ETH Chart Flashes Classic Rally Pattern, $4.8K or $7K Next?

Ethereum (ETH) has moved back above key support after a brief breakdown, with the asset recovering toward $4,150. The move comes after a 24-hour gain of over 8%, though ETH remains down more than 8% over the past week.

Pattern Repeats After False Breakdown

A chart shared by Trader Tardigrade outlines a recurring price pattern: a false breakdown, followed by a reclaim of support, and then a rally.

$ETH/daily#Ethereum has reclaimed above the previous low, which was marked as a support, after a false breakdown.

It’s following this pattern:

🔴 False breakdown

🟡 Reclaim

🟢 RallyWe might see a Rally moving above the previous high soon 🚀 pic.twitter.com/BEJTQda0oY

— Trader Tardigrade (@TATrader_Alan) October 13, 2025

The exact sequence has occurred multiple times over the past year. In each case, the breakdown led to a sharp recovery. The most recent setup shows ETH reclaiming the $3,650 zone. The pattern points to a possible move back toward the $4,800 level if momentum continues.

Chart Targets $7,000 by Mid-2026

Investor Mike Investing posted a weekly ETH chart projecting a long-term price target of $7,000 by May 2026. The chart shows ETH trading well above its 200-week moving average, now near $2,447. This level has acted as a base during previous market cycles.

Remarkably, the post claims that during the recent correction, large firms including BlackRock, BitMine, and Vanguard increased their ETH holdings. While this activity isn’t confirmed in public filings, the chart suggests a strong return is possible over the next several months if ETH holds above support.

I’m officially calling it…$ETH had its final hard pullback below $4,000 before it begins its multi month incoming rally.

During the recent pullback institutions like BitMine, Blackrock, & Vanguard all loaded collectively billions in $ETH.

$7000+ by May 2026.

Mark my words… pic.twitter.com/m0xCGA0pb1

— Mike Investing (@MrMikeInvesting) October 12, 2025

You may also like:

- Institutions Scoop Up BTC and ETH After Crypto’s Biggest Liquidation Event

- Bitcoin Soars Beyond $114K, Ethereum Spikes 6% as US-China Tensions Ease

- Altcoin Bloodbath: ETH, XRP, SOL, DOGE Crumble as Liquidations Near $900M

In addition, a separate chart from Mister Crypto compares Ethereum’s current structure to its 2016–2017 cycle. The side-by-side view shows that both charts experienced a breakout, followed by a short pullback. In the earlier cycle, this setup led to a steep multi-month rally.

The post claims, “This $ETH setup looks so much like it did in 2017,” placing the current phase just before a major leg up. Traders watching fractals often use these historical patterns as rough guides, but outcomes can vary.

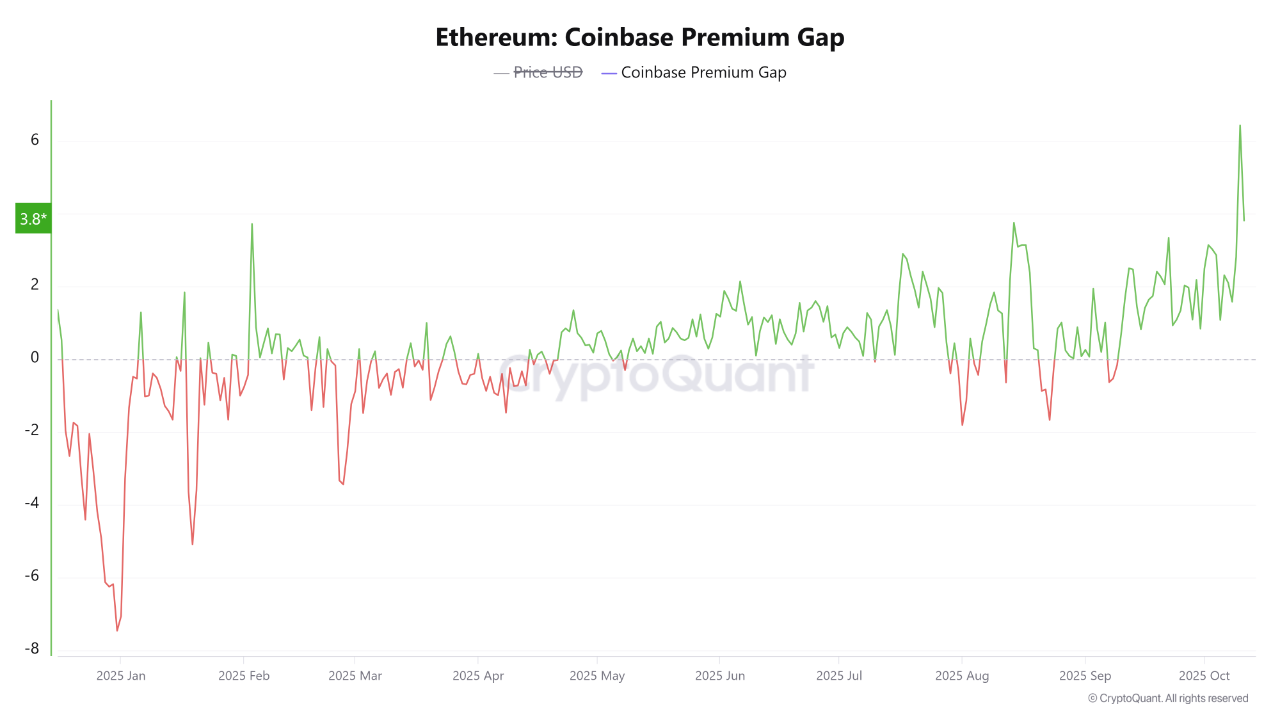

Coinbase Premium Hits Year-High

On-chain analyst CryptoOnchain reported a sharp spike in Ethereum’s Coinbase Premium Gap, hitting +6.0 on October 10. This shows ETH was trading much higher on Coinbase than on global exchanges like Binance, often a sign of strong U.S. demand.

“While the global market was selling, an overwhelmingly aggressive wave of buying was taking place on the Coinbase exchange,” the post said.

This kind of buying often reflects institutional interest, especially when it shows up during market corrections.

The data suggests that major investors are positioning during dips, creating a possible floor around current price levels.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Cardano

Cardano  USDS

USDS  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Canton

Canton  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Hedera

Hedera  sUSDS

sUSDS  Rain

Rain  Litecoin

Litecoin  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  PayPal USD

PayPal USD  Avalanche

Avalanche  Zcash

Zcash  WETH

WETH  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  World Liberty Financial

World Liberty Financial  Polkadot

Polkadot  Tether Gold

Tether Gold  MemeCore

MemeCore  Uniswap

Uniswap  PAX Gold

PAX Gold  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aave

Aave  Circle USYC

Circle USYC  Bittensor

Bittensor  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  OKB

OKB  Pepe

Pepe  Pi Network

Pi Network  syrupUSDC

syrupUSDC  Sky

Sky  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  BFUSD

BFUSD  POL (ex-MATIC)

POL (ex-MATIC)  Worldcoin

Worldcoin  KuCoin

KuCoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Gate

Gate  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Algorand

Algorand  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Filecoin

Filecoin  Function FBTC

Function FBTC  Render

Render  USDD

USDD  Stable

Stable  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  syrupUSDT

syrupUSDT  Ondo US Dollar Yield

Ondo US Dollar Yield  pippin

pippin  Binance Staked SOL

Binance Staked SOL  VeChain

VeChain  Arbitrum

Arbitrum  Beldex

Beldex  Decred

Decred  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Usual USD

Usual USD  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Jupiter

Jupiter  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  GHO

GHO  Stacks

Stacks  A7A5

A7A5  clBTC

clBTC  TrueUSD

TrueUSD  Virtuals Protocol

Virtuals Protocol  Sei

Sei  EURC

EURC  USDai

USDai  StakeWise Staked ETH

StakeWise Staked ETH  Pudgy Penguins

Pudgy Penguins  Dash

Dash  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  PancakeSwap

PancakeSwap  WrappedM by M0

WrappedM by M0  Tezos

Tezos  JUST

JUST  Kinesis Gold

Kinesis Gold  Ether.fi

Ether.fi  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  c8ntinuum

c8ntinuum  Story

Story  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  LayerZero

LayerZero  Resolv wstUSR

Resolv wstUSR  BitTorrent

BitTorrent  COCA

COCA  Chiliz

Chiliz  Lighter

Lighter  Liquid Staked ETH

Liquid Staked ETH  Gnosis

Gnosis  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  PRIME

PRIME  Aerodrome Finance

Aerodrome Finance  AINFT

AINFT  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Injective

Injective  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Sun Token

Sun Token  Pyth Network

Pyth Network  IOTA

IOTA  Celestia

Celestia  SPX6900

SPX6900  Binance-Peg XRP

Binance-Peg XRP  Power Protocol

Power Protocol  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  The Graph

The Graph  Renzo Restaked ETH

Renzo Restaked ETH  JasmyCoin

JasmyCoin  crvUSD

crvUSD  sBTC

sBTC  FLOKI

FLOKI  DoubleZero

DoubleZero  Olympus

Olympus  Jupiter Staked SOL

Jupiter Staked SOL  Maple Finance

Maple Finance  Savings USDD

Savings USDD  Legacy Frax Dollar

Legacy Frax Dollar  Lido DAO

Lido DAO  Optimism

Optimism  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Helium

Helium  BTSE Token

BTSE Token  Siren

Siren  Telcoin

Telcoin  Staked Aave

Staked Aave  Ethereum Name Service

Ethereum Name Service