Ethereum Bounces Off Key Weekly Support: Here’s Its Next Possible Direction

Ethereum rebounds above a major weekly support as volatility rises, with traders watching higher resistance levels for direction.

Notably, Ethereum is trading at $3,164.58, showing renewed strength after a volatile start to the week. The daily trading range sits between $3,076.91 and $3,217.54, reflecting a relatively stable intraday structure as buyers continue to defend higher support zones. Over the past 24 hours, ETH has dipped slightly by 1.3%, but the longer-term trend remains intact.

The 7-day performance shows a 4.6% increase, supported by a notable rebound from sub-$2,800 levels visible on the weekly chart. Momentum strengthens further when viewed on a 14-day basis, with Ethereum up 12.3%. As price now consolidates above the $3,100 region, market watchers are assessing whether this positive structure can extend into the coming sessions.

Ethereum Price Analysis

On the technical side, Ethereum’s weekly chart shows the price bouncing off the lower Bollinger Band based at $2,822, a key support level that recently halted the market’s correction. The midline of the Bollinger Bands, around $3,956, now acts as the next major resistance, signaling where bullish momentum may face its first real test.

Ethereum Weekly Chart

The width of the bands has expanded, indicating renewed volatility after days of downward pressure, showing that volatility might cool in the upcoming sessions. Price is currently trading below the 20-week SMA, indicating that Ethereum is still attempting to reclaim its medium-term trend structure.

Further, the Stochastic RSI sits near 10, deeply in oversold territory, suggesting that bearish momentum has weakened and a potential reversal is forming. Historically, Ethereum has shown strong upside reactions whenever the Stoch RSI crosses upward from these levels on the weekly timeframe.

If bulls maintain control above $2,820, the next upside targets lie at $3,300 to $3,400, followed by the stronger resistance at the Bollinger midline near $3,950. A breakout above this region would shift weekly market structure back into a bullish trend. Conversely, a failure to hold $2,820 exposes lower support levels around $2,645.

Ethereum Liquidation Data

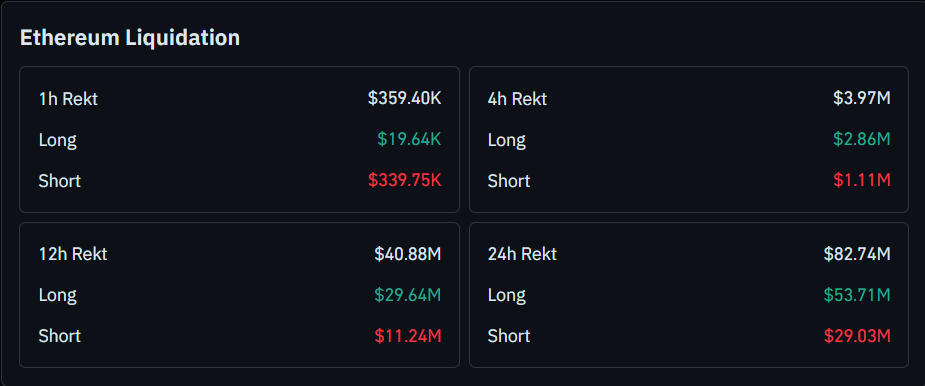

Elsewhere, Ethereum’s liquidation data show that long traders are taking the brunt of losses. The 4-hour data, reflecting a broader price continuation, shows $3.97M in liquidations, with long liquidations at $2.86M outpacing short liquidations at $1.11M, indicating consistent volatility on both sides of the market.

Ethereum Liquidation Data

The 12-hour window expands this dynamic, with liquidations totaling $40.88M. Longs absorbed a majority of the losses at $29.64M, while shorts accounted for $11.24M, suggesting that earlier bullish momentum faded and trapped late long entries.

Over the 24-hour period, liquidations rose sharply to $82.74M, where long liquidations of $53.71M significantly exceeded short liquidations of $29.03M. This pattern implies that while Ethereum attempted a recovery move, price volatility ultimately led to a broader flush-out of leveraged long positions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Hedera

Hedera  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  Polkadot

Polkadot  PAX Gold

PAX Gold  Uniswap

Uniswap  MemeCore

MemeCore  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Circle USYC

Circle USYC  Pi Network

Pi Network  Bittensor

Bittensor  Aave

Aave  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  Pepe

Pepe  HTX DAO

HTX DAO  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  BFUSD

BFUSD  Ondo

Ondo  Pump.fun

Pump.fun  Worldcoin

Worldcoin  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  Quant

Quant  Ethena

Ethena  Ondo US Dollar Yield

Ondo US Dollar Yield  Jito Staked SOL

Jito Staked SOL  Cosmos Hub

Cosmos Hub  NEXO

NEXO  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Filecoin

Filecoin  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Official Trump

Official Trump  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Render

Render  USDD

USDD  syrupUSDT

syrupUSDT  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  Arbitrum

Arbitrum  YLDS

YLDS  Beldex

Beldex  Stable

Stable  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Decred

Decred  Lombard Staked BTC

Lombard Staked BTC  Bonk

Bonk  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Stacks

Stacks  Virtuals Protocol

Virtuals Protocol  Sei

Sei  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  EURC

EURC  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  USDai

USDai  tBTC

tBTC  Dash

Dash  WrappedM by M0

WrappedM by M0  JUST

JUST  Tezos

Tezos  Ether.fi

Ether.fi  Kinesis Gold

Kinesis Gold  LayerZero

LayerZero  Chiliz

Chiliz  c8ntinuum

c8ntinuum  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  River

River  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv wstUSR

Resolv wstUSR  pippin

pippin  COCA

COCA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Gnosis

Gnosis  Siren

Siren  Liquid Staked ETH

Liquid Staked ETH  Humanity

Humanity  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Lombard

Lombard  AINFT

AINFT  Aerodrome Finance

Aerodrome Finance  BitTorrent

BitTorrent  Wrapped Flare

Wrapped Flare  PRIME

PRIME  SPX6900

SPX6900  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Kaia

Kaia  ADI

ADI  Story

Story  Sun Token

Sun Token  Lighter

Lighter  Binance-Peg XRP

Binance-Peg XRP  Celestia

Celestia  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Injective

Injective  Renzo Restaked ETH

Renzo Restaked ETH  Bitcoin SV

Bitcoin SV  Pyth Network

Pyth Network  sBTC

sBTC  IOTA

IOTA  The Graph

The Graph  JasmyCoin

JasmyCoin  Jupiter Staked SOL

Jupiter Staked SOL  FLOKI

FLOKI  Savings USDD

Savings USDD  Maple Finance

Maple Finance  Legacy Frax Dollar

Legacy Frax Dollar  Plasma

Plasma  Marinade Staked SOL

Marinade Staked SOL  Olympus

Olympus  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Venice Token

Venice Token  Optimism

Optimism  Lido DAO

Lido DAO  crvUSD

crvUSD  Staked Aave

Staked Aave