4 Warning Signs Suggest Ethereum (ETH) Price May Not Recover Soon in Late December

Ethereum (ETH) has traded sideways around the $3,000 level for the past two weeks. Although recent buying came from firms such as BitMine and Trend Research, the demand appears insufficient.

The following data reveals the rest of the picture, as selling pressure remains equally strong. As a result, ETH is unlikely to stage a quick recovery in the short term.

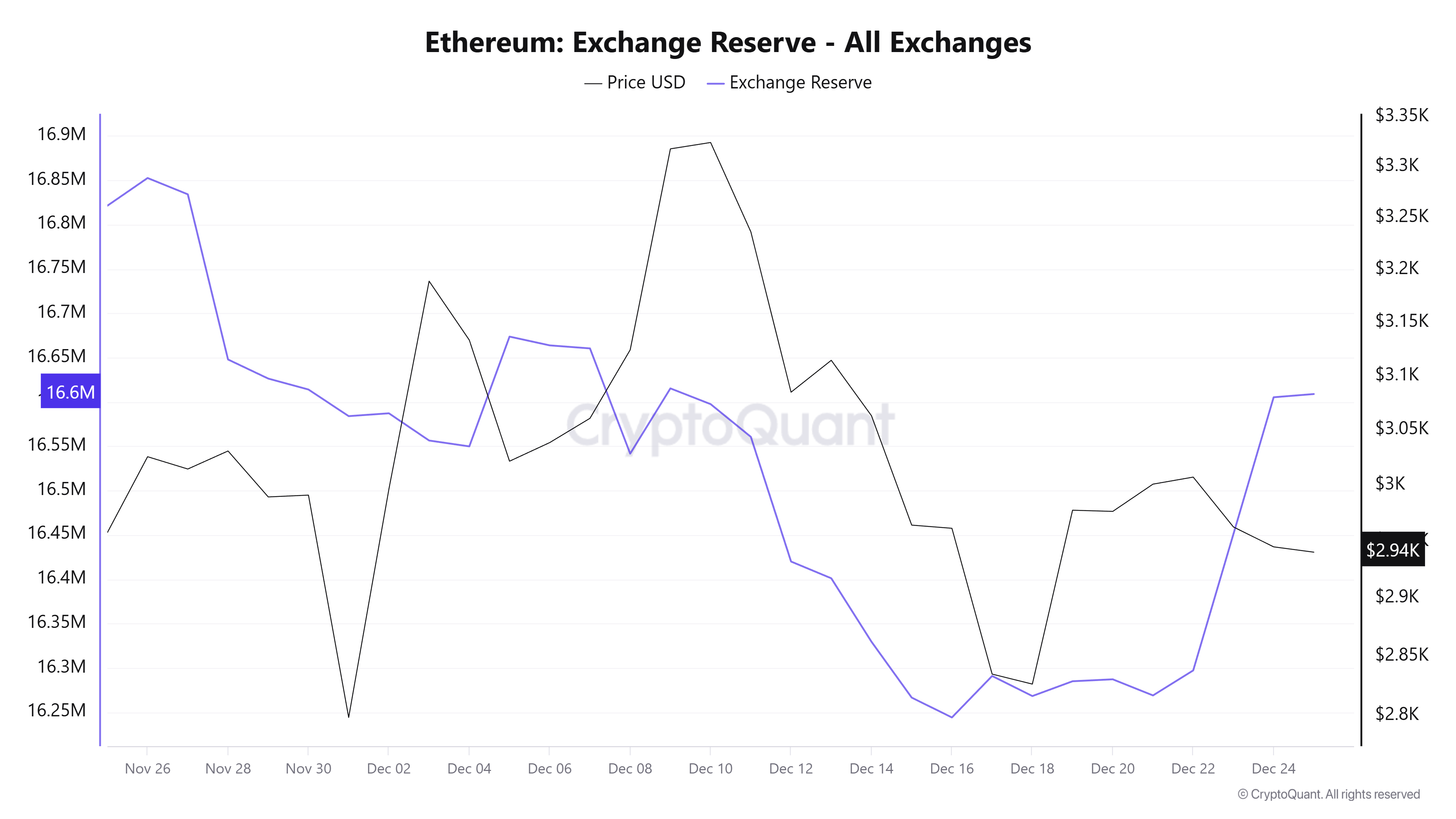

1. ETH Exchange Reserves Rise Again During Christmas Week

Data from CryptoQuant shows that ETH reserves across all exchanges had declined steadily for several months.

However, the trend reversed in December. This week, ETH exchange reserves increased from 16.2 million to 16.6 million. That rise equals roughly 400,000 ETH transferred onto exchanges.

Ethereum Exchange Reserve. Source: CryptoQuant.

On-chain data reveals that one “OG whale” alone deposited 100,000 ETH into Binance.

Recent BeInCrypto reports show that BitMine Immersion Technologies bought 67,886 ETH this week. Trend Research also purchased 46,379 ETH. Even so, these figures remain smaller than the amount of ETH moved onto exchanges.

If ETH is transferred to exchanges for liquidation and exceeds buying absorption, selling pressure could intensify. If this trend continues into the final days of the year, ETH prices may face further downside pressure.

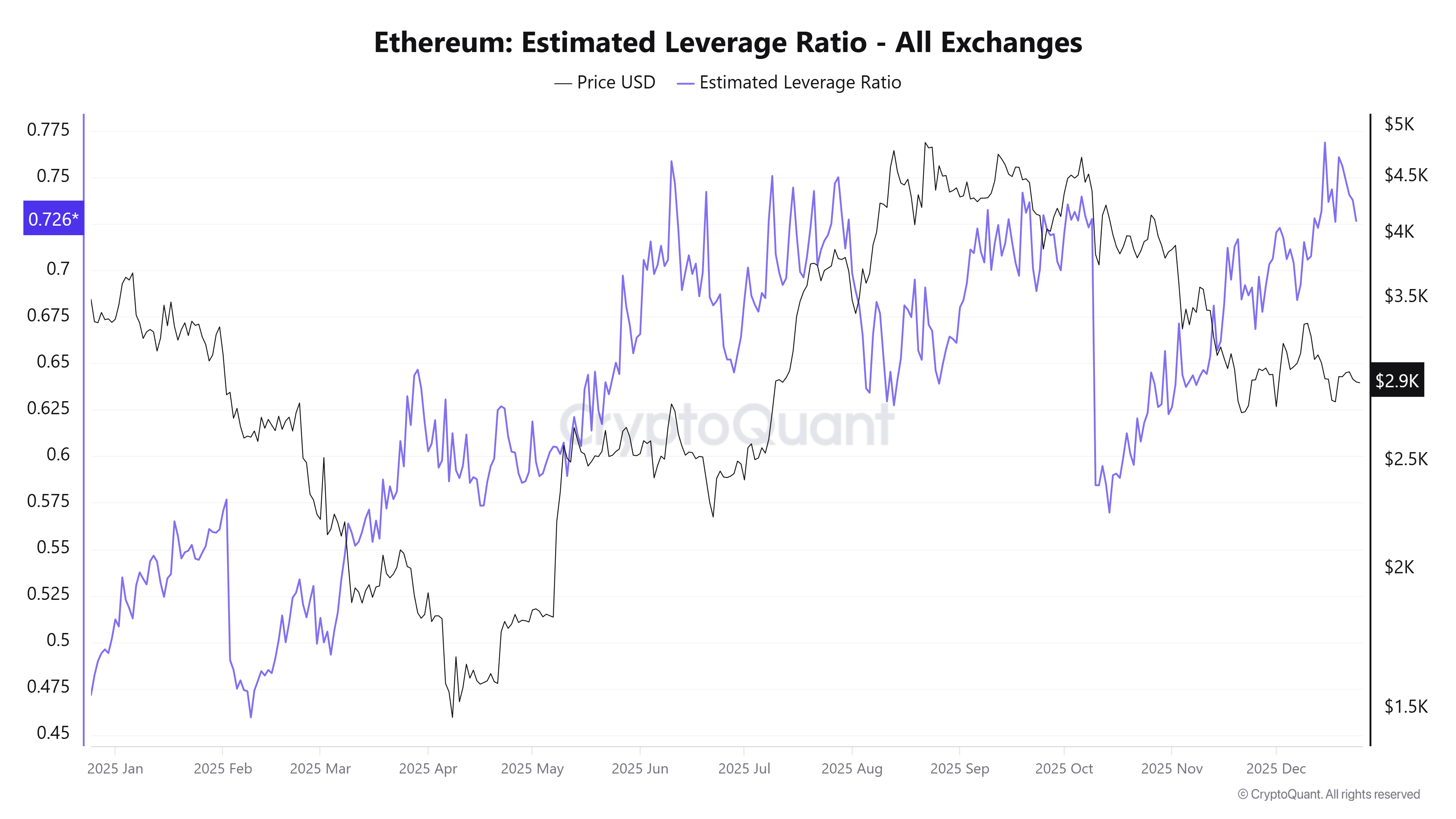

2. Ethereum’s Estimated Leverage Ratio Remains Elevated

Another key metric is Ethereum’s Estimated Leverage Ratio, which remains at an alarming level, according to CryptoQuant.

This ratio equals exchange open interest divided by coin reserves. It reflects the average leverage used by traders. Rising values suggest more investors are taking on higher leverage in derivatives markets.

Ethereum Estimated Leverage Ratio. Source: CryptoQuant.

On October 10, the day with the largest liquidation losses in market history, the ratio stood at 0.72. Currently, the ratio has returned to similar levels. Some readings even reach as high as 0.76.

With leverage still elevated, Ethereum remains vulnerable to small price moves. Such moves could trigger cascade liquidations.

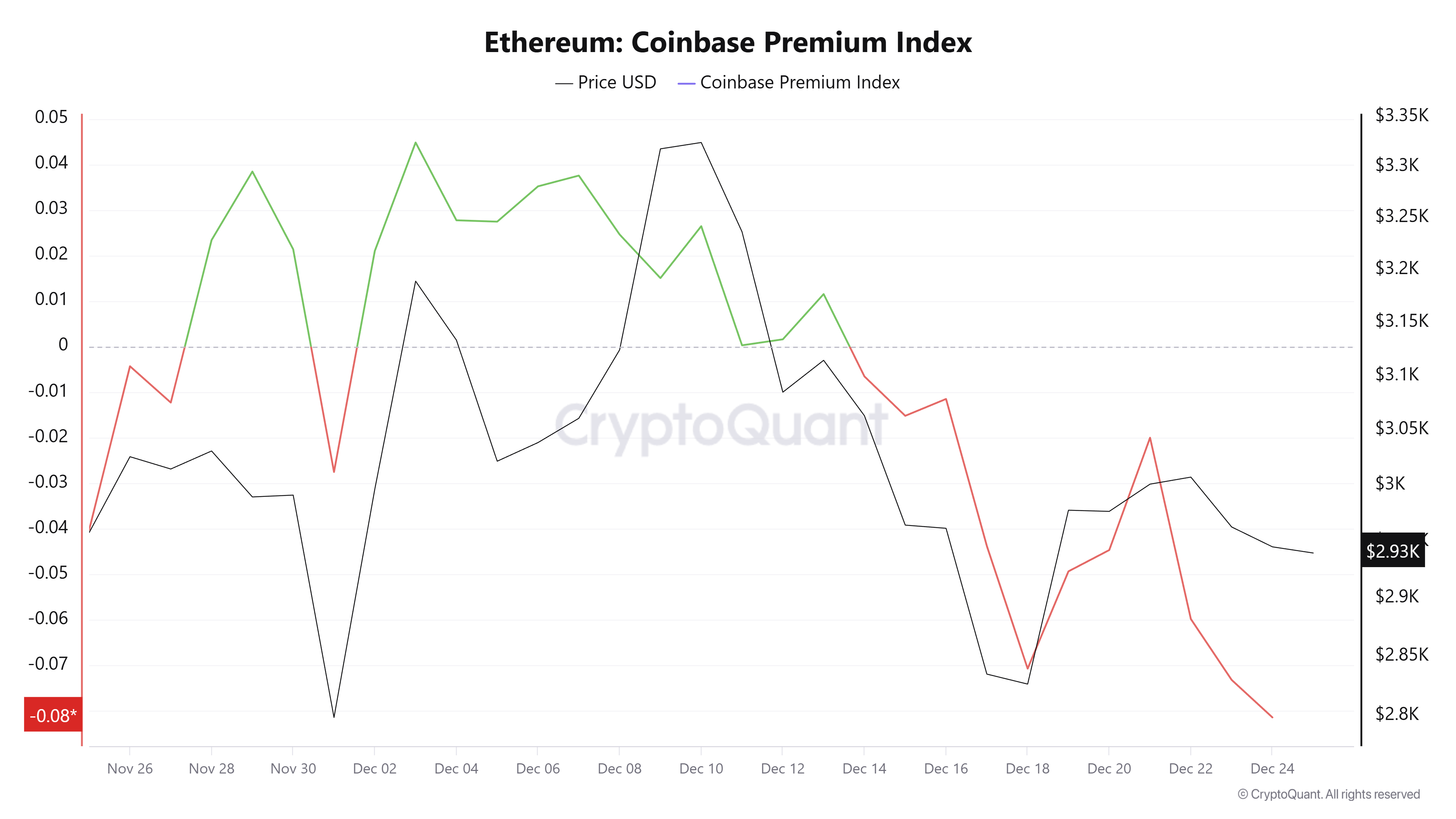

3. Ethereum Coinbase Premium Turns Deeper Negative in December

BeInCrypto previously reported that Ethereum’s Coinbase Premium turned negative in December.

During Christmas week, the indicator moved further into negative territory. It currently stands at -0.08, the lowest level in the past month.

Ethereum Coinbase Premium Index. Source: CryptoQuant.

This indicator measures the percentage price difference between ETH on Coinbase Pro (USD pair) and Binance (USDT pair). Negative values indicate lower prices on Coinbase.

This trend suggests that US investors continue selling at discounted prices. ETH may struggle to recover in the short term until the Coinbase Premium turns positive again.

4. ETH ETF Flows Enter a Second Consecutive Month of Outflows

December is nearing its end, and ETH ETF flows are likely to close with a second straight month of net outflows.

Last month, net flows across all ETH ETFs reached -$1.42 billion. This month, outflows have already exceeded $560 million.

Total Ethereum Spot ETF Net Inflow. Source: SoSoValue.

Without fresh inflows, ETH lacks upward momentum. If outflows persist, especially during low-volume year-end holidays, prices may retest lower support levels.

“Since early November, the 30D-SMA of net flows into both Bitcoin and Ethereum ETFs has turned negative and remained so. This persistence suggests a phase of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction across the crypto market,” Glassnode reported.

In summary, four signals—rising exchange reserves, elevated leverage, deeply negative premiums, and sustained ETF outflows—suggest that ETH may remain in a consolidation phase or face further downside.

Maintaining proper stop-loss levels for derivatives positions and using prudent capital allocation for spot buying can help traders reduce risk amid unexpected volatility.

The post 4 Warning Signs Suggest Ethereum (ETH) Price May Not Recover Soon in Late December appeared first on BeInCrypto.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Figure Heloc

Figure Heloc  WhiteBIT Coin

WhiteBIT Coin  Bitcoin Cash

Bitcoin Cash  Cardano

Cardano  USDS

USDS  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped Bitcoin

Wrapped Bitcoin  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Canton

Canton  Chainlink

Chainlink  Monero

Monero  USD1

USD1  Wrapped eETH

Wrapped eETH  Stellar

Stellar  Litecoin

Litecoin  sUSDS

sUSDS  Dai

Dai  Zcash

Zcash  Avalanche

Avalanche  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Hedera

Hedera  PayPal USD

PayPal USD  Sui

Sui  WETH

WETH  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Cronos

Cronos  USDT0

USDT0  Rain

Rain  World Liberty Financial

World Liberty Financial  Tether Gold

Tether Gold  PAX Gold

PAX Gold  MemeCore

MemeCore  Polkadot

Polkadot  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Mantle

Mantle  Bitget Token

Bitget Token  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Falcon USD

Falcon USD  Aave

Aave  OKB

OKB  Circle USYC

Circle USYC  Pepe

Pepe  Bittensor

Bittensor  Aster

Aster  Sky

Sky  syrupUSDC

syrupUSDC  Global Dollar

Global Dollar  HTX DAO

HTX DAO  Ripple USD

Ripple USD  Ethereum Classic

Ethereum Classic  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  BFUSD

BFUSD  Pi Network

Pi Network  Pump.fun

Pump.fun  Ondo

Ondo  MYX Finance

MYX Finance  Gate

Gate  KuCoin

KuCoin  Worldcoin

Worldcoin  POL (ex-MATIC)

POL (ex-MATIC)  Jupiter Perpetuals Liquidity Provider Token

Jupiter Perpetuals Liquidity Provider Token  USDD

USDD  Ethena

Ethena  Cosmos Hub

Cosmos Hub  Quant

Quant  Jito Staked SOL

Jito Staked SOL  Superstate Short Duration U.S. Government Securities Fund (USTB)

Superstate Short Duration U.S. Government Securities Fund (USTB)  Midnight

Midnight  USDtb

USDtb  Binance-Peg WETH

Binance-Peg WETH  Algorand

Algorand  Rocket Pool ETH

Rocket Pool ETH  Aptos

Aptos  Binance Bridged USDC (BNB Smart Chain)

Binance Bridged USDC (BNB Smart Chain)  NEXO

NEXO  Official Trump

Official Trump  Wrapped BNB

Wrapped BNB  Function FBTC

Function FBTC  Janus Henderson Anemoy AAA CLO Fund

Janus Henderson Anemoy AAA CLO Fund  Render

Render  Filecoin

Filecoin  OUSG

OUSG  Ondo US Dollar Yield

Ondo US Dollar Yield  syrupUSDT

syrupUSDT  VeChain

VeChain  Spiko EU T-Bills Money Market Fund

Spiko EU T-Bills Money Market Fund  Arbitrum

Arbitrum  Binance Staked SOL

Binance Staked SOL  Beldex

Beldex  Usual USD

Usual USD  Janus Henderson Anemoy Treasury Fund

Janus Henderson Anemoy Treasury Fund  Bonk

Bonk  USDai

USDai  Polygon Bridged USDC (Polygon PoS)

Polygon Bridged USDC (Polygon PoS)  GHO

GHO  Solv Protocol BTC

Solv Protocol BTC  Jupiter

Jupiter  Lombard Staked BTC

Lombard Staked BTC  Sei

Sei  A7A5

A7A5  TrueUSD

TrueUSD  clBTC

clBTC  Stacks

Stacks  Dash

Dash  Story

Story  PancakeSwap

PancakeSwap  EURC

EURC  StakeWise Staked ETH

StakeWise Staked ETH  Decred

Decred  Tezos

Tezos  Kinetiq Staked HYPE

Kinetiq Staked HYPE  tBTC

tBTC  Chiliz

Chiliz  WrappedM by M0

WrappedM by M0  Pudgy Penguins

Pudgy Penguins  Lighter

Lighter  Optimism

Optimism  Kinesis Gold

Kinesis Gold  Virtuals Protocol

Virtuals Protocol  c8ntinuum

c8ntinuum  Curve DAO

Curve DAO  Mantle Staked Ether

Mantle Staked Ether  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  JUST

JUST  Polygon PoS Bridged DAI (Polygon POS)

Polygon PoS Bridged DAI (Polygon POS)  Resolv USR

Resolv USR  Resolv wstUSR

Resolv wstUSR  LayerZero

LayerZero  COCA

COCA  Stable

Stable  AINFT

AINFT  Gnosis

Gnosis  Liquid Staked ETH

Liquid Staked ETH  Kaia

Kaia  Arbitrum Bridged WBTC (Arbitrum One)

Arbitrum Bridged WBTC (Arbitrum One)  Maple Finance

Maple Finance  Sun Token

Sun Token  BitTorrent

BitTorrent  Ether.fi

Ether.fi  Wrapped Flare

Wrapped Flare  Injective

Injective  DoubleZero

DoubleZero  L2 Standard Bridged WETH (Base)

L2 Standard Bridged WETH (Base)  Kinesis Silver

Kinesis Silver  Steakhouse USDC Morpho Vault

Steakhouse USDC Morpho Vault  Lido DAO

Lido DAO  FLOKI

FLOKI  IOTA

IOTA  Binance-Peg XRP

Binance-Peg XRP  The Graph

The Graph  Ether.Fi Liquid ETH

Ether.Fi Liquid ETH  crvUSD

crvUSD  Renzo Restaked ETH

Renzo Restaked ETH  Aerodrome Finance

Aerodrome Finance  Celestia

Celestia  sBTC

sBTC  Telcoin

Telcoin  Bitcoin SV

Bitcoin SV  SPX6900

SPX6900  Jupiter Staked SOL

Jupiter Staked SOL  Legacy Frax Dollar

Legacy Frax Dollar  Savings USDD

Savings USDD  Olympus

Olympus  pippin

pippin  JasmyCoin

JasmyCoin  Marinade Staked SOL

Marinade Staked SOL  Arbitrum Bridged WETH (Arbitrum One)

Arbitrum Bridged WETH (Arbitrum One)  Pyth Network

Pyth Network  Starknet

Starknet  PRIME

PRIME  Humanity

Humanity