Ethereum ($ETH) price prediction for June 14, 2025: Sharp drop to $2,500 tests key demand as bearish pressure builds

The Ethereum price today is trading near $2,507 after a sharp drop from the $2,870 range. This steep pullback comes after ETH failed to hold above the critical $2,740–$2,760 supply zone, triggering a downward cascade that pushed price below key short-term supports.

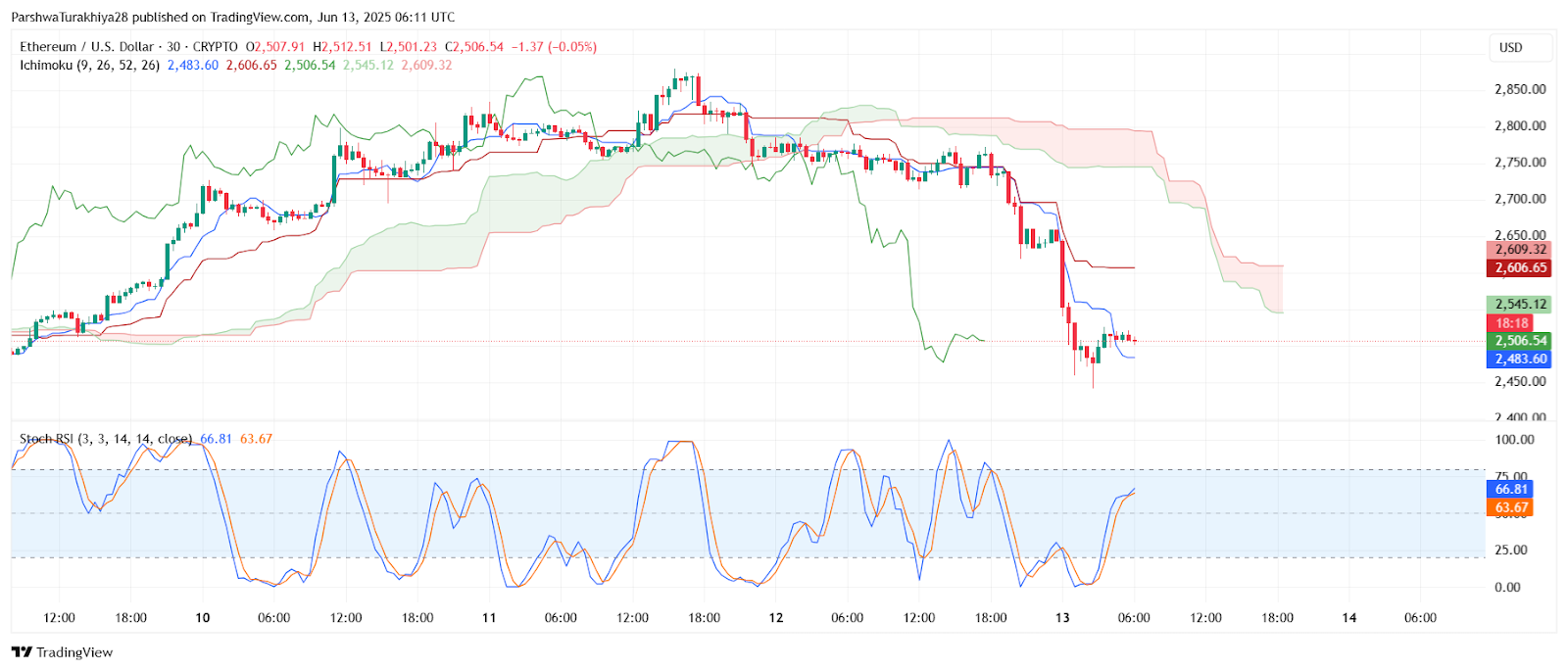

ETH price dynamics (Source: TradingView)

As of now, Ethereum is attempting to stabilize just above the $2,490–$2,500 demand range, a level that could define the short-term recovery or further downside ahead.

What’s Happening With Ethereum’s Price?

ETH price dynamics (Source: TradingView)

The recent correction in the Ethereum price action marks a strong rejection from the upper resistance cluster visible on both the daily and 4-hour charts. After rallying into the $2,850 zone, ETH was unable to breach the 0.618 Fibonacci retracement level at $2,846 (measured from the November 2024 high to the March 2025 low). This region acted as a historical resistance and coincided with the upper Bollinger Band on the 4H timeframe.

On the lower timeframes, the Ethereum price update shows clear exhaustion. The 30-minute RSI dipped to 29.48, signaling oversold territory, while MACD readings remain bearish with both signal lines well below the zero axis. A modest rebound is underway, but momentum remains weak. This technical structure suggests that unless ETH recovers and holds above $2,550–$2,580, it could revisit the $2,440–$2,460 support band.

Why Ethereum Price Going Down Today?

ETH price dynamics (Source: TradingView)

The sell-off was driven by a confluence of overbought signals and the breakdown of a rising wedge pattern on the 4-hour chart. The Ethereum price volatility expanded significantly during this fall, as seen in the aggressive widening of Bollinger Bands. Price sharply pierced through all short-term exponential moving averages (20/50/100), now flipping them into dynamic resistance. In addition, the Ichimoku Cloud on the 30-minute and 1-hour charts has turned fully bearish, with price now trading well below the Kumo span and Tenkan/Kijun lines.

From a macro-technical perspective, the rejection at the 0.618 Fib level aligns with prior tops formed in April and November 2024. That zone around $2,845–$2,875 continues to act as a major ceiling for ETH unless buyers return with volume-backed conviction.

Ethereum Price Prediction and Short-Term Forecast

ETH price dynamics (Source: TradingView)

Looking ahead, ETH must reclaim the $2,550–$2,580 zone to shift sentiment away from the current bearish bias. If bulls manage a close above $2,600, the next resistance lies near $2,674 (20 EMA on the 4-hour chart) and $2,730 (upper Bollinger Band). A break past $2,745 would re-open the path toward the $2,845–$2,875 resistance cluster.

ETH price dynamics (Source: TradingView)

Conversely, failure to hold $2,500 would expose ETH to further losses toward the broader support at $2,420, followed by a more critical level at $2,300. The weekly chart shows that ETH remains below the 0.5 Fib level at $2,745, reinforcing that the broader trend remains under pressure until that level is reclaimed.

Technical Forecast Table (14th June 2025)

Indicator/Zone Level Signal Ethereum price today $2,507 Attempting to stabilize Key Resistance 1 (EMA + Fib) $2,745 Strong resistance zone Key Resistance 2 (supply zone) $2,875 Multi-timeframe rejection Key Support 1 (daily structure) $2,440 Holding as soft base Key Support 2 (weekly Fib .236) $2,027 Long-term support pivot RSI (30-min) 29.48 Oversold MACD (4H) Bearish crossover Negative momentum Ichimoku Cloud (1H) Bearish Trend remains down Bollinger Bands (4H) Expanding downwards High volatility Trend Bias Bearish Caution warranted

Ethereum now finds itself in a sensitive technical position, with the $2,500–$2,550 range acting as the immediate battleground. While indicators hint at near-term exhaustion, broader trend pressures persist. A bullish reversal would require reclaiming $2,600 with confirmation, while a breakdown below $2,440 could invite deeper correction into the lower $2,300s.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  LEO Token

LEO Token  Chainlink

Chainlink  Hyperliquid

Hyperliquid  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Stellar

Stellar  WETH

WETH  Ethena USDe

Ethena USDe  Canton

Canton  Zcash

Zcash  Litecoin

Litecoin  Sui

Sui  Avalanche

Avalanche  USD1

USD1  Hedera

Hedera  Shiba Inu

Shiba Inu  USDT0

USDT0  World Liberty Financial

World Liberty Financial  Dai

Dai  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  Tether Gold

Tether Gold  MemeCore

MemeCore  Bitget Token

Bitget Token  Aave

Aave  PAX Gold

PAX Gold  Bittensor

Bittensor  OKB

OKB  Falcon USD

Falcon USD  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Binance-Peg WETH

Binance-Peg WETH  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Pump.fun

Pump.fun  Internet Computer

Internet Computer  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  HTX DAO

HTX DAO  Ondo

Ondo  Circle USYC

Circle USYC  Aster

Aster  Global Dollar

Global Dollar  Sky

Sky  Worldcoin

Worldcoin  KuCoin

KuCoin  Ripple USD

Ripple USD  Pi Network

Pi Network  Wrapped BNB

Wrapped BNB  syrupUSDC

syrupUSDC  Binance Staked SOL

Binance Staked SOL  Ethena

Ethena  BFUSD

BFUSD  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  POL (ex-MATIC)

POL (ex-MATIC)  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Gate

Gate  MYX Finance

MYX Finance  USDD

USDD  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Lombard Staked BTC

Lombard Staked BTC  Arbitrum

Arbitrum  River

River  Function FBTC

Function FBTC  Render

Render  Midnight

Midnight  Official Trump

Official Trump  NEXO

NEXO  Filecoin

Filecoin  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  USDtb

USDtb  VeChain

VeChain  Mantle Staked Ether

Mantle Staked Ether  syrupUSDT

syrupUSDT  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Liquid Staked ETH

Liquid Staked ETH  WrappedM by M0

WrappedM by M0  Bonk

Bonk  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Solv Protocol BTC

Solv Protocol BTC  Ondo US Dollar Yield

Ondo US Dollar Yield  Dash

Dash  Story

Story  Sei

Sei  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  clBTC

clBTC  OUSG

OUSG  StakeWise Staked ETH

StakeWise Staked ETH  Jupiter

Jupiter  Renzo Restaked ETH

Renzo Restaked ETH  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  USDai

USDai  PancakeSwap

PancakeSwap  COCA

COCA  Jupiter Staked SOL

Jupiter Staked SOL  Binance-Peg XRP

Binance-Peg XRP  Pudgy Penguins

Pudgy Penguins  Wrapped Flare

Wrapped Flare  Beldex

Beldex  Usual USD

Usual USD  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Tezos

Tezos  Optimism

Optimism  Stable

Stable  Chiliz

Chiliz  c8ntinuum

c8ntinuum  Virtuals Protocol

Virtuals Protocol  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  tBTC

tBTC  Stacks

Stacks  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  GHO

GHO  A7A5

A7A5  Curve DAO

Curve DAO  GTETH

GTETH  TrueUSD

TrueUSD  Lighter

Lighter  Kinesis Silver

Kinesis Silver  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Injective

Injective  Lido DAO

Lido DAO  Kinesis Gold

Kinesis Gold  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Marinade Staked SOL

Marinade Staked SOL  Ether.fi

Ether.fi  DoubleZero

DoubleZero  Aerodrome Finance

Aerodrome Finance  EURC

EURC  Stader ETHx

Stader ETHx  sBTC

sBTC  LayerZero

LayerZero  Maple Finance

Maple Finance  Resolv USR

Resolv USR  pippin

pippin  Staked Aave

Staked Aave  BitTorrent

BitTorrent  Resolv wstUSR

Resolv wstUSR  FLOKI

FLOKI  Celestia

Celestia  JUST

JUST  Cap USD

Cap USD  The Graph

The Graph  Kaia

Kaia  Gnosis

Gnosis  Axie Infinity

Axie Infinity  Trust Wallet

Trust Wallet  Pyth Network

Pyth Network  IOTA

IOTA  crvUSD

crvUSD  Wrapped ApeCoin

Wrapped ApeCoin  Starknet

Starknet  Bitcoin SV

Bitcoin SV  Sun Token

Sun Token  Conflux

Conflux  AINFT

AINFT  Telcoin

Telcoin  Ethereum Name Service

Ethereum Name Service