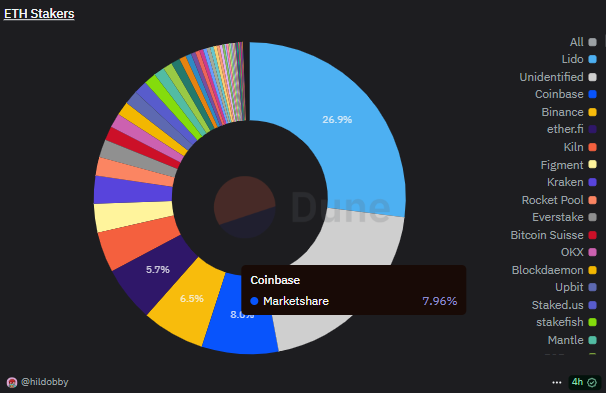

Coinbase controls 8% of staked ETH, opening the door to staking ETF

Coinbase is one of the biggest holders of staked Ethereum (ETH), potentially signaling its ability to offer staking ETFs. The exchange controls up to 8% of staked ETH.

Coinbase is one of the biggest stakers of Ethereum (ETH), carrying up to 8% of the staked supply. The centralized exchange even surpassed Binance, which carries around 2.2M in staked ETH.

Coinbase is among the biggest proxies for staking, allowing retail investors to gain yield without locking 32 ETH.

Centralized exchanges work as hubs for more secure staking, while also gaining passive income. Coinbase currently offers up to 2.14% APY for using it as an intermediary. Currently, staking can bring back up to 3.95% in annualized earnings for those that deposit 32 ETH. Coinbase offers returns for smaller stakes, while handling the logistics of being a validator.

Coinbase has been proactive in securing some of the top chains, recently also becoming one of the fast Solana validators.

The exchange’s role for Ethereum may be linked to providing staking-based ETFs. The existing funds often resort to Coinbase Custody for holding their assets, and may extend to Coinbase’s staking service.

Staked ETH may revive ETF buying

One of the problems for ETH is the relatively weak demand for its available ETF. In the past couple of days, most of the top ETFs had a net outflow. The lowered demand follows selling pressures for ETH, as the price hovers in the $1,600 range.

A staking ETF may give incentives to new buyers, as they receive additional income on their investment. Staking has been proposed for other altcoin ETFs, including Solana and AVAX. However, ETH staking remains the most reliable source of regular rewards.

Coinbase also contributes by issuing Coinbase Staked ETH, cbETH, an asset that is also spreading to DeFi protocols. The ability to stake ETH, while receiving a new form of token may add an extra layer of potential earnings. The derivative asset, cbETH, also trades at a premium of $1,758.62, giving extra incentives for staking with Coinbase.

A staking ETF is currently in the pipeline, pending approval by the US Securities and Exchange Commission (SEC). There are expectations that a first approval can potentially arrive in seven weeks. The arrival of institutional staking also expects an Ethereum update, which would allow the staking of up to 2048 ETH in a single validator. One of the obstacles to staking scalability is the 32 ETH limit, leaving large-scale holders with multiple validators.

The US market still lacks a staking ETF, but European investors have access to products with passive income, provided by 21 Shares and Bitwise. An ETF can remove friction and the technical risks of staking, while also satisfying the demand for yield.

Currently, around 34M ETH are staked, expanding the number of validators. Buying an ETF would reduce the complexity of staking, while doing away with the 32 ETH requirement for retail buyers. Stakers split over 17,429 ETH from block rewards each week, while validators also gain a small share of gas fees. ETH retains a yearly inflation of 0.75%, offset by the staking yield.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  JUSD

JUSD  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  Cardano

Cardano  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  WhiteBIT Coin

WhiteBIT Coin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hyperliquid

Hyperliquid  WETH

WETH  Stellar

Stellar  Ethena USDe

Ethena USDe  Zcash

Zcash  Canton

Canton  Sui

Sui  Litecoin

Litecoin  Avalanche

Avalanche  USD1

USD1  Shiba Inu

Shiba Inu  Hedera

Hedera  USDT0

USDT0  Dai

Dai  World Liberty Financial

World Liberty Financial  sUSDS

sUSDS  PayPal USD

PayPal USD  Ethena Staked USDe

Ethena Staked USDe  Toncoin

Toncoin  Cronos

Cronos  Rain

Rain  Polkadot

Polkadot  Uniswap

Uniswap  Mantle

Mantle  MemeCore

MemeCore  Tether Gold

Tether Gold  Bitget Token

Bitget Token  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Falcon USD

Falcon USD  PAX Gold

PAX Gold  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Pump.fun

Pump.fun  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  Binance-Peg WETH

Binance-Peg WETH  Ethereum Classic

Ethereum Classic  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Circle USYC

Circle USYC  HTX DAO

HTX DAO  Aster

Aster  Wrapped SOL

Wrapped SOL  Global Dollar

Global Dollar  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Pi Network

Pi Network  Sky

Sky  KuCoin

KuCoin  Ripple USD

Ripple USD  Binance Staked SOL

Binance Staked SOL  Ethena

Ethena  Wrapped BNB

Wrapped BNB  syrupUSDC

syrupUSDC  BFUSD

BFUSD  River

River  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Gate

Gate  MYX Finance

MYX Finance  USDD

USDD  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Midnight

Midnight  Arbitrum

Arbitrum  Function FBTC

Function FBTC  Lombard Staked BTC

Lombard Staked BTC  Render

Render  Official Trump

Official Trump  NEXO

NEXO  Filecoin

Filecoin  VeChain

VeChain  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  USDtb

USDtb  Mantle Staked Ether

Mantle Staked Ether  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  syrupUSDT

syrupUSDT  Liquid Staked ETH

Liquid Staked ETH  Dash

Dash  Bonk

Bonk  Story

Story  WrappedM by M0

WrappedM by M0  Solv Protocol BTC

Solv Protocol BTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Sei

Sei  Renzo Restaked ETH

Renzo Restaked ETH  Ondo US Dollar Yield

Ondo US Dollar Yield  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  StakeWise Staked ETH

StakeWise Staked ETH  clBTC

clBTC  OUSG

OUSG  Kinetiq Staked HYPE

Kinetiq Staked HYPE  Jupiter

Jupiter  COCA

COCA  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  PancakeSwap

PancakeSwap  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  USDai

USDai  Jupiter Staked SOL

Jupiter Staked SOL  Binance-Peg XRP

Binance-Peg XRP  Pudgy Penguins

Pudgy Penguins  Tezos

Tezos  Wrapped Flare

Wrapped Flare  Beldex

Beldex  Chiliz

Chiliz  Usual USD

Usual USD  Optimism

Optimism  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Virtuals Protocol

Virtuals Protocol  Stacks

Stacks  c8ntinuum

c8ntinuum  tBTC

tBTC  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  A7A5

A7A5  Curve DAO

Curve DAO  GTETH

GTETH  GHO

GHO  TrueUSD

TrueUSD  Lighter

Lighter  Injective

Injective  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Cap USD

Cap USD  Lido DAO

Lido DAO  Ether.fi

Ether.fi  Marinade Staked SOL

Marinade Staked SOL  pippin

pippin  Coinbase Wrapped Staked ETH

Coinbase Wrapped Staked ETH  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Kaia

Kaia  Axie Infinity

Axie Infinity  Aerodrome Finance

Aerodrome Finance  Kinesis Silver

Kinesis Silver  DoubleZero

DoubleZero  Stader ETHx

Stader ETHx  FLOKI

FLOKI  Stable

Stable  LayerZero

LayerZero  sBTC

sBTC  BitTorrent

BitTorrent  Resolv USR

Resolv USR  Kinesis Gold

Kinesis Gold  EURC

EURC  Maple Finance

Maple Finance  Celestia

Celestia  Staked Aave

Staked Aave  The Graph

The Graph  Resolv wstUSR

Resolv wstUSR  ether.fi Staked ETH

ether.fi Staked ETH  Gnosis

Gnosis  AB

AB  IOTA

IOTA  Wrapped ApeCoin

Wrapped ApeCoin  SPX6900

SPX6900  Starknet

Starknet  Pyth Network

Pyth Network  Bitcoin SV

Bitcoin SV  Trust Wallet

Trust Wallet  Conflux

Conflux  JUST

JUST  AINFT

AINFT  crvUSD

crvUSD