Ethereum Eyes $2,000 as On-Chain Metrics Signal Bottom Formation

Ethereum is nearing a breakout above $1,850 as rising open interest, increasing long positions, and on-chain volume trends suggest a bottom may be forming.

As Bitcoin climbs above the $97,000 mark, Ethereum struggles around the $1,800 level. However, the daily chart reflects a short-term recovery trend, nearing a potential breakout rally. Will a post-retest reversal push Ethereum past the $2,000 mark?

Ethereum Price Analysis

In the daily chart, Ethereum’s price reversal has breached a long-standing resistance trendline, confirming a bullish breakout from a falling channel pattern.

Ethereum Price Chart

Ethereum is currently trading at $1,821 after a 2.51% surge last night. However, the bullish trend still faces strong resistance near the high-supply zone around the $1,850 level.

This resistance constrains the breakout rally and may lead to a potential retest. Still, the ongoing recovery has triggered a positive cycle in the MACD and signal lines.

The declining 50-day EMA aligns with the supply zone, acting as a dynamic resistance. A breakout above the 50-day EMA and the supply zone would likely generate a buy signal for price action traders.

Based on Fibonacci retracement levels, the next immediate resistance lies at the 23.60% level near the psychological $2,000 mark. Beyond that, the 200-day EMA near the 38.20% level at approximately $2,400 will serve as a critical resistance.

On the downside, key support remains near the $1,600 level.

Near-Zero Rates Fuel Surge in Long Positions

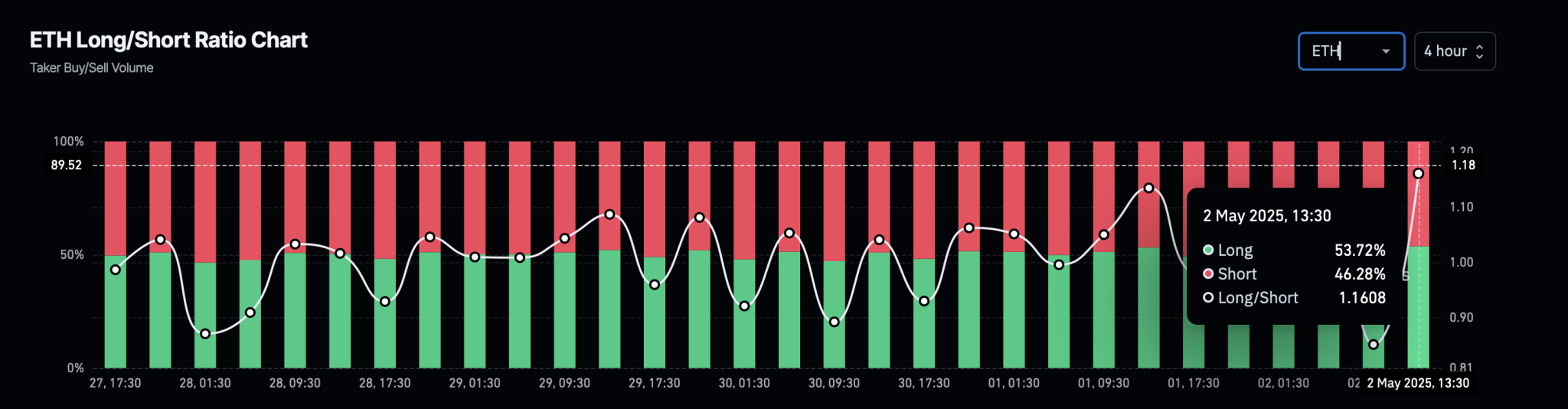

In the derivatives market, traders anticipate a major breakout rally in Ethereum. The Ethereum Long-to-Short Ratio chart shows 53.72% long positions accumulated over the past four hours.

ETH LongShort Positions

This puts the Long-to-Short Ratio at 1.1608, indicating a bullish dominance. Additionally, open interest has increased by more than 3%, reaching $21.60 billion, while the overall market funding rate remains near 0%.

A near-zero funding rate lowers the cost of holding long positions, which is likely reinforcing bullish sentiment.

Historic Returns Suggest Bullish Reversal

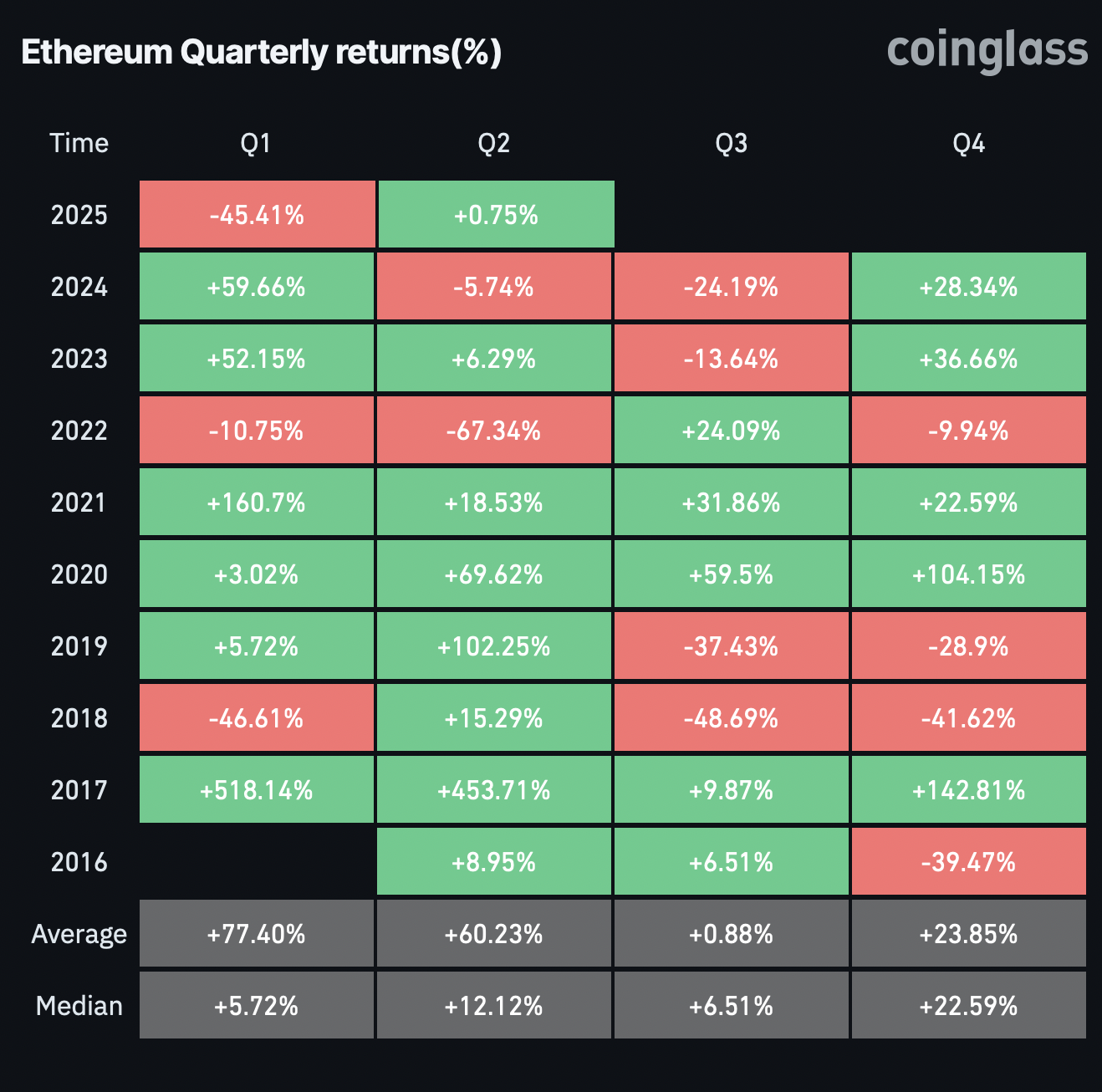

The historical price returns in Ethereum support the possibility of a breakout rally. Based on the data from CoinGlass, the Ethereum quarterly returns highlight a possibility of a bullish comeback.

Since 2016, Ethereum has posted positive Q2 results in seven out of nine years—excluding 2022 and 2024. The average Q2 return stands at nearly 60%, with a median return of 12.12%.

Historic Quarterly Returns

Ethereum Selling Pressure Waning

According to data from CryptoQuant, selling pressure in the derivatives market is gradually easing. The net taker volume turned positive on April 23 and 24 — a sign of growing buyer aggression.

As of May 1, the 30-day moving average stood at $311,406, reflecting a notable improvement. If this trend persists, Ethereum could be in the process of establishing a real bottom.

This shift may support a bullish recovery and increase the likelihood of a broader trend reversal in the coming weeks.

ETH Net Taker Volume

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pi Network

Pi Network  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Bittensor

Bittensor  Aave

Aave  Sky

Sky  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Gate

Gate  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  OUSG

OUSG  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Aptos

Aptos  Wrapped BNB

Wrapped BNB  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Function FBTC

Function FBTC  Filecoin

Filecoin  Official Trump

Official Trump  USDD

USDD  Render

Render  syrupUSDT

syrupUSDT  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Beldex

Beldex  Arbitrum

Arbitrum  Stable

Stable  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Pudgy Penguins

Pudgy Penguins  JUST

JUST  WrappedM by M0

WrappedM by M0  Dash

Dash  Tezos

Tezos  Ether.fi

Ether.fi  Kinesis Gold

Kinesis Gold  LayerZero

LayerZero  c8ntinuum

c8ntinuum  Chiliz

Chiliz  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  pippin

pippin  Resolv wstUSR

Resolv wstUSR  Siren

Siren  COCA

COCA  AINFT

AINFT  Gnosis

Gnosis  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Liquid Staked ETH

Liquid Staked ETH  River

River  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  PRIME

PRIME  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  SPX6900

SPX6900  Story

Story  Lombard

Lombard  Celestia

Celestia  Humanity

Humanity  Binance-Peg XRP

Binance-Peg XRP  Injective

Injective  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lighter

Lighter  Renzo Restaked ETH

Renzo Restaked ETH  Bitcoin SV

Bitcoin SV  IOTA

IOTA  sBTC

sBTC  JasmyCoin

JasmyCoin  The Graph

The Graph  Pyth Network

Pyth Network  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  FLOKI

FLOKI  Olympus

Olympus  crvUSD

crvUSD  Marinade Staked SOL

Marinade Staked SOL  DoubleZero

DoubleZero  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Venice Token

Venice Token  Optimism

Optimism  Staked Aave

Staked Aave  Conflux

Conflux