Analyst Sounds Alarm: Ethereum Could Unwind To $2,850

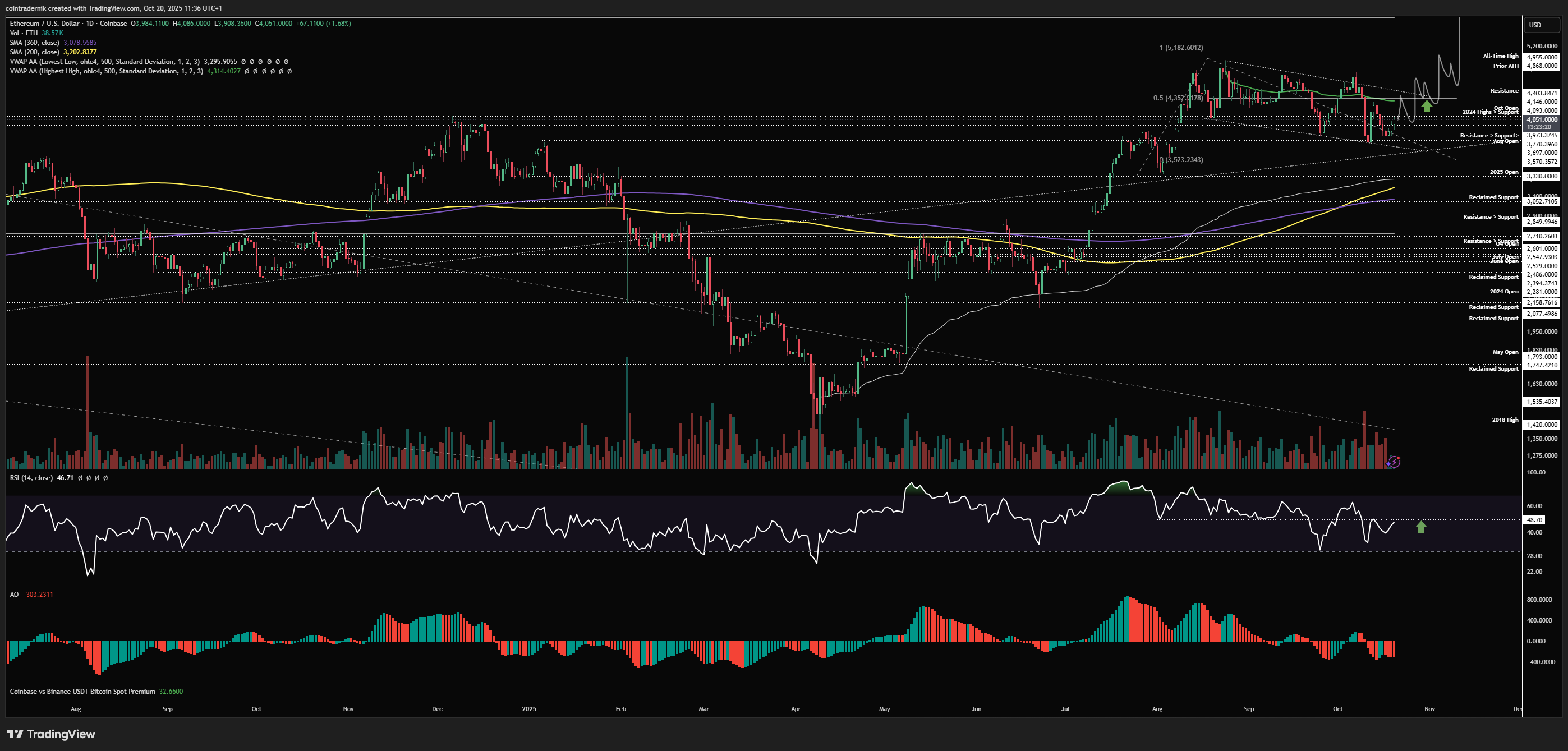

In a market update on Oct. 10, technical analyst Nik Patel (@OstiumLabs) argued that Ethereum is approaching a make-or-break zone where the next few sessions could define whether the advance resumes or a deeper unwind unfolds. With spot ETH quoted around $4,000, Patel anchored his thesis to a tight cluster of reclaim and invalidation levels on both ETH/USD and ETH/BTC, emphasizing that lower-timeframe behavior must align with higher-timeframe structure to keep the bullish path open.

Key Price Levels For Ethereum Now

On the weekly ETH/USD chart, Patel said the market “wicked lower into the August open last week but held above the previous weekly low and trendline support,” resulting in an inside week that nevertheless closed “marginally below that major pivot.” The pivot is explicit: “We want to see this pivot at $4,093 reclaimed immediately and not flipped into resistance here on the lower timeframes, or else we could expect another flush of the lows towards that 2025 open.”

If buyers do force the reclaim, Patel expects last week’s action to stand as a quarterly low: “If we do reclaim $4,093 here, which is what I expect, we should have our quarterly low now in and I would want to see $4,400 flipped into support for the move higher into all-time highs and beyond.”

He framed the weekly invalidation at $3,700, warning that a close below would put the yearly open on watch as “last-stand support” for the bullish structure; failure there risks “a much bigger unwind back into $2,850.” Patel’s base case remained constructive: “acceptance back above $4,093 into next week and then a close above $4,400 for October, leading to new highs through $5,000 in early November and a very strong month for ETH.”

The daily ETH/USD read connects that high-timeframe blueprint to momentum and market structure. Patel noted “momentum exhaustion into the lows” followed by a higher-low last week, a formation that now must be defended. He wants to see the sequence reassert itself with a drive above the mid-range and a subsequent higher-low above the weekly pivot: “we absolutely want to see this structure now protected and price to form a higher-high above the mid-range at $4,352 and then another higher-low above $4,093 before a breakout higher and a push towards fresh highs.”

For confirmation of an impulsive leg, he flagged a trendline break, a flip of the ATH-anchored VWAP into support, and an RSI regime shift: “If we get a trendline breakout and price flips that ATH VWAP into support with daily RSI above 50, I’d expect a move into $4,950 very swiftly, followed by price discovery in November.” The daily invalidation mirrors the weekly logic: if $4,093 acts as resistance and the market pushes below $3,700—then closes beneath it—“we’re absolutely retesting the yearly open,” in his view.

ETH Vs. BTC

Against Bitcoin, Patel contends that the relative pair has likely printed its Q4 low. On the weekly ETH/BTC chart, price was rejected at trendline resistance, then retraced to the yearly open and held, closing “marginally green” while respecting trendline support off the 2025 lows.

“It is my view that the Q4 low for the pair has formed here,” he wrote, adding that a retest and break above the descending boundary into early November would set the stage for a measured expansion: “acceptance above 0.0417 opens up the next leg higher into 0.055.” He placed weekly invalidation at 0.0319.

The daily ETH/BTC map refines those signals into actionable levels. Price “marked out that low between 0.0319 and the yearly open before bouncing hard and reclaiming 0.036 as support.” Ideally, 0.036 now acts as a springboard; if not, Patel allows for a higher-low “above the 0.0319 level before continuation higher.”

The tactical tell would be a flip of nearby supply: “If we can flip 0.0379 as reclaimed support here, that would be promising for the view that a trendline breakout is imminent, following which I would expect 0.0417 to be taken out and price to head higher, with minor resistance above that at 0.049 before 0.055.” He also identified a confluence band below: “We have a confluence of support between 0.0293 and 0.0319, so flipping that range into resistance would be very bearish ETH/BTC.”

Taken together, Patel’s Oct. 10 blueprint hinges on three synchronizations: ETH/USD must swiftly reclaim and defend $4,093; $4,400 must convert from ceiling to floor to clear the runway toward prior highs and a potential $4,950 extension; and ETH/BTC should drive through 0.0379 and then 0.0417 to confirm relative-strength breadth beneath any dollar-denominated breakout.

The downside is equally crisp: failure to reclaim $4,093, a weekly close below $3,700, and a subsequent loss of the yearly open would validate the risk that, in Patel’s words, Ethereum could “unwind back into $2,850.”

At press time, ETH traded at $3,872.

Featured image created with DALL.E, chart from TradingView.com

Source

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Chainlink

Chainlink  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Rain

Rain  sUSDS

sUSDS  Dai

Dai  Hedera

Hedera  PayPal USD

PayPal USD  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Zcash

Zcash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Circle USYC

Circle USYC  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Pi Network

Pi Network  OKB

OKB  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Bittensor

Bittensor  Aave

Aave  Sky

Sky  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  NEAR Protocol

NEAR Protocol  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Gate

Gate  Worldcoin

Worldcoin  Pump.fun

Pump.fun  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  POL (ex-MATIC)

POL (ex-MATIC)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Midnight

Midnight  Ondo US Dollar Yield

Ondo US Dollar Yield  Cosmos Hub

Cosmos Hub  Jito Staked SOL

Jito Staked SOL  Ethena

Ethena  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  NEXO

NEXO  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  OUSG

OUSG  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Filecoin

Filecoin  Official Trump

Official Trump  USDD

USDD  Render

Render  syrupUSDT

syrupUSDT  Jupiter

Jupiter  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Beldex

Beldex  Arbitrum

Arbitrum  Stable

Stable  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  GHO

GHO  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  Sei

Sei  StakeWise Staked ETH

StakeWise Staked ETH  PancakeSwap

PancakeSwap  USDai

USDai  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  JUST

JUST  Pudgy Penguins

Pudgy Penguins  WrappedM by M0

WrappedM by M0  Dash

Dash  Tezos

Tezos  Ether.fi

Ether.fi  Kinesis Gold

Kinesis Gold  Chiliz

Chiliz  c8ntinuum

c8ntinuum  LayerZero

LayerZero  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  pippin

pippin  Resolv wstUSR

Resolv wstUSR  Siren

Siren  COCA

COCA  AINFT

AINFT  Gnosis

Gnosis  River

River  Liquid Staked ETH

Liquid Staked ETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  BitTorrent

BitTorrent  PRIME

PRIME  Kaia

Kaia  Wrapped Flare

Wrapped Flare  Aerodrome Finance

Aerodrome Finance  Sun Token

Sun Token  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  ADI

ADI  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  SPX6900

SPX6900  Story

Story  Celestia

Celestia  Injective

Injective  Humanity

Humanity  Binance-Peg XRP

Binance-Peg XRP  Lombard

Lombard  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Lighter

Lighter  Renzo Restaked ETH

Renzo Restaked ETH  Bitcoin SV

Bitcoin SV  IOTA

IOTA  sBTC

sBTC  JasmyCoin

JasmyCoin  The Graph

The Graph  Pyth Network

Pyth Network  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  FLOKI

FLOKI  Olympus

Olympus  crvUSD

crvUSD  Marinade Staked SOL

Marinade Staked SOL  DoubleZero

DoubleZero  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Venice Token

Venice Token  Optimism

Optimism  Staked Aave

Staked Aave  Lido DAO

Lido DAO