Analysis: Is Coinbase’s Shady Staking Affecting Ethereum’s Price?

Coinbase, the largest Ethereum staking custodian, has consistently avoided disclosing information on its staked ETH holdings for the past five quarters. And now, estimates suggest Coinbase manages approximately 21% of all staked ETH, making its lack of transparency a significant concern.

Despite calling itself a transparent entity, Coinbase has not provided details on its staked ETH, cbETH backing, or cbBTC reserves. This has raised doubts about the integrity of its staking operations, particularly as its address rotation and custody structure make tracking more challenging.

1/ it’s the 5th quarter where @coinbase, the largest staked ETH custodian, refuses to share any info on their staked ETH ?

estimates indicate they manage ~21% of all staked ETH pic.twitter.com/6a28StGrOH

— hildobby (@hildobby_) February 18, 2025

Coinbase’s Transparency Issues & Staking

Tracking Coinbase’s staked ETH has proven difficult due to its frequent address rotations. While independent analysts have estimated a constant 15% of staked ETH under Coinbase in previous quarters, recent data suggests this number could be around 8.4%.

However, this figure only accounts for labeled addresses, with a significant portion unaccounted for. As Coinbase continues to modify its staking structure, accurately determining its true holdings remains a challenge.

Base Network and cbETH

Base, Coinbase’s Ethereum Layer-2 network, aligns closely with Ethereum’s ecosystem, yet the exchange refuses to disclose its role in Ethereum’s security layer. A more transparent approach could enhance trust in its staking products.

Additionally, cbETH might have gained broader adoption if its backing was verifiable. Instead, Coinbase expanded cbETH’s supply without proving the corresponding staked ETH, creating uncertainty about its actual value.

8/ Coinbase is all about transparency but has never shared any info on their staked ETH amount, cbETH backing or cbBTC backinghttps://t.co/Lb4EyxRAIa

— hildobby (@hildobby_) February 18, 2025

Ethereum Price Analysis

Key Support and Resistance Levels

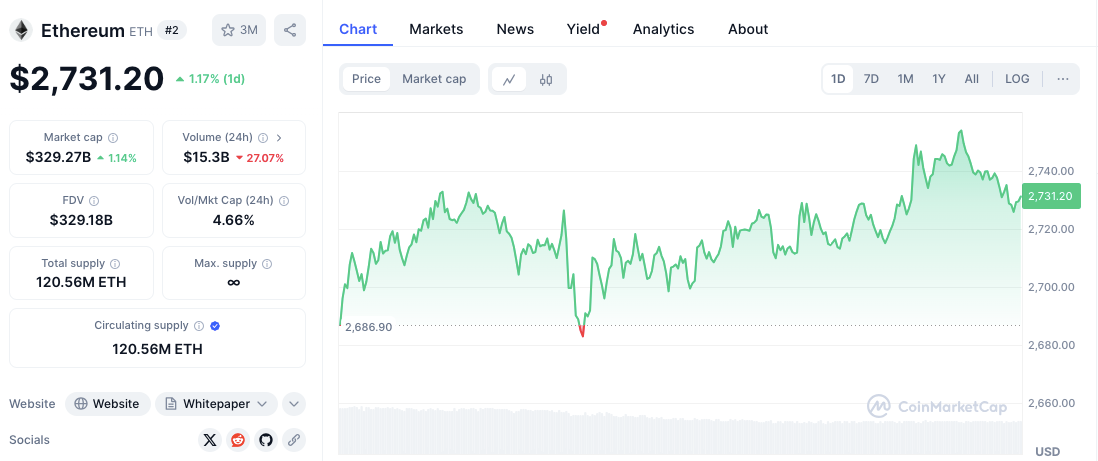

Ethereum has been showing signs of stability, trading at $2,728.67 with a 1.55% gain in the past 24 hours.

A critical support zone lies between $2,685 and $2,690, where previous price action suggests strong buying interest. If ETH fails to hold above this level, the next key support may form around $2,650.

Source: CoinMarketCap

On the upside, resistance is visible between $2,740 and $2,750. A breakout above this level could push Ethereum toward $2,780 or even $2,800 in the near term. Given the current price movements, ETH is maintaining an upward trend with minor corrections, suggesting a bullish outlook.

Ethereum’s Technical Indicators

ETH/USD daily price chart, Source: TradingView

The Relative Strength Index (RSI) currently stands at 43.14, slightly above the oversold territory. This suggests ETH remains in a neutral-to-bearish zone, with potential for recovery if buying pressure increases.

Meanwhile, the MACD indicator reveals a bearish trend, with the MACD line at -113.4 below the signal line at -138.3.

However, the histogram is showing signs of turning positive, signaling a possible bullish reversal. If momentum shifts, ETH could see an upward breakout beyond current resistance levels.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Figure Heloc

Figure Heloc  Dogecoin

Dogecoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Canton

Canton  Stellar

Stellar  Wrapped eETH

Wrapped eETH  USD1

USD1  Dai

Dai  sUSDS

sUSDS  Rain

Rain  Hedera

Hedera  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Litecoin

Litecoin  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Zcash

Zcash  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDT0

USDT0  Cronos

Cronos  Tether Gold

Tether Gold  World Liberty Financial

World Liberty Financial  MemeCore

MemeCore  PAX Gold

PAX Gold  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Pi Network

Pi Network  Circle USYC

Circle USYC  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Sky

Sky  Falcon USD

Falcon USD  Aster

Aster  Global Dollar

Global Dollar  Aave

Aave  NEAR Protocol

NEAR Protocol  syrupUSDC

syrupUSDC  Ripple USD

Ripple USD  Bitget Token

Bitget Token  HTX DAO

HTX DAO  Pepe

Pepe  Internet Computer

Internet Computer  BFUSD

BFUSD  Ondo US Dollar Yield

Ondo US Dollar Yield  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Pump.fun

Pump.fun  Gate

Gate  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  KuCoin

KuCoin  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Quant

Quant  NEXO

NEXO  Jito Staked SOL

Jito Staked SOL  Midnight

Midnight  Cosmos Hub

Cosmos Hub  Ethena

Ethena  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Rocket Pool ETH

Rocket Pool ETH  Render

Render  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  Algorand

Algorand  Wrapped BNB

Wrapped BNB  Aptos

Aptos  Function FBTC

Function FBTC  OUSG

OUSG  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  USDD

USDD  Official Trump

Official Trump  Filecoin

Filecoin  syrupUSDT

syrupUSDT  Beldex

Beldex  VeChain

VeChain  Binance Staked SOL

Binance Staked SOL  YLDS

YLDS  Stable

Stable  Jupiter

Jupiter  Arbitrum

Arbitrum  GHO

GHO  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  Usual USD

Usual USD  Solv Protocol BTC

Solv Protocol BTC  Bonk

Bonk  Lombard Staked BTC

Lombard Staked BTC  Decred

Decred  TrueUSD

TrueUSD  clBTC

clBTC  A7A5

A7A5  Stacks

Stacks  EURC

EURC  Virtuals Protocol

Virtuals Protocol  PancakeSwap

PancakeSwap  StakeWise Staked ETH

StakeWise Staked ETH  JUST

JUST  Pudgy Penguins

Pudgy Penguins  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Sei

Sei  Ether.fi

Ether.fi  WrappedM by M0

WrappedM by M0  LayerZero

LayerZero  Dash

Dash  Chiliz

Chiliz  Kinesis Gold

Kinesis Gold  Tezos

Tezos  c8ntinuum

c8ntinuum  Mantle Staked Ether

Mantle Staked Ether  Curve DAO

Curve DAO  pippin

pippin  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Siren

Siren  Resolv wstUSR

Resolv wstUSR  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  COCA

COCA  Gnosis

Gnosis  AINFT

AINFT  ADI

ADI  Liquid Staked ETH

Liquid Staked ETH  BitTorrent

BitTorrent  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Kaia

Kaia  PRIME

PRIME  USDai

USDai  Aerodrome Finance

Aerodrome Finance  Wrapped Flare

Wrapped Flare  Sun Token

Sun Token  Bitcoin SV

Bitcoin SV  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Injective

Injective  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Celestia

Celestia  SPX6900

SPX6900  JasmyCoin

JasmyCoin  FLOKI

FLOKI  River

River  Binance-Peg XRP

Binance-Peg XRP  Story

Story  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  Legacy Frax Dollar

Legacy Frax Dollar  Renzo Restaked ETH

Renzo Restaked ETH  IOTA

IOTA  The Graph

The Graph  sBTC

sBTC  Lombard

Lombard  Olympus

Olympus  Pyth Network

Pyth Network  Jupiter Staked SOL

Jupiter Staked SOL  crvUSD

crvUSD  Savings USDD

Savings USDD  DoubleZero

DoubleZero  Maple Finance

Maple Finance  BTSE Token

BTSE Token  Marinade Staked SOL

Marinade Staked SOL  Conflux

Conflux  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Lighter

Lighter  Optimism

Optimism  Telcoin

Telcoin  Lido DAO

Lido DAO