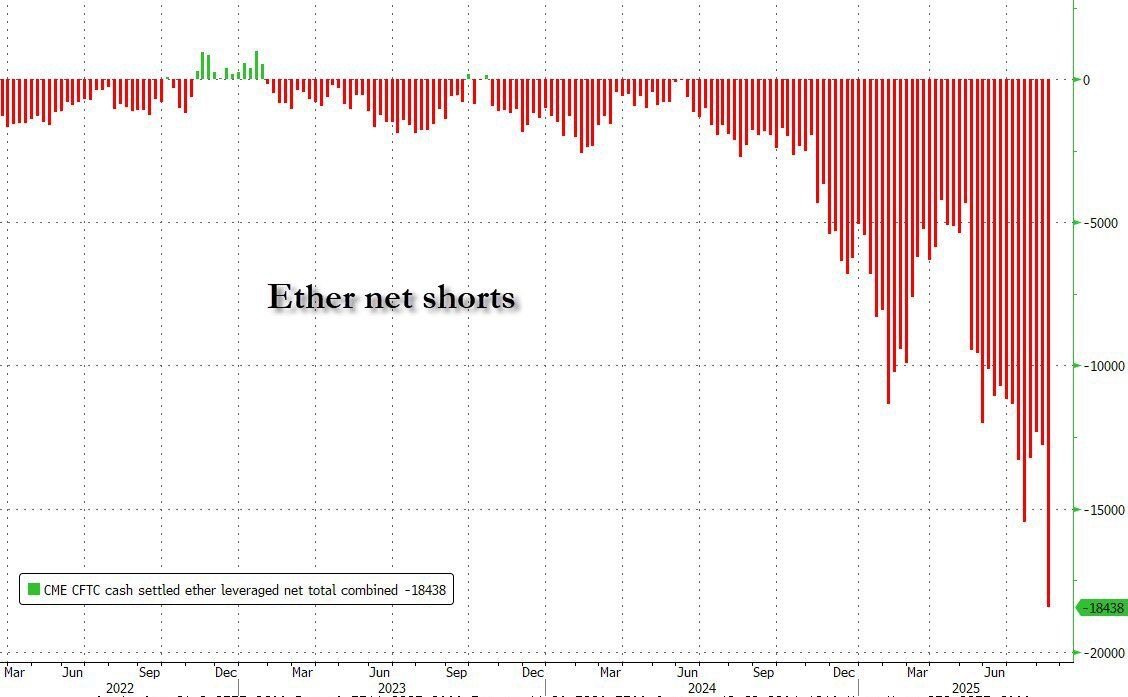

Ethereum is entering one of its most decisive moments yet, with unprecedented short positioning building up in the market. According to top analyst Ted Pillows, we’re witnessing the biggest leveraged short position on ETH ever recorded. Net leveraged shorts have climbed to 18,438 contracts, marking the biggest bearish bet in Ethereum’s history. This surge in positioning reflects a market bracing for volatility, as traders place aggressive downside bets following Ethereum’s retrace from the $4,790 level.

However, Pillows emphasizes that this dynamic could create the perfect storm for a short squeeze. If Ethereum manages to rally from current levels, these bearish positions could quickly unwind, forcing shorts to cover at higher prices and accelerating the rally. Historically, such imbalances have led to explosive upside moves in a short timeframe, catching bears off guard and rewarding bulls with rapid gains.

While short-term volatility remains elevated, strong fundamentals — including declining exchange supply, institutional accumulation, and broader adoption trends — continue to support the long-term bullish thesis. For now, all eyes remain on whether the record-short positioning turns into the catalyst for Ethereum’s next breakout.

ETH Technical Details: Testing Demand Level

Ethereum is currently trading at $4,284, showing signs of volatility after its recent decline from the $4,800 region. The 4-hour chart highlights how ETH has struggled to reclaim momentum, with price now testing a key support zone around the $4,200–$4,250 range. This level is crucial because it aligns with the 100-day moving average (green line), which has acted as dynamic support during previous pullbacks in this rally.

The price structure shows that bulls remain active but are under pressure. After weeks of consistent gains, Ethereum is now experiencing heavier selling volume, as visible in the recent red bars on the chart. However, the broader trend remains bullish as long as ETH holds above the 200-day moving average (red line), currently sitting below $3,920.

A breakdown of $4,200 could expose ETH to further downside toward $4,000 or even $3,900 in the short term. On the other hand, if buyers defend this zone, Ethereum could attempt another rally to retest resistance levels around $4,500–$4,600.

Featured image from Dall-E, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Zcash

Zcash  Hedera

Hedera  Litecoin

Litecoin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  PayPal USD

PayPal USD  Avalanche

Avalanche  WETH

WETH  Shiba Inu

Shiba Inu  Sui

Sui  World Liberty Financial

World Liberty Financial  USDT0

USDT0  Toncoin

Toncoin  Cronos

Cronos  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pepe

Pepe  Aster

Aster  Aave

Aave  Falcon USD

Falcon USD  Bittensor

Bittensor  OKB

OKB  Bitget Token

Bitget Token  Global Dollar

Global Dollar  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Circle USYC

Circle USYC  Ripple USD

Ripple USD  HTX DAO

HTX DAO  Sky

Sky  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Internet Computer

Internet Computer  Cosmos Hub

Cosmos Hub  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  KuCoin

KuCoin  Midnight

Midnight  Quant

Quant  Ethena

Ethena  Jito Staked SOL

Jito Staked SOL  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Official Trump

Official Trump  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Render

Render  Wrapped BNB

Wrapped BNB  USDD

USDD  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Filecoin

Filecoin  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  Aptos

Aptos  VeChain

VeChain  Beldex

Beldex  Binance Staked SOL

Binance Staked SOL  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  Usual USD

Usual USD  Arbitrum

Arbitrum  Stable

Stable  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  A7A5

A7A5  Lombard Staked BTC

Lombard Staked BTC  TrueUSD

TrueUSD  pippin

pippin  Sei

Sei  clBTC

clBTC  USDai

USDai  EURC

EURC  Stacks

Stacks  Dash

Dash  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  PancakeSwap

PancakeSwap  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Virtuals Protocol

Virtuals Protocol  Tezos

Tezos  WrappedM by M0

WrappedM by M0  Decred

Decred  Kinesis Gold

Kinesis Gold  Story

Story  JUST

JUST  Lighter

Lighter  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Mantle Staked Ether

Mantle Staked Ether  Chiliz

Chiliz  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  c8ntinuum

c8ntinuum  Resolv wstUSR

Resolv wstUSR  Ether.fi

Ether.fi  COCA

COCA  LayerZero

LayerZero  Injective

Injective  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  AINFT

AINFT  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  Wrapped Flare

Wrapped Flare  PRIME

PRIME  Pyth Network

Pyth Network  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Gnosis

Gnosis  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  ADI

ADI  IOTA

IOTA  SPX6900

SPX6900  The Graph

The Graph  Humanity

Humanity  Binance-Peg XRP

Binance-Peg XRP  FLOKI

FLOKI  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Aerodrome Finance

Aerodrome Finance  Renzo Restaked ETH

Renzo Restaked ETH  Celestia

Celestia  crvUSD

crvUSD  sBTC

sBTC  JasmyCoin

JasmyCoin  Lido DAO

Lido DAO  Optimism

Optimism  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  Conflux

Conflux  Olympus

Olympus  Helium

Helium  Marinade Staked SOL

Marinade Staked SOL  Maple Finance

Maple Finance  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  DoubleZero

DoubleZero  BTSE Token

BTSE Token  Telcoin

Telcoin  Ethereum Name Service

Ethereum Name Service  Staked Aave

Staked Aave